Norway's Sovereign Wealth Fund And The Trump Tariff Challenge: Nicolai Tangen's Actions

Table of Contents

The Trump Administration's Tariff Policies and Their Global Impact

The Trump administration's trade protectionism, characterized by the imposition of tariffs on various imported goods, created considerable global economic uncertainty. These tariffs, intended to protect American industries, significantly disrupted international trade flows. The ripple effects were felt worldwide, leading to market volatility and impacting investment strategies across the globe.

- Specific examples: Tariffs on steel and aluminum, for instance, directly impacted sectors where the SWF held significant investments, such as energy and manufacturing. Similarly, tariffs imposed on technology goods affected the fund's holdings in the tech sector.

- Market fluctuations: The resulting market uncertainty caused significant fluctuations in the SWF's portfolio value. Predicting market movements became significantly more challenging, as trade policy shifts were sudden and unpredictable.

- Challenges for long-term strategies: The unpredictability of the Trump administration's trade policies posed significant challenges to NBIM's long-term investment strategies, requiring a more agile and adaptive approach to risk management. The traditional long-term investment horizon had to be adapted to accommodate short-term market shocks.

Nicolai Tangen's Initial Response to the Tariff Challenges

Upon assuming his role, Nicolai Tangen faced the immediate challenge of managing the SWF's exposure to the risks stemming from the Trump tariffs. His initial response involved a multifaceted strategy focusing on both portfolio adjustments and stakeholder engagement.

- Portfolio adjustments: NBIM likely implemented diversification strategies, potentially reducing exposure to sectors heavily impacted by tariffs while increasing allocations to less-affected areas. Divestment from specific companies or sectors most vulnerable to the negative effects of the tariffs may also have been considered. The exact details of these adjustments remain largely confidential due to market sensitivity.

- Stakeholder engagement: Tangen engaged actively with government officials to better understand the evolving trade landscape. Communication with investors was crucial to maintain transparency and reassure them about the fund's management approach during this period of uncertainty.

- Assessment of initial response: While the precise financial impact of Tangen's initial response is difficult to isolate from other market factors, it’s widely believed that his proactive measures helped mitigate some of the potential negative effects of the tariffs.

Long-Term Strategies Adopted by NBIM Under Tangen's Leadership

Under Tangen's leadership, NBIM has adopted several long-term strategies designed to navigate future trade uncertainties and broader geopolitical risks. These strategies aim to build resilience and ensure the fund's long-term sustainability.

- Sustainable investing and ESG factors: NBIM has increased its focus on Environmental, Social, and Governance (ESG) factors, recognizing that companies with strong ESG profiles tend to be more resilient in the face of external shocks. This long-term view aligns with sustainable development goals.

- Geographic and sector diversification: NBIM has further diversified its portfolio across geographies and sectors, reducing reliance on any single region or industry and mitigating the impact of localized trade disputes.

- Strengthened risk management: The experience with the Trump tariffs prompted improvements in NBIM's risk management protocols. This includes enhancing its ability to anticipate and model the impacts of future geopolitical events on its investments.

- Engagement with companies: NBIM actively engages with the companies in which it invests, promoting responsible business practices and encouraging them to adopt sustainable and resilient strategies.

Assessing the Effectiveness of Tangen's Actions

Evaluating the effectiveness of Tangen’s responses requires a multifaceted analysis. While precise figures regarding the fund's performance during this period are often kept confidential, several aspects suggest a degree of success.

- Quantitative data: While specific figures aren't publicly available, analysts can review the overall performance of the SWF during this period, comparing it against benchmarks and other SWFs to assess its resilience relative to the global market climate. Portfolio diversification metrics can reveal the extent to which the fund’s structure mitigated the impact of tariffs.

- Qualitative analysis: Tangen's clear communication and proactive engagement with stakeholders helped maintain confidence in NBIM's management during a period of significant uncertainty. This is a significant qualitative factor reflecting his leadership.

- Comparison with other SWFs: Comparing NBIM's performance against similar sovereign wealth funds that faced similar challenges during the Trump tariff period provides valuable context for evaluating the effectiveness of Tangen's strategies.

- Lessons learned: The experience provided valuable lessons regarding the importance of proactive risk management, diversified investment strategies, and robust stakeholder engagement in navigating global trade uncertainties.

Conclusion: Norway's Sovereign Wealth Fund and the Future of Global Trade

Nicolai Tangen's leadership during the Trump tariff challenge demonstrated the importance of proactive risk management and diversified investment strategies for sovereign wealth funds operating in a volatile global environment. His emphasis on sustainable investing and proactive stakeholder engagement positioned NBIM well to weather this storm and sets a strong foundation for the future. The long-term implications of his strategies for the Norwegian economy and the SWF's future success are significant. To delve deeper into Norway's Sovereign Wealth Fund's management of global trade risks and Nicolai Tangen's strategic responses, explore further resources on NBIM's website and related financial publications. Understanding the nuances of managing a sovereign wealth fund in a period of trade uncertainty is crucial for anyone interested in global finance and economic policy.

Featured Posts

-

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025

Examining The Reported Conflict Between Blake Lively And Anna Kendrick

May 05, 2025 -

How Anna Kendrick And Rebel Wilson Became Friends A Pitch Perfect Tale

May 05, 2025

How Anna Kendrick And Rebel Wilson Became Friends A Pitch Perfect Tale

May 05, 2025 -

Inside A Wild Crypto Party A Two Day Account

May 05, 2025

Inside A Wild Crypto Party A Two Day Account

May 05, 2025 -

Feud Or Friendship A Body Language Expert Deciphers Blake Lively And Anna Kendricks Dynamics

May 05, 2025

Feud Or Friendship A Body Language Expert Deciphers Blake Lively And Anna Kendricks Dynamics

May 05, 2025 -

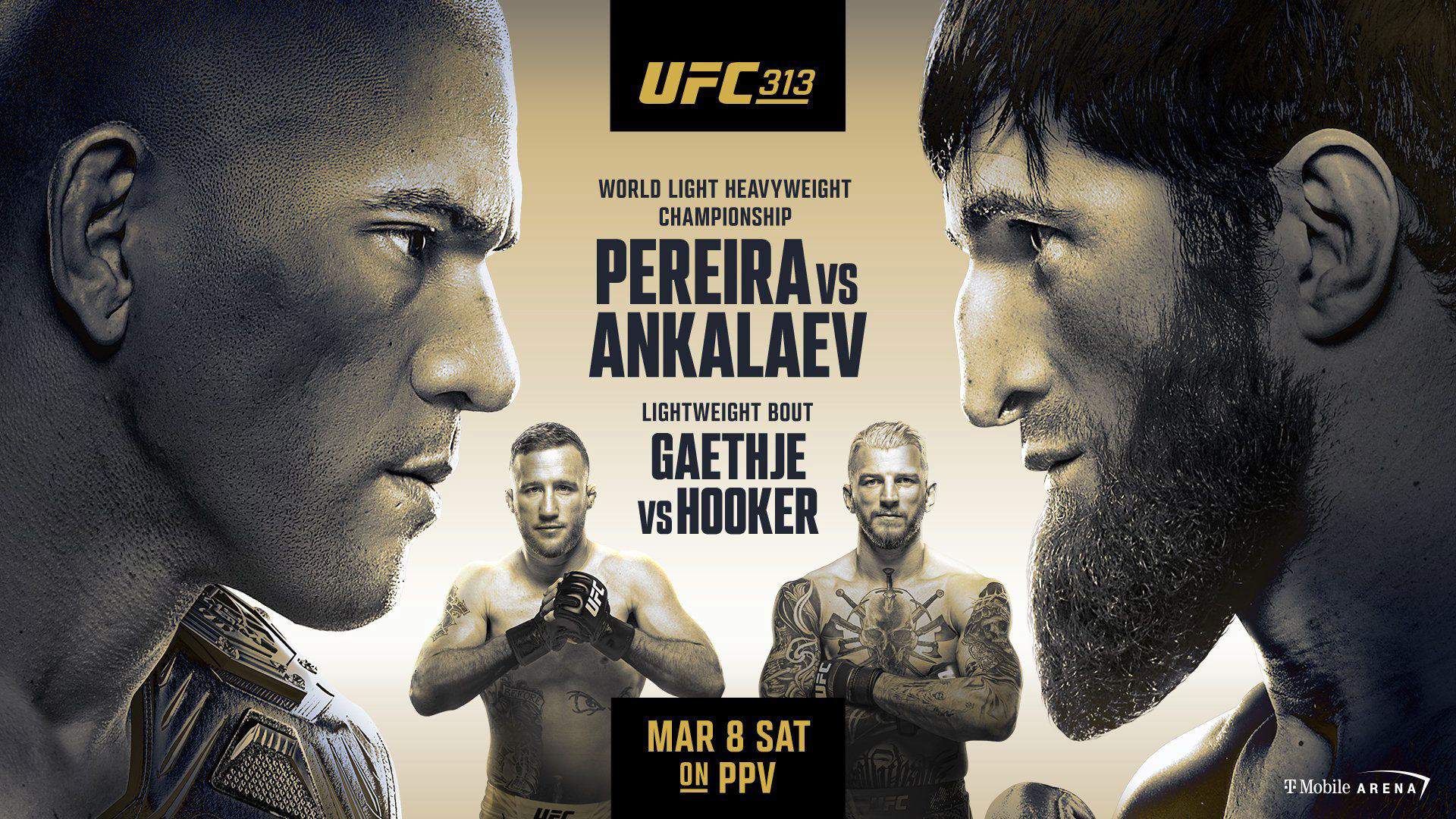

Is Dustin Poiriers Retirement A Mistake Paddy Pimblett Weighs In

May 05, 2025

Is Dustin Poiriers Retirement A Mistake Paddy Pimblett Weighs In

May 05, 2025

Latest Posts

-

Ufc 314 Volkanovski Lopes Fight Initial Betting Odds And Predictions

May 05, 2025

Ufc 314 Volkanovski Lopes Fight Initial Betting Odds And Predictions

May 05, 2025 -

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 05, 2025

Peter Distad To Lead Foxs New Direct To Consumer Streaming Service

May 05, 2025 -

Ufc 314 Changes To The Fight Card Announced

May 05, 2025

Ufc 314 Changes To The Fight Card Announced

May 05, 2025 -

Revised Fight Order For Ufc 314 Pay Per View Event

May 05, 2025

Revised Fight Order For Ufc 314 Pay Per View Event

May 05, 2025 -

Ufc 314 Fight Card Official Changes Announced

May 05, 2025

Ufc 314 Fight Card Official Changes Announced

May 05, 2025