U.S.-China Truce Fuels Global Stock Market Rally

Table of Contents

Easing Trade Tensions: The Catalyst for the Rally

The recent de-escalation in the U.S.-China trade war has acted as a powerful catalyst for the global stock market rally. Reduced uncertainty and improved business sentiment are key drivers of this positive market reaction.

Reduced Tariffs and Trade Barriers

The reduction or removal of tariffs between the U.S. and China directly impacts global trade and investor confidence. This translates to tangible benefits for businesses and consumers alike.

- Examples of specific tariff reductions: While specific details vary, the easing of tariffs on certain goods, particularly in the technology and agricultural sectors, has been observed. This has led to a noticeable decrease in the cost of importing and exporting these products.

- Positive effects on specific sectors: The technology sector, previously heavily impacted by trade restrictions, has seen a significant surge. Similarly, the agricultural sector, which relies heavily on exports to China, has experienced renewed optimism.

- Increased cross-border investment: Reduced trade barriers foster a more favorable climate for foreign direct investment (FDI), facilitating increased capital flows between the U.S. and China, and boosting economic activity in both countries.

Improved Business Sentiment and Predictability

Reduced uncertainty regarding trade policies has significantly improved business sentiment and predictability. This encourages businesses to invest more aggressively, expand operations, and hire more employees.

- Increased corporate profits: With reduced trade friction, companies can focus on core business activities, leading to improved efficiency and increased profitability.

- Improved consumer confidence: The positive economic outlook driven by the U.S.-China truce also boosts consumer confidence, leading to increased spending and demand.

- Data supporting increased business activity: Various economic indicators, such as manufacturing PMI (Purchasing Managers' Index) and consumer spending data, are reflecting this improved business activity.

Global Market Reactions: A Sector-by-Sector Analysis

The U.S.-China truce has had a ripple effect across various sectors globally, with some benefiting more than others.

Technology Stocks Surge

Technology stocks, previously heavily impacted by the trade war, have experienced a significant surge following the easing of tensions.

- Performance data for specific technology companies: Companies like Apple, Qualcomm, and others have seen their stock prices increase substantially as trade uncertainties have diminished.

- Analysis of reasons for the surge: The improved access to Chinese markets and reduced regulatory hurdles have contributed significantly to this positive performance.

- Potential long-term implications: This surge suggests a renewed confidence in the long-term growth prospects of the technology sector within the context of improved U.S.-China relations.

Emerging Markets Benefit

Emerging markets, particularly those closely tied to China's economy, have also experienced positive spillover effects from the U.S.-China truce.

- Examples of specific emerging markets: Countries in Southeast Asia and other regions that have strong economic ties with China have seen improved market performance.

- Explanation of the economic linkages: China's economic growth significantly impacts these regions, and the improved U.S.-China relations foster greater economic stability and growth in these emerging markets.

- Investment opportunities and risks: While opportunities abound, investors must carefully assess the specific risks and opportunities presented by individual emerging markets.

Safe-Haven Assets Decline

As investor risk appetite increases due to the improved outlook, we've seen a shift away from "safe-haven" assets.

- Price movements of gold and other safe-haven assets: The price of gold, a typical safe-haven asset, has generally declined alongside other similar assets.

- Reasoning behind the shift: Investors are moving away from safe-haven assets as they become more optimistic about the global economic outlook.

- Potential future implications: This shift suggests a growing confidence in the stability of global markets, at least in the short-term.

Cautious Optimism: Remaining Risks and Uncertainties

While the U.S.-China truce has fueled a significant market rally, investors should exercise cautious optimism. Several risks and uncertainties remain.

Fragility of the Truce

The U.S.-China relationship remains inherently volatile, and the current truce could easily unravel.

- Unresolved issues: Many underlying issues remain between the two countries, potentially causing renewed tensions.

- Potential triggers for renewed tensions: Any unexpected geopolitical event or policy shift could reignite trade disputes.

- Geopolitical factors impacting the situation: Broader geopolitical factors beyond the bilateral relationship could also negatively impact the situation.

Inflationary Pressures

The easing of trade tensions might contribute to global inflationary pressures.

- Discussion of supply chain dynamics: Changes in supply chain dynamics, due to increased trade, could lead to price increases for certain goods.

- Potential impact on consumer prices: This could lead to higher consumer prices, impacting consumer spending and economic growth.

- Implications for central bank policies: Central banks might need to adjust monetary policies to counter potential inflationary pressures.

Geopolitical Risks Remain

Other global political and economic risks persist, capable of impacting market stability.

- Examples of ongoing conflicts or economic uncertainties: Various global conflicts and economic uncertainties continue to pose significant risks.

- Their potential impact on the stock market rally: These risks could easily reverse the current market gains.

Conclusion

The U.S.-China truce has fueled a significant global stock market rally, driven by reduced trade tensions and improved business sentiment. However, investors should remain cautious, mindful of the fragility of the truce and the existence of other geopolitical risks. Understanding the nuances of the U.S.-China relationship is crucial for navigating the current global stock market rally. Stay informed about the latest developments and make informed investment decisions based on a comprehensive risk assessment. Learn more about managing your portfolio in the face of U.S.-China trade dynamics and capitalize on the opportunities presented by this evolving relationship. Successfully navigating this dynamic landscape requires a keen understanding of the ongoing U.S.-China relationship and its impact on global markets.

Featured Posts

-

Great Value Brand Recalls 14 Significant Product Safety Issues At Walmart

May 14, 2025

Great Value Brand Recalls 14 Significant Product Safety Issues At Walmart

May 14, 2025 -

Tom Cruises Mission Impossible 7 North American Box Office Projections And Potential For A Record Breaking Opening

May 14, 2025

Tom Cruises Mission Impossible 7 North American Box Office Projections And Potential For A Record Breaking Opening

May 14, 2025 -

Decarbonizing Steel Eramets Era Low Low Co 2 Manganese Alloy

May 14, 2025

Decarbonizing Steel Eramets Era Low Low Co 2 Manganese Alloy

May 14, 2025 -

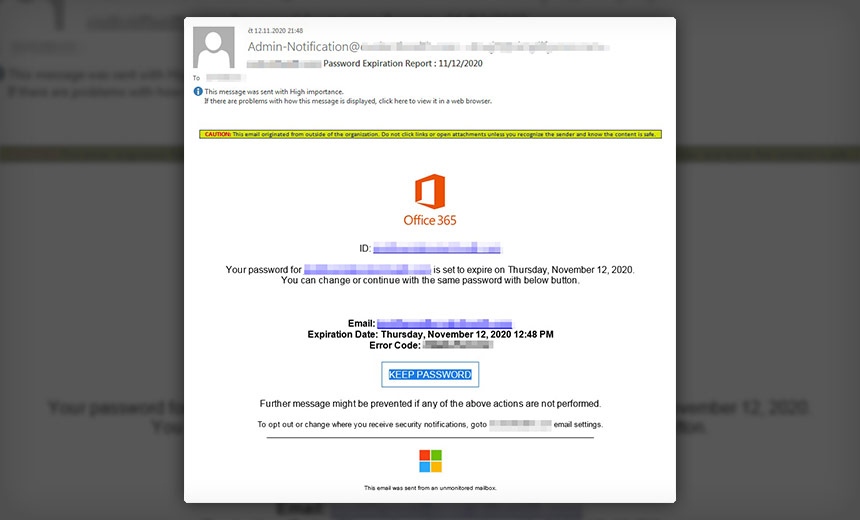

Millions Stolen Through Sophisticated Office365 Executive Account Hacking

May 14, 2025

Millions Stolen Through Sophisticated Office365 Executive Account Hacking

May 14, 2025 -

R Sociedad Vs Sevilla Minuto A Minuto La Liga Espanola Fecha 27 En Tn

May 14, 2025

R Sociedad Vs Sevilla Minuto A Minuto La Liga Espanola Fecha 27 En Tn

May 14, 2025