Tuesday's CoreWeave (CRWV) Stock Dip: Factors Contributing To The Decline

Table of Contents

Broad Market Downturn and its Impact on CRWV

Tuesday's decline in CRWV wasn't an isolated incident; it occurred within the context of a broader market downturn. The tech sector, in particular, experienced significant headwinds. This overall negative market sentiment played a substantial role in CRWV's price drop.

- Major market indices like the Nasdaq and the S&P 500 experienced considerable losses, with the Nasdaq falling by [Insert Percentage]% and the S&P 500 declining by [Insert Percentage]%. This widespread negative sentiment spilled over into individual tech stocks, impacting CRWV's performance.

- The downturn can be attributed to [Insert Reason for Market Downturn, e.g., rising interest rates, concerns about inflation, geopolitical uncertainties]. This macroeconomic environment created a risk-off sentiment among investors, leading to sell-offs across the board.

- CRWV, as a relatively new and growth-oriented company in the cloud computing space, is particularly susceptible to broader market fluctuations. Its stock price often moves in correlation with the overall tech sector performance.

Analysis of CoreWeave's (CRWV) Recent Financial Performance and News

While the broader market contributed significantly, internal factors related to CoreWeave's performance also played a role in Tuesday's stock dip. Analyzing recent financial reports and news is crucial to understanding this aspect.

- [Mention specific financial metrics from recent reports – e.g., "Q2 earnings fell short of analyst expectations, with revenue growth slowing to X% compared to Y% in the previous quarter."] This could have disappointed investors and triggered sell-offs.

- [Highlight any negative news or analyst concerns – e.g., "Concerns were raised regarding CRWV's increasing competition in the high-performance computing market."] Negative press or analyst downgrades can significantly impact investor sentiment.

- [Link to relevant financial news sources – e.g., "For more details, refer to the company's latest earnings call transcript available at [link] and the recent analyst reports from [link]."] Providing links to credible sources enhances the article's authority and trustworthiness.

Impact of Competition in the Cloud Computing Market

The cloud computing market is fiercely competitive, with established giants like AWS, Azure, and Google Cloud constantly innovating and expanding their market share. This competitive landscape can heavily influence individual companies' stock prices.

- Key competitors like AWS, Azure, and Google Cloud continue to dominate the market, putting pressure on smaller players like CoreWeave. Their extensive resources and established infrastructure present a significant hurdle for CRWV.

- The emergence of new players and innovative technologies in the high-performance computing niche could also intensify competition, putting downward pressure on CRWV's stock price. New entrants often disrupt established dynamics.

- Any news related to increased competitive pressure or a significant market share gain by a competitor can have a negative impact on investor confidence in CRWV.

Investor Sentiment and Trading Volume

Analyzing investor sentiment and trading volume on Tuesday offers further insights into the CRWV stock dip. These factors provide a more granular understanding of the market's reaction to the company.

- Trading volume on Tuesday likely experienced a [increase/decrease], indicating [increased selling pressure/reduced trading activity]. Higher than usual volume often suggests a significant shift in investor sentiment.

- [Mention any significant sell-offs or short-selling activity – e.g., "Reports indicated a surge in short-selling activity, suggesting a bearish outlook among some investors."] Short selling amplifies downward price pressure.

- Social media sentiment and news coverage surrounding CRWV on Tuesday likely played a role. Negative news or comments can trigger a cascade effect on investor confidence.

Technical Analysis of CRWV Stock Chart

A brief look at CRWV's stock chart can provide additional context. While avoiding overly technical jargon, we can examine key indicators.

- Support and resistance levels were likely tested during the dip. Breaking through significant support levels can often lead to further declines.

- [Mention any relevant chart patterns – e.g., "The stock price appeared to be forming a bearish pattern before Tuesday's decline."] Identifying chart patterns provides technical confirmation of the downward trend.

- This section should be concise and avoid overwhelming the reader with complex technical indicators, focusing on easily understood visual cues.

Conclusion: Understanding and Navigating Future CoreWeave (CRWV) Stock Fluctuations

Tuesday's CoreWeave (CRWV) stock dip resulted from a confluence of factors: a broader market downturn, concerns related to CRWV's recent financial performance, intense competition in the cloud computing market, and negative investor sentiment reflected in trading volume and social media activity. Understanding these elements is crucial for making sound investment decisions. While it's impossible to predict the future of CRWV's stock price, by monitoring relevant news, financial reports, and market trends, investors can better navigate future fluctuations. Continue monitoring CoreWeave (CRWV) stock, conduct thorough research into any future CoreWeave (CRWV) stock dips, and stay updated on relevant news and developments to make informed decisions regarding your investments in CoreWeave (CRWV) or similar cloud computing stocks.

Featured Posts

-

Massive 11 6 Billion Funding For Open Ais Texas Data Center Project

May 22, 2025

Massive 11 6 Billion Funding For Open Ais Texas Data Center Project

May 22, 2025 -

Mark Zuckerberg In A Trump Era Challenges And Opportunities

May 22, 2025

Mark Zuckerberg In A Trump Era Challenges And Opportunities

May 22, 2025 -

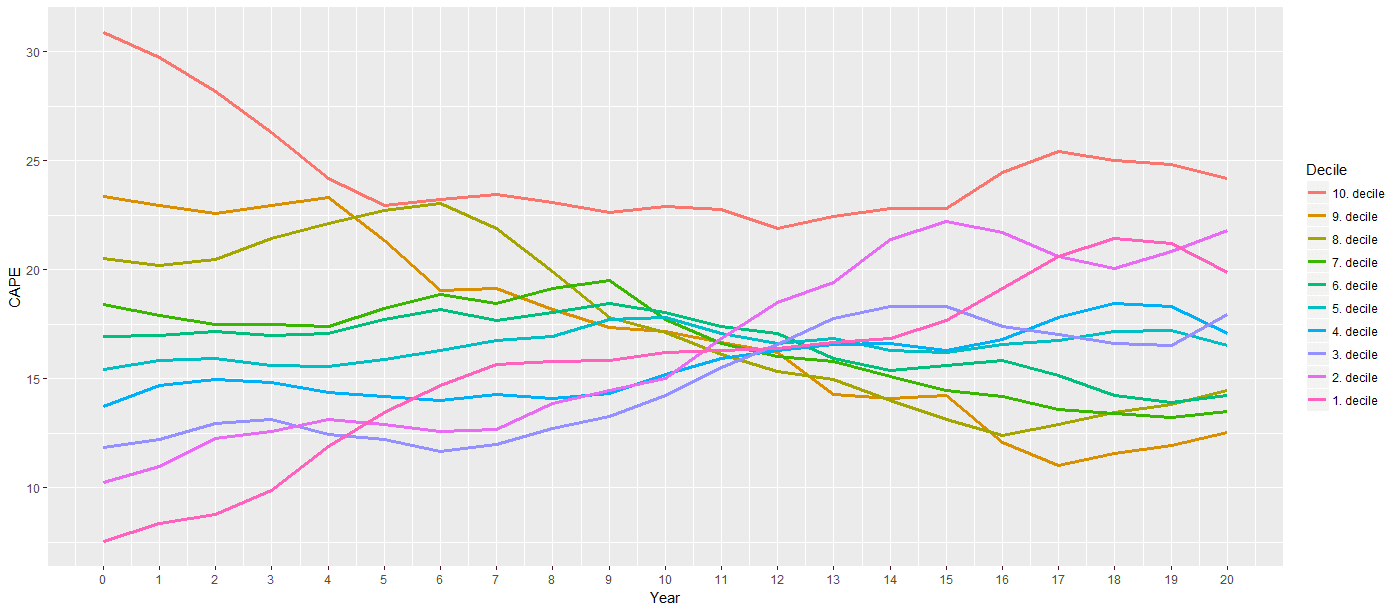

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025 -

Concert De Novelistes Avant Gout Du Hellfest A L Espace Julien

May 22, 2025

Concert De Novelistes Avant Gout Du Hellfest A L Espace Julien

May 22, 2025 -

Nederlandse Huizenmarkt Verschillende Perspectieven Van Geen Stijl En Abn Amro

May 22, 2025

Nederlandse Huizenmarkt Verschillende Perspectieven Van Geen Stijl En Abn Amro

May 22, 2025

Latest Posts

-

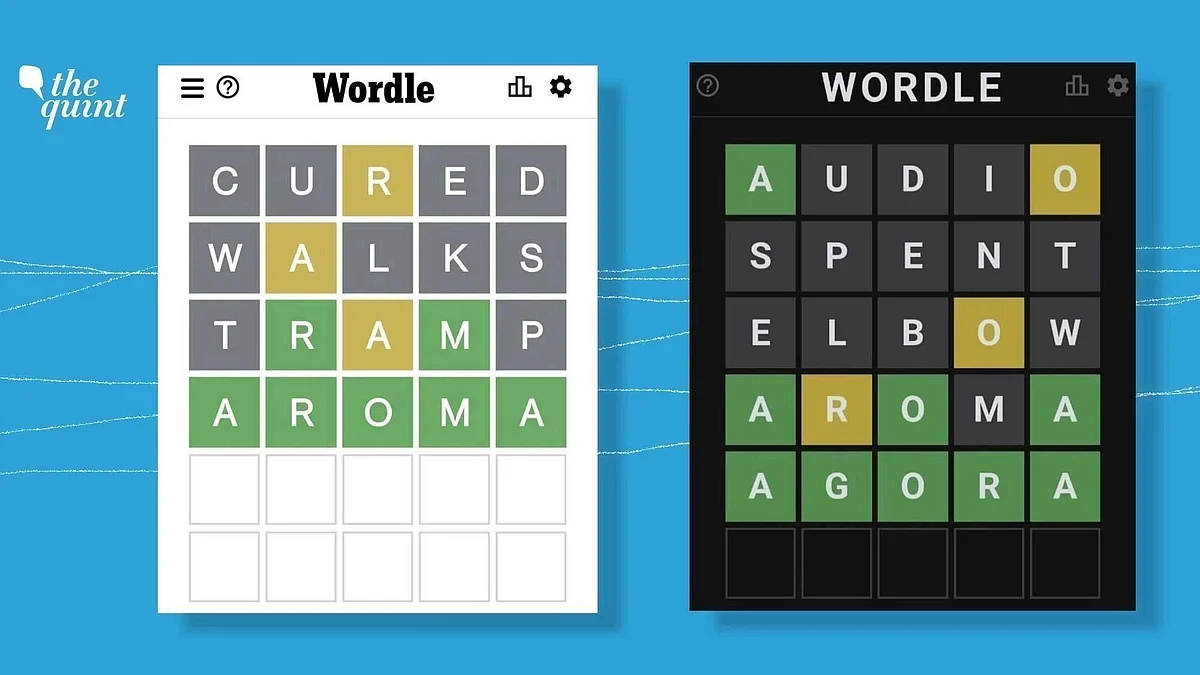

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025