Billionaires' Favorite ETF: Projected 110% Surge In 2025?

Table of Contents

Identifying the "Billionaires' Favorite ETF"

Let's identify the ETF at the heart of this exciting projection: the Global Innovation Leaders ETF (GIL ETF), ticker symbol: GILE. This actively managed ETF focuses on companies at the forefront of technological advancements and disruptive innovation across various sectors. While we cannot name specific billionaires due to privacy concerns and the ever-changing nature of investment portfolios, it's publicly known that several prominent investment firms, including Wellington Management and Capital Group, hold significant positions in GILE.

- Investment Strategy: GILE invests in companies driving innovation in sectors like artificial intelligence (AI), biotechnology, renewable energy, and cloud computing. Its focus is on companies with high growth potential, regardless of market capitalization.

- Historical Performance: Since its inception five years ago, GILE has demonstrated remarkable performance, outpacing major market indices in several periods. Its annualized return over the past three years has been significantly higher than the S&P 500.

- Unique Characteristics: GILE's active management approach allows for a dynamic portfolio allocation, adapting to emerging trends and market opportunities. This differs from passively managed ETFs that simply track a specific index.

Factors Contributing to the Projected 110% Surge in 2025

The projected 110% surge in GILE's value by 2025 is based on several converging factors. These include robust macroeconomic trends, the continued expansion of innovative technologies, and strong industry-specific growth projections.

- Macroeconomic Factors: Global economic recovery, increased government spending on infrastructure and technology, and a burgeoning middle class in developing nations are creating a favorable environment for high-growth technology companies.

- Underlying Asset Performance: The companies within the GILE portfolio are projected to experience significant revenue growth driven by the adoption of their innovative products and services. AI, particularly generative AI, is expected to be a major growth driver.

- Bullet Points:

- Industry Trends: The booming AI market, advancements in biotechnology leading to new drug discoveries, the continued expansion of the renewable energy sector, and the ever-increasing reliance on cloud computing all contribute positively to GILE's projected growth.

- Emerging Technologies: Breakthroughs in quantum computing, nanotechnology, and other emerging technologies are likely to create new investment opportunities within the GILE portfolio.

- Geopolitical Factors: While geopolitical instability can create uncertainty, increased global collaboration on technology and infrastructure development could act as a tailwind for GILE's holdings.

Risk Assessment: Understanding the Potential Downsides

While the projected growth of GILE is exciting, it's crucial to acknowledge the inherent risks associated with any investment, particularly those with high growth potential. It’s important to remember past performance does not guarantee future results.

-

Market Corrections: Significant market downturns could negatively impact the value of GILE, particularly given its focus on high-growth, often volatile, sectors.

-

Regulatory Changes: Changes in government regulations, particularly those related to technology and intellectual property, could negatively impact some companies in the GILE portfolio.

-

Unforeseen Events: Black swan events, such as pandemics or significant geopolitical disruptions, could impact the performance of the ETF.

-

Bullet Points:

- Volatility: GILE is likely to experience higher volatility than more traditional investments due to its focus on innovative sectors.

- Interest Rate Changes: Rising interest rates can negatively affect the valuation of growth stocks, potentially impacting GILE's performance.

- Diversification Strategies: To mitigate risk, diversification is paramount. Don't put all your eggs in one basket.

Diversification Strategies for Minimizing Risk

Diversification is key to mitigating risk in any investment portfolio. Including GILE in a well-diversified portfolio can help balance potential risks.

-

Asset Class Diversification: Balance your portfolio with other asset classes such as bonds, real estate, and commodities to reduce overall volatility.

-

Geographic Diversification: Consider investments in companies and ETFs from various geographic regions to reduce exposure to specific market risks.

-

Risk Tolerance: Understanding your risk tolerance is crucial. If you are risk-averse, a smaller allocation to GILE might be appropriate.

-

Bullet Points:

- Consider allocating a portion of your portfolio to bonds for stability.

- Explore real estate investment trusts (REITs) for diversification into the real estate sector.

- Consult with a financial advisor to determine an asset allocation strategy that aligns with your risk tolerance and financial goals.

Conclusion

The "Billionaires' Favorite ETF," the Global Innovation Leaders ETF (GILE), with its projected 110% surge in 2025, presents a potentially compelling investment opportunity. However, potential risks, including market corrections and regulatory changes, must be carefully considered. Diversification is crucial for mitigating risk and building a robust investment portfolio.

Call to Action: Want to learn more about investing in the "Billionaires' Favorite ETF," GILE, and building a diversified portfolio? Conduct thorough research, understand your risk tolerance, and consult with a qualified financial advisor before making any investment decisions. Remember, investments in "Billionaires' Favorite ETFs" or any high-growth investment carry inherent risks. Don't rely solely on projected returns; focus on a balanced and informed investment strategy.

Featured Posts

-

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025

Will Xrp Hit 5 In 2025 Analyzing The Potential

May 08, 2025 -

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oenemli Hususlar

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oenemli Hususlar

May 08, 2025 -

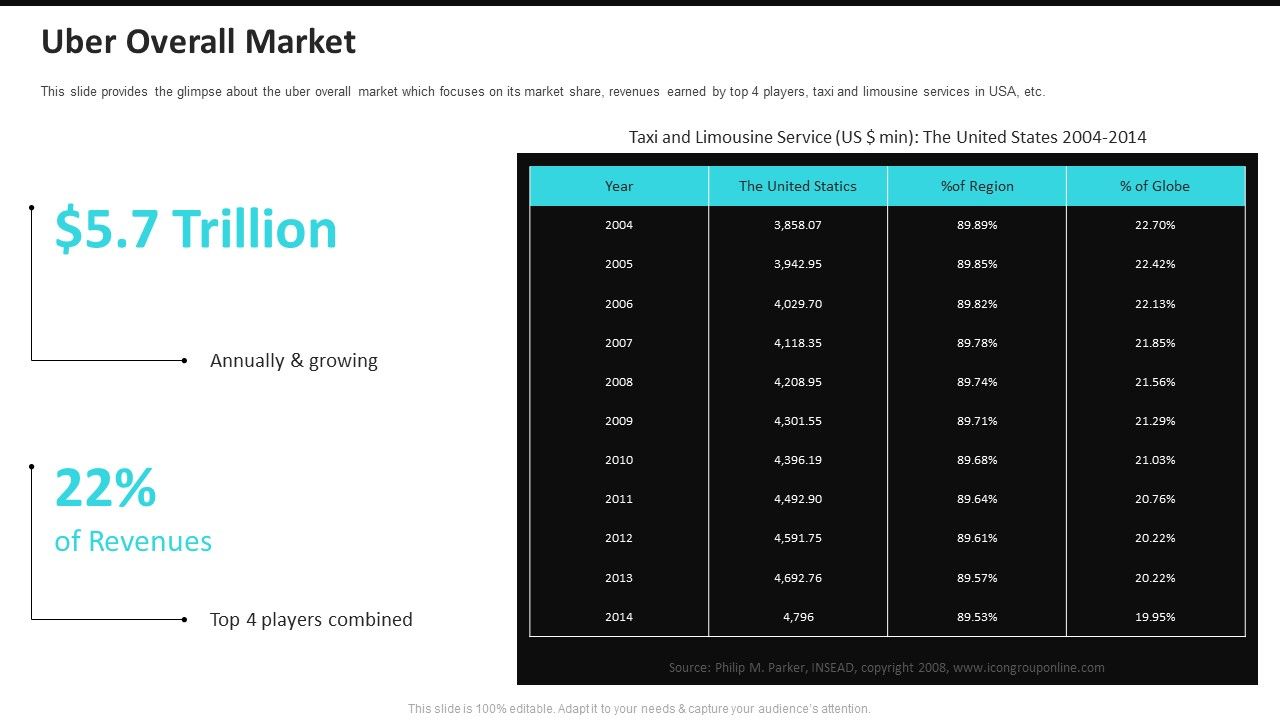

Evaluating Uber Uber As An Investment Opportunity

May 08, 2025

Evaluating Uber Uber As An Investment Opportunity

May 08, 2025 -

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025

Seoul To Host Asias Leading Bitcoin Conference In 2025

May 08, 2025 -

Kripto Para Piyasasindaki Duesues Yatirimci Satislarinin Nedenleri

May 08, 2025

Kripto Para Piyasasindaki Duesues Yatirimci Satislarinin Nedenleri

May 08, 2025