Trump Media, Crypto.com, And ETFs: A New Era For Digital Assets?

Table of Contents

Trump Media's foray into the digital asset space:

Potential for tokenization and fundraising:

Trump Media's potential entry into the digital asset space opens exciting avenues for fundraising and capital acquisition. By issuing its own token, the company could bypass traditional financial institutions, potentially accessing a wider pool of investors and raising capital more efficiently. This approach could lead to higher valuations compared to traditional funding methods. However, significant regulatory challenges and legal hurdles exist. The SEC's scrutiny of security tokens and the complexities of complying with international regulations present considerable obstacles.

- Increased access to capital: Tokenization can unlock access to a global investor base beyond traditional venture capital and private equity.

- Bypassing traditional fundraising routes: This offers greater speed and potentially more favorable terms compared to traditional IPOs or debt financing.

- Potential for higher valuations: The potential for rapid growth in the digital asset market could lead to higher valuations for tokenized assets.

- Regulatory uncertainty: Navigating complex and evolving regulations is a major hurdle for any company entering the digital asset space.

- Investor appeal: The novelty and potential for high returns could attract a large number of investors, especially those familiar with the crypto market.

Impact on the political landscape and public perception of digital assets:

Trump Media's involvement could significantly influence public perception of cryptocurrencies, potentially boosting mainstream awareness and acceptance. Conversely, it could also lead to increased political polarization around digital assets, with debates intensifying around regulation and adoption. This heightened visibility might influence regulatory decisions, potentially accelerating or hindering the development of the crypto market. The very public nature of this potential involvement could shape public opinion, driving both positive and negative narratives surrounding digital assets.

- Increased mainstream awareness: The association with a prominent political figure could significantly raise the profile of digital assets.

- Potential for political polarization: The involvement could deepen existing political divisions regarding cryptocurrencies and their regulation.

- Impact on regulatory decisions: Increased political attention could lead to faster or more stringent regulatory frameworks.

- Influence on public opinion: Public perception of digital assets could be significantly shaped by the success or failure of Trump Media's digital asset strategy.

Crypto.com's role in mainstream adoption:

Crypto.com's marketing and user acquisition strategies:

Crypto.com's remarkable growth stems from its aggressive and effective marketing and user acquisition strategies. The platform's celebrity endorsements, such as its partnership with Matt Damon, combined with large-scale advertising campaigns, have significantly boosted brand awareness and user acquisition. Its user-friendly interface and competitive fees further contribute to its popularity. Strategic partnerships, particularly in the sports and entertainment industries, have solidified its position as a leading cryptocurrency exchange.

- Celebrity endorsements: High-profile partnerships enhance brand recognition and attract a wider audience.

- Aggressive marketing campaigns: Extensive advertising and promotional efforts drive user growth.

- User-friendly interface: Intuitive design and easy navigation make the platform accessible to a broader user base.

- Competitive fees: Lower trading fees compared to competitors attract cost-conscious traders.

- Strategic partnerships: Collaborations with major organizations broaden reach and enhance credibility.

The influence of exchange platforms on the digital asset market:

Centralized exchanges like Crypto.com play a vital role in facilitating the trading and adoption of digital assets. They provide crucial liquidity, enabling efficient price discovery. However, this influence comes with risks. Security breaches, regulatory scrutiny, and custodial risks are potential downsides associated with using centralized exchanges. Robust regulatory oversight is essential to mitigate these risks and maintain market stability.

- Liquidity provision: Exchanges like Crypto.com provide a marketplace for buyers and sellers, ensuring efficient trading.

- Price discovery: The trading activity on exchanges helps to determine the fair market value of digital assets.

- Security concerns: Centralized exchanges are vulnerable to hacking and other security breaches.

- Regulatory oversight: Regulations are necessary to protect investors and maintain market integrity.

- Custodial risks: Users entrust their assets to the exchange, creating potential risks if the platform is compromised.

The rise of ETFs and their impact on accessibility:

ETFs as a gateway for institutional and retail investors:

Crypto ETFs provide a crucial bridge for institutional and retail investors seeking exposure to the digital asset market without the complexities of direct cryptocurrency trading. They offer diversification benefits, reducing the overall risk associated with investing in individual cryptocurrencies. This increased accessibility is a key driver of broader market adoption. The regulated nature of ETFs also boosts investor confidence compared to directly holding cryptocurrencies.

- Reduced risk through diversification: ETFs offer exposure to a basket of cryptocurrencies, mitigating the risk associated with individual asset volatility.

- Regulatory compliance: ETFs are subject to regulatory oversight, offering greater investor protection.

- Ease of access for retail investors: Investing in ETFs is generally simpler and more convenient than trading individual cryptocurrencies.

- Institutional adoption: ETFs provide a regulated avenue for institutional investors to participate in the crypto market.

- Potential for price stability: While not guaranteed, ETFs may offer greater price stability compared to individual cryptocurrencies.

The future of regulatory frameworks for crypto ETFs:

The regulatory landscape surrounding crypto ETFs is constantly evolving. Securing regulatory approval is crucial for widespread adoption and investor confidence. However, concerns remain regarding market manipulation and the need for robust oversight. International regulatory cooperation is also essential to address cross-border challenges and prevent regulatory arbitrage.

- Increased investor confidence: Regulatory approval enhances trust and attracts a wider range of investors.

- Regulatory clarity: Clear guidelines reduce uncertainty and encourage investment.

- Potential for market manipulation: Regulations need to prevent market manipulation and ensure fair trading practices.

- Need for robust oversight: Strong regulatory frameworks are vital for protecting investors and maintaining market stability.

- Cross-border regulatory challenges: Harmonizing regulations across different jurisdictions is crucial for global market development.

Conclusion:

The involvement of Trump Media, Crypto.com, and the growing acceptance of crypto ETFs strongly suggests a significant shift in the perception and adoption of digital assets. While regulatory hurdles remain, the increased mainstream attention and improved accessibility are paving the way for a new era of growth and innovation in the sector. Whether this signifies a complete paradigm shift remains to be seen, but the current trends are undeniably pointing towards a future where digital assets play a far more significant role in the global financial system. Stay informed about the latest developments in digital asset technology and regulation to capitalize on the opportunities and navigate the challenges ahead.

Featured Posts

-

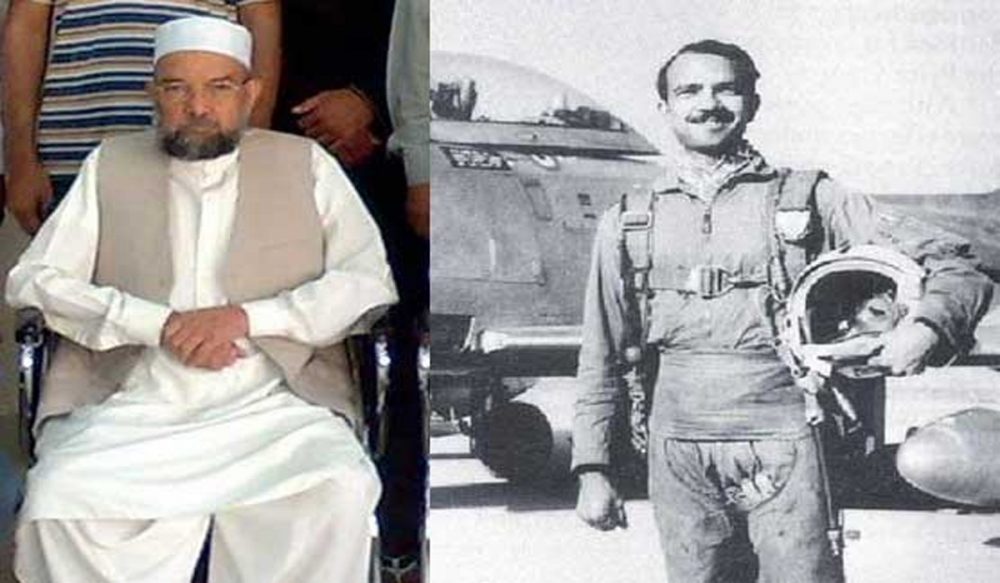

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Ky Tqrybat Ka Aghaz

May 08, 2025 -

Prelazna Vlada Stavovi Pavla Grbovica Iz Psg A

May 08, 2025

Prelazna Vlada Stavovi Pavla Grbovica Iz Psg A

May 08, 2025 -

Xrps Strong Performance After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025

Xrps Strong Performance After Sec Acknowledges Grayscale Xrp Etf Application

May 08, 2025 -

The Real Story Behind The Thunder And Bulls Offseason Trade

May 08, 2025

The Real Story Behind The Thunder And Bulls Offseason Trade

May 08, 2025 -

Analyzing Bitcoins Potential 10x Multiplier A Weekly Chart Perspective

May 08, 2025

Analyzing Bitcoins Potential 10x Multiplier A Weekly Chart Perspective

May 08, 2025