Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For ETFs like the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV reflects the underlying value of the assets it holds, which primarily track the MSCI World Index. It's a crucial indicator of the ETF's intrinsic worth. The NAV differs from the market price, which can fluctuate throughout the trading day due to supply and demand.

- Definition of NAV: NAV is the net asset value of a fund per share.

- Calculation of NAV for ETFs: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- Factors influencing NAV fluctuations: Market movements in the underlying assets (the MSCI World Index in this case), currency exchange rate fluctuations (especially relevant due to the "USD Hedged" aspect), and dividend distributions from the underlying companies.

- Example of NAV calculation (Illustrative): Let's assume an ETF holds $10 million in assets and has $100,000 in liabilities, with 1 million shares outstanding. The NAV would be (($10,000,000 - $100,000) / 1,000,000) = $9.90 per share. This is a simplified example and does not reflect the actual NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is influenced by several key factors. The "USD Hedged" aspect is particularly important. This means the ETF employs strategies to mitigate the impact of currency fluctuations between the underlying assets' currencies and the US dollar. This can lead to greater NAV stability compared to an unhedged version.

- Impact of currency hedging on NAV stability: The hedging strategy aims to reduce the volatility of the NAV caused by currency exchange rate movements.

- Influence of MSCI World Index performance on NAV: The ETF tracks the MSCI World Index, a broad market index representing large and mid-cap equities across developed markets globally. Therefore, the performance of this index directly impacts the ETF's NAV.

- Dividend distribution and its effect on NAV: When the underlying companies in the MSCI World Index pay dividends, these are typically distributed to ETF shareholders, which slightly reduces the NAV after the distribution.

- Comparison with unhedged versions of similar ETFs: An unhedged version of a similar ETF would be more susceptible to currency fluctuations, potentially leading to greater NAV volatility.

Where to Find the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Reliable and up-to-date NAV information for the Amundi MSCI World II UCITS ETF USD Hedged Dist is readily available from several sources:

- Amundi's official website: Amundi, the ETF provider, typically publishes daily NAV data on their investor relations section.

- Major financial data providers (Bloomberg, Refinitiv, etc.): These professional-grade data services offer real-time and historical NAV data.

- Brokerage platforms: Most online brokerage accounts will display the current NAV of ETFs held within your portfolio.

- Frequency of NAV updates: NAV is typically updated daily, usually at the end of the trading day.

Interpreting NAV Changes

Analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV over time provides valuable insights into its performance. It's crucial to focus on long-term trends rather than short-term fluctuations.

- Analyzing NAV trends over different time periods: Compare the NAV over weeks, months, and years to identify long-term growth patterns.

- Relating NAV movement to market performance: Analyze the NAV's correlation with the MSCI World Index and other relevant market indicators.

- Identifying potential investment opportunities based on NAV analysis: While not a sole indicator, understanding NAV trends can inform investment decisions.

Conclusion

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is vital for making informed investment decisions. By regularly monitoring the NAV and considering its relationship to market trends, you can effectively track the performance of your investment and make strategic adjustments to your portfolio. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today! Learn more about effectively using Amundi MSCI World II UCITS ETF USD Hedged Dist NAV for your investment portfolio.

Featured Posts

-

Escape To The Country Making The Most Of Rural Life

May 24, 2025

Escape To The Country Making The Most Of Rural Life

May 24, 2025 -

Planning Your Escape To The Country A Practical Guide

May 24, 2025

Planning Your Escape To The Country A Practical Guide

May 24, 2025 -

Analiza Porsche Cayenne Gts Coupe Czy To Najlepszy Suv

May 24, 2025

Analiza Porsche Cayenne Gts Coupe Czy To Najlepszy Suv

May 24, 2025 -

Dax Holds Steady Frankfurt Stock Market Opens Following Record Run

May 24, 2025

Dax Holds Steady Frankfurt Stock Market Opens Following Record Run

May 24, 2025 -

Ferrari Service Excellence Arrives In Bengaluru

May 24, 2025

Ferrari Service Excellence Arrives In Bengaluru

May 24, 2025

Latest Posts

-

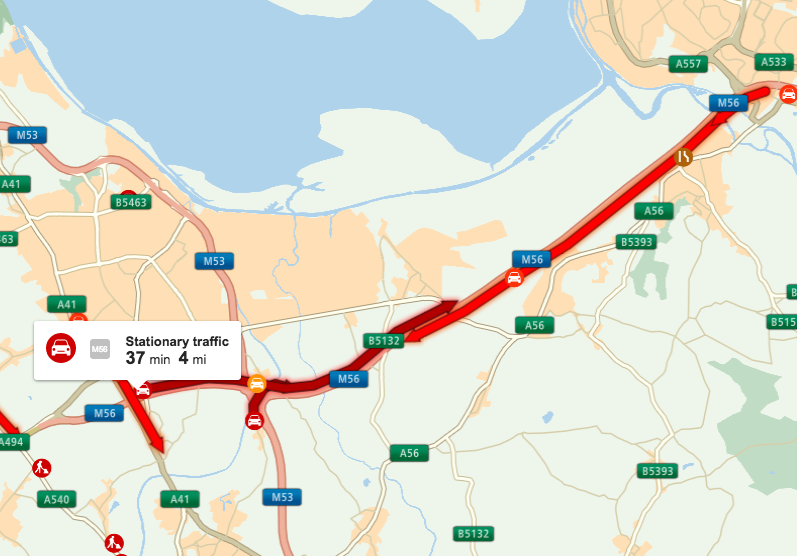

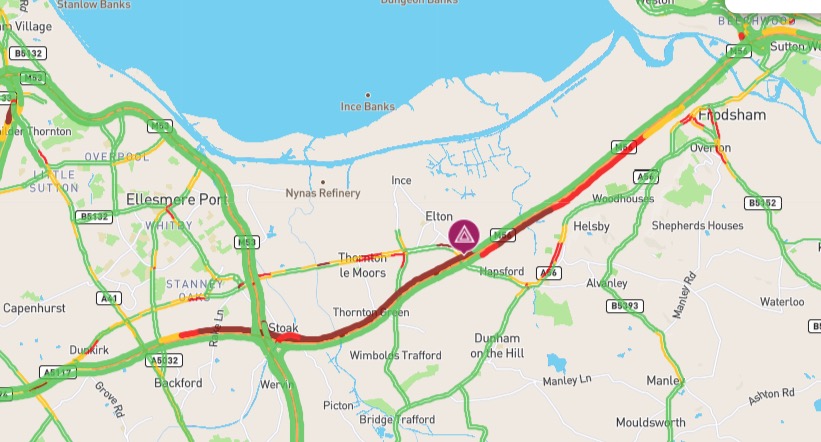

Traffic Delays On M56 Near Cheshire Deeside Due To Collision

May 24, 2025

Traffic Delays On M56 Near Cheshire Deeside Due To Collision

May 24, 2025 -

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025

Cheshire Deeside M56 Delays Following Road Accident

May 24, 2025 -

M6 Crash Causes Severe Traffic Disruption And Delays

May 24, 2025

M6 Crash Causes Severe Traffic Disruption And Delays

May 24, 2025 -

M6 Traffic Chaos Van Overturns Causing Major Delays

May 24, 2025

M6 Traffic Chaos Van Overturns Causing Major Delays

May 24, 2025 -

M62 Westbound Resurfacing Project Causes Manchester To Warrington Closure

May 24, 2025

M62 Westbound Resurfacing Project Causes Manchester To Warrington Closure

May 24, 2025