Tracking The NAV: Amundi Dow Jones Industrial Average UCITS ETF Distribution

Table of Contents

What is Net Asset Value (NAV) and why is it important?

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated daily by taking the total market value of all the stocks in the Dow Jones Industrial Average that the ETF holds, subtracting any liabilities, and dividing by the total number of outstanding ETF shares. This calculation reflects the intrinsic value of the ETF.

Understanding the NAV is paramount because:

- NAV reflects the underlying asset value: The NAV provides a snapshot of the true worth of the ETF's holdings, unaffected by short-term market fluctuations.

- Daily NAV fluctuations show ETF performance: Tracking daily NAV changes helps assess the ETF's performance against the Dow Jones Industrial Average and other benchmarks.

- NAV is crucial for buy/sell decisions: Investors often compare the NAV to the ETF's market price to identify potential buying or selling opportunities. A significant difference might indicate arbitrage possibilities.

Understanding Amundi Dow Jones Industrial Average UCITS ETF Distributions

ETFs, like the Amundi Dow Jones Industrial Average UCITS ETF, often distribute income generated from dividends paid by the underlying companies within the Dow Jones Industrial Average. These distributions are typically paid out periodically.

- Distribution Frequency: The Amundi Dow Jones Industrial Average UCITS ETF typically distributes income annually or semi-annually, depending on the dividends received from the underlying stocks. Always check the fund's prospectus for the most up-to-date information.

- Types of Distributions: Distributions can include dividends from the underlying companies and capital gains realized from the sale of assets within the ETF's portfolio.

- Ex-Dividend Date and Payment Date: The ex-dividend date is when the ETF's price is adjusted to reflect the upcoming distribution. Investors must own the shares before the ex-dividend date to receive the distribution. The payment date is when the distribution is actually paid to shareholders.

- Impact on NAV after distribution: After a distribution is paid out, the NAV of the ETF will typically decrease by the amount of the distribution. This is because the assets held by the ETF are reduced by the amount distributed.

How to Track the NAV and Distributions of the Amundi Dow Jones Industrial Average UCITS ETF

Tracking the NAV and distributions of the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward. Here's how:

- Amundi's Official Website: The most reliable source is Amundi's official website. Look for sections dedicated to investor information or fund fact sheets. They usually provide daily NAV data and information on past and upcoming distributions.

- Financial News Websites and Data Providers: Major financial news providers like Bloomberg, Refinitiv, Yahoo Finance, and Google Finance typically provide real-time or delayed NAV quotes and distribution information for ETFs.

- Brokerage Account Statements: If you own shares of the ETF, your brokerage account statements will clearly show the NAV at the time of purchase or sale, as well as any distributions you receive.

- Using ETF Tracking Apps or Websites: Many financial apps and websites offer ETF tracking capabilities, including NAV and distribution information.

Potential discrepancies in NAV data between different sources can occur due to time lags in data updates. Always prioritize information from the fund manager's official website to ensure accuracy.

Factors Affecting the NAV and Distribution of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV and distributions of the Amundi Dow Jones Industrial Average UCITS ETF:

- Market Performance (Dow Jones Industrial Average): The primary driver of the ETF's NAV is the performance of the Dow Jones Industrial Average. A rising index generally leads to a higher NAV, and vice versa.

- Impact of Dividends from Underlying Companies: The dividends paid out by the companies within the Dow Jones Industrial Average directly affect the amount of distributions the Amundi ETF can make to its shareholders.

- Influence of Currency Exchange Rates: Although less significant for a primarily USD-denominated ETF, currency fluctuations can still impact the NAV if the ETF holds assets in other currencies.

- Expense Ratio: The ETF's expense ratio (management fees) will slightly reduce the overall returns and therefore affect both the NAV and the potential amount of distributions.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF Distribution Tracking

Successfully tracking the Amundi Dow Jones Industrial Average UCITS ETF Distribution involves understanding the importance of NAV as a measure of the ETF's underlying value, knowing the frequency and composition of distributions, and utilizing reliable resources to obtain accurate data. By consistently monitoring the NAV and distributions, investors can make more informed decisions about buying, selling, and overall portfolio management. We encourage you to actively track the Amundi Dow Jones Industrial Average UCITS ETF Distribution using the resources mentioned above for optimal investment management. For a deeper dive into ETF investing, consider exploring additional resources from reputable financial education websites and publications.

Featured Posts

-

I Miliardari Piu Potenti Del 2025 La Classifica Forbes Aggiornata

May 25, 2025

I Miliardari Piu Potenti Del 2025 La Classifica Forbes Aggiornata

May 25, 2025 -

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Karisiklik

May 25, 2025

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Karisiklik

May 25, 2025 -

Amsterdam Market Opens Down 7 Intensifying Trade War Concerns

May 25, 2025

Amsterdam Market Opens Down 7 Intensifying Trade War Concerns

May 25, 2025 -

Public Disagreement Ex French Pm And President Macron

May 25, 2025

Public Disagreement Ex French Pm And President Macron

May 25, 2025 -

Princess Road Incident Emergency Services Respond To Pedestrian Accident Live Updates

May 25, 2025

Princess Road Incident Emergency Services Respond To Pedestrian Accident Live Updates

May 25, 2025

Latest Posts

-

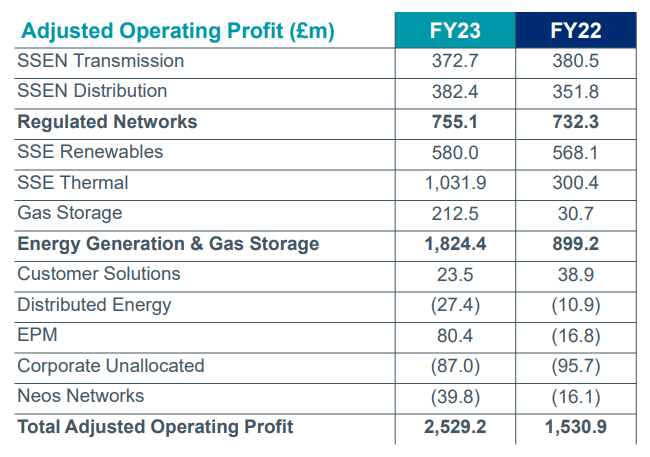

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025

3 Billion Slash To Sse Spending Details Of The Revised Plan

May 25, 2025 -

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025

The China Market And Its Implications For Bmw Porsche And Competitors

May 25, 2025 -

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 25, 2025 -

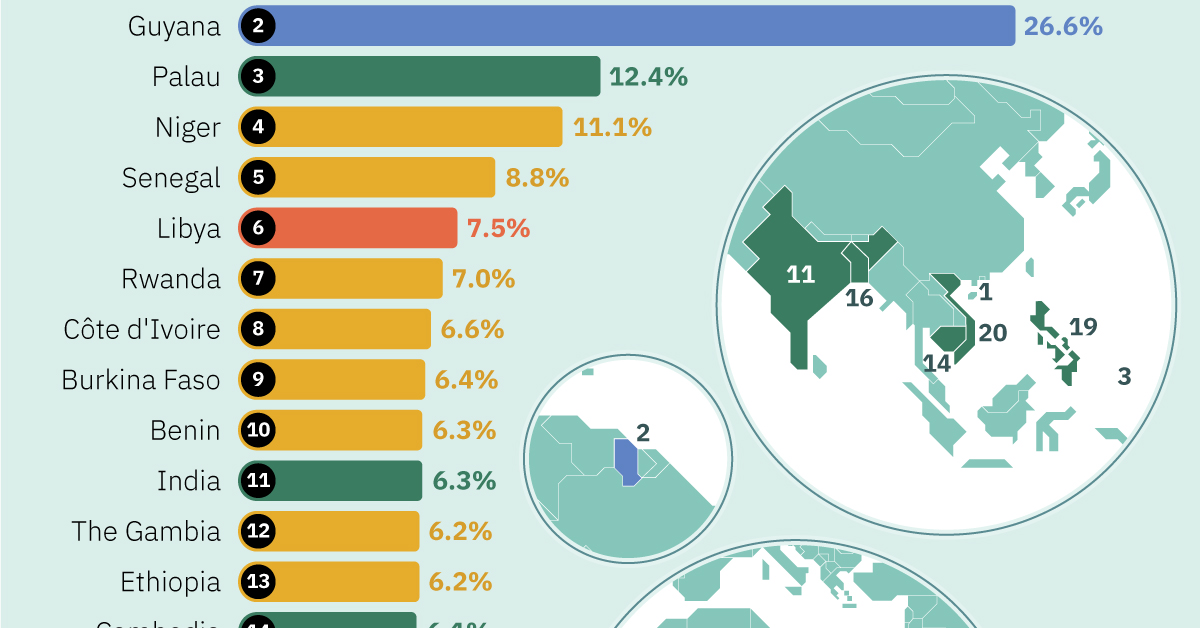

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025 -

The Pilbara Debate Rio Tintos Response To Claims Of Environmental Damage

May 25, 2025

The Pilbara Debate Rio Tintos Response To Claims Of Environmental Damage

May 25, 2025