Toronto Home Sales Plummet: 23% Year-Over-Year Drop, Prices Fall 4%

Table of Contents

Toronto Home Sales: A 23% Year-Over-Year Plunge – What's Driving the Decline?

The 23% year-over-year plunge in Toronto home sales represents a substantial shift from the robust market seen in previous years. Data from the Toronto Regional Real Estate Board (TRREB) reveals a stark contrast between 2022 and 2023 sales figures.

- Specific Numbers: In Q3 2022, approximately X number of homes were sold, compared to Y number in Q3 2023, representing a Z% decrease. (Note: Replace X, Y, and Z with actual data from a reliable source like TRREB).

- Breakdown by Property Type: The decline wasn't uniform across all property types. Detached homes experienced a more significant drop (insert percentage) than condos (insert percentage), while townhouses saw a decline of (insert percentage).

- Areas Most Affected: Specific neighbourhoods like (mention specific neighbourhoods experiencing the most significant drops) saw particularly sharp reductions in sales activity.

Several factors have contributed to this dramatic decline in Toronto home sales:

- Rising Interest Rates: The Bank of Canada's aggressive interest rate hikes have significantly increased borrowing costs, making mortgages less affordable for many potential buyers. This has reduced purchasing power and cooled down buyer demand.

- Increased Borrowing Costs: Higher interest rates translate to higher monthly mortgage payments, pushing many potential buyers out of the market. Stress tests on mortgages have also tightened lending criteria.

- Economic Uncertainty: Global economic uncertainty, inflation, and recessionary fears have contributed to a more cautious approach from buyers, leading to decreased demand.

- Government Policies: While not as direct an impact as interest rates, government policies aimed at cooling the market (if any were implemented) could have played a role in reducing sales activity.

Toronto House Prices: A 4% Decrease – Is This the Start of a Trend?

The 4% decrease in average Toronto house prices reflects the softening demand in the market. While still relatively high compared to historical averages, this price correction is noteworthy.

- Average Price Drop by Property Type: The average price of detached homes decreased by (insert percentage), condos by (insert percentage), and townhouses by (insert percentage).

- Comparison to Previous Years: This represents a significant shift from the rapid price increases seen in previous years (provide data for comparison).

- Areas with the Most Noticeable Price Drops: Specific areas like (mention specific neighbourhoods with significant price drops) have witnessed more pronounced price reductions.

The implications of this price drop are significant:

- Emerging Buyer's Market?: While not a full-blown buyer's market yet, the shift indicates a more balanced market with greater negotiating power for buyers.

- Impact on Investor Sentiment: The price correction may deter some investors, leading to decreased investment activity.

- Potential for Further Price Corrections: Depending on economic conditions and interest rate movements, further price adjustments are possible.

The Impact on Toronto's Real Estate Landscape: A Shifting Market

The significant drop in Toronto home sales and prices has broader implications for the city's real estate landscape:

- Impact on Real Estate Agents and Brokers: Reduced sales activity naturally impacts the income and workload of real estate professionals.

- Effects on the Construction Industry: Decreased demand could lead to slower construction activity and potential project delays.

- Potential Long-Term Effects on Housing Affordability: While prices have fallen slightly, affordability remains a major concern, especially with increased borrowing costs.

Current market sentiment reflects a degree of hesitation among both buyers and sellers. Buyers are waiting for more price drops or a clearer economic picture, while sellers are adjusting their expectations. The future trajectory of the Toronto real estate market remains uncertain.

Conclusion: Navigating the Changing Toronto Home Sales Landscape

The significant drop in Toronto home sales, coupled with a decrease in Toronto property prices, signals a substantial shift in the market. Rising interest rates, economic uncertainty, and changes in buyer sentiment are contributing factors to this downturn. While the market is cooling, it's crucial for both buyers and sellers to stay informed about the evolving trends. The potential for further adjustments means staying updated on Toronto home sales data and Toronto property price fluctuations is paramount. Subscribe to our newsletter or regularly check our website for the latest updates on Toronto home sales and Toronto property prices to navigate this changing market effectively.

Featured Posts

-

Food Delivery War Heats Up Ubers Lawsuit Against Door Dash

May 08, 2025

Food Delivery War Heats Up Ubers Lawsuit Against Door Dash

May 08, 2025 -

Sdmt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025

Sdmt Marakana Barbwza Ykhsr Asnanh Fy Nzal Enyf

May 08, 2025 -

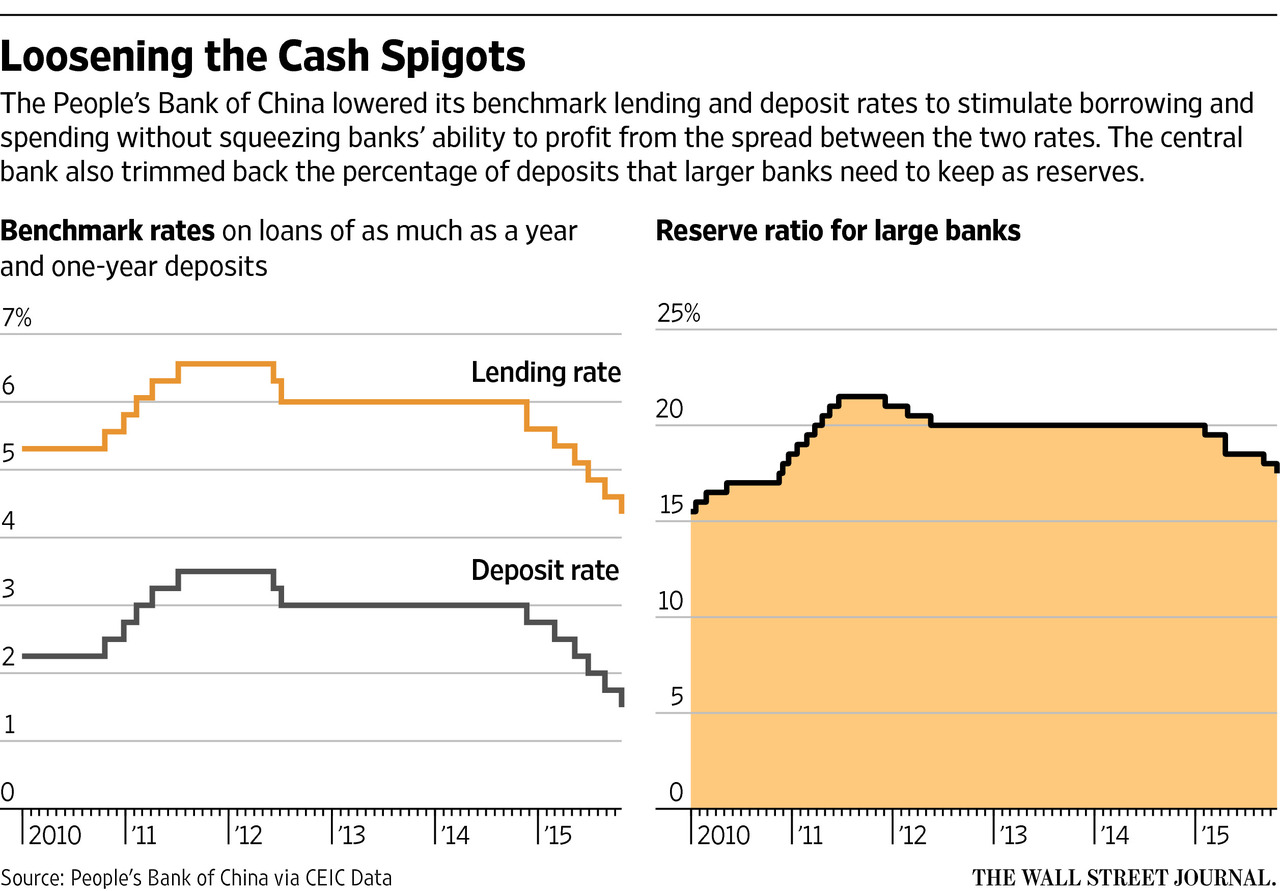

The Impact Of Chinas Rate Cuts On Bank Lending And The Economy

May 08, 2025

The Impact Of Chinas Rate Cuts On Bank Lending And The Economy

May 08, 2025 -

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025 -

Cassidy Hutchinsons Memoir A Deep Dive Into The January 6th Hearings

May 08, 2025

Cassidy Hutchinsons Memoir A Deep Dive Into The January 6th Hearings

May 08, 2025