Top Performing Quantum Computing Stocks In 2025: Rigetti (RGTI) And Beyond

Table of Contents

Rigetti Computing (RGTI): A Deep Dive

Rigetti Computing, trading under the ticker symbol RGTI, is a prominent player in the burgeoning quantum computing industry. Understanding its strengths and weaknesses is crucial for anyone considering investing in top performing quantum computing stocks.

RGTI's Technological Advantages

Rigetti's core strength lies in its innovative quantum processing unit (QPU) architecture. Unlike some competitors, Rigetti utilizes a multi-chip architecture designed for scalability, a critical factor in achieving fault-tolerant quantum computation. This approach, coupled with their focus on improving qubit coherence (the ability of qubits to maintain their quantum state), positions them favorably in the race for quantum advantage. They also boast several unique patents related to their control systems and qubit design, giving them a competitive edge.

- Multi-chip architecture: Enables the creation of larger, more powerful quantum computers by connecting multiple QPUs.

- Hybrid quantum-classical approach: Leverages the strengths of both classical and quantum computers for enhanced performance.

- Focus on specific applications: Rigetti targets high-value applications like drug discovery, materials science, and financial modeling, accelerating their path to profitability.

RGTI's Business Model and Partnerships

Rigetti generates revenue through its cloud-based quantum computing platform, providing access to its QPUs for researchers and businesses. They also offer quantum computing services tailored to specific client needs. Furthermore, they've secured several key partnerships and collaborations, strengthening their market position and validating their technology.

- Strategic alliances: Collaborations with leading research institutions and technology companies enhance their technological capabilities and market reach.

- Government contracts: Funding from government agencies supports research and development efforts, accelerating technological advancements.

- Cloud-based quantum computing platform: Provides accessible and scalable quantum computing resources to a wider audience.

RGTI's Investment Potential and Risks

While RGTI presents significant investment potential due to its technological prowess and strategic partnerships, investors should also acknowledge inherent risks. The quantum computing market is still nascent, and significant technological hurdles remain. Competition is intense, with other major players vying for market share.

- Market capitalization: Analyzing RGTI's market cap provides a snapshot of its current valuation and growth potential.

- Analyst ratings: Reviewing analyst reports offers insights into the company's prospects and potential risks.

- Potential for high returns (and losses): Investing in RGTI entails both the potential for substantial returns and the risk of significant losses.

Other Promising Quantum Computing Stocks to Watch in 2025

While Rigetti offers a compelling investment opportunity, the quantum computing landscape boasts other promising players. Diversification is key, and understanding these alternatives is crucial for building a well-rounded portfolio of top performing quantum computing stocks.

Identifying Key Players

Beyond Rigetti, several publicly traded companies are making significant strides in the quantum computing field. Each boasts unique technologies and focuses on different market segments.

- IonQ: Utilizes trapped ion technology, known for its high qubit fidelity and scalability potential.

- D-Wave: Focuses on adiabatic quantum computing, specializing in optimization problems and offering a commercially available quantum annealer.

Comparing Quantum Computing Investment Opportunities

| Company | Market Cap (approx.) | Revenue (approx.) | Technological Focus | Key Differentiator |

|---|---|---|---|---|

| Rigetti (RGTI) | (Check current data) | (Check current data) | Gate-based quantum computing | Multi-chip architecture |

| IonQ | (Check current data) | (Check current data) | Trapped ion quantum computing | High qubit fidelity |

| D-Wave | (Check current data) | (Check current data) | Quantum annealing | Commercially available system |

Note: Market cap and revenue figures are approximate and subject to change. This comparison table serves as a starting point for further research. The criteria for selection emphasize technological leadership, market potential, and financial stability, factors crucial for long-term success.

Assessing the Risks and Rewards of Investing in Quantum Computing

Investing in quantum computing offers potentially substantial rewards but also carries significant risks. Understanding this duality is critical for making informed investment decisions.

The Volatility of the Quantum Computing Market

The quantum computing market is inherently volatile. As an emerging technology, it faces uncertainties concerning technological breakthroughs, market adoption, and regulatory changes. Short-term fluctuations are expected.

- Early-stage technology: Quantum computing is still in its early stages, making predictions about its future uncertain.

- High risk/high reward: The potential for high returns is matched by the potential for significant losses.

- Market fluctuations: Expect significant price swings due to the market's sensitivity to news and technological advancements.

Diversification Strategies for Quantum Computing Investments

Diversification is crucial for mitigating risk in any investment portfolio, especially in the volatile quantum computing sector.

- Dollar-cost averaging: Investing a fixed amount at regular intervals reduces the impact of market fluctuations.

- Diversification across multiple companies: Spreading investments across several quantum computing companies reduces exposure to the failure of any single company.

Conclusion: Investing Wisely in Top Performing Quantum Computing Stocks

This article highlights the potential of Rigetti (RGTI) and other promising companies in the quantum computing sector. While the potential for significant returns is undeniable, understanding the risks associated with investing in this emerging technology is equally important. Top performing quantum computing stocks in 2025 will likely be those with a strong technological foundation, strategic partnerships, and a clear path to profitability.

Understanding the nuances of the quantum computing market is crucial to successfully identifying top performing quantum computing stocks in 2025. Do your due diligence, consider the potential risks and rewards, and strategically build your portfolio to capitalize on this transformative technology. Begin your research now and explore the opportunities available in the exciting world of quantum computing.

Featured Posts

-

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025

Us Typhon Missile System In Philippines A Counter To Chinese Aggression

May 20, 2025 -

Tampoy I Marilena Dexetai Epithesi Me Maxairi Deite Ti Tha Ginei Sto Epomeno Epeisodio

May 20, 2025

Tampoy I Marilena Dexetai Epithesi Me Maxairi Deite Ti Tha Ginei Sto Epomeno Epeisodio

May 20, 2025 -

O Giakoymakis Kai To Mls Poso Realistiki Einai I Epistrofi

May 20, 2025

O Giakoymakis Kai To Mls Poso Realistiki Einai I Epistrofi

May 20, 2025 -

Addressing High Stock Market Valuations A Bof A Analysts Perspective

May 20, 2025

Addressing High Stock Market Valuations A Bof A Analysts Perspective

May 20, 2025 -

Your First Solo Trip A Step By Step Guide

May 20, 2025

Your First Solo Trip A Step By Step Guide

May 20, 2025

Latest Posts

-

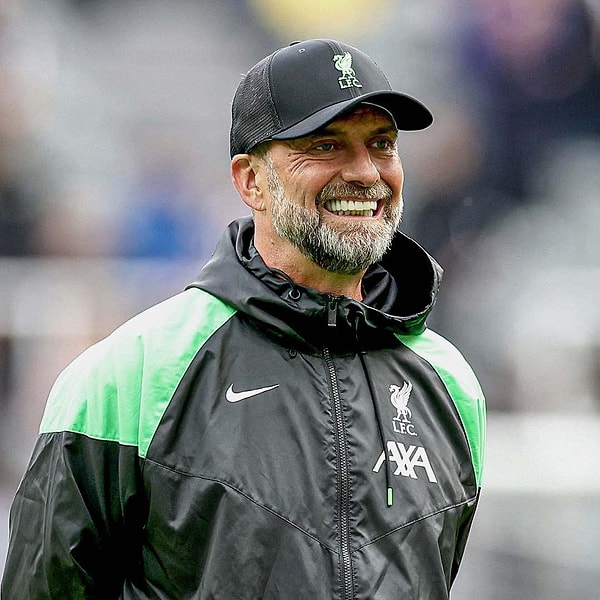

Teknik Direktoer Secimi Ancelotti Ve Klopp Un Avantajlari Ve Dezavantajlari

May 21, 2025

Teknik Direktoer Secimi Ancelotti Ve Klopp Un Avantajlari Ve Dezavantajlari

May 21, 2025 -

Liverpool Ve Real Madrid Klopp Ile Ancelotti Nin Basarilari

May 21, 2025

Liverpool Ve Real Madrid Klopp Ile Ancelotti Nin Basarilari

May 21, 2025 -

Bayern Muenih In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025

Bayern Muenih In Yeni Teknik Direktoerue Klopp Mu Ancelotti Mi

May 21, 2025 -

2024 25 Premier League Champions In Pictures

May 21, 2025

2024 25 Premier League Champions In Pictures

May 21, 2025 -

From Anfield To Hout Bay Klopps Coaching Influence On A South African Club

May 21, 2025

From Anfield To Hout Bay Klopps Coaching Influence On A South African Club

May 21, 2025