Today's Stock Market: Dow Futures, Earnings, And Market Movers

Table of Contents

Dow Futures: A Glimpse into Tomorrow's Trading

Dow Futures are contracts obligating the buyer to purchase (or the seller to sell) a specific number of Dow Jones Industrial Average (DJIA) index shares at a predetermined price on a future date. They serve as a valuable indicator of market sentiment and potential price movements in the near term. Analyzing Dow Futures can offer a glimpse into the likely direction of the broader market before the actual opening bell.

Several factors significantly influence Dow Futures prices:

- Economic Indicators: Key economic data releases, such as inflation reports (CPI, PPI), employment figures (Non-Farm Payrolls), and GDP growth rates, heavily impact investor confidence and, consequently, Dow Futures. Stronger-than-expected data often leads to increased optimism and higher futures prices, while weaker data can trigger declines.

- Global Events: Geopolitical instability, international trade tensions, and unexpected global crises can all create volatility in Dow Futures. Uncertainty about the future often translates into increased market caution and lower futures prices.

- Investor Sentiment: The overall mood and confidence of investors play a vital role. Periods of high optimism tend to push Dow Futures higher, while pessimism leads to lower prices. This sentiment is often reflected in news headlines, analyst reports, and social media discussions.

Bullet Points:

- Impact of interest rate hikes on Dow Futures: Increased interest rates generally put downward pressure on Dow Futures as borrowing costs rise and companies face higher financing expenses.

- Correlation between Dow Futures and other major indices (e.g., S&P 500, Nasdaq): Dow Futures are highly correlated with other major indices. Movements in the Dow Futures often foreshadow similar movements in the S&P 500 and Nasdaq.

- Analyzing Dow Futures charts and technical indicators: Technical analysis tools, such as moving averages, relative strength index (RSI), and candlestick patterns, can be used to identify potential price trends and trading opportunities in Dow Futures. (Include a sample chart here if possible)

Earnings Season: Deciphering Company Performance and Market Impact

Earnings season is a crucial period for investors. The release of quarterly earnings reports by publicly traded companies provides valuable insights into their financial health and future prospects. These reports significantly influence individual stock prices and can impact the overall market.

Understanding key financial metrics within earnings reports is crucial:

- EPS (Earnings Per Share): This metric reflects a company's profitability on a per-share basis. A higher EPS generally indicates better performance.

- Revenue: Total revenue generated by a company during the reporting period. Consistent revenue growth is a positive sign.

- Guidance: Management's expectations for future performance. Upward revisions in guidance usually lead to positive market reactions.

Bullet Points:

- Highlighting companies with significant earnings beats or misses: Companies exceeding or falling short of analysts' expectations often experience significant price movements.

- Analyzing the market reaction to specific earnings announcements: Immediate market reactions to earnings releases can reveal investor sentiment towards a specific company and its sector.

- Identifying potential investment opportunities based on earnings performance: Analyzing earnings reports can help identify undervalued companies with strong future potential.

For example, a significant earnings beat by a tech giant like Apple can send ripples throughout the entire technology sector, influencing the broader market. Conversely, a disappointing earnings report from a major financial institution could trigger a sell-off in the financial sector and affect broader market indices.

Identifying and Analyzing Key Market Movers

"Market movers" are significant events or factors that can cause substantial shifts in market prices and overall investor sentiment. These can range from economic data releases and company-specific news to geopolitical events and regulatory changes.

Different types of market movers include:

- Geopolitical Events: Wars, political instability, and international relations heavily influence investor confidence and market volatility.

- Regulatory Changes: New laws and regulations impacting industries can dramatically affect specific sectors and the overall market.

- Technological Breakthroughs: Major innovations and advancements in technology can create new investment opportunities and reshape existing industries.

Bullet Points:

- Examples of recent significant market movers and their consequences: (e.g., The impact of the war in Ukraine, interest rate changes by the Federal Reserve, or a significant technological advancement).

- Strategies for identifying potential market movers: Staying informed through reputable financial news sources, analyzing economic trends, and following industry-specific news are crucial strategies.

- The importance of staying informed about news and events impacting the market: Proactive monitoring of global events and news is critical for anticipating potential market movements.

Risk Management in Today's Volatile Market

Effective risk management is paramount in today's volatile market. Investors need strategies to protect their portfolios and mitigate potential losses.

Various risk management techniques include:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of losses in a single area.

- Hedging: Utilizing financial instruments like options or futures contracts to offset potential losses in other investments.

- Stop-loss orders: Setting predetermined sell orders to automatically limit potential losses if a stock price falls below a specified level.

Bullet Points:

- The role of diversification in mitigating risk: A diversified portfolio is less susceptible to significant losses from adverse events affecting a single sector or asset class.

- Strategies for managing portfolio risk during periods of high volatility: Reducing overall exposure, increasing cash holdings, and employing hedging strategies are common approaches.

- Importance of having a well-defined investment strategy: A clearly defined investment plan that outlines risk tolerance, investment goals, and asset allocation is crucial for managing risk effectively.

Conclusion: Understanding Today's Stock Market for Informed Decisions

Understanding today's stock market requires a multifaceted approach encompassing the analysis of Dow Futures for short-term predictions, the interpretation of earnings reports for assessing company performance, and the identification and analysis of key market movers for understanding broader trends. By incorporating effective risk management strategies, investors can navigate this dynamic environment more effectively.

To make informed investment decisions, stay informed about today's stock market by regularly checking reputable financial news sources, analyzing market data, and utilizing technical and fundamental analysis tools. Consider subscribing to a financial newsletter or following respected financial analysts on social media for up-to-date insights on Dow Futures, earnings announcements, and key market movers. Remember to seek professional financial advice if needed. Don't let the complexities of today's stock market overwhelm you; with the right knowledge and tools, you can make sound investment choices and achieve your financial goals.

Featured Posts

-

Hkm Qdayy Dd Ryys Shbab Bn Jryr

May 01, 2025

Hkm Qdayy Dd Ryys Shbab Bn Jryr

May 01, 2025 -

Colorado Basketball Heads To Texas Tech Toppins Impact And Game Outlook

May 01, 2025

Colorado Basketball Heads To Texas Tech Toppins Impact And Game Outlook

May 01, 2025 -

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025 -

Xrp Price Prediction 2024 Boom Or Bust After Sec Case

May 01, 2025

Xrp Price Prediction 2024 Boom Or Bust After Sec Case

May 01, 2025 -

Englands Last Minute Try Secures Six Nations Win Over France

May 01, 2025

Englands Last Minute Try Secures Six Nations Win Over France

May 01, 2025

Latest Posts

-

Nba Cavaliers Week 16 Performance Trade Analysis And Rest Evaluation

May 01, 2025

Nba Cavaliers Week 16 Performance Trade Analysis And Rest Evaluation

May 01, 2025 -

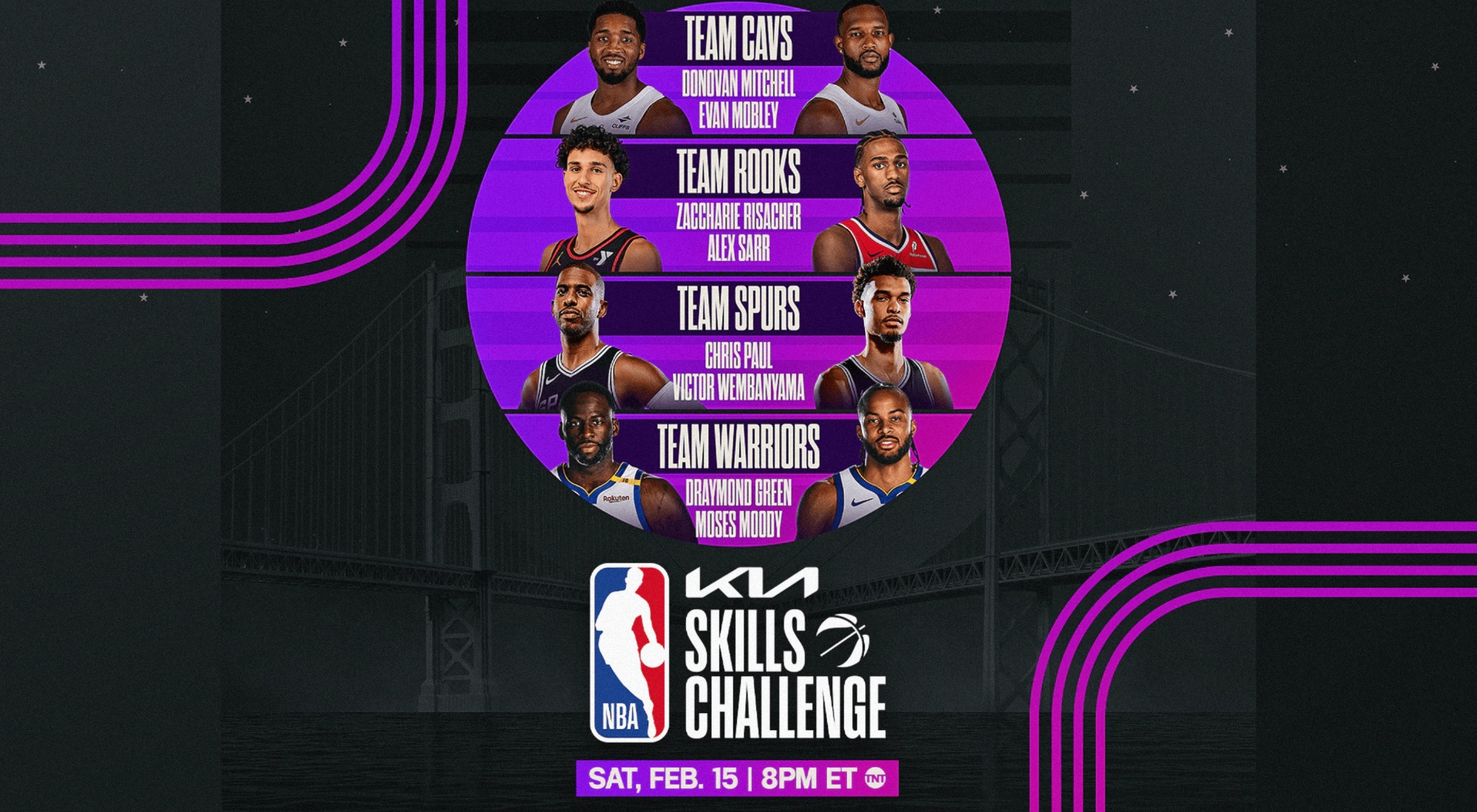

Nba Skills Challenge 2025 Players Teams And The Competition Format

May 01, 2025

Nba Skills Challenge 2025 Players Teams And The Competition Format

May 01, 2025 -

Pacers Cavs Matchups Where To Watch Game Schedule And Expert Analysis

May 01, 2025

Pacers Cavs Matchups Where To Watch Game Schedule And Expert Analysis

May 01, 2025 -

Celtics Championship Homestand Pressure Cooker Atmosphere

May 01, 2025

Celtics Championship Homestand Pressure Cooker Atmosphere

May 01, 2025 -

Cavs Week 16 Review Assessing The Recent Trade And Player Rest

May 01, 2025

Cavs Week 16 Review Assessing The Recent Trade And Player Rest

May 01, 2025