XRP Price Prediction 2024: Boom Or Bust After SEC Case?

Table of Contents

The Ripple vs. SEC Lawsuit: A Defining Factor

The legal battle between Ripple and the SEC is undeniably the most significant factor impacting XRP's price. The outcome of this case will have profound and long-lasting consequences.

The Current State of the Legal Battle

The SEC alleges that Ripple's sale of XRP constituted an unregistered securities offering. Ripple counters that XRP is a currency and not a security. The case has seen numerous developments, including:

- Key Court Decisions: Summary judgment motions have been filed and ruled upon, shaping the direction of the trial. Specific rulings regarding certain aspects of XRP sales have been pivotal.

- Expert Opinions: Both sides have presented expert witnesses offering contrasting perspectives on the classification of XRP and the implications of its sales.

- Potential Outcomes: Three primary scenarios are possible: a Ripple victory, an SEC victory, or a settlement. Each would dramatically affect XRP's market position and price.

Impact of the Ruling on XRP Price

The impact of the court's decision on XRP's price will be immediate and potentially substantial.

- Bullish Scenario (Ripple Wins): A favorable ruling could unleash a wave of positive market sentiment, leading to a significant price surge. Increased investor confidence and reduced regulatory uncertainty would fuel this rally.

- Bearish Scenario (SEC Wins): An unfavorable ruling could trigger a sharp price drop, as investors react to the increased regulatory risk and potential for further legal challenges.

- Neutral Scenario (Settlement): A settlement could lead to a period of consolidation, with price movements dictated by broader market trends rather than the legal uncertainty surrounding XRP. This outcome is uncertain but represents a potential middle ground. The terms of any settlement could significantly impact the sentiment surrounding XRP.

Technological Advancements and Ripple's Ecosystem

Beyond the legal battles, Ripple's technological advancements and the growth of its ecosystem play a crucial role in shaping the XRP price prediction 2024.

RippleNet Adoption and Growth

RippleNet, Ripple's payment network, continues to expand its reach and partnerships globally. This increased adoption strengthens XRP's utility and drives demand.

- Key Partnerships: Numerous financial institutions are using RippleNet for cross-border payments, increasing the network's credibility and transaction volume.

- New Integrations: The integration of RippleNet with new platforms and services enhances its versatility and user base, further solidifying XRP's position in the payment landscape.

- Growing Adoption: The increasing number of financial institutions adopting RippleNet signals a growing confidence in Ripple's technology and potentially a growing demand for XRP.

Future Developments and Innovations

Ripple is continually working on developing its technology and expanding its ecosystem.

- XRP Ledger Upgrades: Potential improvements to the XRP Ledger's scalability and functionality could enhance its efficiency and attractiveness to users.

- New Products and Partnerships: New products and partnerships could broaden Ripple's market reach and create new use cases for XRP, thereby increasing its value.

- Technological Innovation: Ripple's ongoing investment in research and development suggests a commitment to technological innovation, which could drive future growth and increase investor confidence.

Market Sentiment and Overall Crypto Market Conditions

External factors also impact XRP's price, including broader market trends and investor sentiment.

The Influence of Bitcoin and Altcoins

XRP's price is correlated with Bitcoin's price and the performance of the broader altcoin market.

- Bitcoin's Dominance: Bitcoin's price movements often influence the entire cryptocurrency market, including XRP. A bull run in Bitcoin can positively impact XRP, and vice versa.

- Altcoin Market Trends: The overall performance of the altcoin market significantly affects XRP's price, as investor sentiment towards altcoins can influence demand for XRP.

- Market Capitalization: XRP's market capitalization relative to other cryptocurrencies can affect its price volatility.

Investor Sentiment and Speculation

Investor sentiment, driven by news, social media, and general market confidence, is a key driver of XRP's price volatility.

- FUD (Fear, Uncertainty, and Doubt): Negative news or speculation can create FUD, leading to a sell-off and price decline.

- Social Media Influence: Social media platforms heavily influence XRP’s price movements. Positive sentiment tends to drive price increases while negative comments result in declines.

- Market Psychology: The overall mood of the cryptocurrency market influences investor behavior, impacting XRP's price.

XRP Price Prediction 2024: Potential Scenarios

Considering the factors discussed above, several scenarios are possible for XRP's price in 2024.

Bullish Case

A favorable outcome in the SEC case, coupled with increased RippleNet adoption and positive overall market sentiment, could lead to a significant price increase.

- Price Target: A bullish scenario might see XRP reaching prices significantly higher than its current levels. This would depend heavily on the speed and extent of adoption and the prevailing market sentiment.

- Supporting Factors: A positive court ruling, expanded partnerships, and broader cryptocurrency market growth would all contribute to a bullish scenario.

Bearish Case

An unfavorable court ruling, coupled with negative market sentiment and regulatory pressure, could lead to a price decline.

- Price Drop: A bearish scenario could result in a substantial price decrease, potentially reaching significantly lower levels.

- Supporting Factors: An adverse court decision, heightened regulatory scrutiny, and a downturn in the overall cryptocurrency market would contribute to this scenario.

Neutral Case

A settlement in the SEC case or a period of sideways movement in the broader cryptocurrency market could lead to a relatively flat price performance for XRP. This assumes a balance between bullish and bearish pressures.

Conclusion: XRP Price Prediction 2024: Key Takeaways and Call to Action

The XRP price prediction 2024 remains highly uncertain, heavily dependent on the Ripple vs. SEC lawsuit's outcome, technological advancements, and prevailing market conditions. While a bullish scenario is possible with a favorable court ruling and increased adoption, a bearish outcome remains a significant risk. A neutral scenario, involving a price consolidation, is also plausible.

Remember, cryptocurrency investments are inherently speculative. This analysis offers potential scenarios based on current information, but future price movements cannot be guaranteed. Always conduct your own thorough research and consult with a financial advisor before making any investment decisions. Stay informed about the latest developments in the XRP price prediction 2024 and make your own informed investment choices.

Featured Posts

-

Remembering Priscilla Pointer A Century Of Acting And Mentorship

May 01, 2025

Remembering Priscilla Pointer A Century Of Acting And Mentorship

May 01, 2025 -

Inteligencia Artificial Da Meta App Proprio Chega Para Competir Com O Chat Gpt

May 01, 2025

Inteligencia Artificial Da Meta App Proprio Chega Para Competir Com O Chat Gpt

May 01, 2025 -

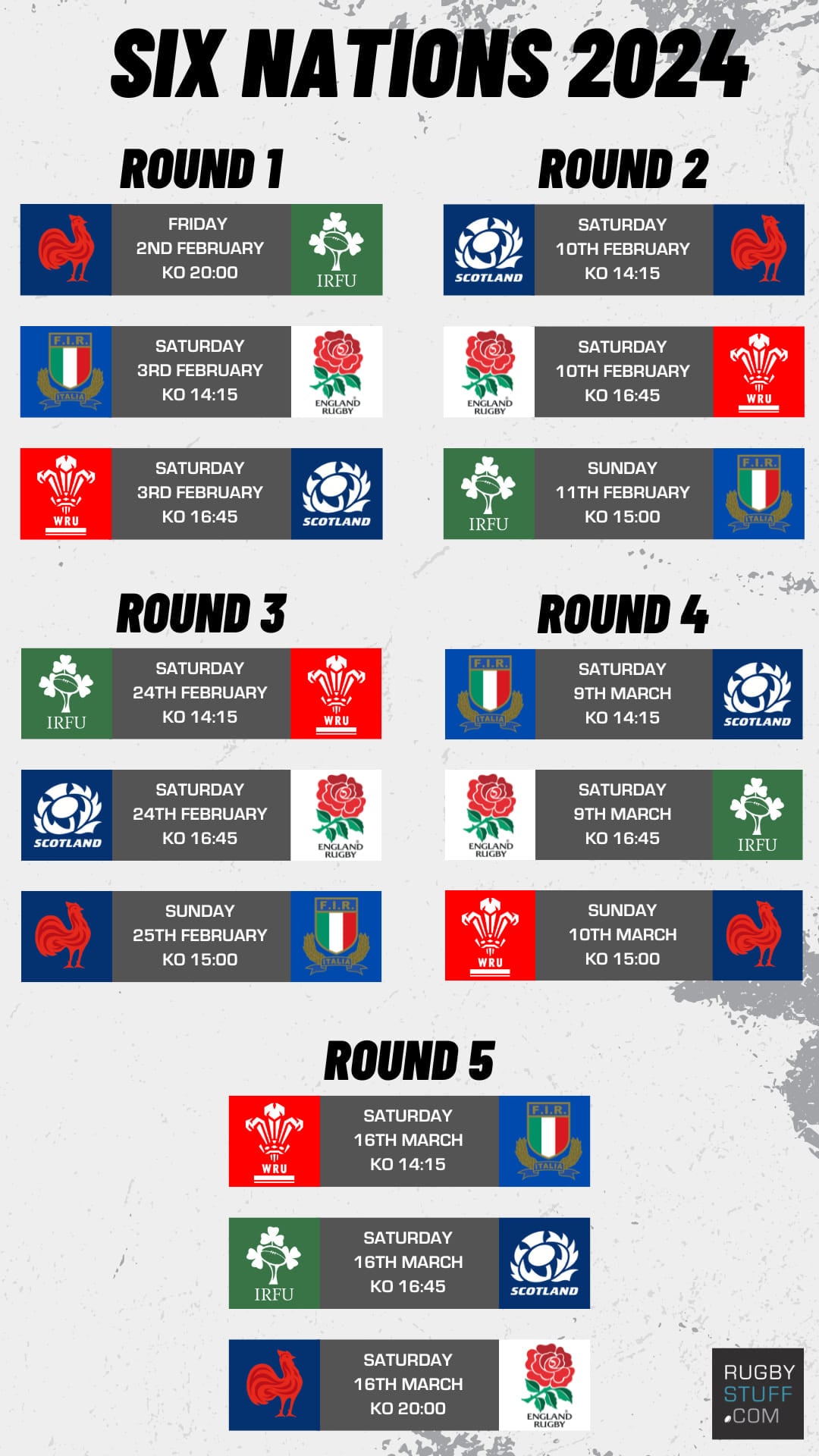

Dalys Late Show Steals Victory England Edges France In Six Nations Thriller

May 01, 2025

Dalys Late Show Steals Victory England Edges France In Six Nations Thriller

May 01, 2025 -

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Daughters Co Star Dies At 100

May 01, 2025 -

Duurzaam Schoolgebouw Kampen Rechtszaak Om Stroomnet Aansluiting

May 01, 2025

Duurzaam Schoolgebouw Kampen Rechtszaak Om Stroomnet Aansluiting

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025