Today's Stock Market: China Tariffs And UK Trade Deal Developments

Table of Contents

The Impact of China Tariffs on Global Markets: A Continuing Threat to Global Stock Market Stability?

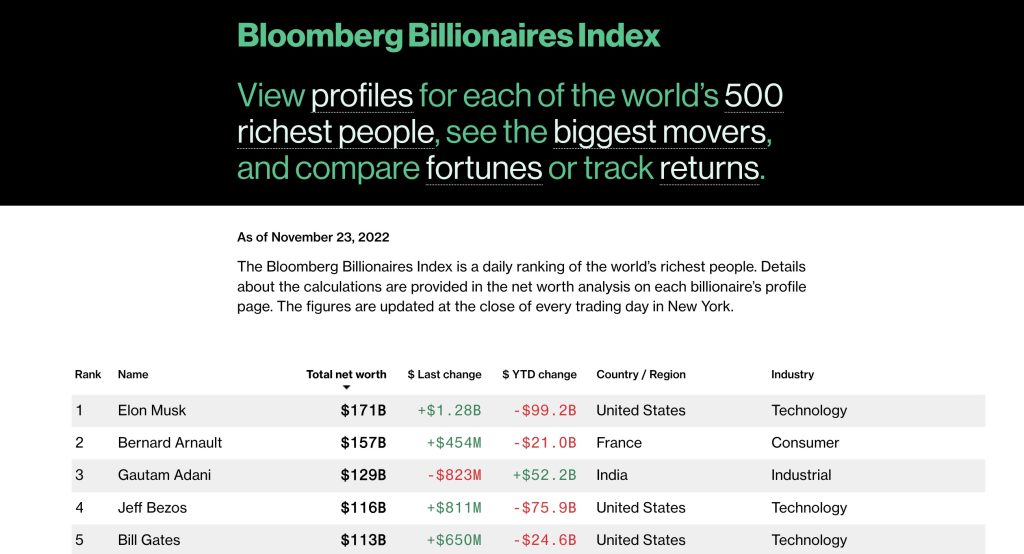

The ongoing trade war between the US and China has significantly impacted global markets. Years of escalating tariffs have created uncertainty and disrupted supply chains, affecting various sectors. The technology sector, in particular, has been heavily impacted, with companies facing increased costs and reduced access to key markets. Similarly, the manufacturing and agricultural sectors have suffered from reduced exports and increased prices.

Data reveals a clear correlation between tariff announcements and stock market fluctuations. For instance, the S&P 500 experienced significant drops following major tariff escalations. The Shanghai Composite, China's primary stock index, also faced considerable volatility during periods of heightened trade tensions.

- Impact on specific stock indices: The S&P 500 and the Shanghai Composite have both shown significant correlation with US-China trade tensions.

- Examples of companies significantly affected by tariffs: Several tech giants, along with numerous manufacturing and agricultural companies, have reported substantial losses due to tariffs.

- Potential for further escalation and its market implications: The possibility of further tariff increases or trade restrictions remains a major source of market uncertainty.

Analyzing the UK Trade Deal and its Stock Market Ripple Effects: Post-Brexit Trade Deal: Navigating Uncertainty in the UK Stock Market

The UK's departure from the European Union and subsequent trade deals have introduced new dynamics into the global economy and the UK stock market. The post-Brexit trade agreement with the EU, while avoiding a no-deal scenario, has created complexities for businesses and investors. The long-term impact on the UK economy and stock market remains to be seen. Specific sectors, such as financial services and automotive, have experienced immediate challenges due to changed regulations and trade barriers.

- Impact on the FTSE 100 and other UK indices: The FTSE 100 has exhibited volatility reflecting uncertainty surrounding the UK's trade relationships.

- Opportunities and challenges presented by new trade agreements: While new trade agreements offer opportunities for increased trade with non-EU countries, navigating the complexities of these deals poses significant challenges for businesses.

- Potential for increased trade with non-EU countries: The UK is actively seeking new trade partnerships globally, which could offer significant long-term benefits for the economy and the stock market.

Smart Investment Strategies in a Volatile Global Market

Navigating the current market climate requires a well-defined investment strategy that accounts for global trade uncertainties. Diversification is crucial to mitigate risk. Investors should consider spreading their investments across different asset classes, including stocks, bonds, and exchange-traded funds (ETFs). A well-diversified portfolio can help to cushion the impact of negative events in any one sector.

- Importance of risk assessment and tolerance: Investors should carefully assess their risk tolerance and choose investments accordingly.

- Strategies for managing portfolio volatility: Employing strategies like dollar-cost averaging and rebalancing can help manage portfolio volatility during uncertain times.

- Seeking professional financial advice: Seeking advice from a qualified financial advisor can provide valuable insights and personalized guidance.

Conclusion: Understanding Today's Stock Market Landscape

The impact of China tariffs and the UK trade deal on today's stock market is multifaceted and complex. Understanding these global trade dynamics is crucial for making informed investment decisions. Staying informed about developments and adapting investment strategies to reflect the changing landscape are essential for mitigating risks and capitalizing on opportunities. It's vital to maintain a flexible approach and consider diversification to navigate this volatile environment. To stay updated on the latest developments in today's stock market, particularly regarding China tariffs and the UK trade deal, subscribe to our newsletter or follow reputable financial news sources for informed insights into global trade and investment strategies.

Featured Posts

-

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 10, 2025

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 10, 2025 -

Open Ais Chat Gpt An Ftc Investigation And Its Potential Outcomes

May 10, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Outcomes

May 10, 2025 -

Draisaitl Reaches Century Mark Oilers Edge Islanders In Ot

May 10, 2025

Draisaitl Reaches Century Mark Oilers Edge Islanders In Ot

May 10, 2025 -

Indian Insurers Advocate For Simpler Bond Forward Regulations

May 10, 2025

Indian Insurers Advocate For Simpler Bond Forward Regulations

May 10, 2025 -

Young Thug Addresses Not Like U Name Drop Following His Release From Prison

May 10, 2025

Young Thug Addresses Not Like U Name Drop Following His Release From Prison

May 10, 2025