The Unseen Risk: Climate Change And Your Ability To Secure A Home Loan

Table of Contents

Increased Flood Risk and Home Loan Approvals

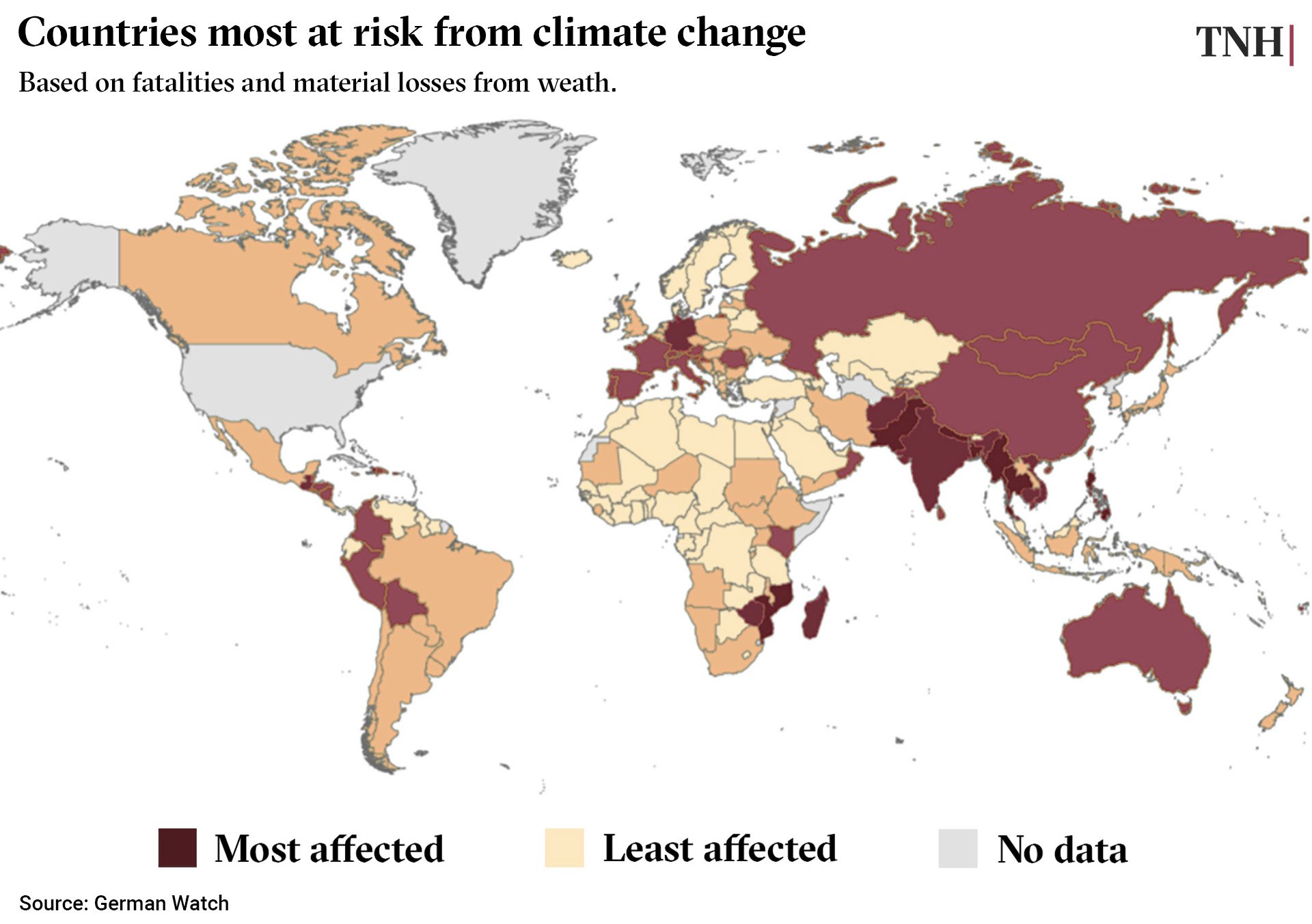

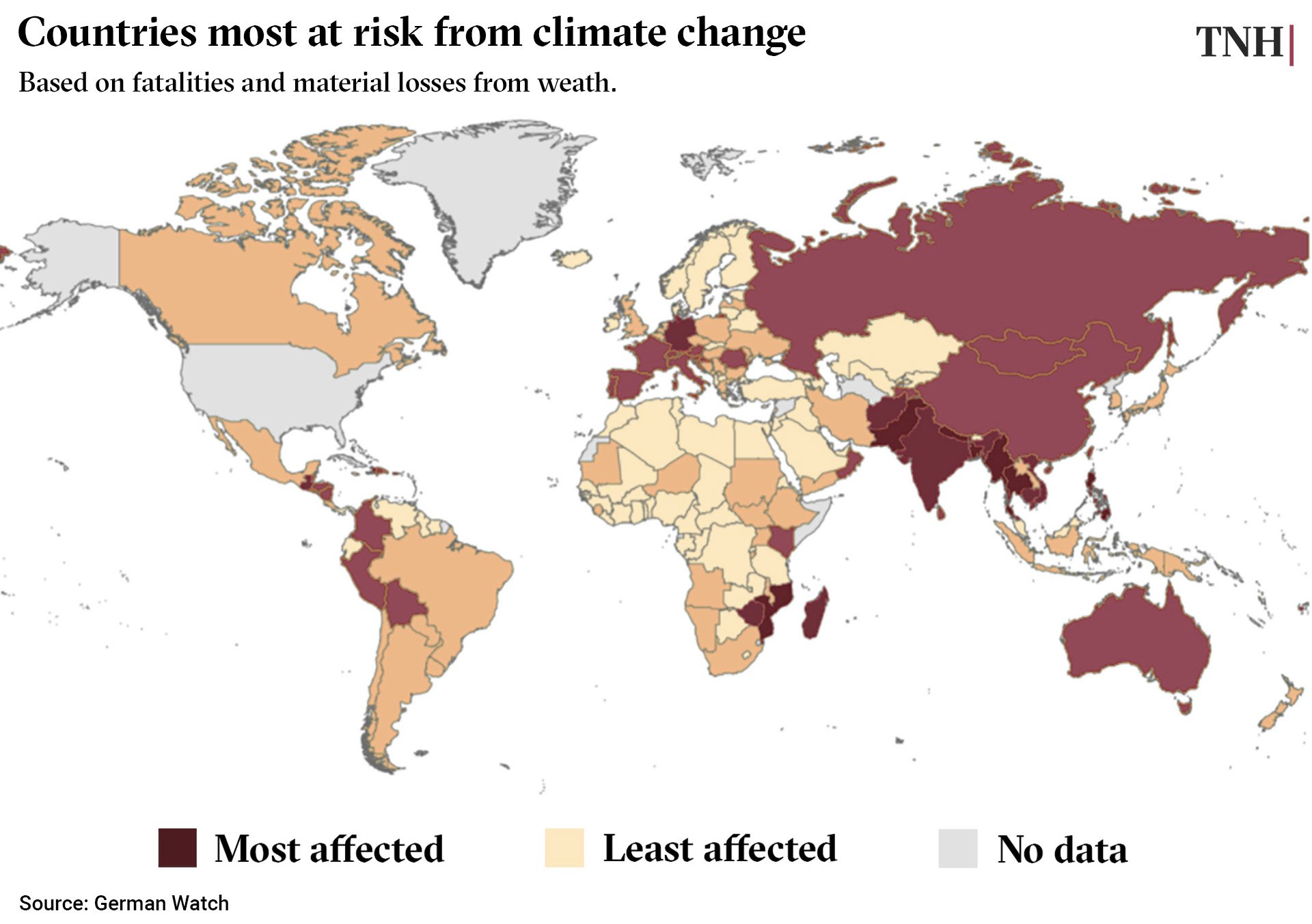

Increased flood risk, a direct consequence of climate change, significantly impacts lenders' assessments of property value and risk. The frequency and severity of flooding are increasing, leading to several challenges for those seeking home loans:

- Higher flood insurance premiums: The cost of insuring a property in a high-risk flood zone is escalating rapidly, making homeownership significantly more expensive. This increased cost is a major factor lenders consider.

- Stricter lending criteria: Lenders are increasingly requiring higher down payments or even denying loans altogether for properties located in high-risk flood zones. This is because the risk of default increases with the likelihood of flood damage.

- Increased scrutiny of property location: Lenders are meticulously examining property location and proximity to waterways. Properties near rivers, coastlines, or other bodies of water face stricter scrutiny.

- Vulnerable areas: Coastal communities and areas with poorly managed drainage systems are particularly vulnerable. Loan applications for properties in these areas face heightened challenges. For example, many areas in Florida and Louisiana are experiencing increased difficulty securing mortgages due to increased flooding.

Extreme Weather Events and Property Damage

Hurricanes, wildfires, and other extreme weather events, exacerbated by climate change, significantly impact property values and consequently, loan applications. The effects are far-reaching:

- Decreased appraisal values: Properties damaged by extreme weather events often see a dramatic decrease in their appraised value, making it harder to secure a loan or requiring a larger down payment.

- Insurance challenges: Securing adequate insurance after a major climate-related event can be incredibly difficult and expensive, if possible at all. This lack of insurance coverage makes properties less attractive to lenders.

- Lender reluctance: Lenders are becoming increasingly reluctant to provide loans in areas frequently affected by extreme weather, considering them high-risk investments.

- Climate risk assessments: Lenders are increasingly incorporating climate risk assessments into their loan approval processes, evaluating the long-term vulnerability of properties.

Rising Interest Rates and Climate Risk

There's a clear correlation between increased climate risk and rising interest rates for home loans. Lenders perceive properties in climate-vulnerable areas as higher risk, leading to:

- Higher interest rates: To compensate for the increased risk, lenders charge higher interest rates on loans for properties in flood zones or areas prone to wildfires. This increases the overall cost of borrowing.

- Government policy impact: Government regulations and policies designed to address climate change can also influence interest rates, particularly for high-risk properties. Incentives for green building or penalties for high-risk construction may affect loan terms.

- Less favorable terms: Securing favorable loan terms, such as low interest rates or long repayment periods, becomes significantly more challenging for properties situated in climate-vulnerable locations.

The Growing Importance of Climate-Related Disclosures

There's a growing trend towards mandatory climate-related disclosures for both lenders and sellers. This transparency aims to ensure buyers are fully informed about the risks:

- Mandatory disclosures: Some regions are now implementing mandatory climate risk disclosures, requiring sellers to reveal potential climate-related hazards associated with the property.

- Buyer impact: These disclosures significantly impact buyer decisions and, consequently, loan applications. Buyers are more likely to reconsider or withdraw their offers if significant climate risks are disclosed.

- Due diligence: It's crucial to conduct thorough research on climate risks before purchasing a home, including checking flood maps and understanding local vulnerability assessments.

Strategies for Navigating Climate Risk When Applying for a Home Loan

Proactive steps can help mitigate climate-related risks when applying for a home loan:

- Thorough research: Research climate risks in your potential locations, including flood maps, wildfire risk assessments, and historical weather data.

- Comprehensive insurance: Secure adequate flood insurance and other hazard insurance policies to protect your investment. Consider supplemental coverage for climate-related events.

- Climate-resilient features: Consider properties with climate-resilient features, such as elevated foundations, fire-resistant materials, and improved drainage.

- Informed lender: Work with a lender who understands and is experienced in handling climate-related risks in the mortgage lending process.

Conclusion:

Climate change poses significant risks to securing a home loan, impacting property values, insurance costs, and loan approval rates. Understanding the impact of climate change on home loans is crucial for securing your financial future. Start researching climate risks in your target area and speak to a lender experienced in handling climate-related considerations. Don't let climate change be the unseen risk that derails your dream of homeownership.

Featured Posts

-

Gamos Kai Tampoy I Istoria Tis Marthas

May 20, 2025

Gamos Kai Tampoy I Istoria Tis Marthas

May 20, 2025 -

Find The Answers Nyt Mini Crossword April 18 2025

May 20, 2025

Find The Answers Nyt Mini Crossword April 18 2025

May 20, 2025 -

Nyt Mini Crossword Answers March 13 Daily Solutions And Solving Tips

May 20, 2025

Nyt Mini Crossword Answers March 13 Daily Solutions And Solving Tips

May 20, 2025 -

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025

F1 Kaoset Hamilton Och Leclerc Diskvalificerade Vad Haende

May 20, 2025 -

Nyt Mini Crossword March 26 2025 Complete Answers And Solutions

May 20, 2025

Nyt Mini Crossword March 26 2025 Complete Answers And Solutions

May 20, 2025

Latest Posts

-

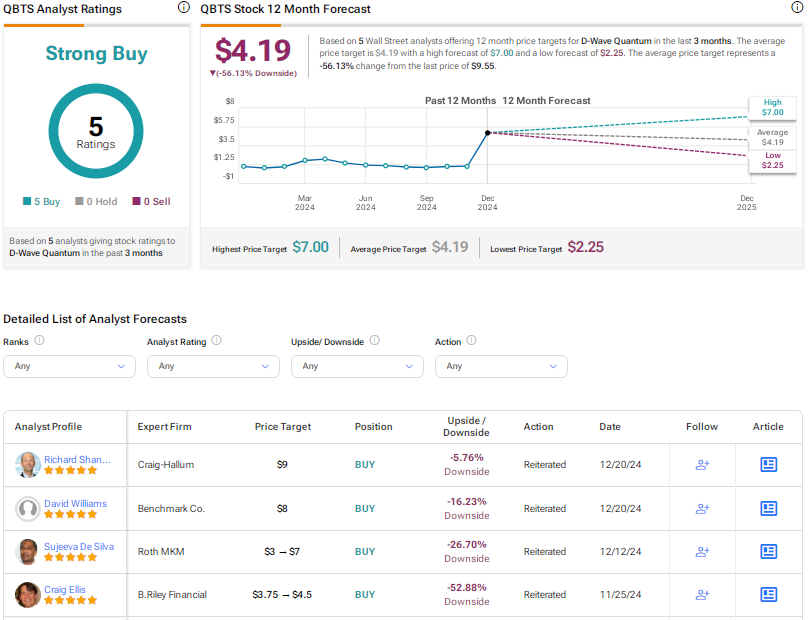

Investment In D Wave Quantum Qbts Understanding The Recent Stock Rally

May 20, 2025

Investment In D Wave Quantum Qbts Understanding The Recent Stock Rally

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Market Performance A Weekly Analysis

May 20, 2025

D Wave Quantum Inc Qbts Stock Market Performance A Weekly Analysis

May 20, 2025 -

D Wave Quantum Qbts Exploring The Factors Behind Todays Stock Growth

May 20, 2025

D Wave Quantum Qbts Exploring The Factors Behind Todays Stock Growth

May 20, 2025 -

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 20, 2025 -

D Wave Quantum Qbts Stock A Comprehensive Investment Analysis

May 20, 2025

D Wave Quantum Qbts Stock A Comprehensive Investment Analysis

May 20, 2025