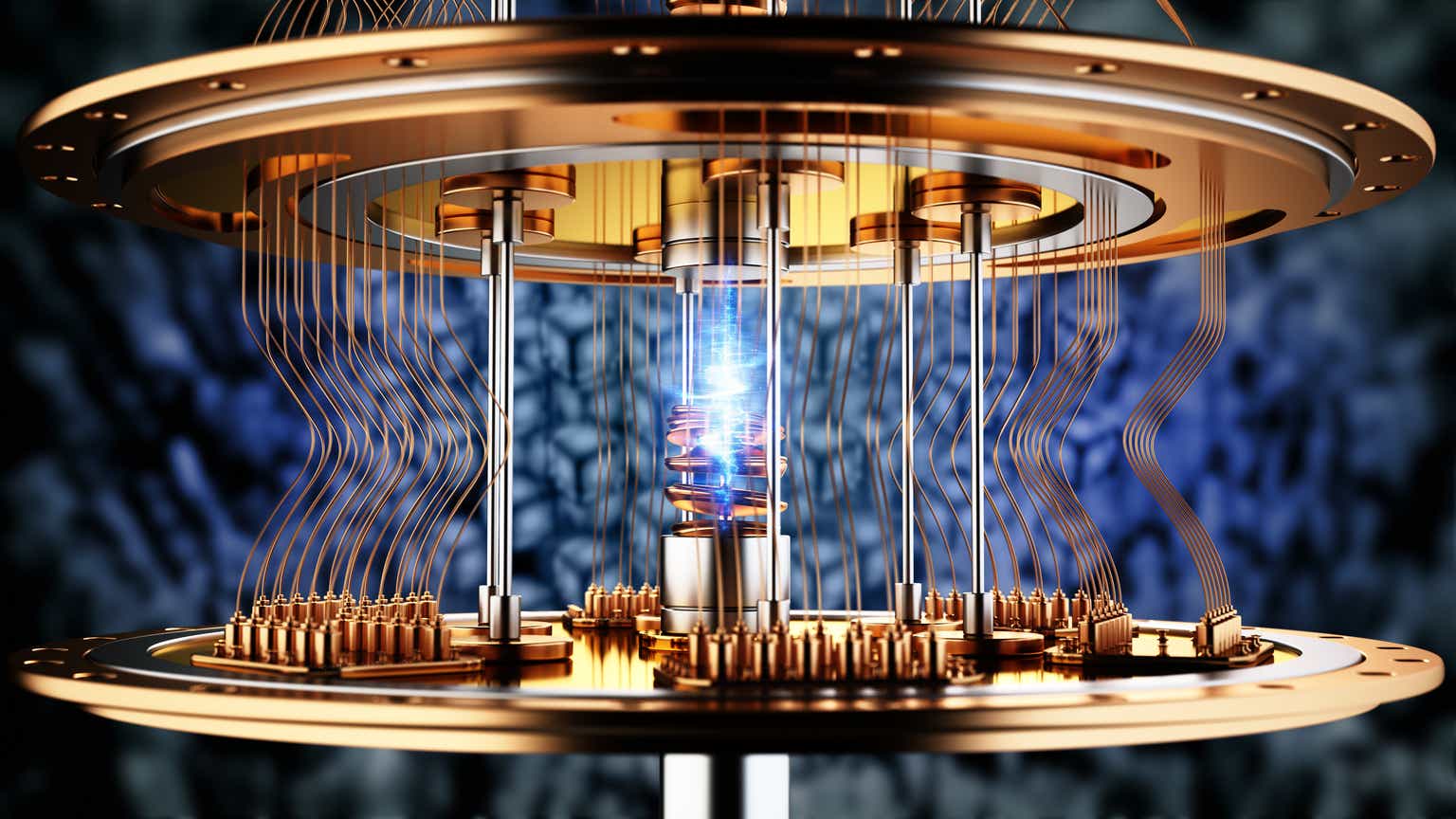

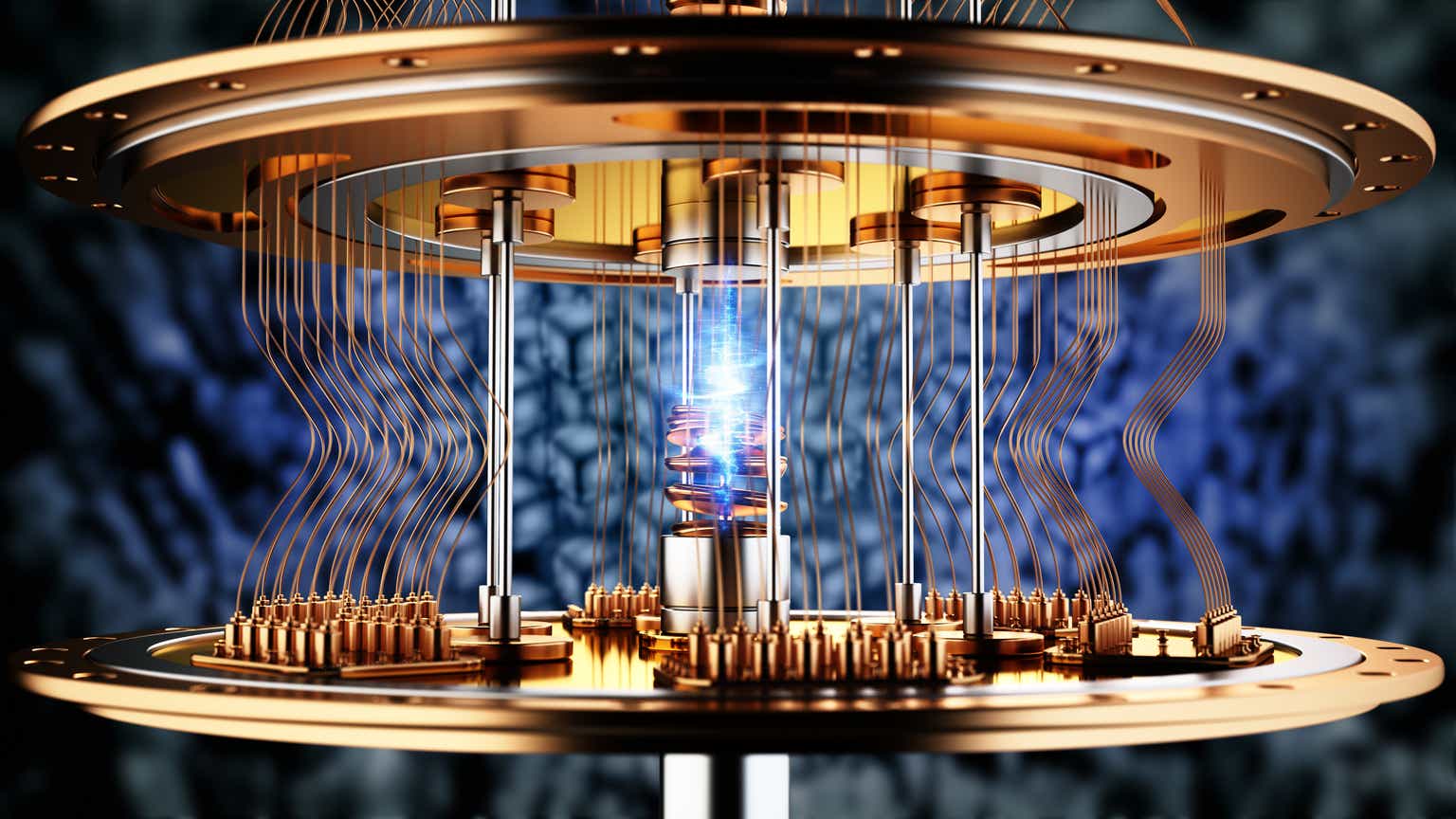

D-Wave Quantum (QBTS) Stock: A Comprehensive Investment Analysis

Table of Contents

H2: Understanding D-Wave Quantum's Business Model

D-Wave's business model rests on its unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computers pursued by competitors like IBM and Google, D-Wave's technology excels at solving specific types of optimization problems.

H3: Quantum Annealing Technology

Quantum annealing leverages the principles of quantum mechanics to find the lowest energy state of a system, effectively solving complex optimization problems. This approach offers advantages in specific areas, such as logistics, materials science, and financial modeling. However, it's not a universal solution and lacks the general-purpose capabilities of gate-based models. This specialization presents both opportunities and limitations for D-Wave. The advantages include speed and efficiency in tackling specific problem sets, while the disadvantages include a narrower range of applicable problems compared to gate-based systems.

H3: Target Market and Applications

D-Wave's quantum computers are currently being utilized across various sectors. Key applications include:

- Logistics and Supply Chain Optimization: Finding optimal routes, scheduling, and warehouse management solutions.

- Materials Science: Discovering new materials with improved properties for various applications.

- Drug Discovery and Development: Simulating molecular interactions to accelerate drug design.

- Financial Modeling: Optimizing portfolios and risk management strategies.

Notable partnerships and clients contribute to the growth of D-Wave's user base. These partnerships often involve collaborations on specific research and development projects, enhancing D-Wave’s market reach and providing real-world applications of their technology.

H3: Revenue Streams and Financial Performance

D-Wave's revenue streams primarily consist of:

- Hardware Sales: Selling its quantum computers to research institutions and corporations.

- Software Licensing: Providing access to its quantum-enhanced software tools.

- Cloud Services: Offering on-demand access to its quantum computers through a cloud-based platform.

Analyzing D-Wave's financial performance requires careful consideration of its revenue growth trajectory, profitability across different revenue streams, and overall financial health. While still in its growth phase, the company's financial statements provide insights into its progress and potential for future profitability. Investors should carefully review financial reports and analyst forecasts to form their own conclusions regarding the financial viability of the company.

- Revenue Diversification Strategy: D-Wave is actively diversifying its revenue streams to reduce dependence on any single product or service.

- Profitability of Revenue Streams: The profitability of each revenue stream varies and is influenced by factors like manufacturing costs, licensing fees, and cloud service usage.

- Growth Trajectory: D-Wave’s growth trajectory is expected to be driven by the increasing adoption of quantum computing across various industries.

H2: Assessing the Investment Risks and Rewards of QBTS Stock

Investing in QBTS stock presents both significant risks and substantial rewards. A thorough understanding of these factors is crucial for informed investment decisions.

H3: Market Volatility and Competition

The quantum computing market is inherently volatile, with significant fluctuations driven by technological breakthroughs, investment trends, and competitive dynamics. Key competitors include IBM, Google, IonQ, and Rigetti, each pursuing different quantum computing approaches. The competitive landscape necessitates a keen eye on technological advancements and market share dynamics.

H3: Technological Challenges and Development Risks

Quantum computing remains a nascent technology facing considerable challenges, including:

- Scalability: Building larger, more powerful quantum computers remains a major hurdle.

- Error Correction: Quantum systems are prone to errors; developing robust error correction techniques is crucial.

- Algorithm Development: Creating algorithms that effectively leverage the power of quantum computers is an ongoing area of research.

The risk of technological obsolescence is ever-present, requiring continuous innovation and adaptation to market demands and technological advancements.

H3: Valuation and Future Growth Potential

Assessing D-Wave's valuation requires careful analysis of its market capitalization, revenue projections, and potential future growth. Analyzing market forecasts and considering technological advancements will help in determining the future growth potential of the company.

- Impact of Government Regulations: Government policies and regulations can significantly impact the quantum computing industry.

- Intellectual Property Portfolio: D-Wave's intellectual property portfolio is a key asset, providing a competitive edge.

- Strength of Management Team: A strong management team with extensive experience in quantum computing and business management is crucial for successful execution of the company's strategy.

H2: D-Wave Quantum (QBTS) Stock: A Comparative Analysis

Comparing D-Wave's performance to other quantum computing stocks like IonQ and Rigetti provides a broader market perspective. Similarly, comparing QBTS to more established tech stocks helps gauge its relative risk and return profile. A comparative analysis of key financial metrics, growth trajectories, and business strategies is crucial for making informed investment decisions.

- Comparative Table of Financial Metrics: A table comparing key financial metrics of QBTS with competitors and traditional tech stocks provides a visual representation of relative performance.

- Risk and Return Profiles: Comparing risk and return profiles helps investors assess the potential gains and losses associated with investing in QBTS compared to other investment options.

- Differences in Business Strategies: Highlighting significant differences in business strategies provides insights into the competitive advantages and disadvantages of each company.

3. Conclusion

Investing in D-Wave Quantum (QBTS) stock presents a unique opportunity to participate in the burgeoning quantum computing revolution. While the technology faces significant challenges and the market is highly competitive, D-Wave's unique approach and growing market presence offer considerable potential for long-term growth. The inherent risks associated with investing in a relatively young company in a volatile market must be carefully considered. Ultimately, the decision to invest in D-Wave Quantum (QBTS) stock should be based on a thorough understanding of the company's business model, financial performance, and the competitive landscape.

Investment Recommendation: Given the potential of quantum computing and D-Wave's established position, QBTS could be a worthwhile addition to a diversified portfolio for investors with a high-risk tolerance and a long-term investment horizon. However, thorough due diligence is essential.

Call to Action: Before making any investment decisions related to D-Wave Quantum (QBTS) stock, conduct your own thorough research and consult with a financial advisor. Stay informed about the exciting developments in the quantum computing space and continue to learn more about D-Wave Quantum (QBTS) stock and its potential. Remember that investing in the stock market always involves risk.

Featured Posts

-

The Future Of Family Planning Exploring Otc Birth Control In A Post Roe World

May 20, 2025

The Future Of Family Planning Exploring Otc Birth Control In A Post Roe World

May 20, 2025 -

Hmrc Tax Return Changes Whos Exempt From Filing This Week

May 20, 2025

Hmrc Tax Return Changes Whos Exempt From Filing This Week

May 20, 2025 -

Finding Information On Bangladesh Your Guide To Bangladeshinfo Com

May 20, 2025

Finding Information On Bangladesh Your Guide To Bangladeshinfo Com

May 20, 2025 -

Understanding The 2025 Decline Of D Wave Quantum Inc Qbts Stock

May 20, 2025

Understanding The 2025 Decline Of D Wave Quantum Inc Qbts Stock

May 20, 2025 -

Miami Gp Hamilton And Ferraris Heated Tea Break Exchange

May 20, 2025

Miami Gp Hamilton And Ferraris Heated Tea Break Exchange

May 20, 2025

Latest Posts

-

Juergen Klopps Return To Liverpool A Pre Season Finale

May 21, 2025

Juergen Klopps Return To Liverpool A Pre Season Finale

May 21, 2025 -

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler

May 21, 2025

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler

May 21, 2025 -

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Etkileri Neler

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Arda Gueler Icin Etkileri Neler

May 21, 2025 -

Liverpools Resurgence The Juergen Klopp Era And Its Impact

May 21, 2025

Liverpools Resurgence The Juergen Klopp Era And Its Impact

May 21, 2025 -

Arda Gueler In Gelecegi Real Madrid In Yeni Teknik Direktoerue Kim Olacak

May 21, 2025

Arda Gueler In Gelecegi Real Madrid In Yeni Teknik Direktoerue Kim Olacak

May 21, 2025