The Ultimate Guide To Federal Student Loan Refinancing

Table of Contents

Understanding Your Federal Student Loans Before Refinancing

Before considering refinancing your federal student loans, it’s crucial to understand your current loan situation. This includes identifying the types of loans you have, assessing your creditworthiness, and analyzing your current repayment plan.

Types of Federal Student Loans

Understanding the nuances of different federal student loan types is critical. Refinancing options can vary depending on the type of loan you hold.

- Direct Subsidized Loans: The government pays the interest while you're in school (under certain conditions).

- Direct Unsubsidized Loans: Interest accrues while you're in school, and you're responsible for paying it.

- Direct PLUS Loans: Loans for graduate students and parents of undergraduates. Generally have higher interest rates.

- Perkins Loans: These are less common now but might still be held by some borrowers. They typically have fixed, low interest rates.

Knowing the specifics of your loan type – including interest rate and repayment plan – is vital to making informed decisions about refinancing.

Checking Your Credit Score and Report

Your credit score plays a significant role in your ability to refinance your federal student loans at favorable rates. Lenders use your credit score to assess your risk.

- Check your credit report: Obtain your free annual credit report from AnnualCreditReport.com to identify any errors and understand your credit history.

- Improve your credit score: Pay down existing debts, avoid opening new credit accounts, and maintain a consistent payment history to improve your score before applying for refinancing. A higher credit score generally leads to better interest rates.

Analyzing Your Current Repayment Plan

Federal student loans offer various repayment plans, each with its own pros and cons.

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase.

- Extended Repayment: Longer repayment period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR): Monthly payments are based on your income and family size.

Refinancing can alter your repayment plan, potentially offering lower monthly payments or a shorter repayment period. However, you'll lose the protections afforded by federal loan programs like IDR plans. Carefully weigh these factors before deciding.

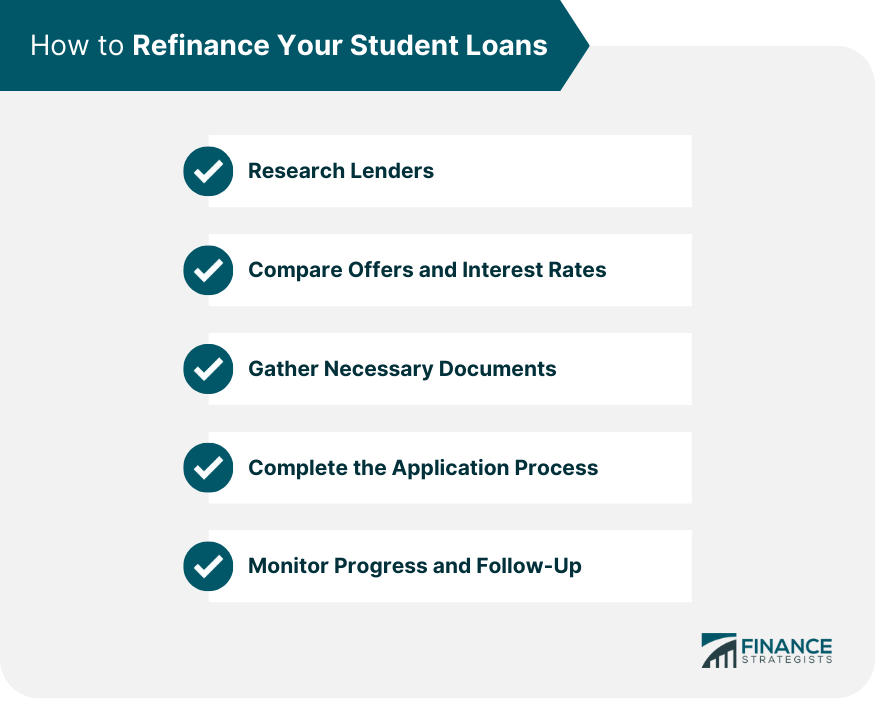

The Federal Student Loan Refinancing Process

Refinancing your federal student loans involves several key steps. Understanding these steps will streamline the process and improve your chances of success.

Finding the Right Lender

Choosing the right lender is crucial. Shop around and compare offers from different lenders based on several factors:

- Interest rates: Look for the lowest interest rate possible.

- Fees: Some lenders charge origination fees or prepayment penalties.

- Customer reviews: Check online reviews to gauge the lender's reputation and customer service.

- Reputable lenders: Research and compare offers from established financial institutions and reputable online lenders specializing in student loan refinancing.

The Application Process

The application process generally involves the following steps:

- Gather required documentation: This usually includes your Social Security number, proof of income, and details of your federal student loans.

- Complete the application: Fill out the online application form accurately and completely.

- Provide supporting documentation: Upload or submit any required documents.

- Review and sign the loan agreement: Carefully review the terms and conditions before signing.

Understanding the Terms and Conditions

The loan agreement outlines the terms of your refinanced loan. Pay close attention to the following:

- Interest rate: Understand the interest rate and whether it’s fixed or variable.

- Fees: Note any associated fees, such as origination fees or prepayment penalties.

- Repayment terms: Understand the repayment period and your monthly payment amount.

- Potential downsides: Recognize that refinancing federal student loans typically means losing access to federal repayment programs like income-driven repayment plans, deferment, and forbearance options.

Eligibility Requirements for Federal Student Loan Refinancing

Eligibility for federal student loan refinancing depends on various factors.

Credit Score and History

Lenders typically have minimum credit score requirements for refinancing. A higher credit score usually translates to better interest rates.

- Improving your credit score: Strategies include paying bills on time, reducing debt, and monitoring your credit report.

Income and Debt-to-Income Ratio

Your income and debt-to-income (DTI) ratio also affect your eligibility. A lower DTI ratio generally improves your chances of approval.

- Calculating your DTI ratio: Divide your total monthly debt payments by your gross monthly income.

- Improving your DTI ratio: Strategies include increasing your income or reducing your debt.

Loan Amount and Type

Not all federal student loans are eligible for refinancing. Check with lenders for specific eligibility criteria.

- Eligible loans: Generally include Direct Subsidized, Unsubsidized, and PLUS loans.

- Ineligible loans: Certain federal loan programs might not be eligible for refinancing.

Potential Benefits and Drawbacks of Federal Student Loan Refinancing

Refinancing offers potential advantages, but also carries risks.

Advantages

- Lower interest rates: You could significantly reduce your interest rate, saving you money over the life of the loan.

- Shorter repayment terms: A shorter repayment period means paying off your loans faster.

- Lower monthly payments: Depending on the new interest rate and loan term, your monthly payments might be lower.

- Simplified repayment: If you have multiple federal loans, refinancing can consolidate them into a single loan, simplifying your repayment process.

Disadvantages

- Loss of federal student loan benefits: You'll lose access to income-driven repayment plans, deferment, and forbearance options.

- Higher interest rates (potential): If your credit score isn't strong, you might end up with a higher interest rate than your current federal loans.

- Prepayment penalties (potential): Some lenders charge prepayment penalties if you pay off your loan early.

Conclusion: Making Informed Decisions about Federal Student Loan Refinancing

Refinancing federal student loans can offer significant financial benefits, but it's crucial to understand the process thoroughly and assess your eligibility. Weighing the potential advantages, such as lower interest rates and monthly payments, against the loss of federal loan benefits is crucial. Carefully review your current loan situation, research different lenders, compare offers, and choose the option best suited to your individual financial circumstances. Start your federal student loan refinancing journey today! Find the best federal student loan refinancing options for your needs and take control of your financial future. Remember to compare various refinancing options and thoroughly understand the terms before committing to any refinancing plan. Don't hesitate to seek professional financial advice if needed.

Featured Posts

-

Nbas Explanation For Game 4 No Call Against Pistons

May 17, 2025

Nbas Explanation For Game 4 No Call Against Pistons

May 17, 2025 -

Top Bitcoin Online Casino 2025 Jackbit Your Guide To Crypto Gambling

May 17, 2025

Top Bitcoin Online Casino 2025 Jackbit Your Guide To Crypto Gambling

May 17, 2025 -

May 16 Oil Market Report News And Price Analysis

May 17, 2025

May 16 Oil Market Report News And Price Analysis

May 17, 2025 -

Teisejo Klaida Nba Rungtynese Tarp Pistons Ir Knicks Retas Atvejis

May 17, 2025

Teisejo Klaida Nba Rungtynese Tarp Pistons Ir Knicks Retas Atvejis

May 17, 2025 -

Exploring The Best Online Casinos In Canada For 2025 Featuring 7 Bit Casino

May 17, 2025

Exploring The Best Online Casinos In Canada For 2025 Featuring 7 Bit Casino

May 17, 2025

Latest Posts

-

Djokovic In 37 Yasindaki Formu Analiz Ve Gelecek

May 17, 2025

Djokovic In 37 Yasindaki Formu Analiz Ve Gelecek

May 17, 2025 -

Kosarkaska Reprezentacija Srbije Pripremna Utakmica I Vesti Pred Evrobasket U Minhenu

May 17, 2025

Kosarkaska Reprezentacija Srbije Pripremna Utakmica I Vesti Pred Evrobasket U Minhenu

May 17, 2025 -

Tenis Yildizi Novak Djokovic 186 Milyon Dolarlik Gelirin Sirri

May 17, 2025

Tenis Yildizi Novak Djokovic 186 Milyon Dolarlik Gelirin Sirri

May 17, 2025 -

37 Yasindaki Djokovic Yasin Oenemini Yok Eden Performans

May 17, 2025

37 Yasindaki Djokovic Yasin Oenemini Yok Eden Performans

May 17, 2025 -

Bajerna Kao Domacin Generalka Kosarkaske Reprezentacije Srbije Pred Evrobasket

May 17, 2025

Bajerna Kao Domacin Generalka Kosarkaske Reprezentacije Srbije Pred Evrobasket

May 17, 2025