The U.S. Dollar's Trajectory: A Historical Perspective On Presidential Economic Impacts

Table of Contents

The Golden Age of the Dollar (Post-WWII to the 1970s)

The post-World War II era witnessed the establishment of the U.S. dollar's global hegemony, a period often referred to as the "golden age" of the dollar. This era was largely defined by the Bretton Woods Agreement.

The Bretton Woods Agreement and its Impact

The Bretton Woods Agreement, signed in 1944, established a fixed exchange rate system where most currencies were pegged to the U.S. dollar, which in turn was convertible to gold. This system solidified the dollar's position as the world's primary reserve currency.

- Key Players: The agreement was largely shaped by the United States and its allies, reflecting the post-war global power dynamics.

- Gold Standard: The link to gold provided a sense of stability and trust in the dollar's value.

- Limitations: The system faced inherent limitations, primarily the inability to accommodate significant imbalances in international payments and the growing demand for dollars exceeding the U.S. gold reserves. This ultimately led to its collapse. The fixed exchange rate, while offering stability, also lacked flexibility to respond to changing economic conditions. Maintaining dollar hegemony under this system required significant U.S. economic strength and consistent policies.

Early Presidential Influences (Truman, Eisenhower, Kennedy)

The early post-war presidents played a crucial role in shaping the U.S. dollar's trajectory during this period. Their economic policies, largely influenced by Keynesian economics, fostered a period of significant economic growth.

- Post-war economic boom: The post-war era saw unprecedented economic expansion in the United States.

- Keynesian economics: Government intervention and fiscal policies aimed at stimulating demand were central to maintaining economic stability.

- Cold War impact: The Cold War also influenced economic policies, impacting resource allocation and international trade relations. The U.S. dollar’s role in global finance was further solidified by its position in the international monetary system designed to facilitate post-war reconstruction and growth.

The Nixon Shock and the Era of Floating Exchange Rates

The relatively stable era of the Bretton Woods system ended abruptly in 1971 with President Nixon's decision to close the gold window. This "Nixon Shock" marked a turning point in the U.S. dollar's trajectory.

The End of Bretton Woods and its Consequences

Nixon's decision to decouple the dollar from gold ushered in an era of floating exchange rates, where the value of currencies was determined by market forces.

- Inflation: The removal of the gold standard contributed to increased inflation in the U.S. and globally.

- Devaluation: The dollar's value fluctuated significantly, experiencing periods of both appreciation and devaluation.

- Shift to a floating exchange rate system: This system offered greater flexibility but also introduced greater volatility into the international monetary system. This instability had a significant impact on the U.S. dollar's trajectory, ushering in a new period of uncertainty and volatility.

Presidential Responses to Economic Volatility (Ford, Carter)

Presidents Ford and Carter faced the challenge of managing the economic fallout of the Nixon Shock, including high inflation and economic recession.

- Oil crisis: The 1973 oil crisis further exacerbated economic instability, impacting inflation and economic growth.

- Inflation control: Both administrations implemented policies aimed at controlling inflation, with varying degrees of success.

- Economic recession: The U.S. economy experienced significant recessions during this period, highlighting the challenges of managing a floating exchange rate system and the complexities of macroeconomic policy. This period saw the emergence of stagflation – a combination of high inflation and slow economic growth – highlighting the complexities of managing the U.S. dollar's trajectory within a volatile global environment.

The Reagan Era and Beyond: Supply-Side Economics and the Dollar

The Reagan administration's economic policies, known as Reaganomics, significantly impacted the U.S. dollar's trajectory.

The Impact of Reaganomics on the U.S. Dollar

Reaganomics, characterized by supply-side economics, tax cuts, and deregulation, led to a period of strong dollar growth, initially.

- Tax cuts: Significant tax cuts aimed to stimulate economic activity.

- Government spending: Increased government spending contributed to budget deficits.

- Influence on dollar strength: Initially, the strong dollar attracted foreign investment, but the large budget deficits eventually put downward pressure on the currency over time. The impact of Reaganomics on the U.S. dollar's trajectory reveals the complex interplay between fiscal policy, monetary policy, and global economic conditions.

Subsequent Presidential Economic Policies and their Influence

Subsequent presidents, from George H.W. Bush to Joe Biden, each grappled with different economic challenges and implemented diverse policies impacting the U.S. dollar's trajectory.

- Globalization: Increased globalization led to greater interdependence and competition in the global economy.

- Financial crises: The Asian financial crisis (1997-98), the dot-com bubble burst (2000-2002), and the 2008 global financial crisis all significantly affected the U.S. dollar's value.

- Quantitative easing: Monetary policies such as quantitative easing, employed in response to the 2008 crisis, had complex effects on the dollar's value and global markets.

- Trade wars: Trade disputes and tariffs, notably under the Trump administration, also influenced the dollar's trajectory and international trade relations. These policies illustrate the continuing evolution of the U.S. dollar's trajectory in a complex, ever-changing global economic environment.

Conclusion: Understanding the U.S. Dollar's Trajectory

The U.S. dollar's trajectory has been a dynamic journey, shaped significantly by presidential economic policies. From the stability of the Bretton Woods system to the volatility of floating exchange rates, each era has presented unique challenges and opportunities. Understanding the interplay between presidential decisions and the resulting impact on the U.S. dollar requires analyzing the specific economic conditions and global context of each period. The ongoing challenges and uncertainties facing the U.S. dollar in the current global economic landscape are substantial. The continued dominance of the dollar remains to be seen as other currencies strengthen their role in international finance.

To gain a deeper understanding of the U.S. dollar's trajectory and its future, continue your research by exploring the historical economic data from the Federal Reserve, examining scholarly articles on international monetary systems, and delving deeper into the economic policies of each U.S. presidency and their global implications.

Featured Posts

-

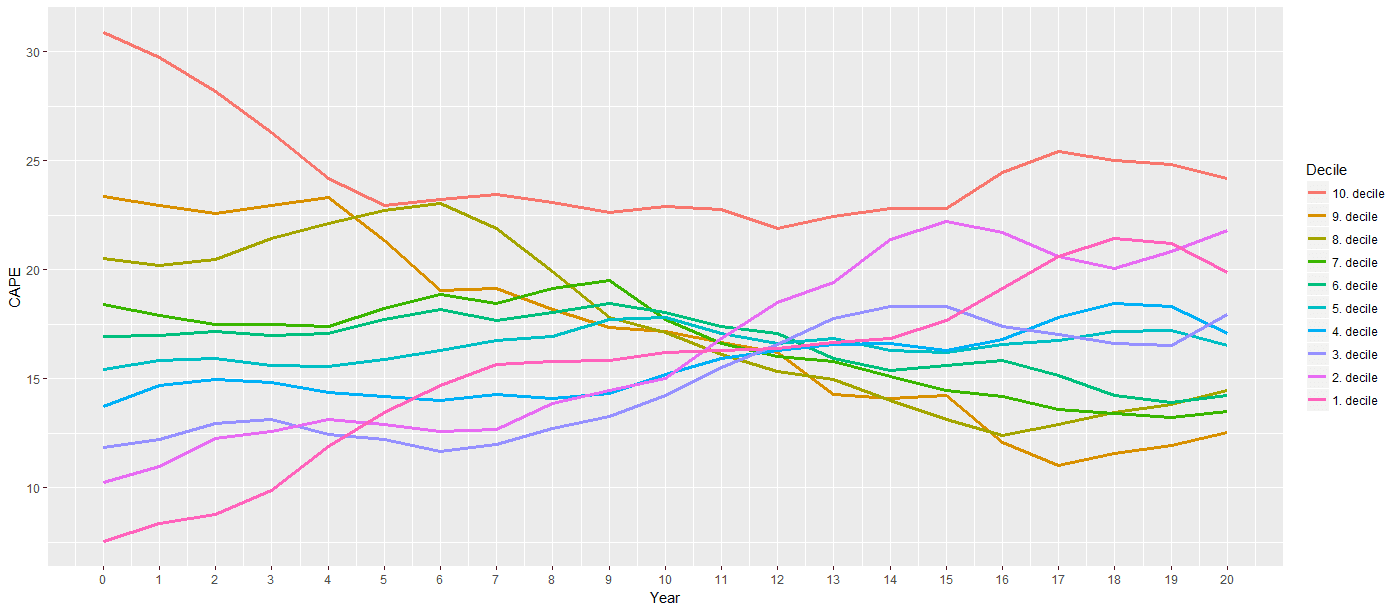

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025

Understanding High Stock Market Valuations Bof As Investor Guidance

Apr 29, 2025 -

Podcast Production Reimagined Ais Role In Processing Repetitive Scatological Texts

Apr 29, 2025

Podcast Production Reimagined Ais Role In Processing Repetitive Scatological Texts

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Following Silver Lake Investment

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Following Silver Lake Investment

Apr 29, 2025 -

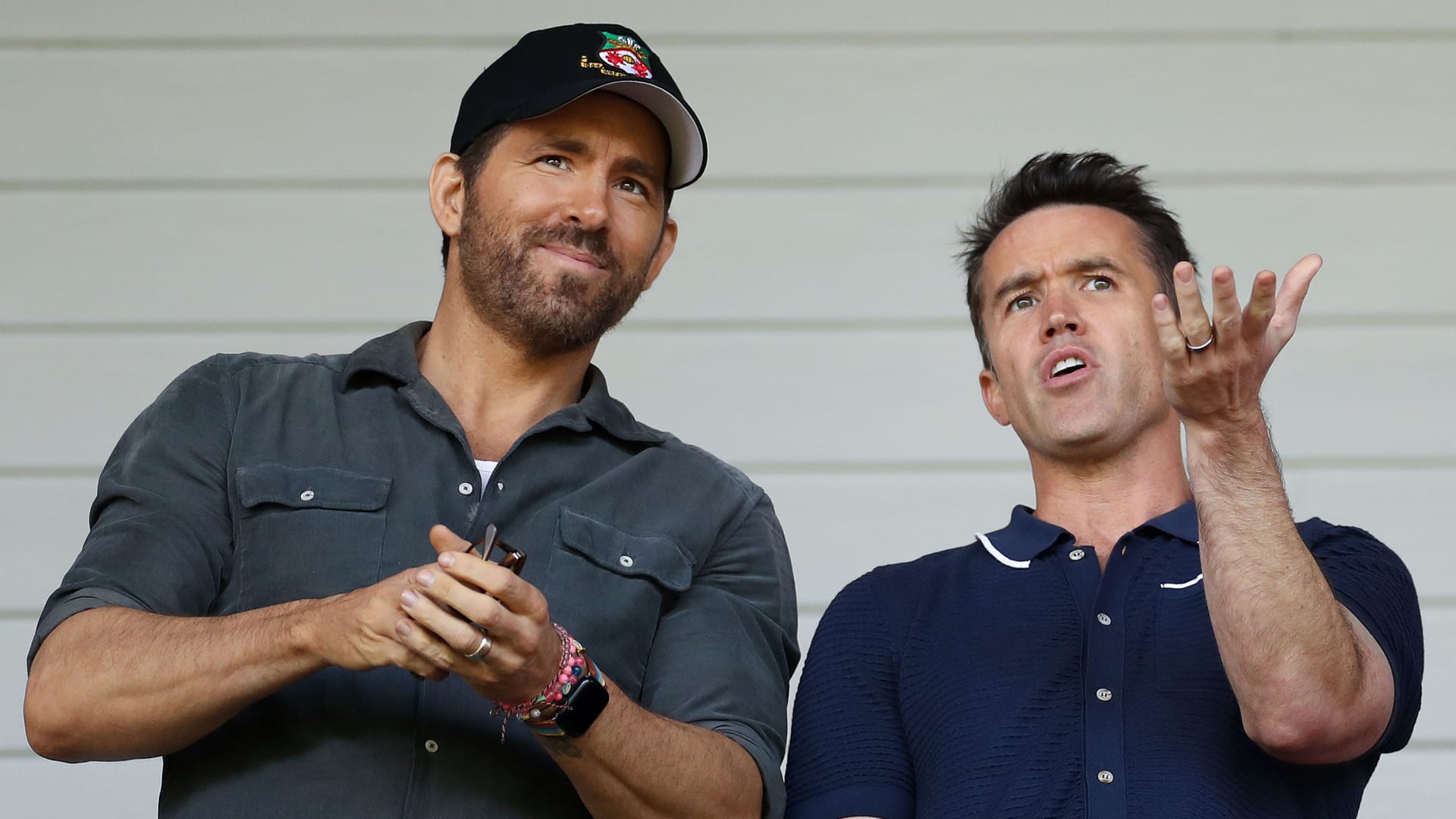

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025 -

Pete Rose Pardon Trumps Announcement And Public Reaction

Apr 29, 2025

Pete Rose Pardon Trumps Announcement And Public Reaction

Apr 29, 2025

Latest Posts

-

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025 -

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025

A Tremors Series For Netflix What We Know So Far

Apr 29, 2025 -

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025

Is Tremors Returning To Netflix Updates And Rumors

Apr 29, 2025 -

Tremor 2 Will Kevin Bacon Return In The New Netflix Series

Apr 29, 2025

Tremor 2 Will Kevin Bacon Return In The New Netflix Series

Apr 29, 2025 -

Netflix Tremors Series Release Date Cast And Plot Speculation

Apr 29, 2025

Netflix Tremors Series Release Date Cast And Plot Speculation

Apr 29, 2025