The Trump Effect: How An XRP Endorsement Impacts Institutional Investors

Table of Contents

Increased Market Volatility and Price Prediction

A Trump endorsement of XRP could send shockwaves through the cryptocurrency market, triggering significant price fluctuations.

Short-Term Price Surge: An endorsement could ignite an immediate, substantial price increase due to heightened demand and the fear of missing out (FOMO).

- Increased trading volume: Expect a surge in XRP trading activity as investors rush to capitalize on the perceived opportunity.

- Short squeezes: The sudden influx of buy orders could lead to short squeezes, further propelling the price upward.

- Potential for pump-and-dump schemes: The volatile nature of the situation could attract manipulative tactics, creating additional price volatility.

Historically, Trump's endorsements have influenced stock prices, often resulting in immediate price jumps. This precedent suggests a similar, if not amplified, effect on the already volatile cryptocurrency market. While predicting exact price targets is impossible, a surge exceeding 50%, even 100% within the first 24-48 hours post-endorsement, is not unreasonable based on past market reactions to similar events.

Long-Term Market Stabilization (or further volatility): The long-term implications are less clear-cut. While it could lead to greater institutional interest and market maturity, it also carries the risk of exacerbating existing volatility.

- Increased regulatory scrutiny: A surge in XRP's price following a Trump endorsement would likely invite heightened scrutiny from regulators like the SEC, potentially delaying broader adoption.

- Potential for market manipulation investigations: The possibility of pump-and-dump schemes following a rapid price increase would necessitate regulatory investigations.

- Influence on adoption by businesses: While increased visibility could encourage businesses to explore XRP integration, regulatory hurdles might hinder widespread adoption.

The long-term effect will depend on several factors, including the regulatory response and the overall market sentiment towards cryptocurrencies. Past instances of political influence on financial markets show that the initial impact can be quite different from the long-term consequences.

Impact on Regulatory Landscape and Institutional Adoption

The regulatory landscape and the stance of institutional investors will be significantly affected by a potential Trump endorsement of XRP.

Heightened Regulatory Scrutiny: A Trump endorsement would undoubtedly attract the attention of regulatory bodies, especially the SEC, already embroiled in a lawsuit against Ripple.

- Potential lawsuits: The SEC might intensify its legal action against Ripple, potentially impacting XRP's value and legal standing.

- Increased compliance costs: Ripple and other XRP-related entities would face increased pressure to comply with regulatory requirements.

- Changes in regulatory frameworks: The situation could catalyze changes in how cryptocurrencies are regulated, potentially impacting XRP's future prospects.

The ongoing SEC lawsuit against Ripple adds another layer of complexity. A Trump endorsement could either complicate the legal proceedings or even influence the outcome, depending on the administration's position on cryptocurrencies. This uncertainty makes it difficult for risk-averse institutional investors to commit significant capital.

Increased Institutional Interest (or hesitation): Despite the regulatory risks, the endorsement could attract institutional investors seeking high-growth potential. Alternatively, it could deter them due to amplified uncertainty.

- Changes in investment strategies: Institutional investors might adjust their strategies based on the perceived risk and reward associated with XRP.

- Allocation of funds to crypto assets: The endorsement could influence the allocation of funds within investment portfolios, potentially increasing or decreasing crypto exposure.

- Impact on portfolio diversification: Institutional investors might consider the impact of XRP on their overall portfolio diversification in the face of increased volatility.

The decision of institutional investors will depend on their risk tolerance, investment horizon, and overall market outlook.

Shift in Public Perception and Investor Sentiment

Public opinion and investor sentiment toward XRP will be significantly influenced by a potential Trump endorsement.

Positive Publicity and Mainstream Appeal: The endorsement could propel XRP into the mainstream, generating significant positive publicity.

- Increased media coverage: News outlets would likely give extensive coverage to the event, increasing XRP's visibility.

- Social media trends: A surge in social media discussions and engagement would further amplify the narrative.

- Impact on public perception of cryptocurrencies: The endorsement could contribute to broader acceptance of cryptocurrencies among the general public.

The power of celebrity endorsements is undeniable. A Trump endorsement could sway public opinion, potentially driving demand for XRP and influencing the actions of retail investors.

Potential for Backlash and Negative Sentiment: However, a significant portion of the population holds opposing views to Trump’s politics. This could result in a backlash.

- Boycotts: Some investors might boycott XRP in protest of the endorsement.

- Negative press: The endorsement might draw negative media attention, potentially damaging XRP's image.

- Impact on investor confidence: The controversy surrounding the endorsement could undermine investor confidence in XRP.

Understanding the diverse opinions and potential for both positive and negative reactions is critical to a realistic assessment of the situation.

Conclusion:

The potential impact of a Trump endorsement on XRP is multifaceted and highly unpredictable. While it could trigger short-term price spikes and attract some institutional investors, it carries significant risks, including heightened regulatory scrutiny, increased market volatility, and potential legal challenges. Institutional investors must conduct thorough due diligence, assess risks carefully, and possess a comprehensive understanding of the regulatory landscape before making any investment decisions. Don't underestimate the potential "Trump effect" on XRP – thorough research and a cautious approach are essential for navigating this complex situation. Research thoroughly before investing in XRP and other cryptocurrencies.

Featured Posts

-

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025

Economic Overhaul Urged Amidst Taiwan Dollars Appreciation

May 08, 2025 -

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

May 08, 2025

Are Ps 5 Pro Sales Disappointing Compared To The Ps 4 Pro

May 08, 2025 -

Is Xrp A Commodity The Secs Stance And Ongoing Debate

May 08, 2025

Is Xrp A Commodity The Secs Stance And Ongoing Debate

May 08, 2025 -

Inter Vs Barcelona Recalling A Champions League Final Classic

May 08, 2025

Inter Vs Barcelona Recalling A Champions League Final Classic

May 08, 2025 -

April 15 2025 Daily Lotto Winning Numbers

May 08, 2025

April 15 2025 Daily Lotto Winning Numbers

May 08, 2025

Latest Posts

-

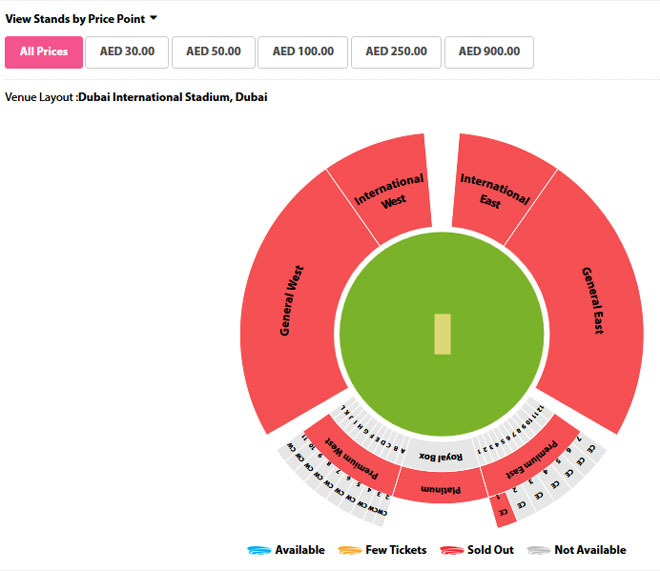

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025 -

Psl 10 Ticket Sales Commence Today

May 08, 2025

Psl 10 Ticket Sales Commence Today

May 08, 2025 -

Pakistan Super League Tickets For Psl 10 Now Available

May 08, 2025

Pakistan Super League Tickets For Psl 10 Now Available

May 08, 2025 -

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025 -

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf Tfsylat

May 08, 2025

Awdhw Ka Armghan Kys Myn Pwlys Ky Nakamy Ka Aetraf Tfsylat

May 08, 2025