Is XRP A Commodity? The SEC's Stance And Ongoing Debate

Table of Contents

This legal clash between the Securities and Exchange Commission (SEC) and Ripple Labs has captivated the attention of the crypto community and beyond. Understanding the arguments on both sides is crucial to navigating this complex issue. This article will delve into the SEC's case, Ripple's defense, the application of the Howey Test, and the wider implications for the cryptocurrency market.

The SEC's Case Against XRP

The SEC alleges that XRP is an unregistered security, arguing that it meets the criteria of the Howey Test. This test, established in the 1946 Supreme Court case SEC v. W.J. Howey Co., defines an investment contract as an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others.

The SEC's key evidence includes:

- Allegations that Ripple conducted unregistered sales of XRP to institutional investors.

- Claims that Ripple's marketing materials promoted XRP as an investment opportunity.

- Allegations that Ripple's efforts directly influenced the price and value of XRP.

If the SEC prevails, the implications are significant. Ripple could face substantial fines and legal repercussions. Furthermore, the ruling could set a precedent impacting other cryptocurrencies, potentially leading to increased regulatory scrutiny and market volatility. This uncertainty could stifle innovation and investment in the broader crypto ecosystem.

Ripple's Defense and Arguments for XRP as a Commodity

Ripple vehemently denies the SEC's claims, arguing that XRP functions primarily as a digital currency or a commodity, not a security. Their defense rests on several key points:

- XRP's decentralized nature: Ripple emphasizes that XRP operates on a decentralized, public blockchain, independent of Ripple's control.

- XRP's utility in cross-border payments: Ripple highlights XRP's use as a fast and efficient tool for international transactions.

- The broad distribution of XRP: Ripple points to the widespread adoption and trading of XRP on numerous exchanges, suggesting it functions as a currency rather than an investment contract.

Ripple cites various legal precedents and arguments to support its position, emphasizing the distinction between a cryptocurrency functioning as a medium of exchange and a security sold for investment purposes. The key difference, in their argument, lies in the lack of a direct expectation of profit solely based on Ripple's efforts.

The Howey Test and its Application to XRP

The Howey Test is central to this debate. It consists of four prongs:

- Investment of money: Did investors contribute capital?

- Common enterprise: Is there a common enterprise between investors and the promoters?

- Expectation of profits: Did investors reasonably expect profits?

- Efforts of others: Were profits derived from the efforts of others?

Applying the Howey Test to XRP presents significant challenges. While the first prong (investment of money) is clear, the remaining three are heavily debated. The decentralized nature of XRP complicates the "common enterprise" and "efforts of others" prongs. The "expectation of profits" prong hinges on whether investors primarily bought XRP for its utility or solely for speculative gains driven by Ripple's efforts. The ambiguity arises from XRP's dual nature – its use as a payment token and its potential for price appreciation. This highlights the difficulty of applying a traditional legal framework designed for securities to the innovative technology of cryptocurrencies.

The Ongoing Debate and its Implications for the Crypto Market

The outcome of the SEC v. Ripple case will have far-reaching consequences for the cryptocurrency industry. A ruling in favor of the SEC could trigger a wave of regulatory action against other cryptocurrencies, creating uncertainty and potentially stifling innovation. Conversely, a victory for Ripple could provide clarity and foster greater confidence in the crypto market.

Legal experts and industry analysts offer differing opinions. Some believe the SEC's case is weak due to XRP's decentralized nature, while others argue that the Howey Test applies broadly to any crypto asset with a centralized entity driving its price. The potential for future regulatory frameworks, such as specific legislation addressing digital assets, is also a point of significant discussion. The case could influence the creation of clearer, more tailored rules for the cryptocurrency market, fostering a more regulated and potentially more stable environment.

Conclusion: Understanding the XRP Commodity Debate and its Future

The SEC's claim that XRP is an unregistered security, based on the Howey Test, is countered by Ripple's assertion that XRP functions primarily as a currency or commodity. The core disagreement centers around the application of traditional securities law to decentralized digital assets. The ongoing legal battle highlights the complexities of regulating this nascent technology. The outcome remains uncertain, yet its implications for the entire cryptocurrency market are undeniable. Stay updated on the latest developments in the XRP commodity debate and learn more about the legal complexities surrounding XRP and its classification. This will allow you to navigate the evolving regulatory landscape of the crypto world more effectively.

Featured Posts

-

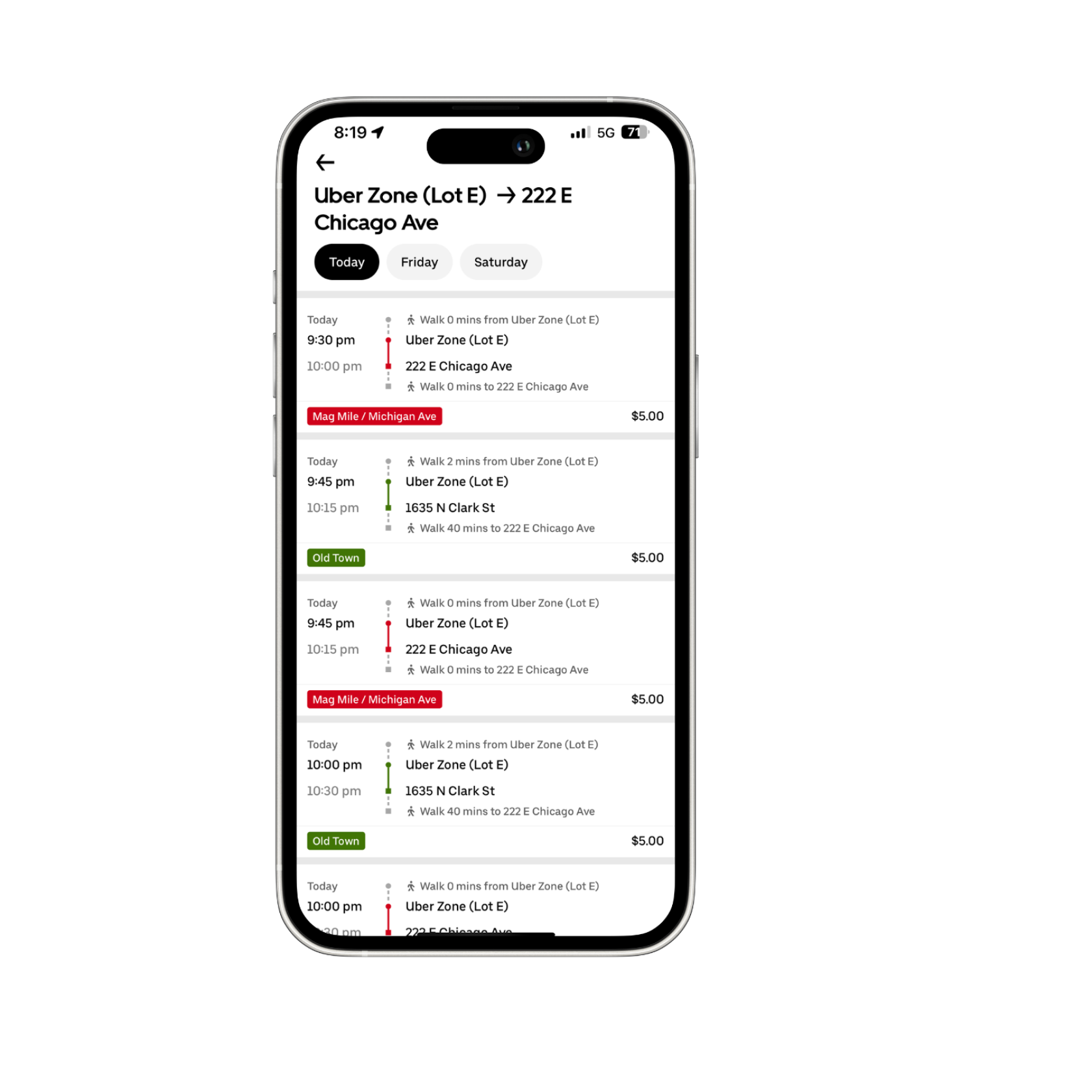

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025

Post Game Transportation Solution 5 Uber Shuttle From United Center

May 08, 2025 -

Understanding The Volatility Why Dogecoin Shiba Inu And Sui Prices Are Fluctuating

May 08, 2025

Understanding The Volatility Why Dogecoin Shiba Inu And Sui Prices Are Fluctuating

May 08, 2025 -

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025 -

Can Xrp Reach New Heights After A 400 Jump

May 08, 2025

Can Xrp Reach New Heights After A 400 Jump

May 08, 2025 -

Vse Matchi Arsenala I Ps Zh V Evrokubkakh Rezultaty I Obzory

May 08, 2025

Vse Matchi Arsenala I Ps Zh V Evrokubkakh Rezultaty I Obzory

May 08, 2025