The Transformation Of X: A Financial Analysis Post-Debt Sale

Table of Contents

Assessing X's Financial Health Pre-Debt Sale

Before the debt sale, X faced considerable financial challenges. High debt levels significantly hampered its operational efficiency and constrained its growth potential. This pre-sale financial distress was evident in several key metrics. A thorough debt sale impact analysis requires understanding this initial state.

-

High Debt Burden: X carried a substantial debt load, resulting in high interest expenses that eroded profitability. The debt-to-equity ratio was alarmingly high, exceeding 2:1, indicating significant financial leverage and risk. This high level of debt made X vulnerable to market fluctuations and economic downturns.

-

Liquidity Issues: Limited liquidity restricted X's ability to invest in new projects, pursue expansion opportunities, and meet its short-term obligations. This constrained growth and hindered its ability to compete effectively in the market. The analysis of liquidity is crucial in any post-debt sale financial performance assessment.

-

Negative Cash Flow: X's negative operating cash flow further exacerbated its financial woes. This inability to generate sufficient cash from operations made it reliant on external financing, increasing its debt burden and vulnerability.

-

Credit Downgrade: The increasing financial risk led to a credit rating downgrade, signaling heightened concerns among investors and lenders. This made it more expensive for X to access capital, further limiting its options. A post-debt sale analysis often includes reviewing credit rating changes as a key indicator.

The Debt Sale Transaction: Structure and Key Terms

To alleviate its financial burden and improve its operational flexibility, X executed a strategic debt sale. This transaction involved the sale of a significant portion of its outstanding debt to a consortium of investors.

-

Type of Debt Sold: The sale primarily included high-yield bonds and certain term loans, representing a considerable portion of X's total debt.

-

Buyer Profile: The buyers were a group of institutional investors seeking high-yield investment opportunities. This demonstrates confidence in X's potential for turnaround. Understanding the buyers provides additional insights into the debt sale's success.

-

Sale Price and Terms: The debt was sold at a discounted price, reflecting the inherent risk associated with distressed debt. However, the terms included a favorable payment schedule, allowing X to manage its cash flow more effectively. The discount offered indicates market perceptions regarding X's financial state and risk profile before the debt sale.

-

Impact on Capital Structure: The successful completion of this transaction significantly improved X's capital structure, reducing its debt-to-equity ratio and strengthening its balance sheet.

Post-Debt Sale Financial Performance Analysis

Following the debt sale, X experienced a marked improvement in its financial performance. A detailed post-debt sale financial performance analysis reveals the positive impact of the restructuring.

-

Improved Debt-to-Equity Ratio: The debt sale dramatically lowered X's debt-to-equity ratio, significantly reducing its financial leverage and risk profile. The improvements can be visualized in updated financial statements showing a clear reduction in debt.

-

Enhanced Liquidity Position: X's liquidity position improved significantly, providing it with the financial flexibility to pursue growth opportunities and meet its operational needs. Improved cash flow allows for strategic investments and operational improvements.

-

Changes in Profitability: The reduction in interest expense, coupled with improved operational efficiency, led to a noticeable increase in net income and operating margins. This demonstrates the positive impact of deleveraging on profitability.

-

Credit Rating Upgrade: The improved financial health led to an upgrade in X's credit rating, lowering its cost of borrowing and expanding its access to capital. An improved credit rating is a sign of financial health following debt restructuring.

Long-Term Implications and Future Outlook

The successful debt sale has laid the foundation for X's long-term growth and sustainability. Looking forward, the long-term implications of this restructuring are positive.

-

Strategic Investments: X is now better positioned to make strategic investments in research and development, enhancing its product offerings and competitive advantage. The financial flexibility is a key driver of long-term growth potential.

-

Expansion Opportunities: With improved liquidity and reduced debt burden, X can explore new market opportunities through expansion or acquisitions. Analyzing market opportunities post-debt sale is crucial for long-term strategic planning.

-

Sustainability of Improved Health: The success of maintaining this improved financial health relies on continued operational efficiency and effective financial management. Maintaining profitability and efficient operations is vital for the long-term success of X.

-

Potential Challenges: Despite the positive outlook, X still faces potential challenges, such as macroeconomic conditions and competition. However, the improved financial position allows the company to navigate these challenges more effectively.

Conclusion

The financial analysis post-debt sale demonstrates a significant transformation in X's financial health. The debt sale successfully reduced its debt burden, improved liquidity, and boosted profitability. This restructuring has positioned X for future growth and long-term sustainability. Understanding the complexities of a financial analysis post-debt sale is vital for investors and companies alike. For a deeper dive into the complexities of post-debt sale financial analysis and how it can impact your own investment decisions, explore further resources on [link to relevant resources/services]. Stay informed about the ongoing financial analysis post-debt sale transformations shaping the market.

Featured Posts

-

Gpu Price Hike Whats Causing The Surge

Apr 28, 2025

Gpu Price Hike Whats Causing The Surge

Apr 28, 2025 -

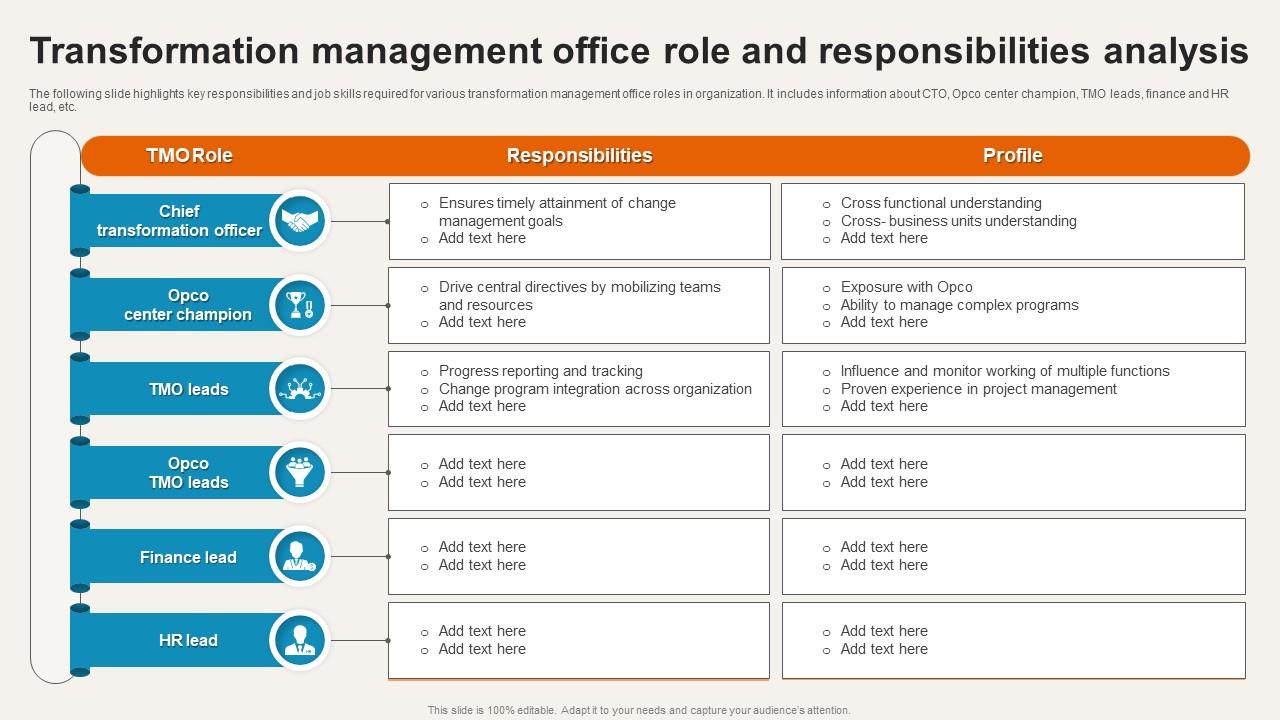

Trump Administrations Impact On Higher Education A Nationwide Analysis

Apr 28, 2025

Trump Administrations Impact On Higher Education A Nationwide Analysis

Apr 28, 2025 -

Colorado Qb Shedeur Sanders Joins Cleveland Browns

Apr 28, 2025

Colorado Qb Shedeur Sanders Joins Cleveland Browns

Apr 28, 2025 -

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 28, 2025

Anchor Brewing Companys 127 Year Run Comes To An End

Apr 28, 2025 -

Xs Financial Realignment Insights From Musks Recent Debt Sale

Apr 28, 2025

Xs Financial Realignment Insights From Musks Recent Debt Sale

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

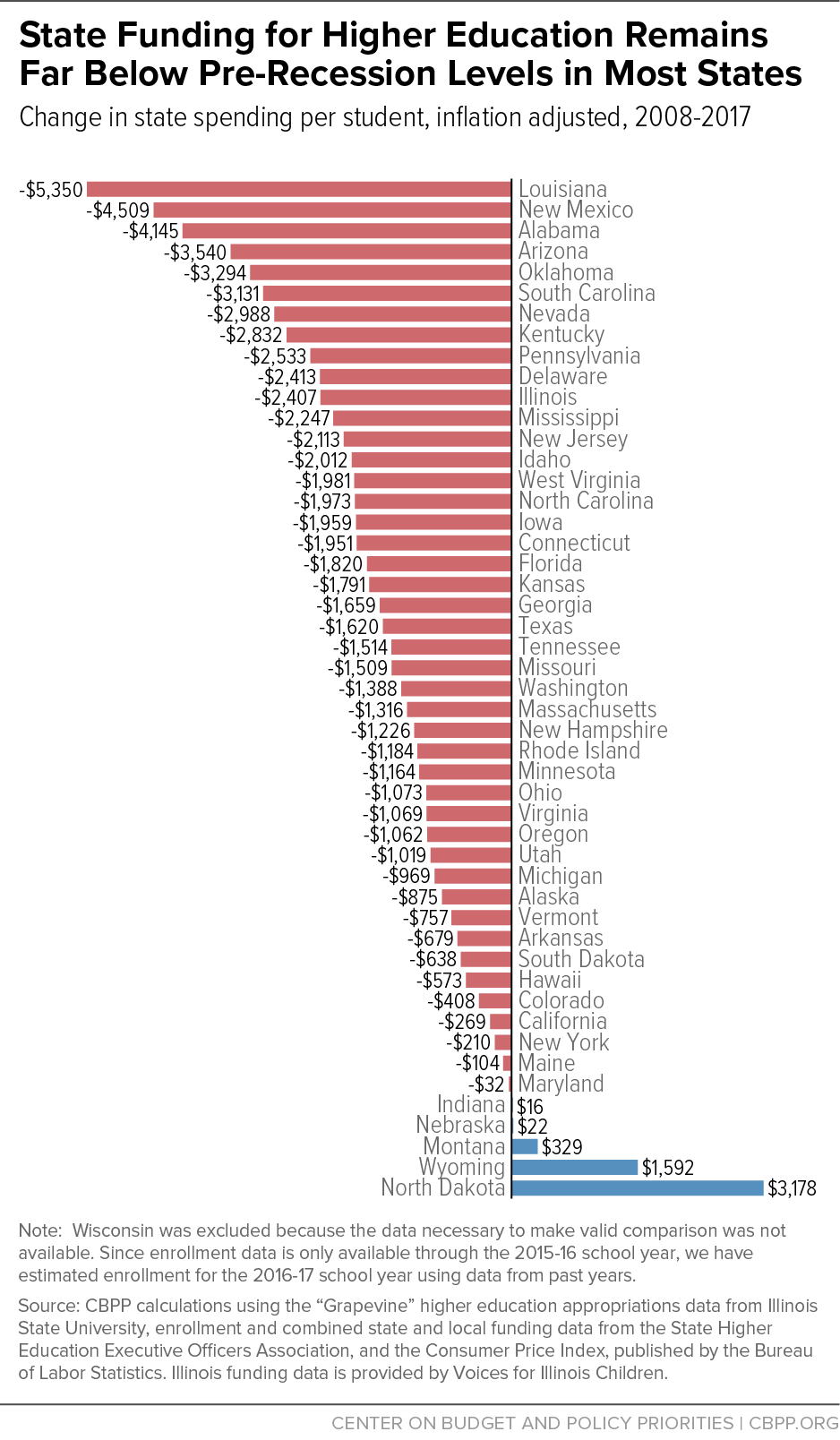

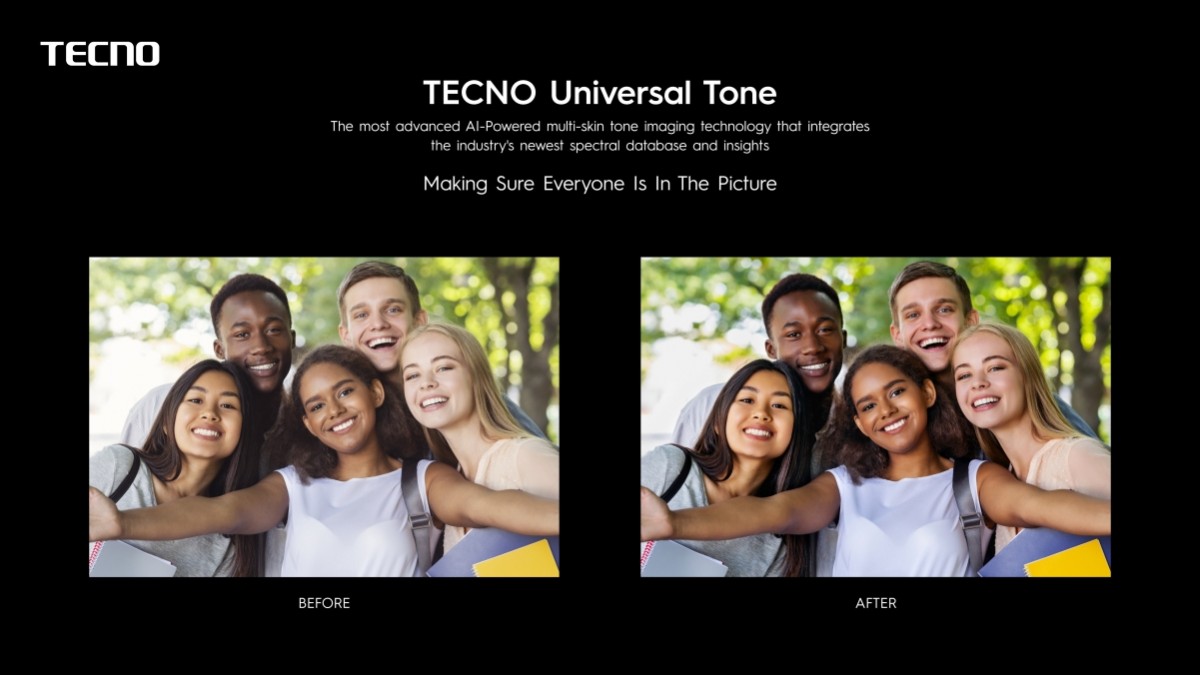

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025