X's Financial Realignment: Insights From Musk's Recent Debt Sale

Table of Contents

The Details of the Debt Sale

The Amount Raised and its Purpose

The exact amount raised through X's recent debt sale remains partially undisclosed, but reports suggest billions of dollars were secured. The lenders involved represent a diverse group, likely including both traditional financial institutions and potentially private equity firms seeking exposure to the high-growth, albeit volatile, tech sector. The funds are reportedly earmarked for a multi-pronged strategy:

- Debt Repayment: A significant portion is likely allocated to refinancing existing debt, reducing the immediate financial pressure on the company.

- Operational Expenses: Funding daily operations, including server costs, employee salaries, and content moderation efforts, is essential for maintaining the platform's functionality.

- Future Acquisitions: While not explicitly stated, the capital injection could also facilitate potential acquisitions of smaller companies to expand X's functionalities or user base. This aligns with Musk's history of aggressive growth strategies.

- Technological Upgrades: Investing in infrastructure improvements and new technologies is crucial for remaining competitive in the ever-evolving landscape of social media.

The interest rates and repayment terms associated with this debt remain largely confidential, but industry analysts suggest they're likely reflecting the perceived risk associated with X's current financial situation and the broader economic climate. Credit rating agencies will continue to assess the debt's impact on X's overall creditworthiness.

The Rationale Behind the Debt Financing

Musk's decision to pursue debt financing instead of equity financing is a key aspect of X's financial realignment. Several factors likely contributed to this strategy:

- Maintaining Ownership: Musk's aversion to diluting his ownership stake in X is well-documented. Debt financing allows him to raise capital without relinquishing control of the company.

- Tax Advantages: Debt financing can offer significant tax advantages compared to equity financing, potentially reducing the company's overall tax burden.

- Perceived Revenue Stability: Despite recent challenges, X likely projects sufficient revenue streams to service the debt, making it a viable option. Advertising revenue, premium subscriptions, and potential future revenue streams are key factors in this assessment.

- Industry Comparison: This strategy differs from many of X's tech competitors, who often favor equity financing for rapid expansion. This highlights Musk's unique approach to financial management.

Impact on X's Financial Health and Stability

Short-Term Effects

The short-term effects of the debt sale on X are multifaceted:

- Improved Liquidity: The infusion of cash significantly improves X's liquidity position, providing a buffer against unexpected expenses or revenue shortfalls.

- Increased Debt Burden: The increased debt obligations mean higher interest payments, impacting profitability in the short term. Managing this increased financial burden will be crucial.

- Credit Rating Impact: Credit rating agencies will scrutinize X's financial performance, and the debt sale could influence their credit rating, impacting the company's ability to borrow money in the future.

Long-Term Implications

The long-term implications of X's financial realignment are more complex and uncertain:

- Funding Future Growth: The capital secured can fuel future growth initiatives, allowing for further product development, expansion into new markets, and strategic acquisitions.

- Default Risk: Failure to meet revenue targets could lead to a default on the debt, resulting in severe financial consequences. Careful management and strategic planning are crucial to mitigate this risk.

- Strategic Decision-Making: The debt burden might constrain X's strategic decision-making, potentially leading to more cautious choices regarding investments and expansions.

- Investor Sentiment: The market's reaction to the debt sale and X's subsequent performance will significantly impact investor sentiment and, if applicable, the company's stock price.

Broader Implications for the Tech Industry

Setting a Precedent

X's debt-fueled financial realignment could set a precedent for other tech companies, especially those facing similar challenges or pursuing aggressive growth strategies:

- Influence on Tech CEOs: Musk's actions might encourage other tech CEOs to explore similar debt financing strategies, potentially increasing the reliance on debt in the tech sector.

- Attractiveness of Debt Financing: The success (or failure) of X's strategy will influence the perceived attractiveness of debt financing for high-growth tech companies.

- Increased Financial Prudence: The current economic climate and the challenges faced by X might underscore the increasing importance of financial prudence in the tech sector, even for high-growth companies.

Market Reactions and Analyst Opinions

Market reactions to X's debt sale have been mixed, reflecting the uncertainty surrounding the strategy's long-term success. Financial experts offer diverse opinions: some view it as a bold but necessary move, while others express concerns about the potential risks involved. Credit rating agencies will provide further insights into the implications of this financial realignment through their subsequent assessments and reports. Observing market movements and analyst reports is essential to gauge the real-time impact of this financial decision.

Conclusion

X's financial realignment, characterized by its significant debt sale, represents a bold strategy with both potential benefits and significant risks. While it provides immediate liquidity and funding for growth initiatives, it also increases the company's debt burden and exposes it to potential default risks. The long-term success of this strategy will depend on X's ability to meet its revenue targets and manage its debt effectively. The broader impact on the tech industry remains to be seen, but it undeniably highlights the evolving dynamics of financing in the high-growth tech sector. Stay informed on the evolution of X's financial realignment and its future strategies to understand the ongoing impact of this crucial decision.

Featured Posts

-

Easing Rent Increases But Housing Costs Still Climbing In Metro Vancouver

Apr 28, 2025

Easing Rent Increases But Housing Costs Still Climbing In Metro Vancouver

Apr 28, 2025 -

Red Sox Breakout Star An Unexpected Contributors Rise

Apr 28, 2025

Red Sox Breakout Star An Unexpected Contributors Rise

Apr 28, 2025 -

Canadian Travel Boycott A Fed Snapshot Of Economic Repercussions

Apr 28, 2025

Canadian Travel Boycott A Fed Snapshot Of Economic Repercussions

Apr 28, 2025 -

Red Sox Blue Jays Game Preview Lineups Buehlers Role And Outfielders Return

Apr 28, 2025

Red Sox Blue Jays Game Preview Lineups Buehlers Role And Outfielders Return

Apr 28, 2025 -

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

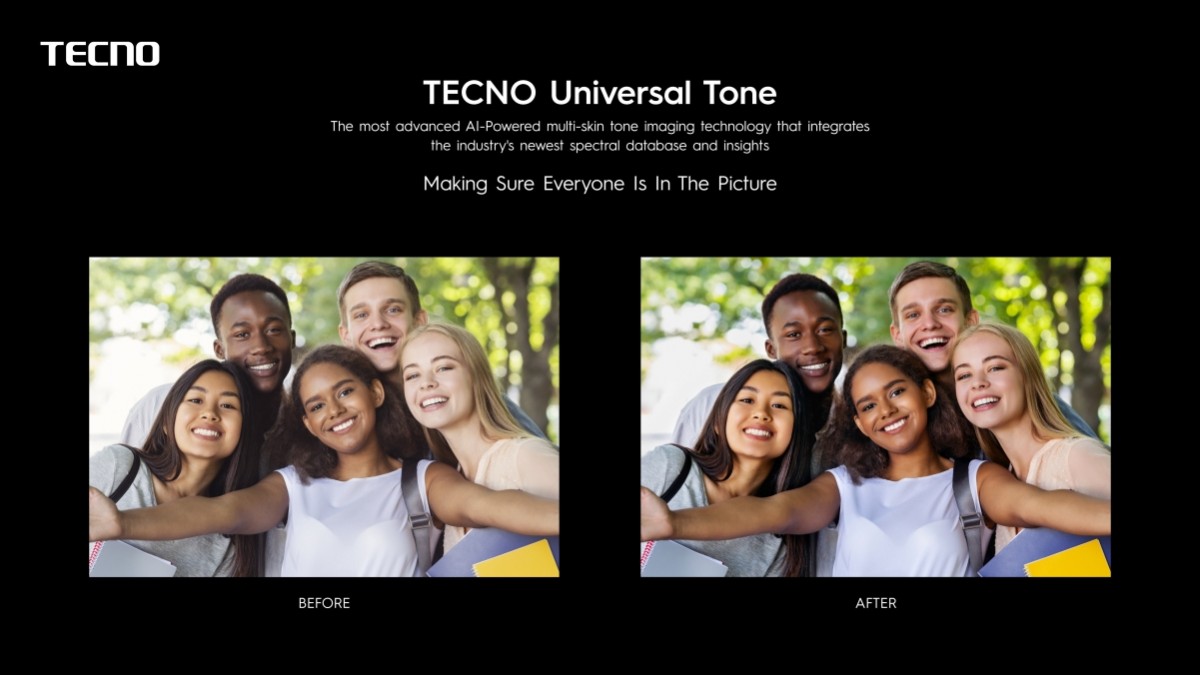

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025