The Risks And Rewards Of Investing In XRP (Ripple) For The Long Term

Table of Contents

Understanding the Potential Rewards of Long-Term XRP Investment

Investing in XRP for the long term presents several potential benefits, primarily driven by Ripple's technological advancements and strategic partnerships.

Ripple's Technological Advantages and Partnerships

RippleNet, Ripple's payment network, is a key driver of XRP's potential. Its adoption by numerous financial institutions worldwide signifies a growing acceptance of XRP as a fast, efficient, and cost-effective solution for cross-border payments.

- Speed and Low Fees: XRP boasts significantly faster transaction speeds and lower fees compared to many other cryptocurrencies, making it attractive for businesses seeking efficient payment solutions.

- Strategic Partnerships: Ripple has forged partnerships with major banks and financial institutions globally. These collaborations are crucial for expanding XRP's reach and driving wider adoption within the traditional financial system.

- Examples include partnerships with Santander, SBI Holdings, and MoneyGram, signifying the growing acceptance of Ripple's technology within the established financial sector. These partnerships could significantly impact XRP's long-term value.

- Global Reach and Scalability: RippleNet's global infrastructure facilitates seamless transactions across borders, potentially increasing the demand for XRP as a bridge currency.

Long-Term Price Appreciation Potential

While past performance is not indicative of future results, analyzing XRP's historical price trends and considering potential future growth factors offers insights into its long-term price appreciation potential.

- Increased Adoption: Wider adoption by financial institutions and businesses could significantly drive up demand for XRP, potentially leading to price increases.

- Regulatory Clarity: A favorable resolution to the SEC lawsuit against Ripple could lead to increased investor confidence and boost XRP's price.

- Hodling Strategy: A long-term "hodling" strategy, involving holding onto XRP despite short-term price fluctuations, could yield significant returns if the cryptocurrency's value appreciates over time.

- Potential price targets are highly speculative and depend on numerous market factors. It's crucial to understand that any price prediction is inherently uncertain. For example, some analysts predict a potential price of $X in a bullish scenario, while others suggest a more conservative $Y in a neutral scenario. These are just possibilities and not financial advice.

Assessing the Risks Associated with Long-Term XRP Investment

Despite the potential rewards, investing in XRP involves significant risks. Understanding these risks is crucial for making informed investment decisions.

Regulatory Uncertainty and Legal Challenges

The ongoing SEC lawsuit against Ripple presents significant regulatory uncertainty. The outcome of this legal battle will have a substantial impact on XRP's price and future adoption.

- SEC Arguments: The SEC argues that XRP is an unregistered security, which could lead to significant legal ramifications for Ripple and potentially depress XRP's price.

- Ripple's Defense: Ripple contends that XRP is a currency and not a security, arguing that it does not meet the Howey Test criteria for securities classification.

- Legal Uncertainty: The uncertain legal landscape surrounding XRP poses a significant risk to long-term investors. The outcome of the lawsuit could substantially affect XRP's value, either positively or negatively.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Significant price swings are common, making long-term investment inherently risky.

- Market Corrections: Cryptocurrency markets experience periodic corrections, often leading to sharp price drops. Investors should anticipate and manage such volatility.

- Negative News: Negative news, such as regulatory setbacks or security breaches, can trigger significant price drops.

- Diversification: Diversifying your investment portfolio across different asset classes is essential to mitigate risk.

Technological Risks and Competition

The fintech landscape is constantly evolving, and technological advancements pose a threat to XRP's long-term competitiveness.

- Competing Technologies: Other cryptocurrencies and alternative payment solutions pose competition to XRP.

- Technological Disruption: New technologies could render XRP's current functionalities obsolete.

- Staying Informed: Staying abreast of technological advancements in the fintech space is critical for assessing the ongoing viability of XRP as an investment.

Conclusion: Making Informed Decisions About Long-Term XRP Investment

Investing in XRP presents both exciting opportunities and substantial risks. The potential for long-term price appreciation driven by Ripple's technological advantages and partnerships is countered by regulatory uncertainty, market volatility, and the ever-evolving competitive landscape. Thorough research, due diligence, and a well-defined risk management strategy are paramount. Before considering a long-term XRP investment strategy, weigh the potential rewards and risks carefully. Conduct thorough research and consult with a financial advisor to determine if XRP aligns with your individual investment goals and risk tolerance. Remember, this is not financial advice; invest responsibly.

Featured Posts

-

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025

Get Ready For Psl 10 Tickets On Sale From Today

May 08, 2025 -

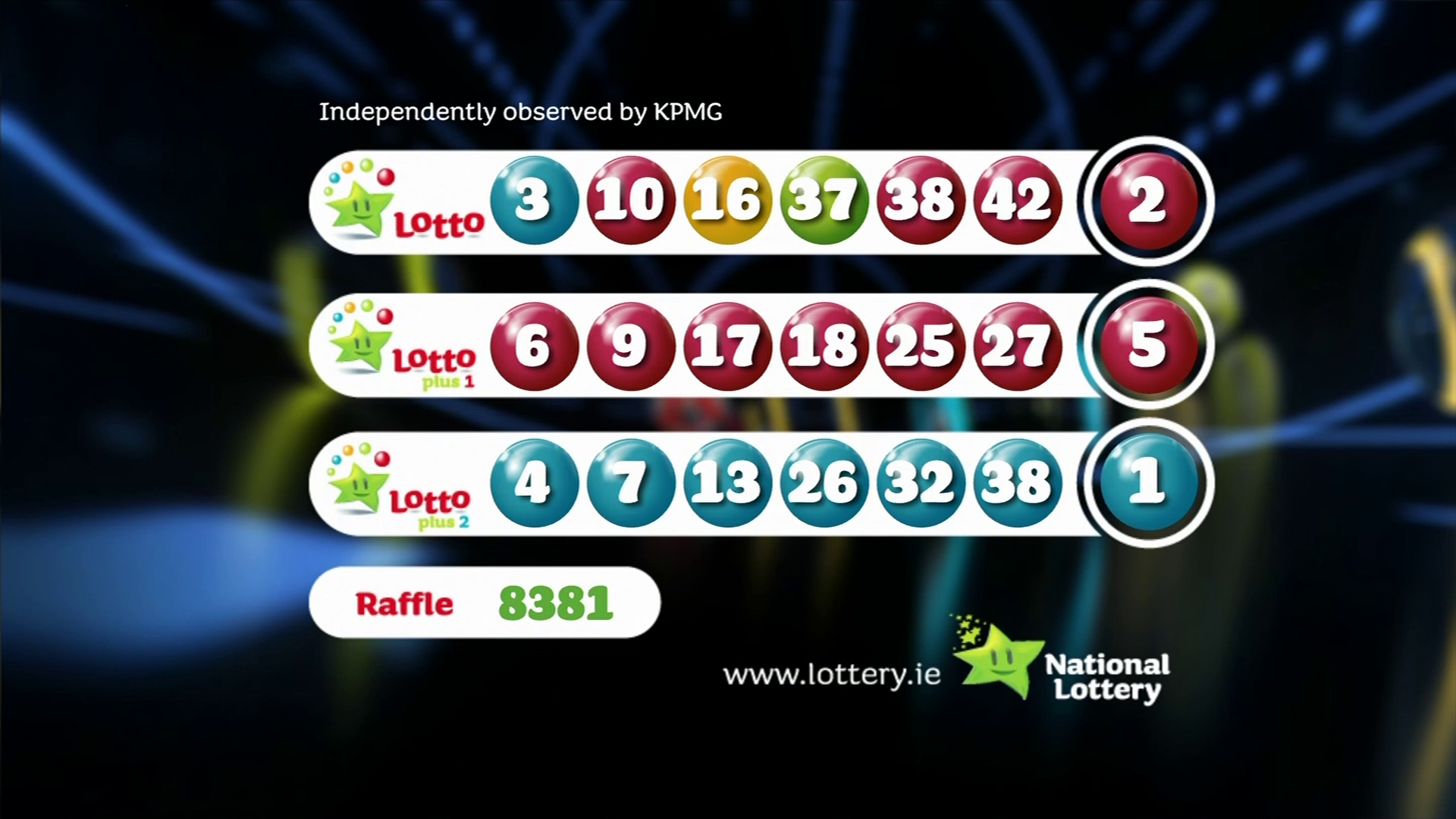

Winning Lotto Numbers Wednesday April 9th Complete Results

May 08, 2025

Winning Lotto Numbers Wednesday April 9th Complete Results

May 08, 2025 -

Tony Gilroys Positive Andor Star Wars Retrospective

May 08, 2025

Tony Gilroys Positive Andor Star Wars Retrospective

May 08, 2025 -

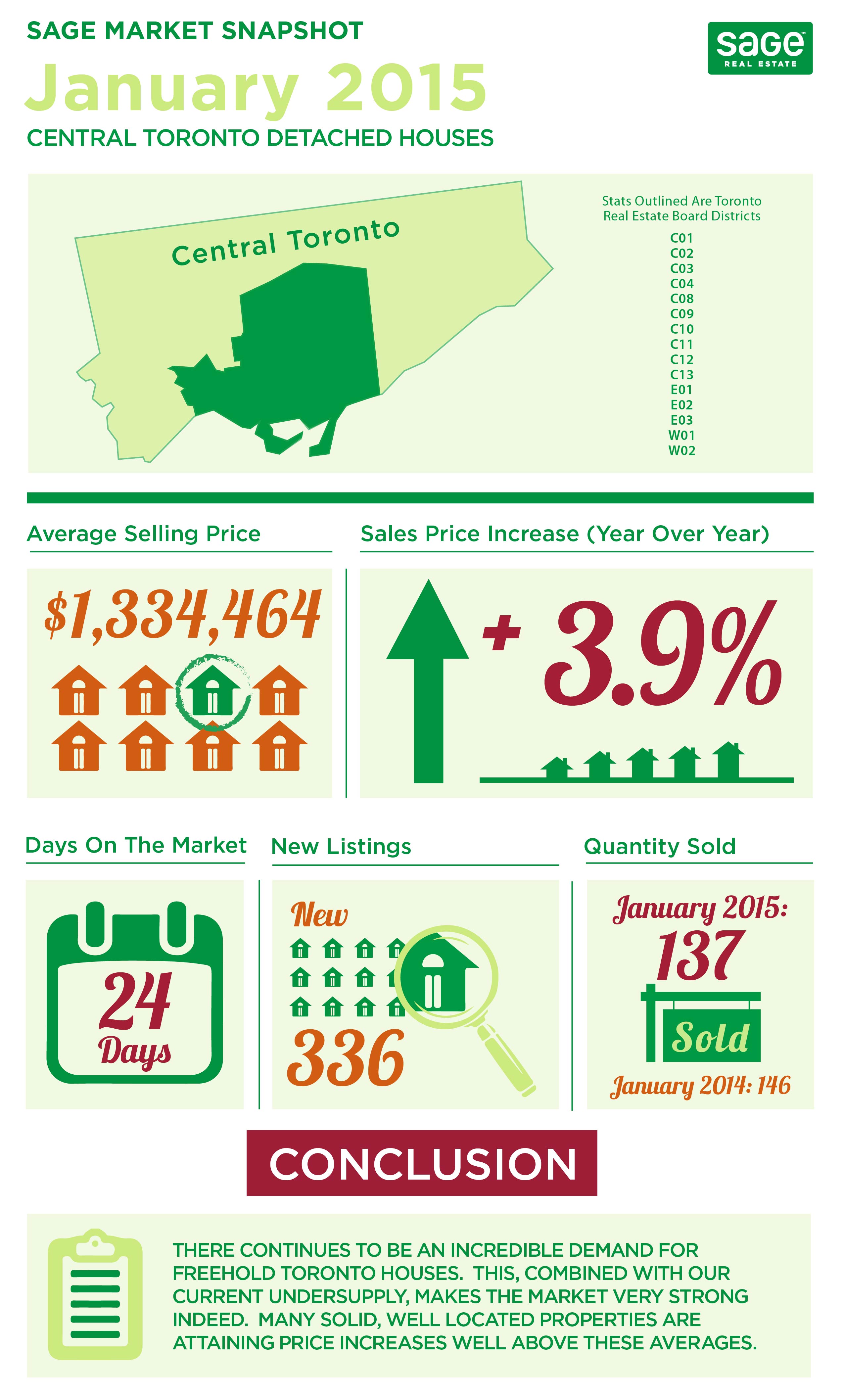

Toronto Real Estate Market Update Sales Down 23 Prices Dip 4

May 08, 2025

Toronto Real Estate Market Update Sales Down 23 Prices Dip 4

May 08, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 08, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 08, 2025