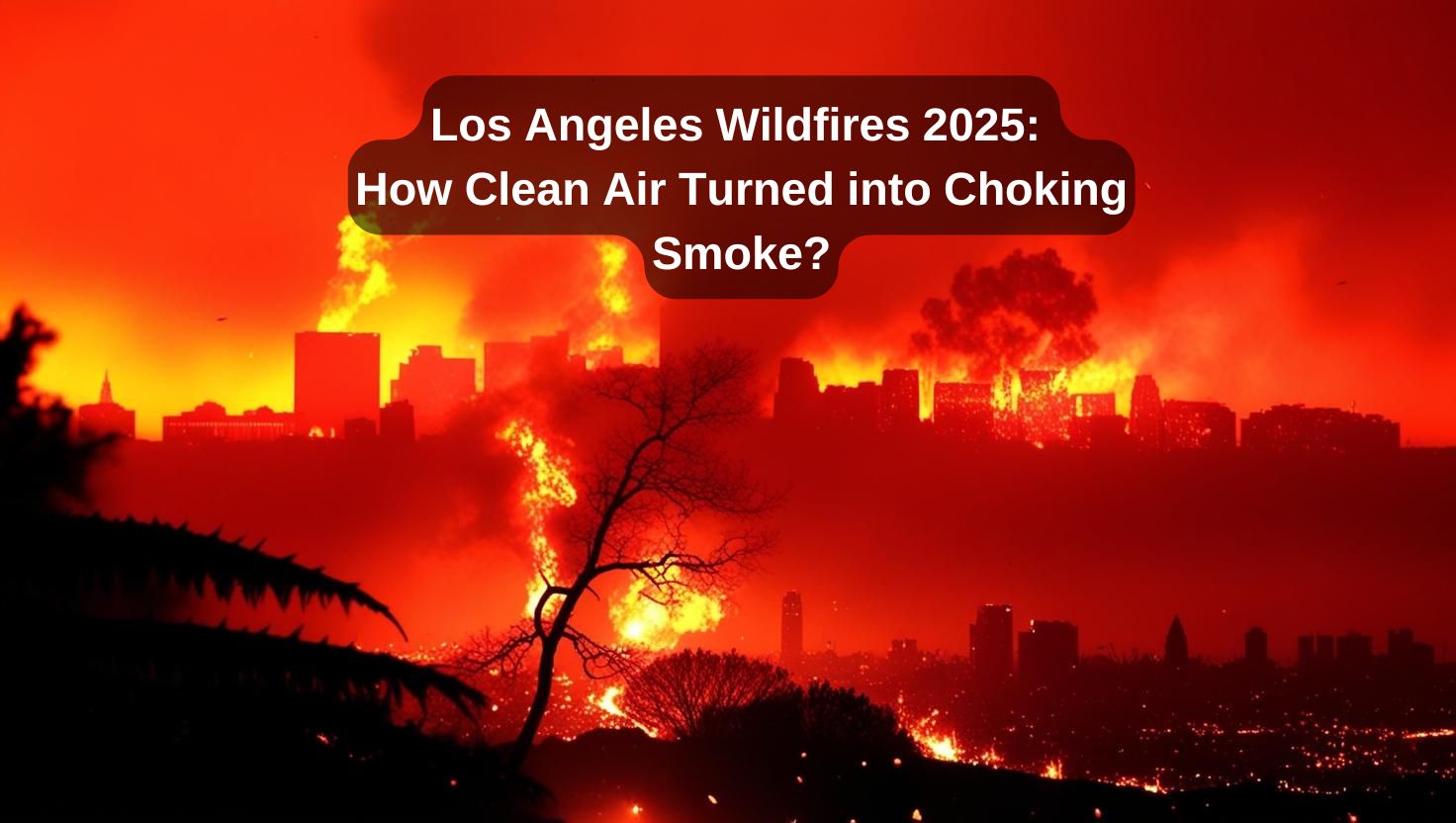

The Rise Of Disaster Betting: Analyzing The Los Angeles Wildfires Case

Table of Contents

The Mechanics of Disaster Betting in the Context of Wildfires

Disaster betting markets, often operating through unregulated online platforms or even informal networks, function similarly to prediction markets but with significantly higher stakes and ethical implications. In the context of the Los Angeles wildfires, we can imagine several types of bets being offered. These speculative markets leverage data and predictive modeling to influence betting odds, creating a complex and potentially volatile environment.

-

Different types of bets offered: These could range from predicting the total acreage burned, the number of structures destroyed, the duration of the wildfire, or even the specific areas most affected. Intensity levels (measured by the rate of spread or fire behavior) could also be the subject of wildfire prediction markets.

-

Role of data and predictive models: Weather patterns, fuel conditions, historical wildfire data, and even real-time satellite imagery are used to develop predictive models influencing the odds offered on these speculative bets. Sophisticated algorithms analyze this data, creating a dynamic market mirroring the unpredictable nature of the wildfire itself.

-

Examples of platforms or methods used for disaster betting: While specific platforms dedicated solely to disaster betting are rarely publicly acknowledged, the potential exists for such markets to operate on decentralized platforms, dark web forums, or through informal networks. This lack of transparency makes regulation exceedingly difficult.

-

The impact of news and media coverage: Real-time news reports and social media updates significantly influence bet placement and market fluctuations. A sudden escalation in fire intensity or a shift in wind direction could trigger rapid changes in the odds, creating potentially lucrative – but ethically dubious – opportunities for some bettors.

Ethical and Societal Concerns of Wildfire Disaster Betting

The ethical implications of profiting from natural disasters are profound and far-reaching. Disaster betting raises serious questions about the commodification of suffering and the potential for exploitation.

-

Potential for exploitation and exacerbating existing inequalities: Those with access to information and resources—perhaps even inside information—could potentially exploit the system for personal gain, widening the gap between the wealthy and vulnerable populations.

-

The psychological impact on victims and communities affected by wildfires: The very existence of disaster betting markets could add to the psychological trauma experienced by wildfire victims, creating a sense of further violation and adding insult to injury.

-

Concerns about market manipulation and insider trading: The potential for manipulating market outcomes by spreading false information or exploiting privileged access to data poses a significant concern. This could drive up or down odds, unfairly benefiting certain bettors at the expense of others.

-

The blurring lines between risk assessment and opportunistic speculation: While assessing risk is a key component of insurance and other financial markets, disaster betting often blurs the lines between responsible risk management and opportunistic speculation solely focused on profit maximization, irrespective of the human cost.

Regulatory Challenges and Responses to Disaster Betting

The current regulatory landscape surrounding disaster betting is largely uncharted territory. Existing gambling laws may not adequately address the unique challenges posed by this emerging market.

-

Existing laws and regulations that may (or may not) apply: Existing gambling legislation may offer a partial framework, but often lack the specificity required to address the ethical and societal concerns presented by disaster betting.

-

Arguments for and against stricter regulations on disaster betting: Supporters of stricter regulations argue that they are necessary to prevent exploitation, protect vulnerable communities, and maintain the integrity of financial markets. Opponents may argue that such regulations stifle free markets and are difficult to enforce effectively.

-

Potential regulatory frameworks for oversight and responsible gambling: Developing a regulatory framework requires careful consideration of how to balance protecting individuals and communities from exploitation with maintaining fair and open markets. This necessitates a multi-faceted approach involving government oversight, industry self-regulation, and public education.

-

International comparisons of regulatory approaches: Examining how other countries regulate similar forms of speculative betting can offer valuable insights and potential best practices for crafting effective legislation. Understanding international approaches is crucial, given the potential for cross-border activity within disaster betting markets.

The Los Angeles Wildfires Case Study: Specific Examples and Data

Unfortunately, publicly available data on specific instances of disaster betting related to the Los Angeles wildfires is limited. The clandestine nature of these markets often prevents comprehensive data collection and analysis. However, future research could potentially reveal patterns in betting activity correlated with wildfire intensity, spread, and overall impact. Analyzing such patterns could provide valuable insights into the mechanics and consequences of this troubling trend.

-

Statistical analysis of betting patterns (hypothetical): If data were available, statistical analysis could reveal relationships between the timing of bets, the odds offered, and the actual outcomes of the wildfire.

-

Examples of actual bets placed and their outcomes (hypothetical): Real-world examples would offer invaluable insight into the dynamics of disaster betting markets. This hypothetical data could illustrate the profit-driven nature of the activity, highlighting the exploitation element.

-

Impact on insurance markets and related financial instruments (hypothetical): Disaster betting could indirectly impact the insurance industry, potentially influencing premiums and creating instability within the financial system.

-

Correlation between betting activity and wildfire severity/impact (hypothetical): Investigating this correlation is crucial to understanding the extent to which speculation might influence risk assessments and emergency response planning.

Conclusion: The Future of Disaster Betting and the Need for Responsible Regulation

The rise of disaster betting, particularly in the context of catastrophic events like the Los Angeles wildfires, presents a profound ethical challenge. Our analysis has highlighted the inherent risks associated with profiting from suffering, the potential for market manipulation, and the need for strong regulatory oversight. The lack of readily available data underscores the clandestine nature of these markets and the urgent need for increased transparency. The human cost of such speculation cannot be ignored.

The lack of sufficient regulatory frameworks allows for the exploitation of vulnerable populations and undermines the integrity of related financial instruments, including insurance markets. We must work together to ensure that disaster betting doesn't further victimize those already suffering from natural disasters. Further research, public discourse, and the development of responsible regulatory frameworks are crucial to mitigating the risks associated with disaster betting and preventing the exploitation inherent in this disturbing trend. The future of disaster betting depends on our collective commitment to ethical considerations and responsible regulation.

Featured Posts

-

Brazil Game Justin Herbert And The Chargers 2025 International Debut

Apr 27, 2025

Brazil Game Justin Herbert And The Chargers 2025 International Debut

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Ein Umfassender Ueberblick

Apr 27, 2025 -

Is The Cdcs New Vaccine Study Researcher Credible Examining Past Misinformation

Apr 27, 2025

Is The Cdcs New Vaccine Study Researcher Credible Examining Past Misinformation

Apr 27, 2025 -

At And T Slams Broadcoms V Mware Price Hike A 1050 Increase

Apr 27, 2025

At And T Slams Broadcoms V Mware Price Hike A 1050 Increase

Apr 27, 2025 -

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Pegulas Charleston Open Comeback Stunning Victory Over Collins

Apr 27, 2025

Latest Posts

-

Assessing The Damage The Economic Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Assessing The Damage The Economic Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025 -

The Us Economy And The Canadian Travel Boycott A Fed Perspective

Apr 28, 2025

The Us Economy And The Canadian Travel Boycott A Fed Perspective

Apr 28, 2025 -

Canadian Travel Boycott Immediate And Long Term Effects On The Us Economy

Apr 28, 2025

Canadian Travel Boycott Immediate And Long Term Effects On The Us Economy

Apr 28, 2025 -

The Us Economy Under Pressure Assessing The Impact Of A Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Assessing The Impact Of A Canadian Travel Boycott

Apr 28, 2025 -

Real Time Economic Analysis The Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Real Time Economic Analysis The Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025