The Real Safe Bet: Investing Strategies For Secure Returns

Table of Contents

H2: Diversification: Spreading Your Risk Across Asset Classes

H3: The Power of Diversification: The core principle of diversification is simple yet powerful: don't put all your eggs in one basket. Effective portfolio diversification involves spreading your investments across various asset classes, reducing your overall portfolio risk. Smart asset allocation is key to mitigating potential losses.

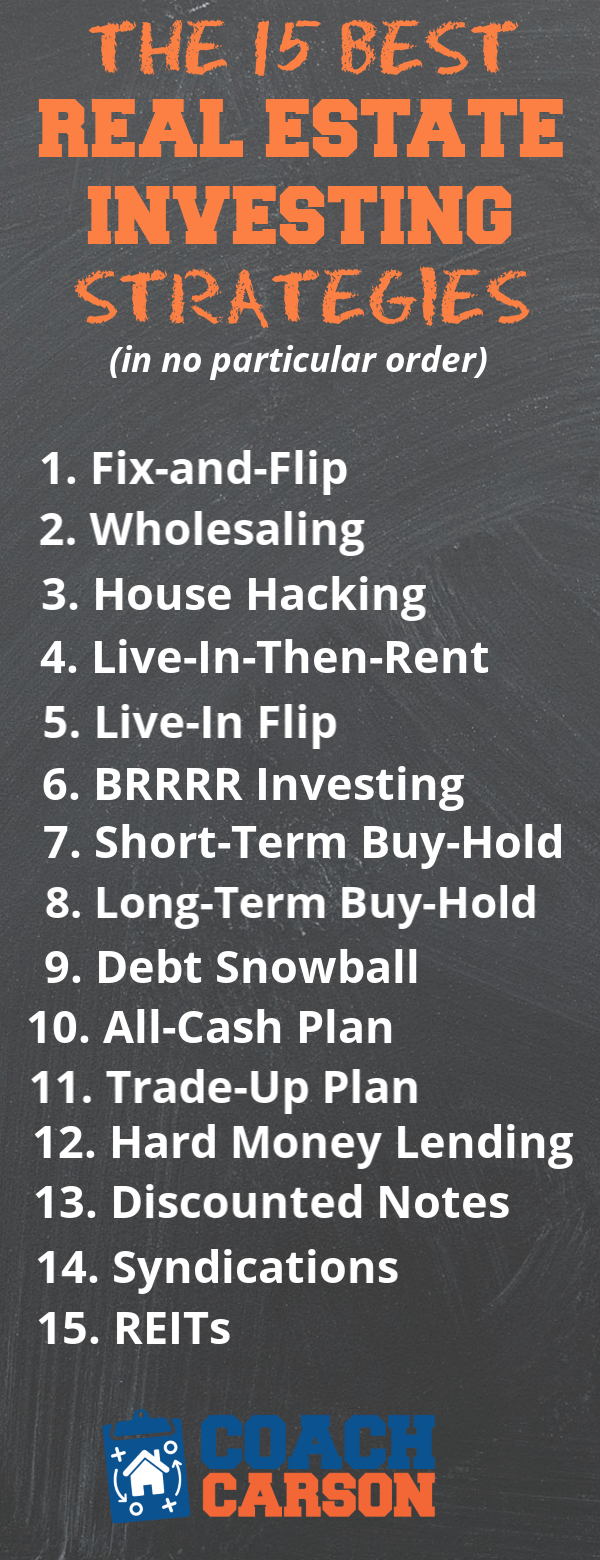

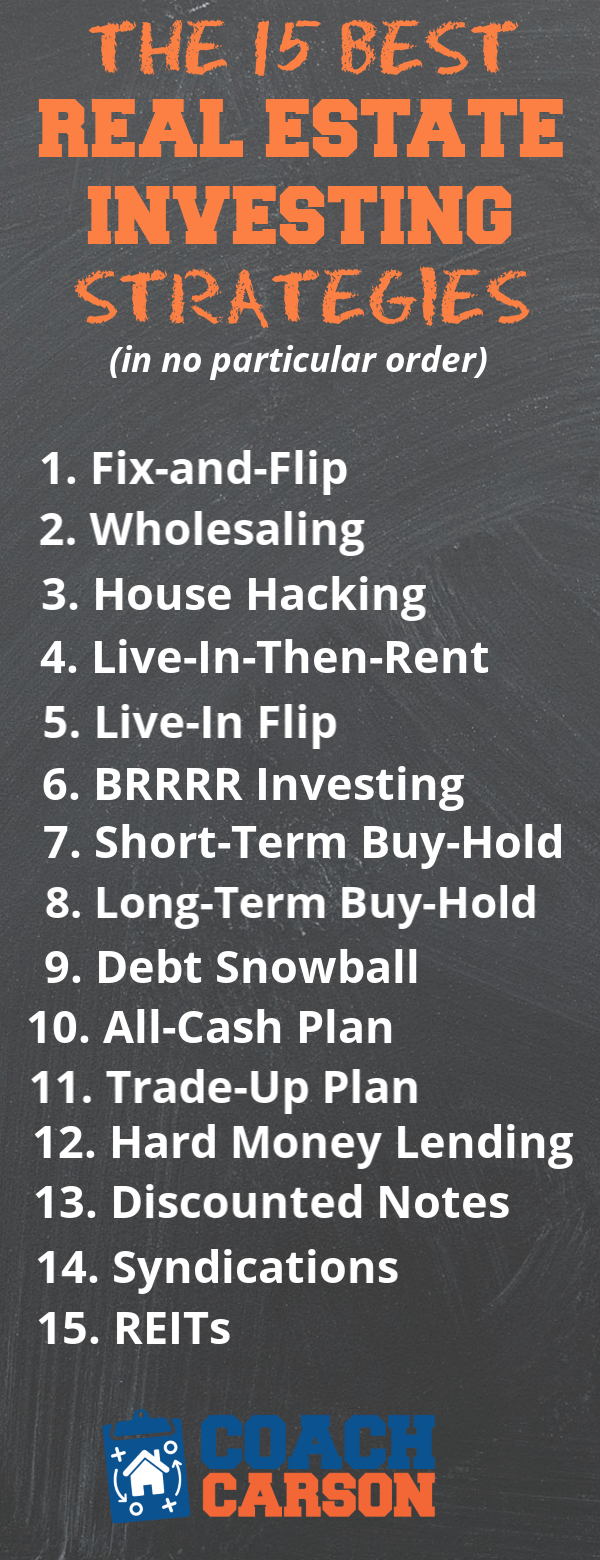

- Examples of asset classes: Stocks (equities), bonds (fixed income), real estate, commodities (gold, oil), and alternative investments.

- Benefits of diversification: By diversifying across different sectors (technology, healthcare, energy) and geographies (US, Europe, Asia), you reduce your dependence on the performance of any single asset or market.

- Diversification Strategies: Consider global diversification for broader market exposure or strategic asset allocation, aligning your investments with your long-term financial goals and risk tolerance.

Diversification works because different asset classes often behave differently. For instance, while stocks may be volatile, bonds tend to be more stable. The correlation between assets—how their prices move in relation to each other—is critical. A diversified portfolio with low correlation between assets reduces overall volatility. For example, during economic downturns, bonds often perform better than stocks, helping offset potential losses.

H2: Investing in Low-Risk, High-Yield Investments

H3: Bonds and Fixed Income: Bonds are a cornerstone of secure investment portfolios. Government bonds are generally considered the safest, offering lower returns but significantly reduced risk compared to stocks. Corporate bonds offer potentially higher yields but carry more credit risk. Understanding bond yields—the return you receive on your investment—is crucial in assessing potential returns. Fixed-income investments provide a predictable stream of income, contributing to portfolio stability.

- Different types of bonds: Treasury bonds, municipal bonds, corporate bonds, etc., each with varying levels of risk and return.

- Advantages of bonds: Relatively lower risk, predictable income stream, potential for diversification.

- Disadvantages of bonds: Lower potential returns compared to stocks, susceptible to interest rate fluctuations.

H3: High-Yield Savings Accounts and CDs: Beyond bonds, high-yield savings accounts and certificates of deposit (CDs) offer relatively secure options for preserving capital. These instruments provide a return in the form of interest rates, offering a safe haven for your cash.

- Factors to consider: Compare interest rates, account fees, and the availability of FDIC insurance (in the US) to protect your deposits.

- Comparing returns: High-yield savings accounts offer greater liquidity (easy access to funds), while CDs typically offer higher interest rates but lock your money in for a specified period.

- Liquidity needs: Consider your short-term and long-term liquidity needs when choosing between these options.

H2: Dollar-Cost Averaging: A Strategy for Steady Growth

H3: Understanding Dollar-Cost Averaging (DCA): Dollar-cost averaging (DCA) is a powerful technique for mitigating market volatility. It involves investing a fixed amount of money at regular intervals (e.g., monthly), regardless of market fluctuations.

- How DCA works: Instead of trying to time the market, you buy more shares when prices are low and fewer when prices are high.

- Advantages of DCA: It reduces the impact of buying high and selling low, smoothing out the bumps in the road.

- When DCA is most effective: This strategy is particularly useful for long-term investors who are less concerned with short-term market fluctuations.

DCA can significantly reduce the psychological impact of market volatility. For example, imagine investing $1000 per month in a stock over a year. If the price fluctuates, you'll buy more shares when it's low and fewer when it's high, ultimately averaging out the purchase price over time.

H2: Seeking Professional Financial Advice

H3: The Value of Expert Guidance: While you can research and implement these strategies independently, seeking professional help from a financial advisor is highly recommended. A personalized investment strategy tailored to your specific financial goals, risk tolerance, and time horizon significantly increases your chances of success.

- Benefits of a financial advisor: Objective advice, personalized planning, ongoing monitoring and adjustments, access to specialized investment products.

- Creating a secure investment plan: A financial advisor can help you navigate complexities, diversify your investments appropriately, and choose suitable asset classes based on your individual circumstances.

- Questions to ask a financial advisor: What are your fees? What is your investment philosophy? What is your experience with clients with similar goals?

Finding a qualified financial advisor involves careful research. Consider their credentials, experience, and client testimonials. Check for affiliations with reputable organizations and review their fee structure.

3. Conclusion:

Building a strong financial future requires a well-defined approach. We've explored several effective Investing Strategies for Secure Returns, including diversification across asset classes, investing in low-risk, high-yield options like bonds and high-yield savings accounts, leveraging dollar-cost averaging to mitigate market volatility, and seeking expert guidance from a financial advisor. Implementing these strategies, either independently or with professional assistance, increases your likelihood of achieving your financial goals while minimizing risk. Start researching and implementing these Investing Strategies for Secure Returns today to secure a brighter financial tomorrow. For more information, explore resources on investment planning and portfolio diversification online.

Featured Posts

-

Public Sector Ai The Impact Of Palantirs New Deal With Nato

May 10, 2025

Public Sector Ai The Impact Of Palantirs New Deal With Nato

May 10, 2025 -

Exclusive Deal Elliott Bets Big On Russian Gas Pipeline

May 10, 2025

Exclusive Deal Elliott Bets Big On Russian Gas Pipeline

May 10, 2025 -

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025 -

Uk Visa Crackdown Stricter Regulations For Work And Student Visas

May 10, 2025

Uk Visa Crackdown Stricter Regulations For Work And Student Visas

May 10, 2025 -

Subsystems Issue Leads To Blue Origin Rocket Launch Cancellation

May 10, 2025

Subsystems Issue Leads To Blue Origin Rocket Launch Cancellation

May 10, 2025