Exclusive Deal: Elliott Bets Big On Russian Gas Pipeline

Table of Contents

Elliott's Investment Strategy and Rationale

Elliott Management's investment philosophy centers on identifying undervalued assets and exploiting market inefficiencies to generate substantial returns. This deal appears consistent with this approach. Several factors could explain Elliott's interest in the Russian gas pipeline sector:

- High-Return Potential: Despite the considerable geopolitical risks, the potential for massive returns is undeniable. Russian natural gas remains a crucial energy source globally, and strategic investments in its infrastructure could prove highly lucrative.

- Long-Term Demand: Despite the push towards renewable energy, the global demand for natural gas, particularly in Europe and Asia, is projected to remain robust for many years to come. This long-term perspective likely factors significantly into Elliott's decision.

- Undervalued Assets: Sanctions and market volatility have likely depressed the value of some Russian assets, presenting an opportunity for shrewd investors like Elliott to acquire them at discounted prices.

- Strategic Partnerships & Privatization: The investment could be a strategic move to gain a foothold in the sector, paving the way for future partnerships or capitalizing on potential privatization opportunities as the Russian energy landscape evolves.

The financial specifics of the deal, including the exact investment amount and anticipated ROI (Return on Investment), remain confidential. However, given Elliott's track record, the investment is likely substantial and the expected return ambitious.

Geopolitical Implications and Risks

The geopolitical landscape surrounding this investment is undeniably fraught with risk. Investing in Russian assets carries inherent uncertainties:

- Sanctions: The ongoing sanctions imposed on Russia could significantly impact the pipeline's operations, potentially reducing its profitability or even halting operations altogether.

- Geopolitical Instability: The region's geopolitical instability and the potential for further conflicts pose a considerable threat to the investment's security and viability.

- Regulatory Changes: Changes in Russian energy regulations could significantly affect the profitability and operational capacity of the gas pipeline.

- Reputational Risk: Investing in Russia carries reputational risks for Elliott Management, especially given the ongoing global concerns surrounding the country's actions.

To mitigate these risks, Elliott will likely employ various strategies, including detailed due diligence, diversification within the energy sector, and robust risk-management protocols. The specifics of these strategies, however, are unknown.

Market Analysis and Future Projections

The global gas market is currently experiencing a period of significant transition. While Russian gas plays a vital role in the global energy mix, its dominance is being challenged by other suppliers and the growing adoption of renewable energy sources. Elliott's investment could significantly influence the Russian gas pipeline sector and the broader market. The investment may lead to increased efficiency, modernization, or even expansion of the pipeline infrastructure.

- Increased Competition: Elliott's entry will increase competition within the Russian gas sector, potentially impacting prices and market share.

- Market Volatility: The investment's impact on market volatility is uncertain but is likely to be significant, depending on the scale of investment and market reaction.

Alternative Energy Sources and the Transition

The transition to renewable energy sources, such as solar and wind power, presents a long-term challenge to the demand for natural gas. This shift towards cleaner energy poses a question mark over the long-term viability of Elliott's investment in fossil fuel infrastructure. The timeframe of this transition and its ultimate impact on natural gas demand remains a key uncertainty.

The Future of Elliott's Russian Gas Pipeline Bet

Elliott Management's significant investment in the Russian gas pipeline sector presents a high-stakes gamble with substantial potential rewards and equally significant risks. The strategic importance of this deal, and its implications for the global energy market, cannot be understated. The long-term prospects are uncertain, dependent on a complex interplay of geopolitical factors, market dynamics, and the global shift towards renewable energy. While the uncertainties are considerable, the potential for significant returns remains a powerful incentive.

To stay informed about the developments related to Elliott's Russian gas pipeline investment and other major energy deals, subscribe to our newsletter and follow us on social media. Stay tuned for updates on this evolving story as "Elliott Bets Big on Russian Gas Pipeline" continues to unfold.

Featured Posts

-

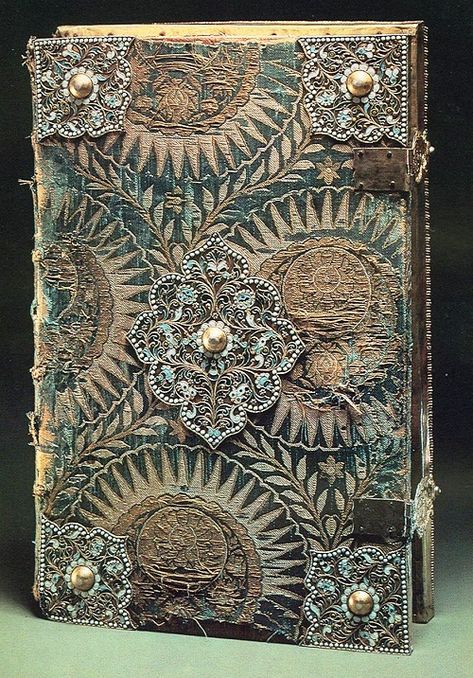

Medieval Book Cover Unveiling Merlin And Arthurs Hidden Tale

May 10, 2025

Medieval Book Cover Unveiling Merlin And Arthurs Hidden Tale

May 10, 2025 -

Accident A Dijon Voiture Contre Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Voiture Contre Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025 -

Figma Vs Adobe Word Press And Canva How Ai Is Reshaping Design

May 10, 2025

Figma Vs Adobe Word Press And Canva How Ai Is Reshaping Design

May 10, 2025 -

Exploring The Countrys Fastest Growing Business Hubs

May 10, 2025

Exploring The Countrys Fastest Growing Business Hubs

May 10, 2025 -

Invest Smart The Definitive Guide To The Countrys Emerging Business Hotspots

May 10, 2025

Invest Smart The Definitive Guide To The Countrys Emerging Business Hotspots

May 10, 2025