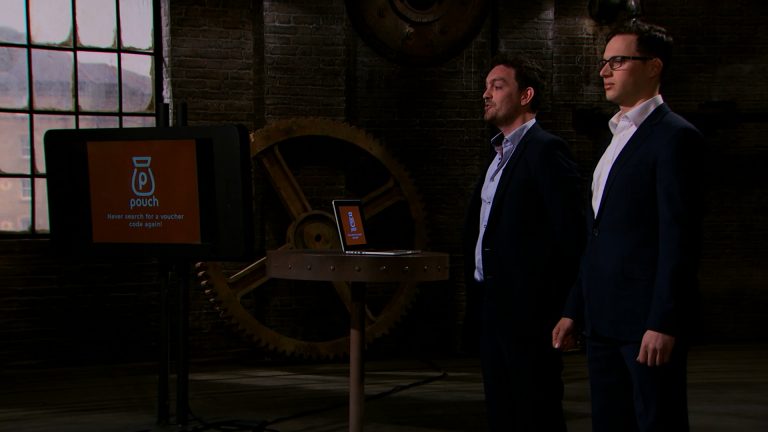

The Psychology Of The Dragon's Den Investors

Table of Contents

Risk Assessment and Reward Perception

The Dragons' investment decisions aren't based solely on numbers; they're deeply rooted in their assessment of risk and perception of reward. They meticulously evaluate potential investments, considering a multitude of factors. Market size, the strength of the competition, the experience and expertise of the founding team – all contribute to their risk assessment. A high-risk, high-reward proposition might appeal to one Dragon, while another might prefer a safer, steadier investment. Their perception of reward is equally nuanced, focusing on factors beyond simple return on investment (ROI). The potential for market disruption, the scalability of the business model, and the overall potential for long-term growth all play a significant role.

- Due diligence process and its psychological aspects: The Dragons' due diligence isn't just a financial exercise; it's a psychological probe, seeking to understand the entrepreneurs' capabilities and the robustness of their plans.

- The role of gut feeling and intuition in investment decisions: Despite their rigorous analysis, intuition and gut feeling often play a surprisingly significant role. A compelling pitch can trigger an immediate positive response, overriding some initial reservations.

- Cognitive biases affecting risk perception: The Dragons, like all investors, are susceptible to cognitive biases. Confirmation bias – seeking out information confirming pre-existing beliefs – and anchoring bias – over-relying on the first piece of information received – can significantly influence their perception of risk.

The Influence of Personality and Negotiating Styles

Each Dragon brings a unique personality to the Den, significantly shaping their investment choices and negotiating styles. Some are known for their aggressive tactics, driving hard bargains to secure favorable terms. Others adopt a more collaborative approach, focusing on building relationships and mutually beneficial partnerships. These differences create fascinating dynamics within the negotiation process.

- Examples of contrasting Dragon personalities and their investment preferences: Deborah Meaden's focus on proven business models contrasts with Peter Jones' willingness to take calculated risks on disruptive technologies.

- How different negotiation tactics influence deal outcomes: A forceful negotiation might secure a better deal for the investor, but could also alienate the entrepreneur and damage the potential partnership.

- The impact of power dynamics on the negotiation process: The inherent power imbalance between the Dragons and the entrepreneurs significantly impacts the negotiation, influencing the terms of any potential deal.

Emotional Intelligence and Empathy in Investment Decisions

While financial acumen is paramount, emotional intelligence plays a crucial role in the Dragons' investment decisions. They're not simply evaluating spreadsheets; they're assessing the entrepreneurs themselves. The ability to connect with an entrepreneur's passion and vision, to empathize with their journey and challenges, often becomes a key factor in determining investment.

- Examples of Dragons connecting with entrepreneurs on an emotional level: A passionate pitch that resonates with a Dragon's personal values can significantly sway their decision, even if the financial projections aren't perfect.

- The impact of trust and rapport building on investment decisions: Trust and rapport are essential. Entrepreneurs who demonstrate honesty, integrity, and a clear understanding of their market can build trust, increasing their chances of securing funding.

- How emotional responses can affect deal terms and outcomes: A strong emotional connection can lead to more favorable terms or even a higher investment than might otherwise be expected.

Identifying and Evaluating Opportunities: A Psychological Perspective

The Dragons' ability to identify promising investment opportunities is a blend of experience, expertise, and psychological acuity. They're adept at recognizing patterns, spotting market trends, and quickly evaluating the potential of a new venture. This process involves more than just financial analysis; it's about understanding the underlying psychology of the market and the entrepreneurs.

- The role of experience and expertise in opportunity identification: Years of experience in business and investing provide the Dragons with a wealth of knowledge and a refined ability to spot promising opportunities.

- Cognitive biases affecting opportunity evaluation: The availability heuristic – overestimating the likelihood of events that are easily recalled – can influence the Dragons' evaluation of market potential.

- The importance of market research and validation in investment decisions: Solid market research and validation are crucial for demonstrating the viability of a business model and reducing investment risk.

Mastering the Psychology of Dragon's Den Investors for Business Success

To conclude, the psychology of Dragon's Den investors is a complex interplay of risk assessment, personality dynamics, emotional intelligence, and opportunity recognition. Understanding these psychological factors is not just interesting; it's essential for entrepreneurs seeking funding. By mastering the art of pitching, building rapport, and demonstrating a deep understanding of your market, you can significantly improve your chances of securing investment. Learn more about the psychology of investment and refine your pitching strategies by exploring [link to relevant resource]. Mastering the psychology of Dragon's Den investors is crucial for securing your funding goals!

Featured Posts

-

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025

Pasifika Sipoti Summary April 4th Highlights

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025 -

Englands Dramatic Late Victory Over France Match Report

May 01, 2025

Englands Dramatic Late Victory Over France Match Report

May 01, 2025 -

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025 -

Buiten Piektijden Opladen Uw Enexis Gids Voor Noord Nederland

May 01, 2025

Buiten Piektijden Opladen Uw Enexis Gids Voor Noord Nederland

May 01, 2025

Latest Posts

-

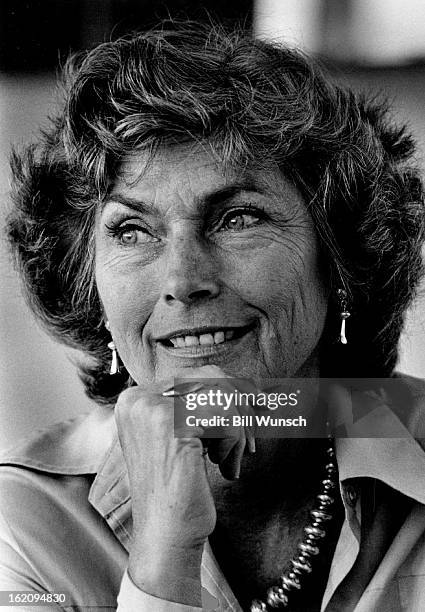

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025

Death Of Priscilla Pointer Tributes Pour In For Dallas And Carrie Star

May 01, 2025 -

Priscilla Pointer Actress Dies At 100

May 01, 2025

Priscilla Pointer Actress Dies At 100

May 01, 2025 -

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025 -

Actress Priscilla Pointer 100 Passes Away A Look Back At Her Career

May 01, 2025

Actress Priscilla Pointer 100 Passes Away A Look Back At Her Career

May 01, 2025 -

Dallas And Hollywood Mourn The Loss Of Priscilla Pointer At 100

May 01, 2025

Dallas And Hollywood Mourn The Loss Of Priscilla Pointer At 100

May 01, 2025