The Long-Term Implications Of 'Liberation Day' Tariffs On Stock Investments

Table of Contents

Immediate Market Reactions to 'Liberation Day' Tariffs

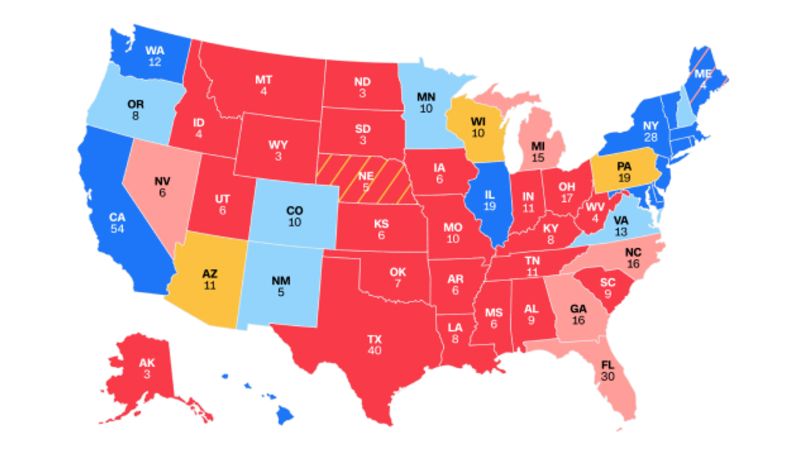

The immediate aftermath of the "Liberation Day" tariffs saw significant market volatility. The sudden introduction of these tariffs created a period of short-term uncertainty, leading to immediate price fluctuations across various sectors.

Short-term Volatility and Market Corrections

- Sectoral Impact: Import/export-dependent industries, such as manufacturing and retail, experienced the most immediate and dramatic effects. Companies heavily reliant on international trade saw their stock prices decline sharply as their profit margins were squeezed by increased costs.

- Initial Price Drops and Investor Panic: The uncertainty surrounding the long-term implications of the tariffs fueled investor panic, leading to widespread selling and a general market correction. Many investors reacted emotionally, making hasty decisions based on short-term fear rather than a long-term strategy.

- Technical Analysis and Short-Term Trading: Traders employed technical analysis, focusing on chart patterns and indicators, attempting to capitalize on short-term price fluctuations. However, this approach is risky and requires significant expertise to navigate the unpredictable market conditions.

Analyzing the Long-Term Economic Effects of 'Liberation Day' Tariffs

The long-term consequences of "Liberation Day" tariffs extend beyond immediate market reactions, impacting various facets of the economy and, consequently, investment returns.

Inflationary Pressures and Their Impact on Investment Returns

- Tariffs and Inflation: Tariffs increase the cost of imported goods, contributing directly to inflation. This rise in prices erodes the purchasing power of consumers and reduces the real return on investments.

- Impact on Corporate Profits and Dividend Payouts: Higher input costs, stemming from tariffs, can negatively affect corporate profit margins, potentially leading to reduced dividend payouts to investors.

Changes in Consumer Spending and Demand

- Decreased Consumer Spending: Increased prices due to tariffs inevitably lead to decreased consumer spending. Consumers may cut back on discretionary purchases, affecting the revenue streams of numerous companies.

- Ripple Effect on Industries: The reduced consumer spending creates a ripple effect across multiple industries, impacting both companies directly affected by tariffs and those reliant on consumer demand.

Geopolitical Ramifications and International Trade Relations

- Potential Trade Wars: The "Liberation Day" tariffs have the potential to trigger retaliatory tariffs from other countries, escalating into a full-blown trade war with significant global economic consequences.

- Shifts in Global Supply Chains: Companies may seek to diversify their supply chains, moving production away from countries affected by tariffs. This shift can lead to significant disruptions and increased costs in the short-term.

- Impact on Multinational Corporations: Multinational corporations with extensive operations in multiple countries are particularly vulnerable to the complexities and uncertainties arising from trade wars and shifting global supply chains.

Strategies for Navigating 'Liberation Day' Tariff-Related Uncertainty

Navigating the uncertainty created by the "Liberation Day" tariffs requires a proactive and strategic approach to investing.

Diversification as a Risk Mitigation Strategy

- Portfolio Diversification: A well-diversified portfolio across various asset classes (stocks, bonds, real estate, etc.) and geographical locations is crucial for reducing exposure to specific risks.

- Reducing Reliance on Specific Sectors: Avoid over-concentration in sectors highly vulnerable to tariff impacts. Spreading investments across various sectors minimizes the overall impact of negative events on your portfolio.

Investing in Defensive Sectors

- Sectors Less Susceptible to Tariff Impacts: Consider investing in defensive sectors, such as consumer staples (food, beverages, household goods) and healthcare, which tend to be less sensitive to economic downturns.

- Fundamental Analysis: Employ fundamental analysis to identify companies with strong fundamentals, irrespective of short-term market fluctuations.

Long-Term Investment Approach versus Short-Term Speculation

- Buy-and-Hold Strategy: Adopt a long-term buy-and-hold strategy, focusing on the long-term growth potential of your investments, rather than reacting to short-term market noise.

- Avoid Impulsive Decisions: Refrain from making impulsive investment decisions based on short-term market fluctuations. Emotional reactions often lead to poor investment outcomes.

Conclusion: Preparing for the Future Impact of 'Liberation Day' Tariffs on Your Portfolio

The "Liberation Day" tariffs present both short-term challenges and long-term implications for investors. While the immediate market reactions may be volatile, the longer-term effects on inflation, consumer spending, and global trade relations require careful consideration. A well-diversified portfolio, a focus on defensive sectors, and a long-term investment strategy are crucial for mitigating the risks associated with these tariffs and similar economic events. Conduct thorough research, consult with a qualified financial advisor, and develop a robust investment plan to navigate the complexities of the current economic climate. Learn more about developing a robust investment strategy in the face of "Liberation Day" tariffs and other market uncertainties [link to relevant resource].

Featured Posts

-

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Influence And The 100 000 Target

May 08, 2025 -

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025

Racha Imparable Dodgers Mejor Inicio De Temporada En La Historia

May 08, 2025 -

Okc Thunder Leadership Williams Highlights A Standout Player

May 08, 2025

Okc Thunder Leadership Williams Highlights A Standout Player

May 08, 2025 -

Sexual Assault Allegations Surface Against Singer Smokey Robinson

May 08, 2025

Sexual Assault Allegations Surface Against Singer Smokey Robinson

May 08, 2025 -

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025