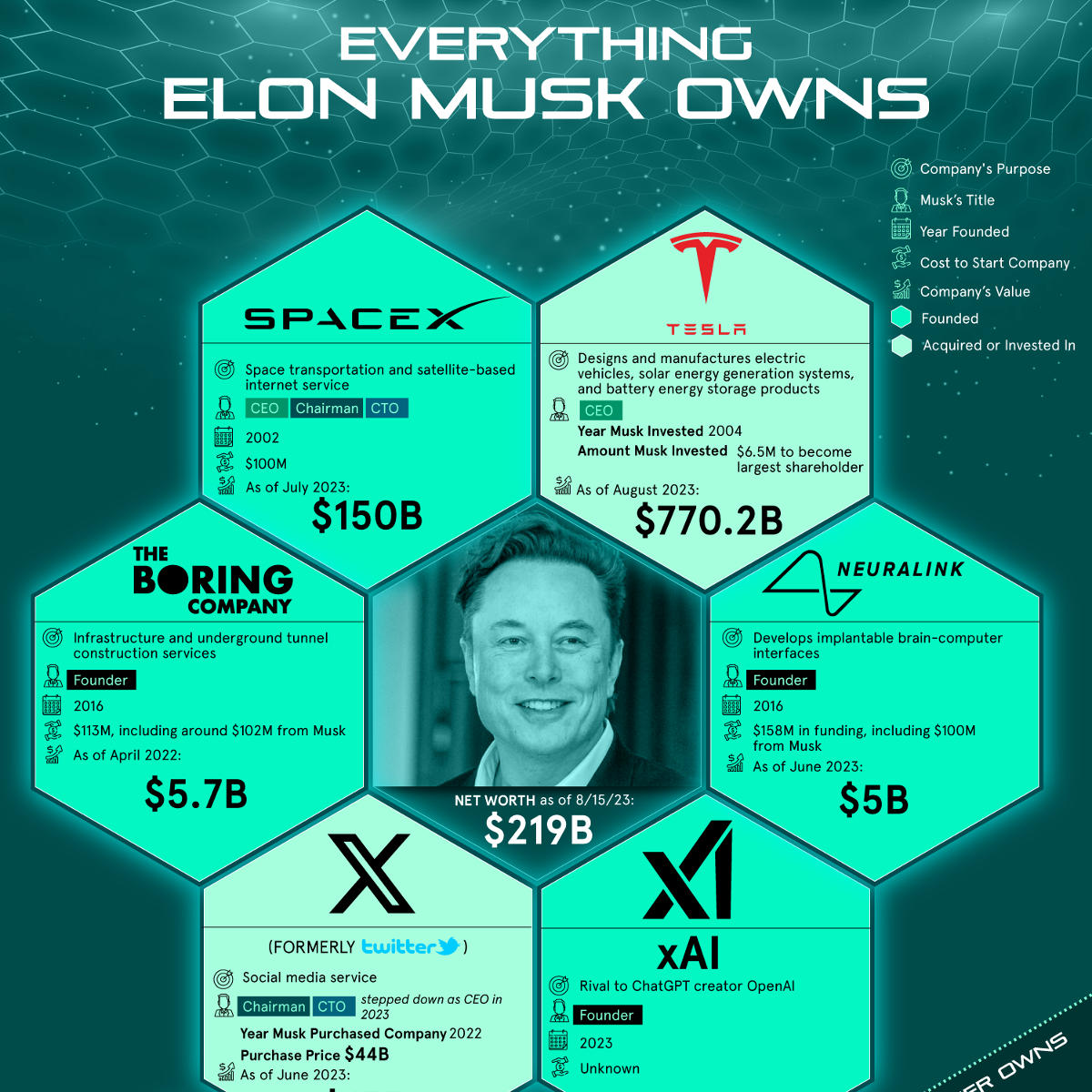

The Impact Of Trump's First 100 Days On Elon Musk's Financial Status

Table of Contents

Regulatory Changes and Tesla's Stock Performance

The early Trump administration signaled a potential shift in regulatory approaches, particularly concerning environmental regulations. This had a direct bearing on Tesla's operations and stock performance.

Relaxation of Environmental Regulations

A less stringent regulatory environment could have offered Tesla several advantages.

- Reduced compliance costs: Easing of environmental regulations, such as emissions standards, could have lowered Tesla's production costs, improving profitability. Less time and resources dedicated to meeting stringent regulations meant more focus on production and innovation.

- Potential for faster production timelines: Relaxed regulations could have potentially streamlined the approval processes for new Tesla models and production facilities, leading to quicker market entry.

- Increased demand due to less stringent emission standards: While Tesla actively promotes its environmentally friendly vehicles, a potential weakening of emission standards might have led to increased demand for electric vehicles in general, benefiting Tesla's market share.

Keyword integration: "Tesla stock," "environmental regulations," "Trump administration," "production costs," "electric vehicle market share".

Changes in Automotive Industry Policies

Trump's administration also considered various automotive industry policies that potentially influenced Tesla's competitiveness.

- Impact of potential tax breaks or incentives for electric vehicle manufacturers: Tax breaks or incentives aimed at boosting domestic electric vehicle manufacturing could have provided a significant boost to Tesla's bottom line.

- Changes in fuel efficiency standards: Potential adjustments to fuel efficiency standards could have altered the competitive landscape for Tesla, affecting both its production costs and market demand. This area is particularly significant when considering the competitive pressures of traditional gas-powered vehicles.

Keyword integration: "electric vehicle," "automotive industry policy," "Tesla competitiveness," "fuel efficiency standards".

International Trade and SpaceX's Global Operations

SpaceX, with its global ambitions, was potentially impacted by Trump's trade policies and shifts in international relations.

Impact of Trade Wars and Tariffs

Trump's focus on trade wars and tariffs introduced uncertainties into SpaceX's operations.

- Increased costs of imported materials: Tariffs on imported materials used in rocket construction and satellite technology could have increased SpaceX's production costs, squeezing profit margins.

- Potential delays in project timelines: Disruptions to global supply chains due to trade tensions might have led to project delays, impacting timelines for both commercial and government contracts.

- Impact on international partnerships: Trade disputes could have strained relationships with international partners, affecting collaborative projects and access to crucial resources.

Keyword integration: "SpaceX," "international trade," "tariffs," "supply chain," "SpaceX contracts".

Changes in Space Exploration Policy

The Trump administration's approach to space exploration also had a potential impact on SpaceX.

- Increased or decreased NASA funding for commercial space programs: Changes in NASA funding directly impacted contracts and opportunities for companies like SpaceX.

- Changes in priorities for space exploration: Shifts in the focus of space exploration could have either benefited or hampered SpaceX's specific areas of expertise.

- Impact on SpaceX contracts: Any alterations in NASA's procurement processes or prioritization of projects could have either boosted or hindered SpaceX’s contract awards.

Keyword integration: "SpaceX funding," "NASA," "space exploration policy," "Trump administration," "commercial space programs".

Overall Economic Climate and Musk's Net Worth

The broader economic climate under Trump's administration, characterized by fluctuations in the stock market and investor sentiment, had a significant impact on Elon Musk's overall net worth.

Stock Market Fluctuations

The general economic climate created by the Trump administration’s policies influenced the stock market and in turn Musk’s net worth.

- Impact of tax cuts on investor sentiment: Tax cuts could have positively impacted investor sentiment, potentially driving up the value of Tesla stock and thus Musk's net worth.

- Overall market volatility: Market volatility during this period could have either increased or decreased the value of Tesla and SpaceX-related assets.

- Correlation between market performance and Musk’s wealth: Musk's wealth is heavily tied to the performance of Tesla's stock, making him vulnerable to market fluctuations.

Keyword integration: "Elon Musk net worth," "stock market," "economic policy," "Trump's economic impact," "Tesla stock price".

Investor Confidence and Funding

Investor confidence plays a vital role in securing funding for ambitious ventures like Tesla and SpaceX.

- Access to capital: The overall investor confidence under the Trump administration influenced the ease with which Tesla and SpaceX could access capital for expansion and new projects.

- Venture capital investments: Investor sentiment directly impacts venture capital investments, which are crucial for high-growth companies like Tesla and SpaceX.

- Bond issues: The cost and availability of borrowing through bond issues were likely influenced by investor confidence and market conditions.

Keyword integration: "Tesla funding," "SpaceX investment," "investor confidence," "Trump presidency," "venture capital".

Conclusion

The first 100 days of the Trump presidency brought about significant policy changes that had a multifaceted impact on Elon Musk's financial status. The analysis presented highlights how regulatory shifts affected Tesla's production costs and market position, while international trade policies influenced SpaceX's operations and supply chain. The overall economic climate and investor confidence under Trump's early administration also played a crucial role in shaping the financial trajectories of both companies. The interplay between these factors underscores the complex and interconnected nature of political and economic influences on major business ventures.

To gain a deeper understanding of the intricate relationship between political climate and business success, further research into the long-term effects of Trump's policies on Elon Musk and his companies is strongly recommended. Continue exploring the impact of "Trump's first 100 days impact on Elon Musk" and related topics to fully grasp the multifaceted nature of this influential period.

Featured Posts

-

Fatal Car Accident On Elizabeth City Road Claims Two Lives

May 10, 2025

Fatal Car Accident On Elizabeth City Road Claims Two Lives

May 10, 2025 -

Nyt Spelling Bee April 4 2025 Hints Answers And Pangram

May 10, 2025

Nyt Spelling Bee April 4 2025 Hints Answers And Pangram

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

May 10, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

May 10, 2025 -

Impact Of Potential Aircraft And Engine Tariffs Under Trump Administration

May 10, 2025

Impact Of Potential Aircraft And Engine Tariffs Under Trump Administration

May 10, 2025