The Impact Of Reduced Consumer Spending On The Credit Card Industry

Table of Contents

Decreased Transaction Volume and Revenue

Lower spending translates directly to fewer credit card transactions, significantly impacting credit card companies' bottom line. This reduction in activity affects several key revenue streams:

-

Lower overall spending means fewer purchases made using credit cards. This is the most direct impact. As consumers tighten their belts, they naturally make fewer purchases, leading to a decline in the total number of credit card transactions processed.

-

Impact on merchant fees (a major revenue source for credit card companies). Credit card companies earn significant revenue through merchant fees, a percentage charged to businesses for each transaction. Reduced transaction volume means lower merchant fees collected.

-

Reduced interest income due to lower outstanding balances. Credit card companies also earn substantial interest income from outstanding balances on credit cards. When consumers spend less, they carry smaller balances, resulting in less interest revenue for the companies.

-

Potential impact on interchange fees. Interchange fees are the fees that merchants pay to credit card networks (like Visa and Mastercard). While not directly controlled by individual credit card issuers, a decrease in overall transaction volume can indirectly impact the fees they receive.

Industry reports show a concerning trend: transaction volume declined by 5% in the last quarter, directly impacting the revenue streams of major credit card companies. This necessitates a strategic reassessment of their business models.

Increased Credit Card Delinquency and Defaults

Reduced consumer spending often leads to financial hardship, increasing the likelihood of credit card delinquency and defaults. This poses a significant threat to credit card companies' financial stability:

-

Consumers struggling to meet expenses may miss credit card payments. As disposable income decreases, many consumers find it difficult to meet their monthly financial obligations, including credit card payments.

-

Higher default rates lead to increased losses for credit card issuers. When borrowers default, credit card companies face significant financial losses, impacting their profitability and requiring increased write-offs.

-

Impact on credit card company's profitability and credit scoring models. The rising default rates necessitate adjustments to credit scoring models and risk assessment strategies. This can lead to stricter lending criteria and reduced credit availability for consumers.

-

Potential for increased charge-off expenses. Credit card companies need to set aside funds (charge-offs) to account for anticipated losses from defaults. Higher default rates lead to larger charge-off expenses, eating into profitability.

The recent economic downturn has already shown a noticeable increase in credit card delinquencies, highlighting the direct correlation between reduced spending and increased financial risk for credit card issuers.

Shift in Consumer Behavior and Spending Habits

Reduced consumer spending is forcing a change in consumer behavior and spending habits, with significant implications for credit card usage:

-

Increased use of debit cards or cash. Consumers are increasingly turning to debit cards and cash to minimize credit card debt and interest payments.

-

Greater focus on budgeting and debt reduction. Many are actively focusing on tighter budgeting and actively working to reduce existing debt.

-

Shift towards cheaper alternatives and avoiding credit card debt. Consumers are actively seeking cheaper alternatives and making conscious decisions to avoid accumulating credit card debt.

-

The rise of buy now, pay later (BNPL) services as an alternative. The popularity of BNPL services, offering installment payments, is growing as consumers seek alternatives to traditional credit cards.

Data shows a clear shift in payment preferences, with debit card usage increasing significantly while credit card usage declines. This trend underscores the need for credit card companies to adapt their strategies to remain competitive.

Strategies Credit Card Companies are Employing to Adapt

Credit card companies are actively developing strategies to mitigate the impact of reduced consumer spending:

-

Offering incentives and rewards programs to encourage spending. Increased rewards points, cashback offers, and other incentives are being offered to attract and retain customers.

-

Adjusting interest rates and fees strategically. Some companies are adjusting interest rates and fees to maintain profitability while others are offering more flexible payment options.

-

Developing more sophisticated risk management tools. Improved credit scoring models and risk assessment tools are being implemented to better predict and manage potential defaults.

-

Focusing on customer retention and loyalty programs. Building stronger customer relationships and loyalty programs become critical to ensure continued usage.

-

Investing in digital technologies and fintech solutions. Many companies invest in mobile payment technologies and digital platforms to streamline processes and improve customer experience.

The Role of Fintech and Digital Payments

Fintech companies are playing a crucial role in shaping the credit card industry's response to reduced consumer spending. Their innovative payment solutions, often with lower fees and increased transparency, are attracting consumers seeking alternatives to traditional credit cards. This competitive pressure forces established players to innovate and adapt their offerings.

Conclusion

Reduced consumer spending significantly impacts credit card companies through lower transaction volumes, increased defaults, and shifting consumer behavior. The interconnectedness of consumer spending, economic health, and the credit card industry is undeniable. Understanding the impact of reduced consumer spending is crucial for both consumers and businesses alike. Stay informed about the latest economic trends and how they affect your financial decisions. Continue to research the effects of reduced consumer spending on your financial health.

Featured Posts

-

Landlord Rent Increases Following La Fires Spark Outrage

Apr 24, 2025

Landlord Rent Increases Following La Fires Spark Outrage

Apr 24, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025 -

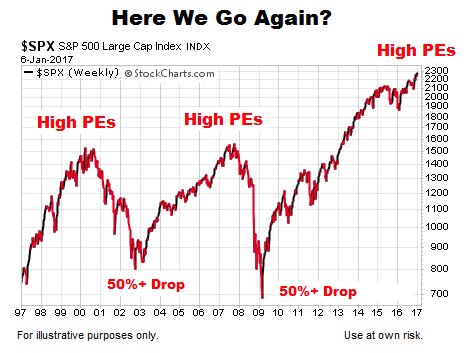

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 24, 2025 -

5 Crucial Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025

5 Crucial Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 24, 2025 -

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025

Startup Airlines Controversial Use Of Deportation Flights

Apr 24, 2025