5 Crucial Do's & Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

Do's for Success in the Private Credit Job Market

Network Strategically: Building strong connections is crucial.

Building a robust network is paramount in the private credit job market. This isn't just about collecting business cards; it's about cultivating meaningful relationships.

- Attend industry events: Conferences, seminars, and workshops provide excellent opportunities to meet professionals, learn about new trends in private debt and mezzanine financing, and even uncover hidden job opportunities. Look for events focused on areas like structured finance, leveraged buyouts, or distressed debt investing.

- Leverage LinkedIn effectively: Your LinkedIn profile should be a polished representation of your skills and experience. Actively connect with professionals working in private credit, join relevant groups (e.g., groups focused on private equity, venture debt, or credit funds), and participate in discussions.

- Informational interviews: Reaching out to professionals for informational interviews can provide invaluable insights into specific firms and roles. These conversations can lead to unexpected job openings or referrals. Remember to prepare thoughtful questions beforehand, demonstrating your genuine interest in the private credit industry.

- Target your networking: Don't cast a wide net indiscriminately. Research specific firms and roles that align with your career goals and focus your networking efforts accordingly. Knowing which firms specialize in areas like direct lending, real estate debt, or special situations will significantly improve your targeting.

Tailor Your Resume and Cover Letter: Generic applications won't cut it.

In the competitive private credit job market, a generic application is unlikely to stand out. Your resume and cover letter must be meticulously crafted to highlight your relevant skills and experience.

- Highlight relevant skills: Emphasize skills and experience related to private credit, leveraged finance, asset-based lending, or other relevant financial fields. This might include experience in financial modeling, valuation, due diligence, credit analysis, or portfolio management.

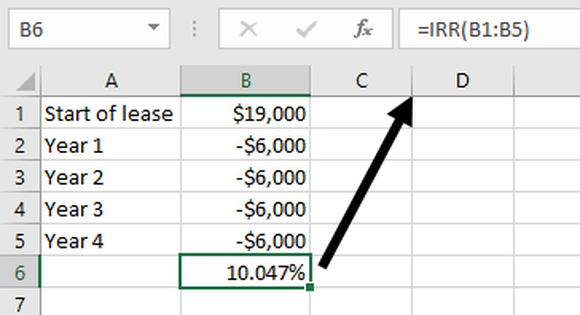

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your achievements with specific examples and demonstrate the impact you had. For instance, instead of saying "Managed a portfolio," say "Managed a $50 million portfolio, achieving a 15% IRR."

- Tailor to each firm: Research each firm thoroughly and tailor your application to their specific investment strategies, portfolio companies, and culture. Show that you understand their business and how your skills align with their needs. Consider using keywords relevant to the specific firm's focus, such as "senior secured debt," "unitranche financing," or "subordinated debt."

- Use relevant keywords: Incorporate keywords frequently used in private credit job descriptions, such as "structured finance," "direct lending," "distressed debt," "private equity," "fund management," and "credit underwriting."

Master the Interview Process: Prepare thoroughly and present yourself confidently.

The interview process is crucial in securing a private credit job. Thorough preparation and confident presentation are essential for success.

- Practice common interview questions: Practice answering common private credit interview questions related to deal structuring, risk assessment, market trends, financial modeling, and valuation. Be ready to discuss your understanding of capital structures, covenants, and credit metrics.

- Demonstrate technical skills: Showcase your proficiency in financial modeling, valuation techniques (DCF, LBO modeling), and other quantitative skills. Be prepared to walk interviewers through your thought process.

- Showcase problem-solving skills: Use real-world examples to demonstrate your analytical and problem-solving skills. Highlight instances where you identified and solved complex financial problems.

- Ask informed questions: Research the interviewers and the firm to formulate insightful and informed questions. This demonstrates your genuine interest and understanding of the firm's activities.

Don'ts to Avoid in Your Private Credit Job Search

Don't Neglect Your Online Presence: A poorly managed online presence can hurt your chances.

Your online presence is often the first impression you make on potential employers. Ensure it reflects professionalism and competence.

- Review your LinkedIn profile: Ensure your LinkedIn profile is up-to-date, accurate, and professionally written. Use a professional headshot and highlight relevant skills and experience.

- Manage your social media: Review your social media profiles (Facebook, Twitter, etc.) to ensure they align with a professional image. Avoid controversial or inappropriate posts.

- Consider a professional website: For more senior roles, consider creating a professional website or online portfolio to showcase your work and expertise.

- Maintain online privacy: Be mindful of your online activity and privacy settings. Employers often check candidate's online presence during the screening process.

Don't Underestimate the Importance of Due Diligence: Thorough research is essential.

Before applying for any role, conduct thorough research on the firms and the private credit market.

- Research firms' investment strategies: Understand each firm's investment thesis, target sectors, deal size, and investment strategies (e.g., senior debt, mezzanine debt, distressed debt).

- Analyze the competitive landscape: Understand the competitive landscape of the private credit market and identify your unique selling proposition (USP). What makes you stand out from other candidates?

- Prepare informed questions: Prepare thoughtful questions to ask during interviews, demonstrating your genuine interest and understanding of the firm's activities and the private credit market.

- Understand the market: Keep up-to-date on market trends, interest rates, economic forecasts, and regulatory changes impacting the private credit industry.

Don't Rush the Process: Patience and persistence are key to success.

Landing a job in private credit takes time and effort. Don't get discouraged by rejections.

- Be patient: The private credit job market is competitive, so be patient and persistent in your search.

- Network consistently: Continue networking and building relationships.

- Follow up on applications: Follow up on your applications after a reasonable time.

- Learn from rejections: Analyze each rejection to identify areas for improvement and refine your approach.

- Seek mentorship: Consider seeking career advice or mentorship from experienced professionals in the private credit industry.

Conclusion:

Securing a position in the competitive private credit job market requires a strategic and well-planned approach. By following these do's and don'ts, you can significantly increase your chances of success. Remember to network effectively, tailor your applications, master the interview process, and maintain a strong online presence. Don't rush the process, and remain persistent in your pursuit of a rewarding career in the dynamic private credit job market. Start your journey today – your dream private credit job awaits!

Featured Posts

-

Hudsons Bay Lease Interest 65 Properties Targeted

Apr 24, 2025

Hudsons Bay Lease Interest 65 Properties Targeted

Apr 24, 2025 -

Tesla Space X And The Epa How Elon Musk And Doge Changed The Narrative

Apr 24, 2025

Tesla Space X And The Epa How Elon Musk And Doge Changed The Narrative

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

Trumps Immigration Policies The Legal Fight Continues

Apr 24, 2025

Trumps Immigration Policies The Legal Fight Continues

Apr 24, 2025 -

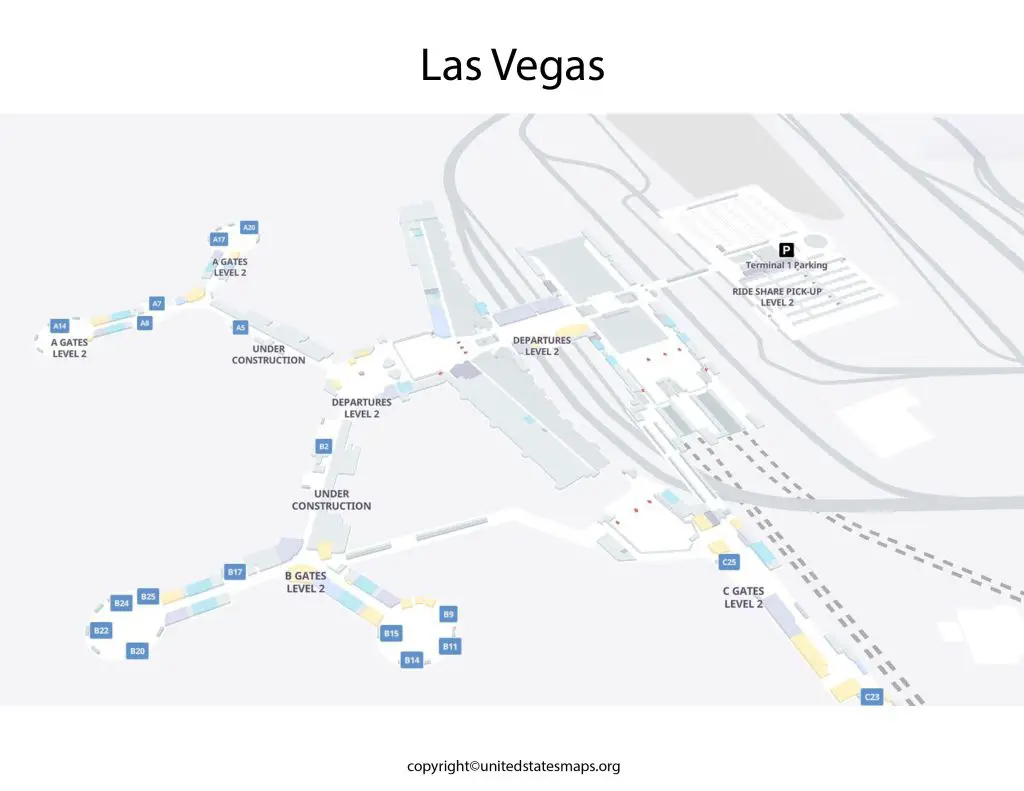

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025