The Impact Of High Down Payments On Canadian Homeownership

Table of Contents

Financial Advantages of Larger Down Payments in Canada

A larger down payment offers several compelling financial benefits. Understanding these advantages can help you strategize effectively for your home purchase.

Reduced Mortgage Payments

A significant down payment translates directly into a smaller mortgage principal. This means lower monthly payments and substantially less interest paid over the life of the loan. For example, a $500,000 home with a 20% down payment ($100,000) results in a $400,000 mortgage, compared to a $450,000 mortgage with a 10% down payment. This seemingly small difference in principal can lead to considerable savings over the amortization period.

- Lower monthly expenses: Freeing up budget for other financial priorities.

- Quicker mortgage payoff: Achieving financial freedom faster.

- Increased affordability: Making homeownership more accessible in the short term.

Lower Mortgage Rates

Lenders often reward borrowers with substantial down payments by offering lower interest rates. A larger down payment signifies lower risk for the lender, leading to more favourable terms. This translates into considerable savings over the lifetime of your mortgage.

- Access to better mortgage options: A wider selection of lenders and products.

- Potential savings on interest: Significant long-term cost reductions.

- Improved credit score: A higher down payment can positively influence your credit rating.

Increased Equity and Financial Stability

A larger down payment leads to quicker equity build-up. Equity is the portion of your home you own outright. Greater equity provides a stronger financial cushion and improved protection against market fluctuations.

- Faster wealth building: Accumulating home equity more rapidly.

- Improved financial security: A safety net against unforeseen circumstances.

- Better protection against market fluctuations: Reducing the risk of negative equity.

Challenges and Disadvantages of High Down Payments in Canada

While the advantages of high down payments are significant, the reality is that saving a substantial sum presents considerable challenges for many Canadians.

Difficulty Saving for a Large Down Payment

Saving for a large down payment, particularly in expensive markets like Toronto and Vancouver, can take years, even decades. This lengthy savings period can delay homeownership, impacting other financial goals such as retirement savings or education funds.

- Lengthy savings period: Potentially delaying homeownership for years.

- Potential delays in homeownership: Impacting life plans and family decisions.

- Impact on other financial goals: Limiting resources for other important investments.

Limited Access to Homeownership for Lower-Income Earners

The high down payment requirement acts as a significant barrier to entry for many lower-income Canadians, exacerbating existing inequalities in homeownership. This creates a significant affordability challenge and limits opportunities for affordable housing.

- Increased inequality in homeownership: Widening the gap between socioeconomic groups.

- Limited opportunities for affordable housing: Restricting access to the housing market.

- Need for government intervention: Highlighting the role of policy in addressing affordability.

Opportunity Cost of Tied-Up Funds

A substantial down payment represents a significant opportunity cost. The money used for the down payment could have been invested elsewhere, potentially generating higher returns.

- Potential lost investment returns: Missing out on potential gains from other investments.

- Missed investment opportunities: Forgoing opportunities in stocks, bonds, or other assets.

- Impact on overall financial planning: Affecting long-term financial strategies.

Alternatives to High Down Payments in Canada

Fortunately, several alternatives exist to help Canadians achieve homeownership without needing a massive upfront payment.

Government-backed Programs

The Canadian government offers various programs designed to assist first-time homebuyers. The Home Buyers' Plan (HBP) allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) tax-free for a down payment, while the Canada Mortgage and Housing Corporation (CMHC) provides mortgage loan insurance, enabling buyers with smaller down payments to secure a mortgage.

- Details on HBP: Understanding eligibility criteria and withdrawal limits.

- CMHC mortgage insurance benefits: Learning about the protection and options available.

- Eligibility criteria: Meeting the requirements for government-backed programs.

Gifting and Co-signing

Family assistance, through gifting or co-signing, can significantly ease the burden of a large down payment. However, it's crucial to understand the legal and financial implications involved.

- Advantages and disadvantages of gifting and co-signing: Weighing the pros and cons carefully.

- Legal implications: Ensuring proper documentation and understanding the legal ramifications.

Exploring Different Mortgage Options

Various mortgage options cater to those with smaller down payments, such as high-ratio mortgages insured by CMHC. Understanding the terms and comparing interest rates is essential.

- Pros and cons of different mortgage types: Making informed decisions based on individual circumstances.

- Understanding mortgage terms: Comprehending amortization, interest rates, and other key elements.

- Comparing interest rates: Securing the most competitive mortgage terms.

Conclusion

The impact of high down payments Canada on homeownership is multifaceted. While larger down payments offer significant financial advantages, the challenges of saving for them are substantial, particularly for first-time buyers and lower-income earners. Understanding the available alternatives, including government programs, family assistance, and various mortgage options, is crucial for navigating the complexities of the Canadian housing market. Research your options thoroughly and make an informed decision about your down payment strategy. Learn more about government programs like the HBP and CMHC insurance to navigate the complexities of high down payments in Canada and achieve your homeownership goals. Understanding the impact of high down payments Canada is crucial for successful home buying.

Featured Posts

-

Solve Nyt Strands Game 402 Hints And Answers For April 9

May 09, 2025

Solve Nyt Strands Game 402 Hints And Answers For April 9

May 09, 2025 -

Slovenska Dakota Johnson Neuveritelna Podobnost S Hollywoodskou Hviezdou

May 09, 2025

Slovenska Dakota Johnson Neuveritelna Podobnost S Hollywoodskou Hviezdou

May 09, 2025 -

Young Thugs Back Outside Album What We Know So Far

May 09, 2025

Young Thugs Back Outside Album What We Know So Far

May 09, 2025 -

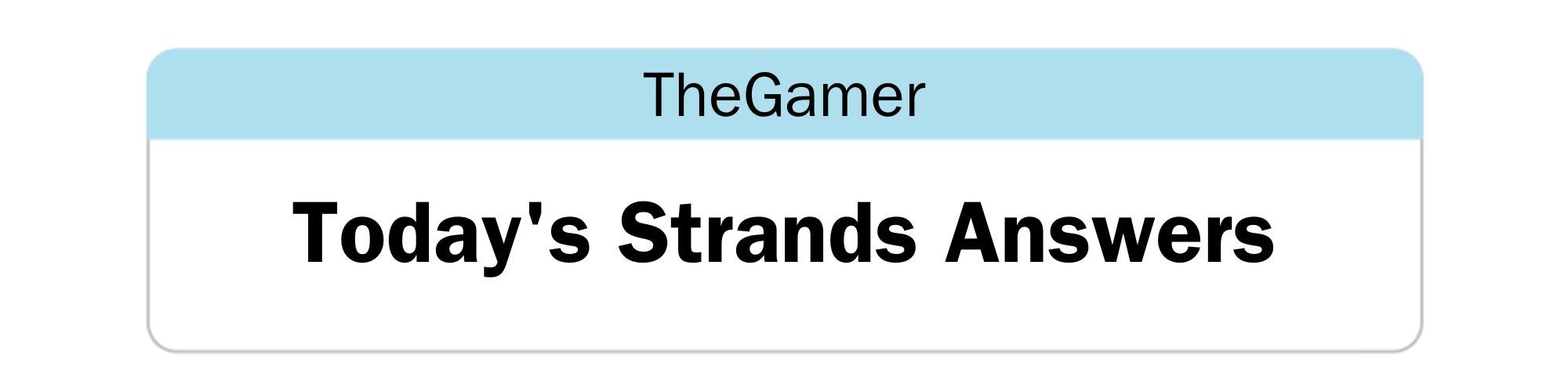

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025

Is Now The Right Time To Invest In Palantir Technologies Stock

May 09, 2025 -

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025

Retired Judge Deborah Taylor To Lead Nottingham Attacks Inquiry

May 09, 2025