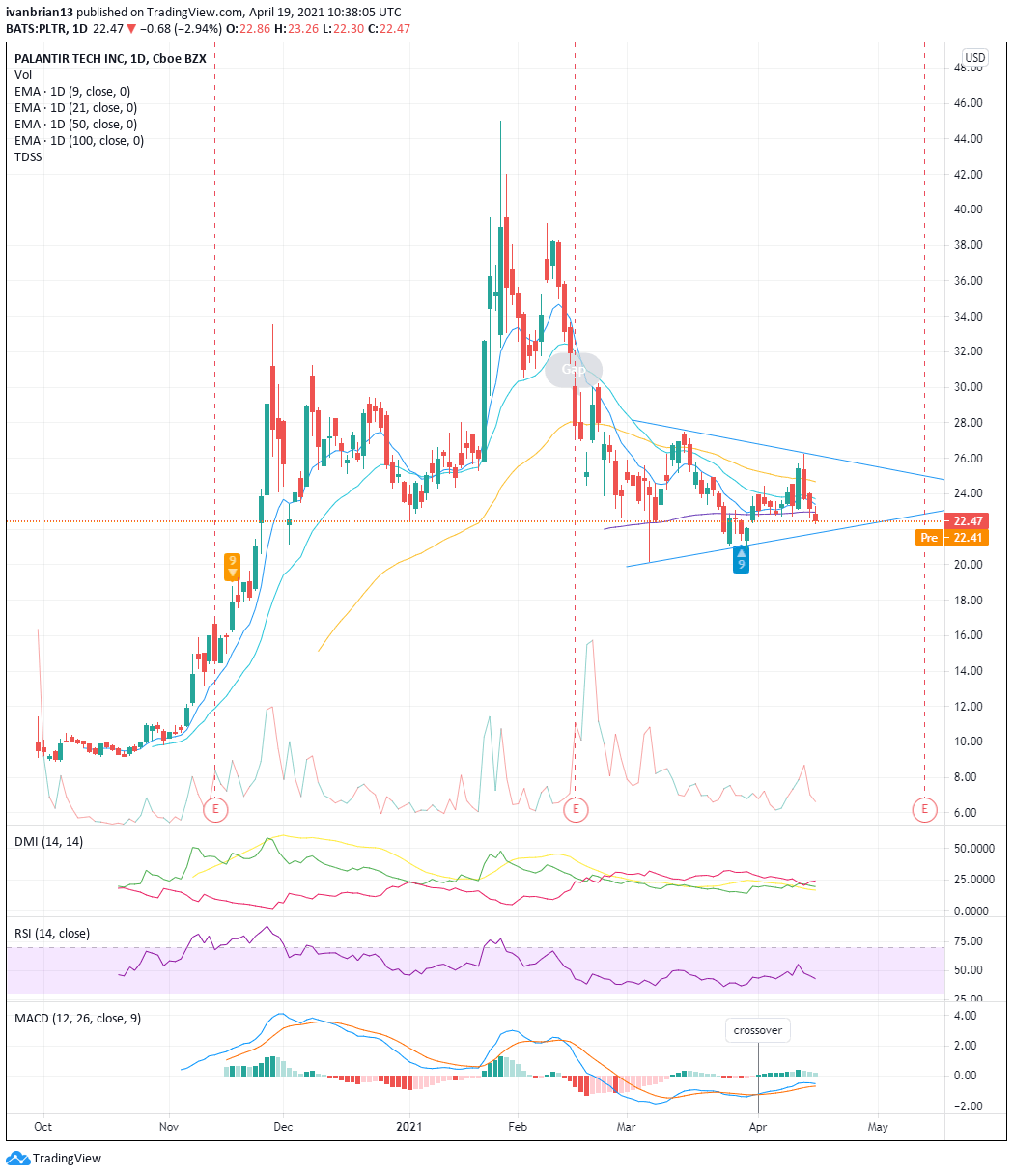

Is Now The Right Time To Invest In Palantir Technologies Stock?

Table of Contents

Palantir's Financial Performance and Future Projections

Analyzing Palantir's financial health is crucial for any potential investor. Recent quarterly earnings reports offer a glimpse into the company's performance and future trajectory. While revenue growth has been impressive, demonstrating the increasing demand for its advanced data analytics platforms, profitability remains a key focus. Investors should carefully examine key financial metrics:

- Revenue Growth: Examine the percentage increase in revenue year-over-year and quarter-over-quarter. Sustained growth is a positive sign for Palantir stock.

- EBITDA and Net Income: Assessing profitability is vital. Look for trends in EBITDA (earnings before interest, taxes, depreciation, and amortization) and net income. Increasing profitability suggests a stronger financial position for Palantir.

- Government vs. Commercial Contracts: Palantir's revenue stream is divided between government and commercial contracts. Understanding the growth trajectory of each sector is important for predicting future performance. A balanced portfolio reduces reliance on any single sector.

- Debt Levels and Cash Flow: Analyze Palantir's debt levels and its ability to generate positive cash flow. A strong cash position indicates financial stability and the potential for future growth and investment.

- Analyst Ratings and Price Targets: Research analyst ratings and price targets for Palantir stock. This provides insight into expert opinions on the stock's future valuation.

Market Competition and Industry Trends

Palantir operates in a competitive market dominated by other big data analytics companies. Understanding its competitive landscape is vital when considering a Palantir investment. Key aspects to assess include:

- Palantir's Technological Advantages: Palantir's proprietary software and advanced algorithms offer a competitive edge. Analyzing its technological innovation and its ability to adapt to emerging technologies is crucial.

- Market Share and Growth Potential: Assess Palantir's current market share and its potential for growth within the expanding data analytics industry. Strong market share growth indicates a competitive advantage.

- Emerging Technologies: The impact of AI, machine learning, and cloud computing on Palantir’s business model must be evaluated. Adaptation to new technologies is essential for long-term success.

- Government Regulations: The data analytics industry is subject to various regulations, especially regarding data privacy and security. Understanding the regulatory landscape and its potential impact on Palantir is essential.

Risk Assessment and Potential Downsides

Investing in Palantir Technologies stock, like any investment, carries inherent risks. A thorough risk assessment is crucial before making any investment decision:

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence creates vulnerability to changes in government spending and policy.

- High Operating Expenses: Palantir's high operating expenses can impact profitability. Monitoring these expenses and their trend is crucial.

- Stock Market Volatility: The stock market's inherent volatility can impact Palantir's stock price, regardless of its financial performance.

- Security Concerns and Data Breaches: Data security is paramount in the data analytics industry. Potential data breaches can significantly harm Palantir’s reputation and stock price.

Long-Term Growth Potential and Investment Strategy

Despite the risks, Palantir operates within a rapidly expanding market with significant long-term growth potential. Considering a long-term investment strategy is crucial:

- International Expansion: Palantir's potential for international expansion significantly impacts its long-term growth prospects.

- Innovation in AI and Machine Learning: Palantir's continued investment in AI and machine learning enhances its competitive advantage and future growth potential.

- Long-Term Market Trends: The increasing demand for data analytics and AI positions Palantir favorably for long-term growth.

- Risk Tolerance and Investment Timeline: Before investing in Palantir stock, carefully assess your risk tolerance and investment timeline. A long-term outlook can help mitigate short-term market volatility.

Conclusion

Investing in Palantir Technologies stock presents both significant opportunities and considerable risks. Its innovative technology and growing market position offer substantial long-term potential. However, dependence on government contracts, high operating expenses, and market volatility must be carefully considered. Before making any decision, conduct your own thorough research, considering your personal financial goals and risk tolerance. Carefully consider investing in Palantir stock only after a complete understanding of the company's financial performance, market position, and inherent risks. Learn more about Palantir Technologies stock and research Palantir investment opportunities before committing your capital. Remember, this information is not financial advice.

Featured Posts

-

Federal Reserve Holds Steady Understanding The Rationale Behind No Rate Cuts

May 09, 2025

Federal Reserve Holds Steady Understanding The Rationale Behind No Rate Cuts

May 09, 2025 -

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025

Dijon Vs Psg Le Match Decisif De L Arkema Premiere Ligue

May 09, 2025 -

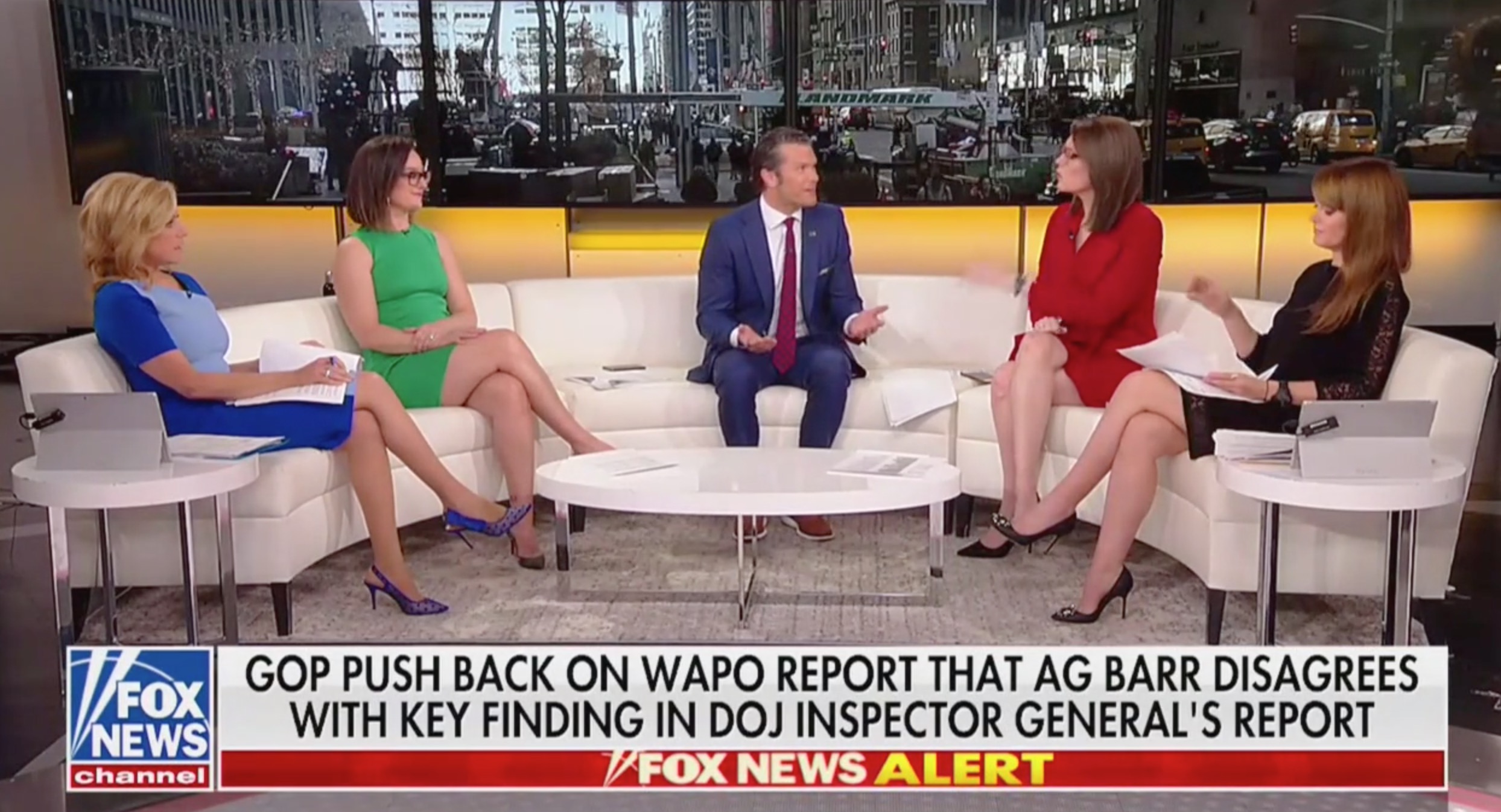

Debate Tarlov Challenges Pirros Pro Trade War Position On Canada

May 09, 2025

Debate Tarlov Challenges Pirros Pro Trade War Position On Canada

May 09, 2025 -

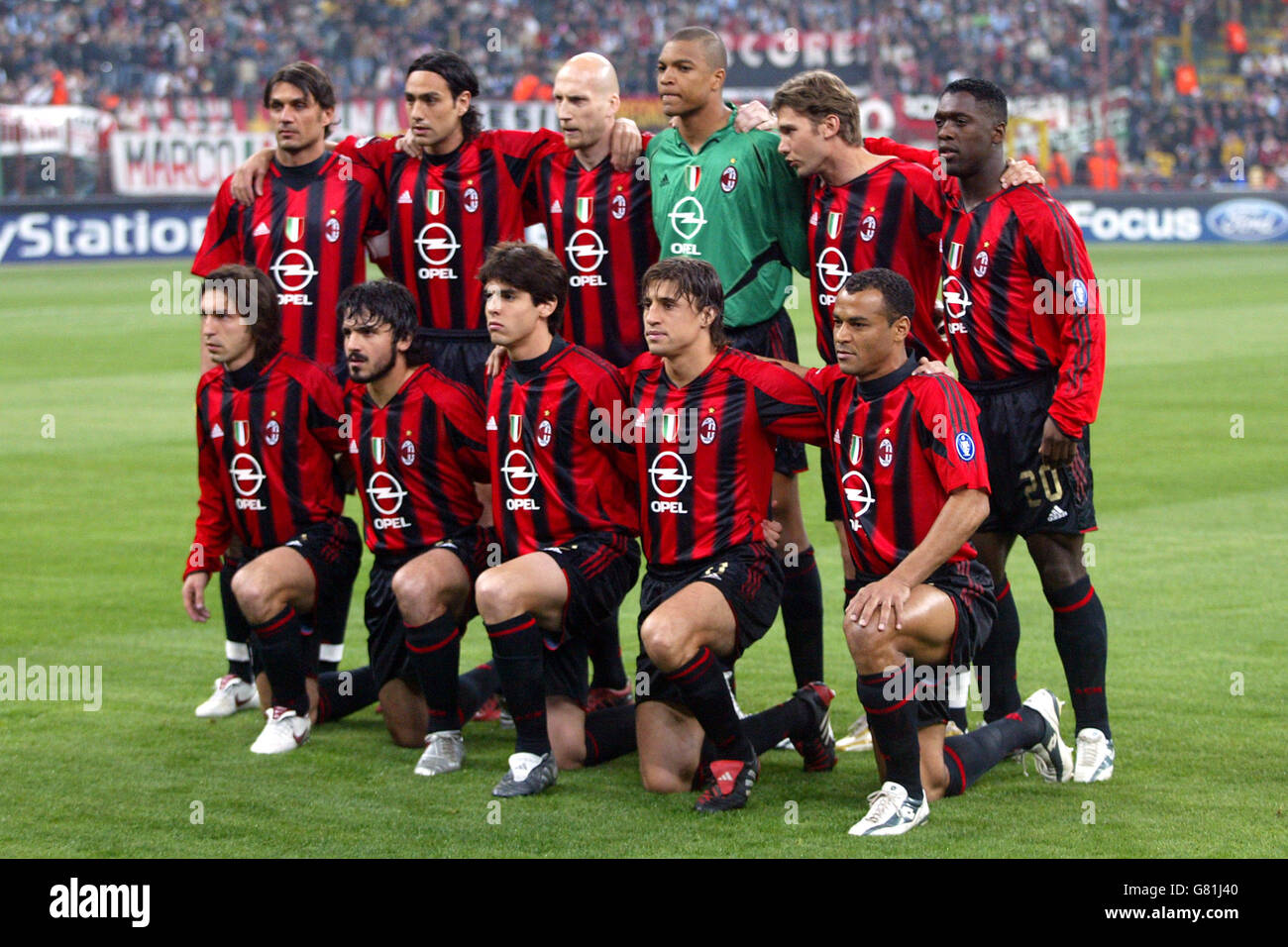

Bayern Munichs Champions League Loss To Inter Milan First Leg Analysis

May 09, 2025

Bayern Munichs Champions League Loss To Inter Milan First Leg Analysis

May 09, 2025 -

The Whats App Spyware Case Metas 168 Million Loss And What It Means For Users

May 09, 2025

The Whats App Spyware Case Metas 168 Million Loss And What It Means For Users

May 09, 2025

Latest Posts

-

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025

Bangkok Post The Urgent Need For Transgender Rights Reform

May 10, 2025 -

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025

Trump Executive Orders And Their Impact On Transgender Individuals Your Stories Matter

May 10, 2025 -

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025

Advocates Push For Transgender Equality Bangkok Post Reports

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Rights

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Rights

May 10, 2025 -

Dissecting The Double Speak Trumps Stance On The Transgender Military Ban

May 10, 2025

Dissecting The Double Speak Trumps Stance On The Transgender Military Ban

May 10, 2025