The Gut-Wrenching Truth About Buy-and-Hold: A Long-Term Investor's Perspective

Table of Contents

The Allure and Promise of Buy-and-Hold Investing

Buy-and-hold, a cornerstone of passive investing, offers a compelling approach to wealth building. Its simplicity and potential for significant long-term growth make it attractive to many investors.

Understanding the Core Principles

The buy-and-hold strategy is based on acquiring assets, such as stocks or bonds, and holding them for an extended period, typically several years or even decades, regardless of short-term market fluctuations. This approach leverages the power of compounding and minimizes the impact of transaction costs associated with frequent trading.

- Long-term growth potential: Buy-and-hold allows investments to ride out market corrections and benefit from long-term economic growth.

- Power of compounding: Reinvesting dividends and capital gains accelerates wealth accumulation through the magic of compound interest.

- Minimizing transaction costs: Frequent buying and selling incurs brokerage fees and taxes, eating into returns. Buy-and-hold significantly reduces these costs.

- Benefits of dollar-cost averaging: Investing a fixed amount regularly, regardless of market price, smooths out volatility and reduces the risk of buying high.

Historical Performance Data (supporting buy-and-hold)

Historical market data strongly supports the efficacy of a long-term buy-and-hold strategy.

- S&P 500 Performance: The S&P 500 index, a benchmark for US large-cap stocks, has consistently delivered positive long-term returns over decades, even accounting for market corrections and bear markets. Consistent investment in the index over the long term would have yielded substantial growth.

- Long-term returns: While short-term fluctuations are inevitable, long-term returns have historically outweighed periods of decline, showcasing the power of time in the market.

The Gut-Wrenching Realities: Navigating Market Volatility

While the long-term outlook for buy-and-hold is generally positive, navigating market volatility presents significant emotional challenges.

Emotional Challenges of Buy-and-Hold

Sticking to a buy-and-hold strategy during market downturns requires significant discipline and emotional resilience.

- Fear of missing out (FOMO): Seeing other investments perform better in the short-term can lead to second-guessing your strategy.

- Panic selling: Market corrections and bear markets can trigger impulsive decisions to sell assets at a loss, cutting short the potential for long-term gains.

- The impact of market corrections and bear markets on investor sentiment: Negative market news can create anxiety and fear, making it difficult to maintain a long-term perspective.

Practical Strategies for Managing Volatility

Several strategies can help mitigate the emotional challenges of buy-and-hold investing.

- Diversification: Spreading investments across different asset classes reduces the impact of losses in any single sector or market.

- Regular portfolio reviews (without frequent trading): Periodic reviews provide a sense of control without the impulsive actions of constant trading.

- Having a well-defined investment plan: A clear plan, developed with a financial advisor, helps you stay focused on your long-term goals.

- Seeking professional financial advice: A financial advisor can provide objective guidance, helping to manage emotions and maintain a rational investment approach.

Beyond the Buy-and-Hold Ideal: Considering Alternatives and Nuances

Buy-and-hold isn't a one-size-fits-all solution, and understanding its nuances is crucial.

Active vs. Passive Investing

Buy-and-hold is a passive investing strategy. Let's contrast it with active investing:

- Passive Investing (Buy-and-Hold): Requires less time and expertise, focusing on long-term growth. Lower transaction costs, generally lower risk.

- Active Investing: Involves frequent trading based on market analysis and attempts to outperform the market. Requires more time, expertise, and carries higher transaction costs and potentially higher risk.

Adapting Your Strategy

Market conditions and personal circumstances change over time, necessitating adjustments to your buy-and-hold strategy.

- Portfolio rebalancing: Periodically adjusting your asset allocation to maintain your desired risk profile.

- Adjusting asset allocation: Shifting investments based on changing market conditions or personal financial goals.

- Recognizing limitations and potential need for adjustments: A rigid adherence to buy-and-hold might not always be optimal, particularly in rapidly changing or volatile markets.

Conclusion

Buy-and-hold investing offers the potential for significant long-term growth, fueled by the power of compounding and the benefits of minimizing transaction costs. However, it's crucial to acknowledge the emotional challenges associated with market volatility and the need for discipline and patience. Understanding the nuances of buy-and-hold investing, considering alternatives like active investing, and adapting your strategy to changing circumstances are essential for success. Ultimately, the success of a buy-and-hold strategy depends on individual circumstances and a well-informed approach. Do your research, consult with a financial advisor, and make informed decisions about your long-term investment strategy.

Featured Posts

-

The Complexities Of Grief Jonathan Peretz Reflects On Loss And Love

May 26, 2025

The Complexities Of Grief Jonathan Peretz Reflects On Loss And Love

May 26, 2025 -

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025

Amazon Primes Etoile Gideon Glicks Captivating Performance

May 26, 2025 -

Is The Hoka Cielo X1 2 0 Right For You A Comprehensive Review

May 26, 2025

Is The Hoka Cielo X1 2 0 Right For You A Comprehensive Review

May 26, 2025 -

The Trump Factor Pressuring Republicans Into A Deal

May 26, 2025

The Trump Factor Pressuring Republicans Into A Deal

May 26, 2025 -

Gravel Tech And Massive Tyres 2025 Paris Roubaix Tech Gallery

May 26, 2025

Gravel Tech And Massive Tyres 2025 Paris Roubaix Tech Gallery

May 26, 2025

Latest Posts

-

Bad Credit Personal Loans Guaranteed Approval And Direct Lender Options Up To 5000

May 28, 2025

Bad Credit Personal Loans Guaranteed Approval And Direct Lender Options Up To 5000

May 28, 2025 -

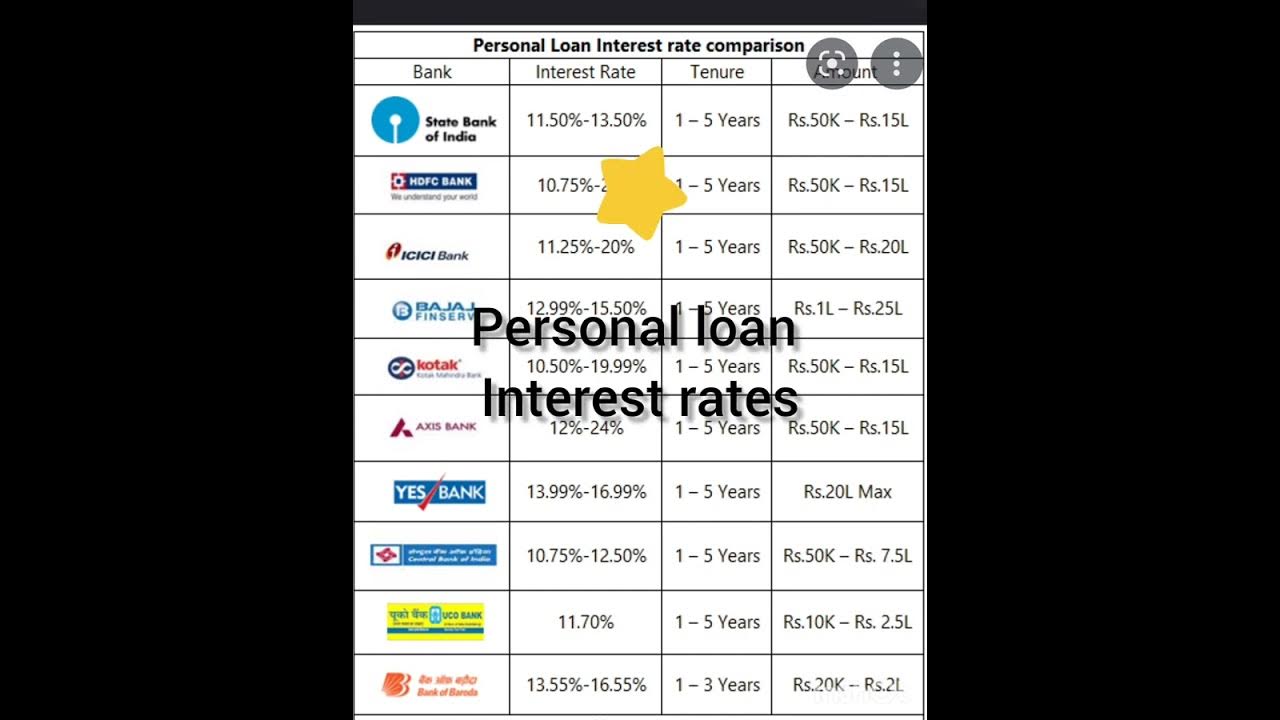

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025 -

5000 Personal Loans For Bad Credit Direct Lender Options And Approval Process

May 28, 2025

5000 Personal Loans For Bad Credit Direct Lender Options And Approval Process

May 28, 2025 -

Tueketici Kredileri Abd Deki Mart Ayi Artisi Ve Gelecek Tahminleri

May 28, 2025

Tueketici Kredileri Abd Deki Mart Ayi Artisi Ve Gelecek Tahminleri

May 28, 2025 -

Abd De Tueketici Kredisi Bueyuemesi Mart Ayinda Hizlandi

May 28, 2025

Abd De Tueketici Kredisi Bueyuemesi Mart Ayinda Hizlandi

May 28, 2025