Personal Loan Interest Rates Today: Financing Starting Under 6%

Table of Contents

Factors Affecting Your Personal Loan Interest Rate

Several factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate and ultimately saving money.

Your Credit Score – The Biggest Factor

Your credit score is arguably the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan. A higher credit score indicates lower risk to the lender, resulting in more favorable interest rates.

- A credit score above 750 typically qualifies you for the best personal loan rates, often under 6%.

- Scores between 670 and 750 might still secure competitive rates, but likely slightly higher.

- Scores below 670 often result in significantly higher interest rates, or loan applications being rejected altogether.

Actionable Steps:

- Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors and inaccuracies.

- Improve your credit score before applying for a personal loan by paying bills on time, reducing your credit utilization ratio, and avoiding new credit applications.

- Consider a secured loan, backed by collateral like a savings account, if your credit score is low. This can help you secure a loan even with less-than-perfect credit.

Loan Amount and Term

The amount you borrow and the length of your repayment term (loan term) also influence your interest rate. Generally, larger loan amounts and longer terms translate to higher interest rates. Lenders perceive these as higher-risk loans.

Examples:

- A $10,000 personal loan over 3 years might carry an interest rate of 7%, while a $20,000 loan over 5 years could have a rate of 9% or higher, even with the same credit score.

Actionable Steps:

- Borrow only the amount you absolutely need to avoid unnecessary interest payments.

- Shop around for different loan terms. A shorter loan term will typically result in a higher monthly payment but a lower overall interest cost.

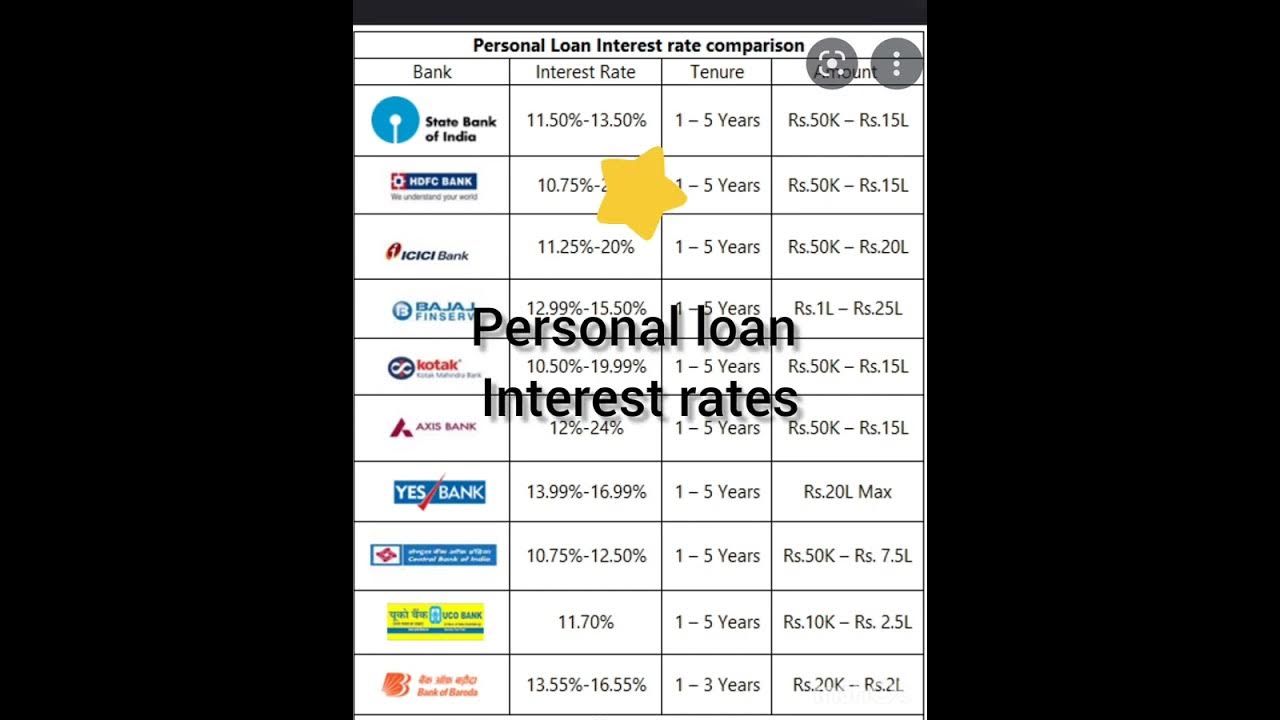

Lender Type and Fees

Interest rates vary significantly among different lenders. Banks, credit unions, and online lenders all offer personal loans, but their rates and fees can differ substantially.

- Credit unions often provide more competitive rates than banks, particularly for members with good credit.

- Online lenders are known for their convenience and sometimes offer competitive rates, but carefully review their fees.

Actionable Steps:

- Compare the Annual Percentage Rate (APR), which includes interest and fees, not just the interest rate itself.

- Be aware of hidden fees such as origination fees, prepayment penalties, and late payment fees. These can significantly increase the overall cost of your loan.

- Read the fine print of your loan agreement carefully before signing.

Finding Personal Loans with Interest Rates Under 6%

Securing a personal loan with an interest rate under 6% is achievable with careful planning and research.

Shop Around and Compare Offers

Comparing offers from multiple lenders is crucial. Don't settle for the first offer you receive. Use online comparison tools to quickly compare rates and terms from various lenders.

Pre-qualification

Pre-qualifying for a loan allows you to check your eligibility without impacting your credit score. This lets you compare offers from several lenders before submitting a formal application.

Negotiate

If you have an excellent credit score and a stable financial history, don't hesitate to negotiate with lenders for a lower interest rate.

Consider Secured Loans

Secured personal loans, which require collateral, often have lower interest rates than unsecured loans. However, this involves risk, as defaulting could result in the loss of your collateral.

Actionable Steps:

- Use online comparison tools to quickly compare offers from various lenders.

- Contact multiple lenders directly to discuss your options and potentially negotiate a better rate.

- Leverage your strong credit history and financial stability during negotiations.

Improving Your Chances of Securing a Low Interest Personal Loan

Several actions can significantly improve your chances of getting a low-interest personal loan.

Boost Your Credit Score

Work on improving your credit score by:

- Paying all bills on time.

- Keeping your credit utilization ratio (the amount of credit you use compared to your total available credit) low (ideally below 30%).

- Avoiding opening multiple new credit accounts in a short period.

Increase Your Income

A higher income demonstrates greater financial stability to lenders, potentially leading to lower interest rates.

Maintain a Stable Financial History

Consistent employment and a proven track record of responsible borrowing significantly enhance your loan application prospects.

Conclusion: Securing the Best Personal Loan Interest Rates Today

Securing the best personal loan interest rates today hinges on several key factors: your credit score, the loan amount and term, and the lender you choose. By understanding these factors and actively working to improve your financial profile, you can significantly increase your chances of obtaining low interest personal loans. Remember to shop around and compare offers from multiple lenders, leveraging pre-qualification to avoid multiple credit inquiries. Start your search for low interest personal loans today! Compare offers and secure the financing you need at a rate that works for you. Use online comparison tools to find the best options for your financial situation. Don't delay – secure the best personal loan interest rates available today!

Featured Posts

-

Luis Arraez Injured In Collision Details On The Dubon Incident

May 28, 2025

Luis Arraez Injured In Collision Details On The Dubon Incident

May 28, 2025 -

Miami Marlins Edge Nationals Reach 500 Winning Percentage

May 28, 2025

Miami Marlins Edge Nationals Reach 500 Winning Percentage

May 28, 2025 -

Behind The Scenes Crafting The World Of The Phoenician Scheme

May 28, 2025

Behind The Scenes Crafting The World Of The Phoenician Scheme

May 28, 2025 -

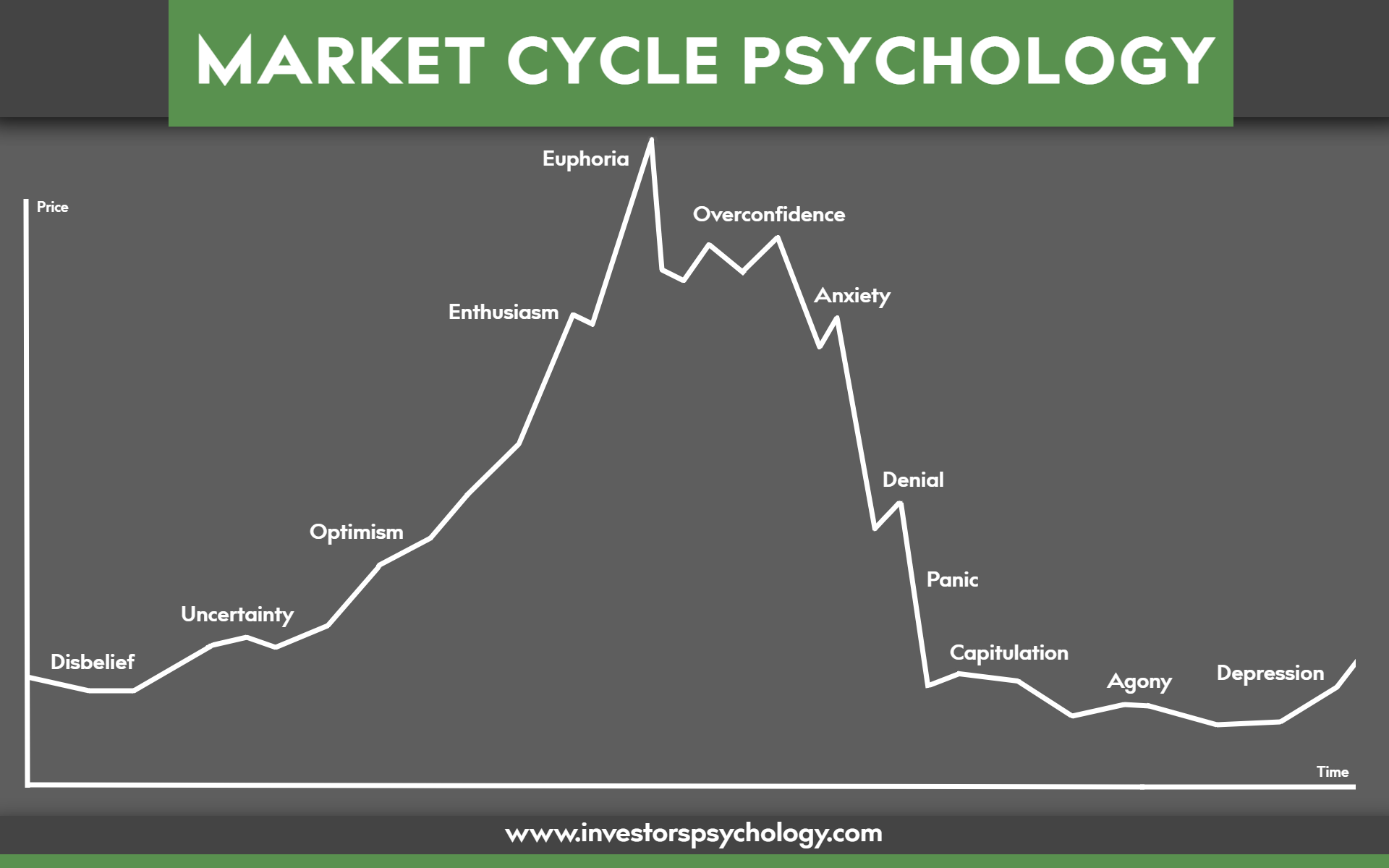

Bond Market Crisis Are Investors Missing The Warning Signs

May 28, 2025

Bond Market Crisis Are Investors Missing The Warning Signs

May 28, 2025 -

Stock Market Valuation Concerns A Bof A Analysis

May 28, 2025

Stock Market Valuation Concerns A Bof A Analysis

May 28, 2025