The Growing Appeal Of The Venture Capital Secondary Market

Table of Contents

Increased Liquidity for Early Investors

Early-stage investing, while potentially highly rewarding, traditionally involves lengthy lock-up periods. Realizing returns often hinges on a successful IPO or acquisition, events that can be unpredictable and years in the making. This illiquidity presents a significant challenge for early investors, especially those with limited risk tolerance or diverse portfolio needs. The VC secondary market provides a much-needed solution, offering a pathway to liquidity long before a traditional exit.

- Faster access to capital: The secondary market allows investors to sell their stakes in privately held companies, gaining access to capital far quicker than waiting for an IPO or acquisition.

- Portfolio diversification: Selling a portion of a mature investment in the secondary market allows investors to diversify their portfolios, reducing overall risk and potentially increasing returns.

- Opportunity to reinvest: Liquidity generated from secondary sales provides capital for reinvestment in new, promising ventures, accelerating overall portfolio growth.

- Reduced reliance on long-term holding: The venture capital secondary market reduces the dependence on extended holding periods, providing flexibility and control over investment timelines.

Enhanced Portfolio Management for Fund Managers

For fund managers, the secondary market offers powerful tools for proactive portfolio management. It enables them to strategically rebalance their holdings, shedding less promising investments and allocating capital to more attractive opportunities. This approach enhances overall fund performance and strengthens investor relations.

- Improved fund performance metrics: Selling mature investments at favorable valuations can significantly improve key performance indicators like Internal Rate of Return (IRR).

- Enhanced investor relations: Active portfolio management, facilitated by the secondary market, demonstrates competence and responsiveness to investor needs.

- Capital allocation to high-potential opportunities: Proceeds from secondary sales can be reinvested in companies with higher growth potential, maximizing fund returns.

- Effective fund lifecycle management: The VC secondary market assists in efficiently managing fund lifecycles, ensuring timely capital distributions and optimal allocation.

Attractive Returns for Secondary Buyers

The venture capital secondary market isn't just beneficial to sellers; it also presents attractive investment opportunities for buyers. These buyers, often including private equity firms, specialized funds, and high-net-worth individuals, are drawn to the potential for superior returns and diversified exposure.

- Discounted valuations: Secondary market transactions often provide access to high-growth companies at valuations lower than those seen in later-stage funding rounds.

- Access to diverse portfolio companies: The secondary market grants access to a wider range of promising companies than might be available through primary investments.

- Robust due diligence: Sophisticated due diligence processes, often conducted by experienced professionals, help mitigate risks associated with private company investments.

- Significant capital appreciation potential: Investing in mature, high-growth companies at discounted valuations offers considerable potential for capital appreciation.

Technological Advancements & Increased Market Transparency

Recent technological advancements have significantly improved the efficiency and transparency of the VC secondary market. Online platforms and data analytics provide better access to information, streamlining transactions and enhancing price discovery.

- Improved due diligence: Readily available data through online platforms enhances due diligence capabilities, facilitating more informed investment decisions.

- Streamlined transaction processes: Technological improvements have simplified and accelerated the transaction process, reducing administrative burdens.

- Increased access to opportunities: Online marketplaces broaden access to a wider range of investment opportunities, connecting buyers and sellers more efficiently.

- Reduced information asymmetry: Greater data availability minimizes information imbalances, fostering a more level playing field for all participants.

Conclusion: The Future of the Venture Capital Secondary Market

The venture capital secondary market offers compelling advantages for both early investors seeking liquidity and fund managers aiming to optimize portfolio performance. Its growing appeal reflects the increasing sophistication of the private equity landscape and the desire for more efficient capital allocation. Ongoing trends point to continued expansion, driven by technological innovation and a growing need for flexible investment solutions. Explore the opportunities presented by the VC secondary market; invest in the secondary market and learn more about accessing liquidity through this dynamic and increasingly important aspect of the private equity world.

Featured Posts

-

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025 -

Urgent Appeal British Paralympian Unseen For Over A Week In Las Vegas

Apr 29, 2025

Urgent Appeal British Paralympian Unseen For Over A Week In Las Vegas

Apr 29, 2025 -

New Developments Bolster Cardinal Beccius Appeal

Apr 29, 2025

New Developments Bolster Cardinal Beccius Appeal

Apr 29, 2025 -

Pacult Geht Jancker Kommt Trainerwechsel Bei Austria Wien

Apr 29, 2025

Pacult Geht Jancker Kommt Trainerwechsel Bei Austria Wien

Apr 29, 2025 -

Conferinta Pw C Romania Actualizari Si Modificari In Legislatia Fiscala Pentru 2025

Apr 29, 2025

Conferinta Pw C Romania Actualizari Si Modificari In Legislatia Fiscala Pentru 2025

Apr 29, 2025

Latest Posts

-

Jeff Goldblums Spouse Emilie Livingston Her Age And Their Kids

Apr 29, 2025

Jeff Goldblums Spouse Emilie Livingston Her Age And Their Kids

Apr 29, 2025 -

Emilie Livingston Wife Of Jeff Goldblum Age And Children

Apr 29, 2025

Emilie Livingston Wife Of Jeff Goldblum Age And Children

Apr 29, 2025 -

Goldblum Family Day Out A Trip To Italy And A Football Game

Apr 29, 2025

Goldblum Family Day Out A Trip To Italy And A Football Game

Apr 29, 2025 -

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025

Re Examining The Fly Jeff Goldblums Performance And The Academys Oversight

Apr 29, 2025 -

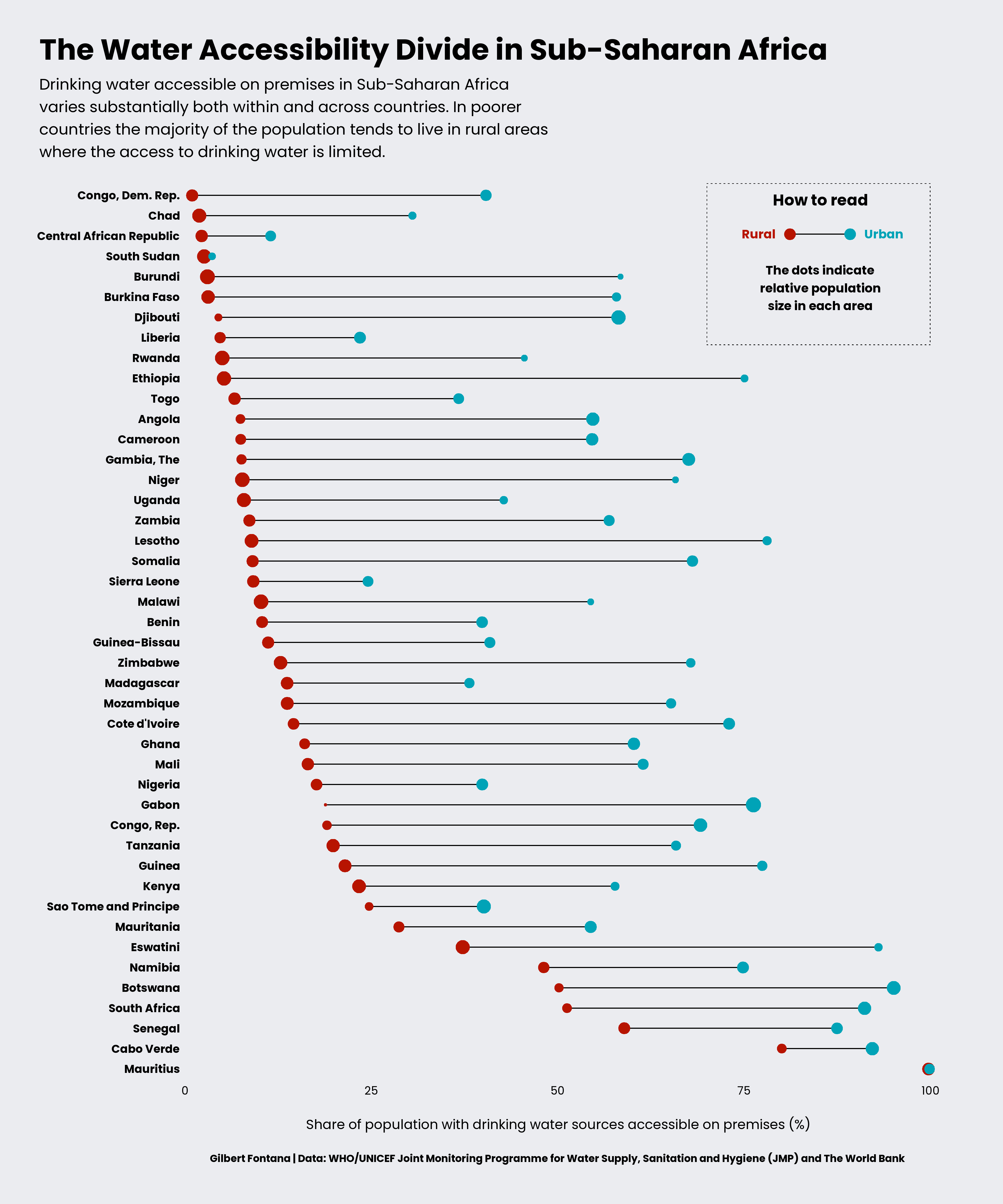

Sub Saharan Africa Faces Pw Cs Exit Exploring The Reasons And Future Outlook

Apr 29, 2025

Sub Saharan Africa Faces Pw Cs Exit Exploring The Reasons And Future Outlook

Apr 29, 2025