Sub-Saharan Africa Faces PwC's Exit: Exploring The Reasons And Future Outlook

Table of Contents

Reasons Behind PwC's Potential Withdrawal from Sub-Saharan Africa

Several interconnected factors could be driving PwC's potential departure. Understanding these is crucial to assessing the overall impact.

Economic Challenges and Market Volatility

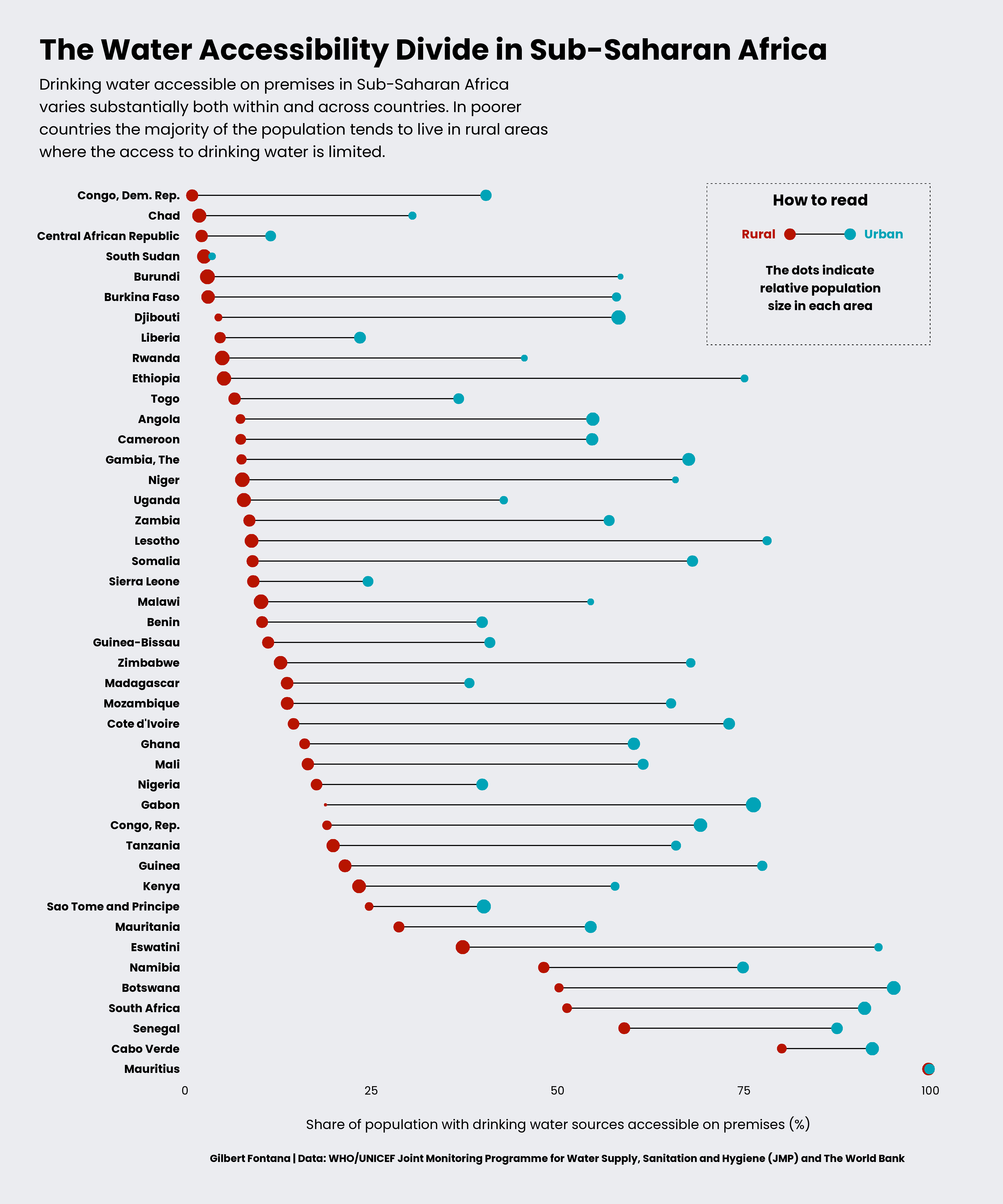

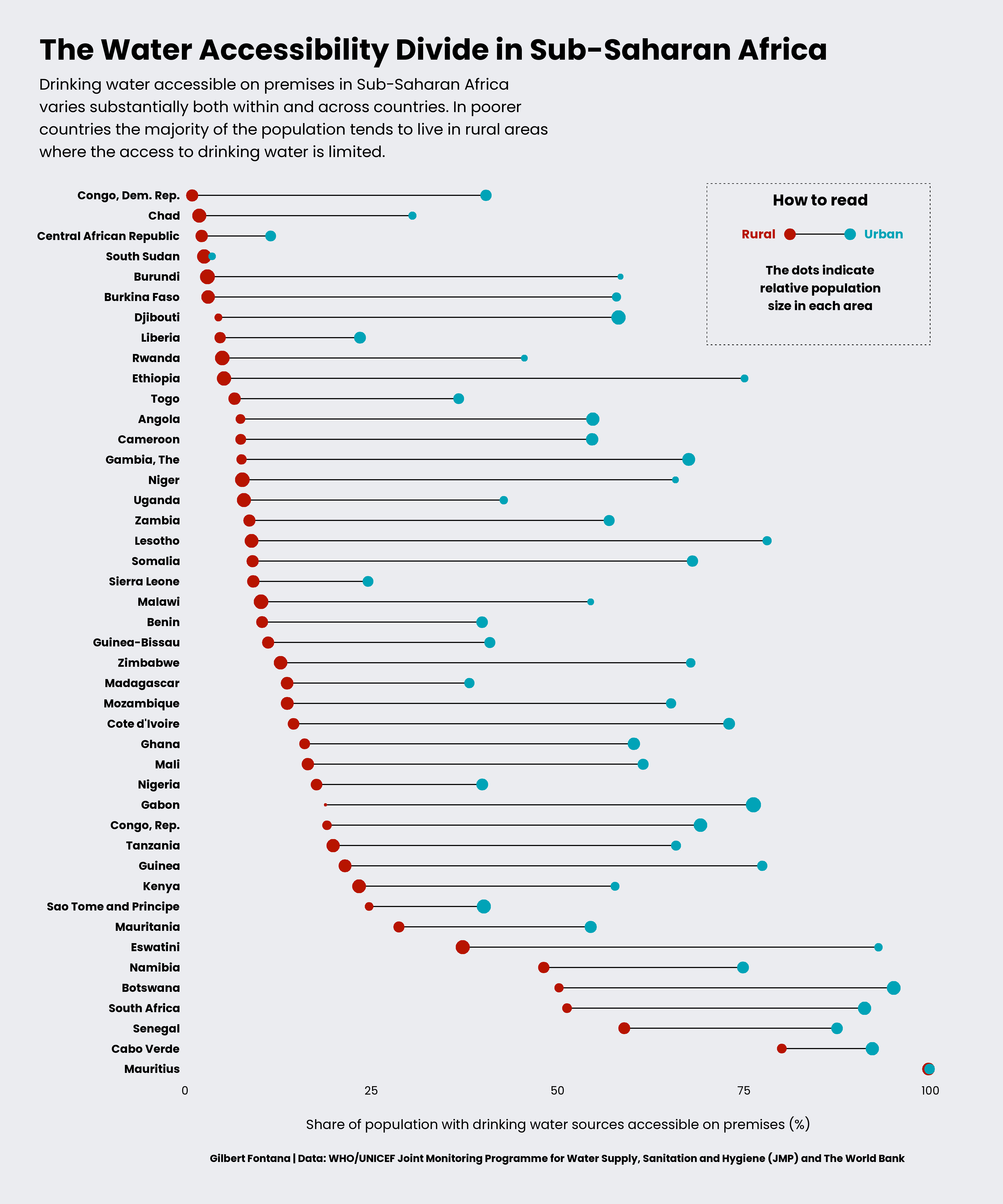

Sub-Saharan Africa, despite its growth potential, faces significant economic instability in several countries. Currency fluctuations, high inflation rates, and unpredictable economic policies create a volatile investment climate. These factors directly impact profitability and increase the risk associated with operating in these emerging markets.

- Examples of countries facing significant economic challenges: Nigeria (currency devaluation), Zimbabwe (hyperinflation), South Sudan (political and economic instability).

- The inherent risks in emerging markets make long-term investment planning difficult, potentially influencing PwC's decision.

Regulatory and Political Risks

Navigating the business environment in Sub-Saharan Africa presents substantial regulatory and political challenges. Bureaucratic hurdles, corruption, and inconsistent enforcement of regulations are major obstacles. Political instability, including civil unrest and changes in government, adds further risk to business operations.

- Examples of regulatory or political risks: Complex tax codes, arbitrary changes in legislation, lack of transparency in government dealings, and potential for asset seizure due to political instability.

- These unpredictable factors contribute to increased operational costs and uncertainty, making the region less attractive for some international firms.

Competition and Market Saturation

The accounting services market in Sub-Saharan Africa is becoming increasingly competitive. Other global accounting firms are expanding their presence, creating intense competition for market share. PwC may have reached a point of market saturation in certain segments, making further expansion less profitable.

- Key competitors operating in Sub-Saharan Africa: Deloitte, Ernst & Young (EY), KPMG.

- While PwC has a strong presence, sustained growth in a saturated market requires significant investment, potentially influencing their strategic decision-making.

Impact of PwC's Exit on Sub-Saharan Africa's Economy

The potential departure of PwC would have far-reaching consequences for Sub-Saharan Africa's economy.

Loss of Expertise and Capacity Building

PwC plays a significant role in training and developing local accounting professionals. Their exit would result in a loss of valuable expertise in auditing, taxation, and advisory services, hindering capacity building initiatives.

- Specific areas where PwC's expertise is crucial: International Financial Reporting Standards (IFRS) compliance, tax optimization strategies, and corporate governance best practices.

- The loss of this expertise will disproportionately impact smaller firms and those lacking the resources to access equivalent training elsewhere.

Effect on Foreign Direct Investment (FDI)

The presence of reputable international accounting firms is a key factor in attracting Foreign Direct Investment (FDI). PwC's departure could decrease investor confidence, leading to a reduction in FDI, thereby hindering economic growth.

- Statistics illustrating the importance of FDI in Sub-Saharan Africa: FDI contributes significantly to infrastructure development, job creation, and technology transfer. A decline in FDI would have cascading negative effects.

- Investors often rely on the due diligence and assurance provided by major accounting firms; PwC's absence could create uncertainty.

Implications for Small and Medium-sized Enterprises (SMEs)

SMEs often rely on affordable and accessible accounting services. PwC's departure could significantly impact their access to professional support, potentially hindering their growth and survival.

- Challenges faced by SMEs in accessing professional accounting services: High costs, limited availability of qualified professionals, and lack of awareness of available resources.

- The loss of affordable services will impact SMEs’ ability to secure funding, comply with regulations, and manage their finances effectively.

Future Outlook and Potential Mitigation Strategies

While PwC's potential exit presents significant challenges, there are potential mitigation strategies.

Role of other Accounting Firms

Other major accounting firms have the potential to expand their operations in Sub-Saharan Africa to fill the gap left by PwC. However, their capacity to scale quickly and effectively remains to be seen. Mergers and acquisitions within the sector are also possibilities.

- Key players in the accounting industry that could expand in the region: Deloitte, EY, KPMG, and potentially smaller regional firms.

- These firms will need to assess the risk-reward balance carefully before significant expansion.

Government Initiatives and Policy Changes

Governments in Sub-Saharan Africa need to create a more attractive business environment to attract and retain international firms. This requires regulatory reforms, anti-corruption measures, and incentives for investment.

- Potential policy changes that could improve the business environment: Simplification of tax codes, improved infrastructure, and a commitment to transparency and accountability.

- Proactive government policies are critical to rebuilding confidence and attracting investment.

Development of Local Accounting Expertise

Investing in education and training for local accounting professionals is essential for building local capacity and reducing reliance on international firms. Universities and professional bodies have a crucial role to play.

- Initiatives to support the growth of local accounting professionals: Scholarships, internships, and partnerships between educational institutions and accounting firms.

- Strengthening local expertise is a long-term solution that will require significant investment and commitment.

Conclusion: Navigating PwC's Potential Exit from Sub-Saharan Africa

PwC's potential withdrawal from Sub-Saharan Africa is driven by economic challenges, regulatory risks, and market dynamics. The consequences for the region's economy are significant, affecting FDI, SME growth, and the development of local expertise. Mitigation strategies require a collaborative effort between governments, other accounting firms, and educational institutions to create a more stable and attractive business environment. Understanding the intricacies of PwC's potential exit from Sub-Saharan Africa requires further analysis. Let's work together to find solutions for a sustainable future for the region's economy.

Featured Posts

-

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025 -

Ftc Appeals Activision Blizzard Deal A Deep Dive Into The Legal Battle

Apr 29, 2025

Ftc Appeals Activision Blizzard Deal A Deep Dive Into The Legal Battle

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets A Braintree And Witham Guide

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets A Braintree And Witham Guide

Apr 29, 2025 -

Private Credit Jobs 5 Key Dos And Don Ts For Applicant Success

Apr 29, 2025

Private Credit Jobs 5 Key Dos And Don Ts For Applicant Success

Apr 29, 2025 -

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025

Pw C Us Partners Ordered To Sever Brokerage Ties Following Internal Probe

Apr 29, 2025

Latest Posts

-

Ru Pauls Drag Race Season 17 Episode 6 Guide Navigating The Fishy Waters

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Guide Navigating The Fishy Waters

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Things Get Fishy A Complete Guide

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Things Get Fishy A Complete Guide

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Preview What To Expect

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Preview What To Expect

Apr 30, 2025 -

Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online Viewing Guide

Apr 30, 2025

Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online Viewing Guide

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 A Fishy Preview And Guide

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 A Fishy Preview And Guide

Apr 30, 2025