The Future Of The Federal Reserve: Trump's Assurance On Powell's Position

Table of Contents

Trump's Past Criticism of Jerome Powell and the Federal Reserve

The Context of the Criticism

Former President Trump's criticism of Jerome Powell and the Federal Reserve stemmed primarily from disagreements over monetary policy, specifically interest rate hikes. Trump consistently argued that Powell's actions were hindering economic growth and harming his chances of re-election. He believed that raising interest rates slowed down the economy unnecessarily.

- Examples of Trump's public statements: Numerous tweets, press conferences, and interviews saw Trump directly criticizing Powell's decisions, often using strong language. He frequently referred to Powell's policies as "crazy" and "incompetent."

- Economic climate during the period of criticism: The US economy experienced a period of robust growth followed by concerns about rising inflation during Trump's presidency. This context fueled the tension between the White House and the Federal Reserve, as Trump prioritized rapid growth, while the Fed focused on maintaining price stability.

- Political pressure on an independent Federal Reserve: Trump's actions highlighted the delicate balance between an independent central bank and political pressure. The Federal Reserve's independence is crucial for maintaining its credibility and effectiveness, however, direct attacks from the President raise questions about this independence.

The Impact of the Criticism on Market Volatility

Trump's public criticism of the Federal Reserve and Jerome Powell directly impacted market volatility. His pronouncements often caused immediate and significant market reactions.

- Examples of market reactions: Stock market indices frequently experienced sharp drops following particularly critical statements from Trump. The bond market also reacted, with yields fluctuating in response to the uncertainty surrounding the Fed's future direction.

- Impact on bond yields and stock prices: Increased uncertainty led to increased volatility in both bond and stock markets, as investors grappled with the implications of the political pressure on the central bank.

- Implications for market stability: Trump's actions underscored the risk of political interference in monetary policy decisions, potentially undermining market confidence and long-term stability.

Assurances (or Lack Thereof) on Powell's Position

Analyzing Trump's Statements

While Trump frequently criticized Powell, he rarely made explicit statements assuring his continued tenure. Any statements that could be interpreted as assurances were often ambiguous and lacked concrete commitment.

- Direct quotes or paraphrases: Finding direct quotes explicitly assuring Powell's position is difficult. Any statements that could be interpreted as such were usually buried within broader criticisms of the Fed's policies.

- Context and intent: The context of Trump's statements suggests that any perceived assurances were conditional on Powell's adopting policies more aligned with the administration's goals.

- True assurances or temporary reprieve?: It's arguable whether Trump's pronouncements ever offered genuine assurances. His criticisms were frequent and intense, suggesting that Powell's position was always tenuous.

The Implications of Powell's Continued Leadership (or Potential Replacement)

Powell's continued leadership, or a potential replacement, carries significant implications for US and global economic policy.

- Potential policy shifts: A new Chair might prioritize different economic goals, potentially leading to shifts in monetary policy, such as different inflation targets or interest rate adjustment strategies.

- Impact on inflation targets and interest rate adjustments: Different leadership could influence the Fed's approach to managing inflation and setting interest rates, potentially impacting economic growth and borrowing costs.

- Effects on international markets and US economic growth: Changes in US monetary policy have ripple effects across global markets, impacting international trade, investment flows, and overall economic stability.

The Broader Impact on the US and Global Economy

Impact on Inflation and Interest Rates

The Federal Reserve's actions directly influence inflation and interest rates. Powell's position (or that of his successor) significantly shapes these key economic indicators.

- Analysis of current inflation levels: Current inflation levels are a key consideration in the Fed's policy decisions. Different approaches to managing inflation could lead to different interest rate adjustments.

- Potential future trajectories: The Fed's choices regarding interest rates directly influence the trajectory of inflation and broader economic growth. Different leadership styles could produce significantly different outcomes.

- Relationship between interest rates, inflation, and economic growth: The Fed aims for a delicate balance, maintaining low inflation while promoting sustainable economic growth. Interest rates are a primary tool for achieving this balance.

Geopolitical Implications

The actions of the Federal Reserve, and the leadership within it, have significant global implications.

- International responses to policy shifts: Changes in US monetary policy can influence exchange rates and capital flows, affecting economies worldwide. International responses vary depending on the nature and extent of these changes.

- Impact on global trade and investment: The Federal Reserve's decisions impact global trade and investment flows, as other countries adjust their own policies in response to US monetary policy changes.

Conclusion

The future of the Federal Reserve, under Chairman Jerome Powell's continued leadership (or a potential successor), remains a pivotal aspect of the US and global economic outlook. Former President Trump's assurances, or lack thereof, regarding Powell's position, have injected uncertainty into an already complex economic landscape. While assessing the long-term implications requires ongoing observation, understanding the history of the criticism and the potential policy shifts is crucial for investors and policymakers alike. Staying informed on developments regarding the Federal Reserve and its monetary policy is paramount for navigating the uncertainties ahead. Continue to monitor news and analyses concerning the Federal Reserve, Jerome Powell’s position, and monetary policy to make informed decisions.

Featured Posts

-

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

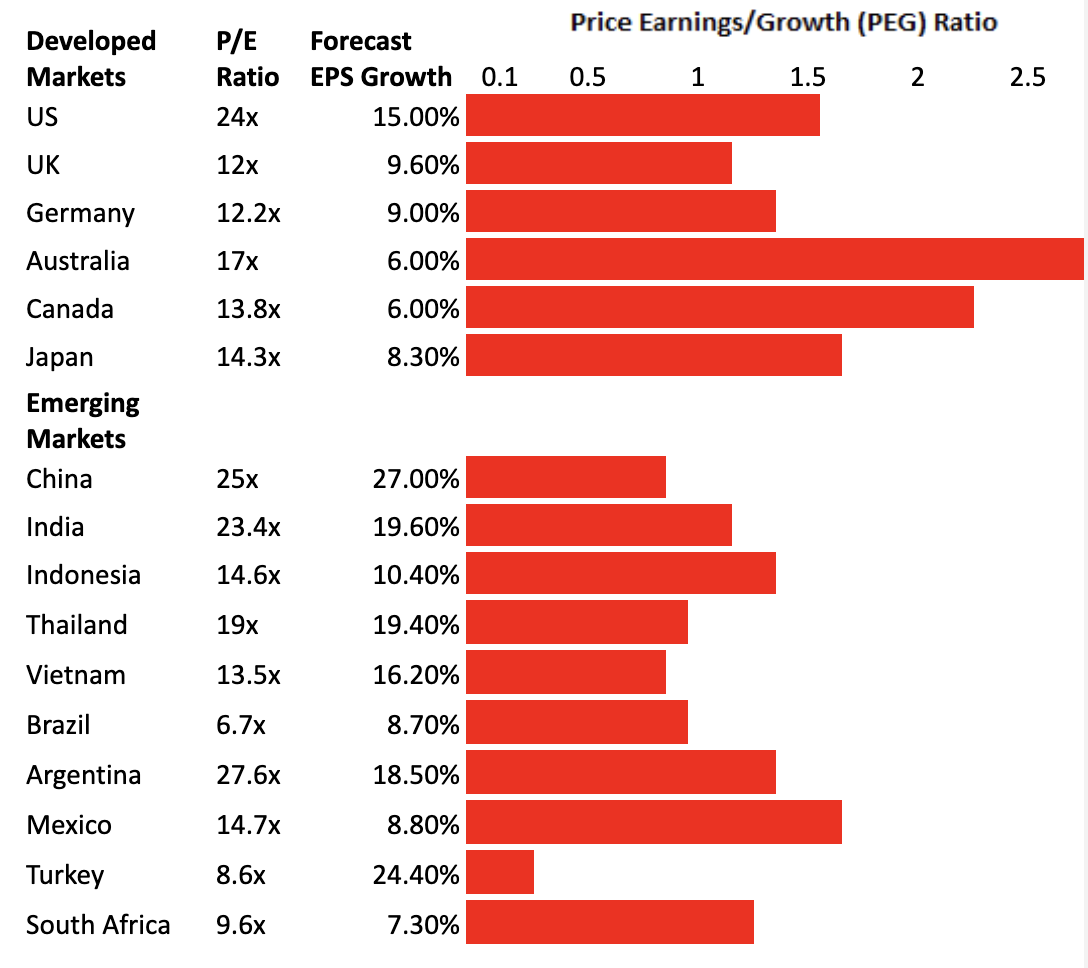

Emerging Market Stock Rally A Contrarian Investment Strategy For 2023

Apr 24, 2025

Emerging Market Stock Rally A Contrarian Investment Strategy For 2023

Apr 24, 2025 -

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025

Rep Nancy Mace Confronted By South Carolina Voter A Heated Exchange

Apr 24, 2025 -

Nbas Investigation Of Ja Morant A Timeline Of Events

Apr 24, 2025

Nbas Investigation Of Ja Morant A Timeline Of Events

Apr 24, 2025 -

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025