Emerging Market Stock Rally: A Contrarian Investment Strategy For 2023?

Table of Contents

The Appeal of Emerging Markets in 2023

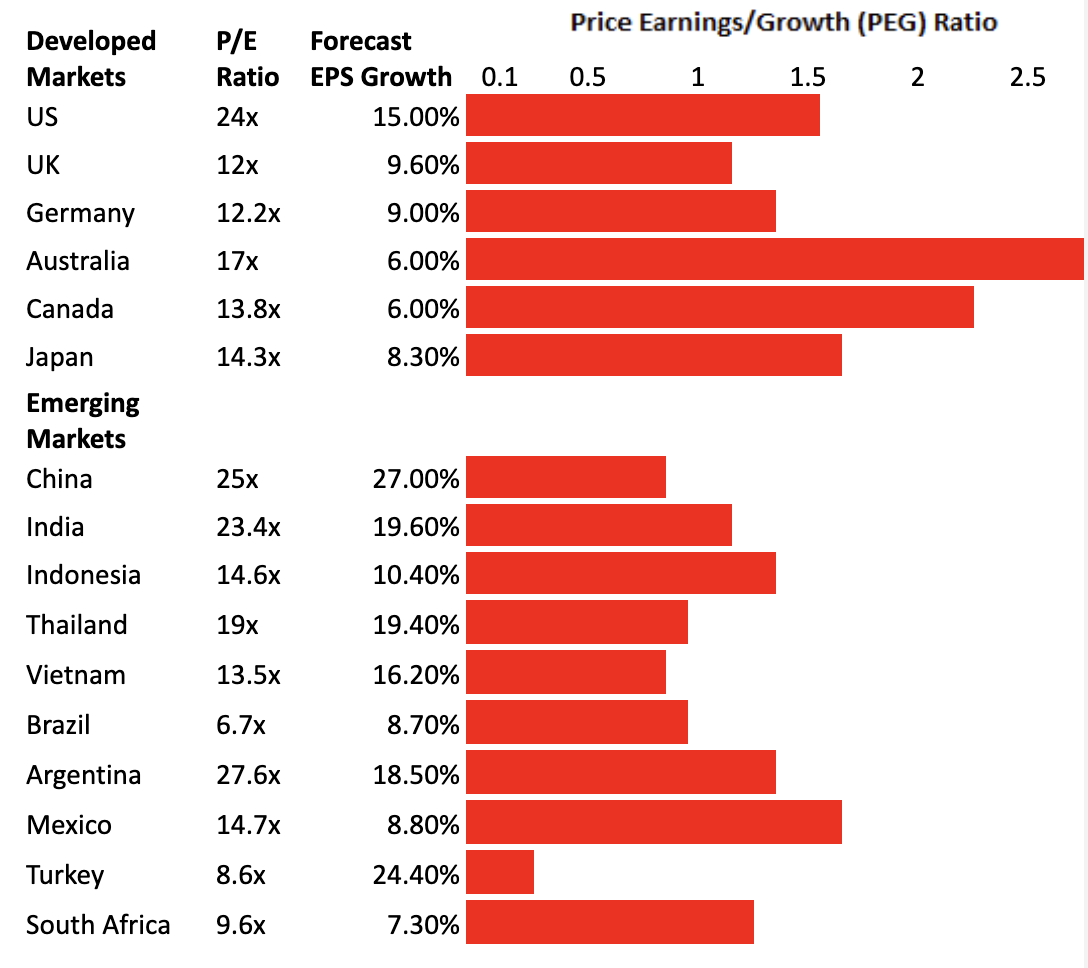

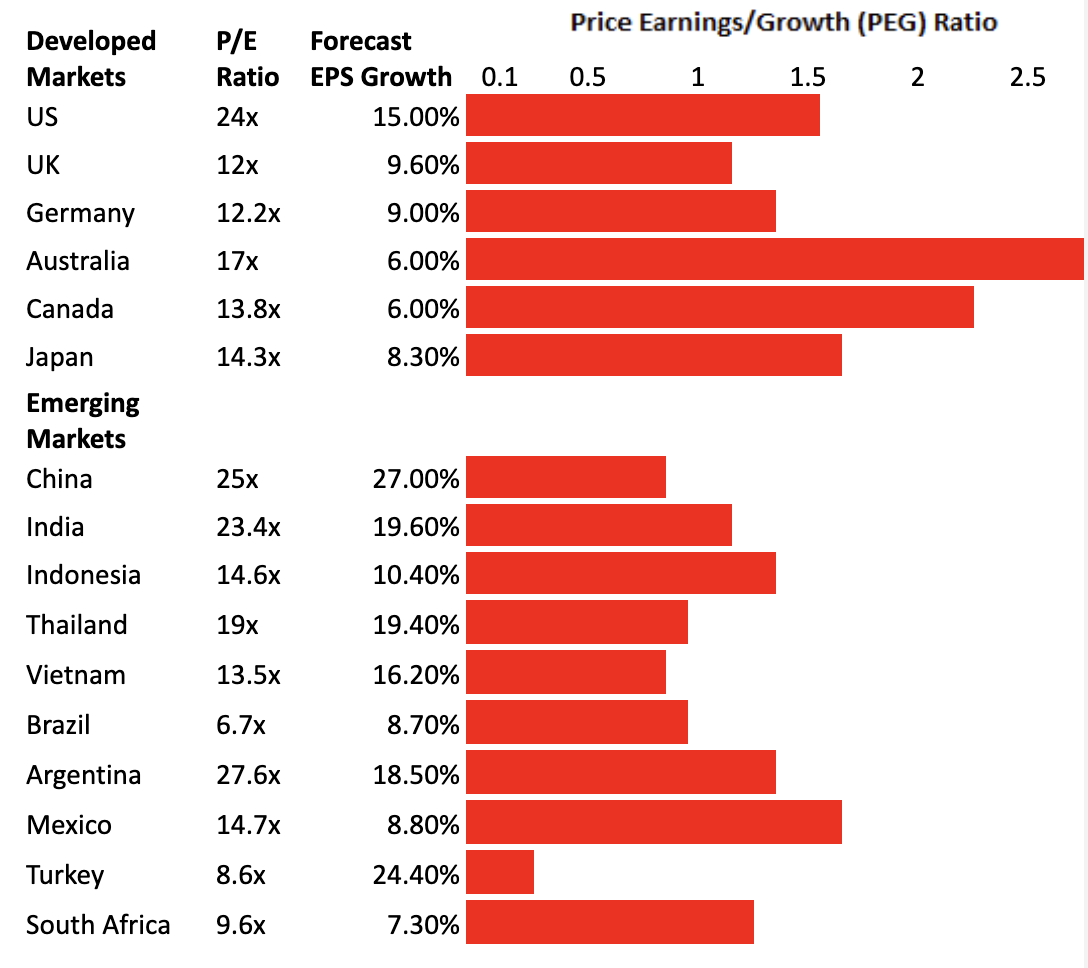

Undervalued Assets and Growth Potential

Many believe emerging markets offer significant potential for higher returns compared to their developed market counterparts. This is primarily due to lower valuations and the promise of robust future growth.

- Faster economic growth projections: Numerous emerging economies are projected to experience significantly faster economic growth than developed nations in the coming years. This growth is fueled by factors like a young and expanding workforce, increasing urbanization, and rising consumer spending.

- Stronger domestic demand: Several key emerging markets are witnessing a surge in domestic demand, creating a robust foundation for sustained economic expansion and corporate profitability. This reduces reliance on volatile global export markets.

- Diversification opportunities: Emerging markets offer diversification benefits beyond traditional investment sectors. Investing in these markets allows investors to reduce overall portfolio risk by adding exposure to companies and industries not typically found in developed markets.

- High-growth sectors: Specific sectors within emerging markets show exceptional promise. For example, the technology sector in India is booming, while infrastructure development across Africa presents significant long-term investment opportunities. Consider the potential of renewable energy development in Latin America or fintech innovations in Southeast Asia.

Contrarian Investing: Going Against the Grain

A contrarian investment strategy in emerging markets involves going against the prevailing market sentiment. Often, during periods of global uncertainty, investors shy away from emerging markets, leading to undervaluation. This presents a unique opportunity for contrarian investors.

- Capitalizing on market sentiment: When global uncertainty hits, emerging markets are often disproportionately impacted, leading to temporary dips. Contrarian investors can use this as an entry point, acquiring assets at discounted prices.

- Long-term gains: Historically, contrarian investors who have patiently held emerging market investments during periods of volatility have often realized significant long-term gains.

- Historical examples: Numerous historical examples demonstrate the success of contrarian emerging market investment strategies. Careful research can reveal periods where such strategies proved remarkably profitable.

- Risk-reward profile: While higher perceived risk exists, the potential for outsized returns can often offset this, making it an attractive proposition for those with a higher risk tolerance.

Navigating the Risks of Emerging Market Investments

Geopolitical Instability and Currency Fluctuations

Investing in emerging markets carries inherent risks, primarily stemming from geopolitical instability and currency fluctuations.

- Political and economic risks: Several emerging market countries face significant political or economic risks, including political instability, corruption, and potential social unrest. These factors can negatively impact investment returns.

- Currency fluctuations: Changes in exchange rates between the investor's home currency and the local currency of the emerging market can significantly influence returns, both positively and negatively.

- Diversification is key: Diversifying investments across multiple emerging markets and asset classes is crucial to mitigate the risk associated with individual country-specific issues.

- Hedging strategies: Employing strategies to hedge against currency risk, such as using currency futures or options, can help protect investment returns from adverse exchange rate movements.

Regulatory and Transparency Concerns

Regulatory frameworks and transparency levels vary significantly across emerging markets. This presents another layer of risk for investors.

- Due diligence is paramount: Thorough due diligence and research are essential before investing in any emerging market. Understand the regulatory environment, corporate governance practices, and the overall business landscape.

- Focus on established companies: Prioritize investments in well-established companies with a proven track record and strong corporate governance.

- Utilize expert advice: Engage reputable financial advisors specializing in emerging markets to leverage their expertise and navigate the complexities of these markets.

- ESG considerations: Increasingly, investors are considering Environmental, Social, and Governance (ESG) factors when assessing risk. This involves evaluating a company’s environmental impact, social responsibility, and corporate governance practices.

Strategies for Investing in an Emerging Market Stock Rally

Diversification: A Cornerstone of Success

Diversification is crucial for mitigating risk and maximizing potential returns in emerging markets.

- ETFs and Mutual Funds: Investing in exchange-traded funds (ETFs) or mutual funds that specialize in emerging markets provides instant diversification across numerous companies and sectors.

- Direct Investment: Direct investment in individual companies requires thorough research and understanding of the specific market dynamics.

- Regional diversification: Diversify across different emerging market regions, such as Latin America, Asia, and Africa, to reduce the impact of regional-specific events.

Long-Term Perspective: Patience and Persistence

A long-term investment horizon is crucial for success in emerging markets. These markets are inherently volatile, and short-term fluctuations are common.

- Understanding volatility: Accept the inherent volatility and avoid making impulsive decisions based on short-term market movements.

- Dollar-cost averaging: Consider using dollar-cost averaging, investing a fixed amount of money at regular intervals, regardless of market conditions.

- Focus on long-term growth: Maintain a focus on the long-term growth potential of the emerging markets, rather than getting bogged down by short-term market noise.

Conclusion

An emerging market stock rally in 2023 presents a compelling, yet potentially risky, opportunity for contrarian investors seeking higher returns. By carefully considering the potential rewards alongside the inherent risks, and employing strategies like diversification and a long-term perspective, investors can potentially capitalize on this exciting market segment. Thorough research, understanding geopolitical factors, and potentially engaging with a financial advisor specializing in emerging markets are crucial steps before embarking on this potentially lucrative, yet volatile, investment strategy. Don't miss out on the potential of an emerging market stock rally – start your research today!

Featured Posts

-

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025

Nba All Star Game Draymond Green Moses Moody And Buddy Hield Participate

Apr 24, 2025 -

Judge Abrego Garcias Stern Warning Stonewalling In Us Lawsuits Ends Now

Apr 24, 2025

Judge Abrego Garcias Stern Warning Stonewalling In Us Lawsuits Ends Now

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 24, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 24, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds And Future Strategies

Apr 24, 2025 -

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025

Draymond Green Moses Moody And Buddy Hield Join The Nba All Star Festivities

Apr 24, 2025