The Future Of Berkshire Hathaway's Apple Stock: A Post-Buffett Analysis

Table of Contents

Succession Planning and Investment Strategy

The succession of leadership at Berkshire Hathaway will significantly impact its investment decisions, particularly regarding its Apple stake. Will the new leadership maintain Buffett's famously long-term hold strategy, or opt for a different approach? The answer will significantly shape the future of Berkshire Hathaway Apple stock.

- Greg Abel's Investment Philosophy: Greg Abel, Buffett's successor, has a proven track record within Berkshire Hathaway. However, his specific investment philosophy regarding large-cap tech stocks like Apple remains to be fully observed. Will he prioritize maintaining the current significant Apple investment, or will he pursue a more diversified portfolio? Analyzing his past decisions and statements will provide crucial clues.

- Past vs. Future Strategies: Comparing past Berkshire Hathaway investment decisions under Buffett with potential future strategies under Abel is critical. Buffett favored long-term, value-oriented investments. Will Abel maintain this approach, or will he embrace a more active or growth-focused strategy? This shift could dramatically impact the Berkshire Hathaway Apple stock position.

- Diversification or Consolidation?: A key question is whether Berkshire Hathaway will maintain its substantial Apple holdings or diversify its portfolio. Reducing the concentration risk associated with such a large position in a single stock might be a priority for the new leadership. Alternatively, they may choose to consolidate their position further, demonstrating unwavering confidence in Apple's future.

- Role of Portfolio Managers: The role of portfolio managers within Berkshire Hathaway will also influence investment decisions. Their expertise and recommendations will likely play a significant part in shaping the future of the Apple investment. Understanding their individual approaches will offer further insight.

Apple's Future Growth and Market Position

Apple's continued success is intrinsically linked to Berkshire Hathaway's investment performance. Analyzing Apple's future prospects provides crucial insight into the potential returns on this massive investment, directly impacting the value of Berkshire Hathaway Apple stock.

- Innovation Pipeline: Apple's ability to consistently innovate and introduce new products and services will be a key determinant of its future growth. Analyzing the company's research and development efforts, along with upcoming product launches, is crucial in assessing its long-term potential.

- Competitive Landscape: The tech market is intensely competitive. Analyzing the competitive threats posed by companies like Samsung, Google, and other emerging players is crucial to understanding Apple's future market share and profitability. This will directly influence the value of Berkshire Hathaway's Apple investment.

- Global Market Expansion: Apple's ability to expand into new global markets and tap into emerging economies is another critical factor. Success in these areas will contribute significantly to increased revenue and stock valuation, strengthening the Berkshire Hathaway Apple stock position.

- Macroeconomic Factors: Global economic conditions, inflation rates, and changes in consumer spending habits can all significantly impact Apple's performance. Understanding these macroeconomic trends is vital for predicting the future value of Berkshire Hathaway's Apple stock.

Market Volatility and its Influence on Berkshire Hathaway's Apple Stock

Market fluctuations and economic downturns can significantly impact the value of any investment, including Berkshire Hathaway's Apple holdings. Understanding these risks is vital for predicting the future of Berkshire Hathaway Apple stock.

- Concentration Risk: Holding such a large position in a single stock inherently carries significant concentration risk. A sharp decline in Apple's stock price could have a disproportionately large impact on Berkshire Hathaway's overall portfolio.

- Historical Market Reactions: Analyzing historical market reactions to economic downturns and their effect on Apple's stock price provides valuable insight into potential future scenarios. This analysis can inform risk management strategies for the Berkshire Hathaway Apple stock.

- Hedging Strategies: Berkshire Hathaway may employ hedging strategies to mitigate the risks associated with its Apple investment. Understanding these strategies is crucial in assessing the resilience of the investment in volatile market conditions.

- Geopolitical Events: Geopolitical events, such as trade wars or global conflicts, can significantly impact Apple's stock price and Berkshire Hathaway's investment. Analyzing these risks is vital for a complete understanding of the future outlook.

Alternative Investment Opportunities

The potential exploration of alternative investment opportunities by Berkshire Hathaway could influence its Apple stock holdings. Will they reduce their Apple holdings to invest in other sectors? This presents a significant consideration for the future of Berkshire Hathaway Apple stock.

- Attractive Sectors: Identifying potential alternative sectors attractive to Berkshire Hathaway, such as renewable energy, healthcare, or infrastructure, provides a clearer picture of potential investment shifts.

- Impact on Apple Holdings: Determining how new investments might impact the Apple stock position is crucial. Will new acquisitions lead to a reduction in Apple holdings to maintain portfolio balance?

- Strategic Implications: Examining the strategic implications of reducing the Apple stake provides crucial insight into the overall investment strategy of Berkshire Hathaway's future leadership.

Conclusion

The future of Berkshire Hathaway's Apple stock is intricately tied to a complex interplay of succession planning, Apple's ongoing performance, market volatility, and the exploration of alternative investment avenues. While the massive investment currently represents a significant portion of Berkshire Hathaway's portfolio, the coming years will reveal the wisdom of the post-Buffett leadership's decisions regarding this crucial holding. To stay informed about the evolving landscape of Berkshire Hathaway Apple stock and its future prospects, continue to follow industry news and expert analyses. Understanding the complexities surrounding Berkshire Hathaway Apple stock is crucial for investors looking to navigate the ever-changing market landscape.

Featured Posts

-

Office365 Data Breach Hacker Accused Of Multi Million Dollar Scheme

May 24, 2025

Office365 Data Breach Hacker Accused Of Multi Million Dollar Scheme

May 24, 2025 -

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025

Evrovidenie 2025 Prognoz Konchity Vurst Na Chetyrekh Pobediteley

May 24, 2025 -

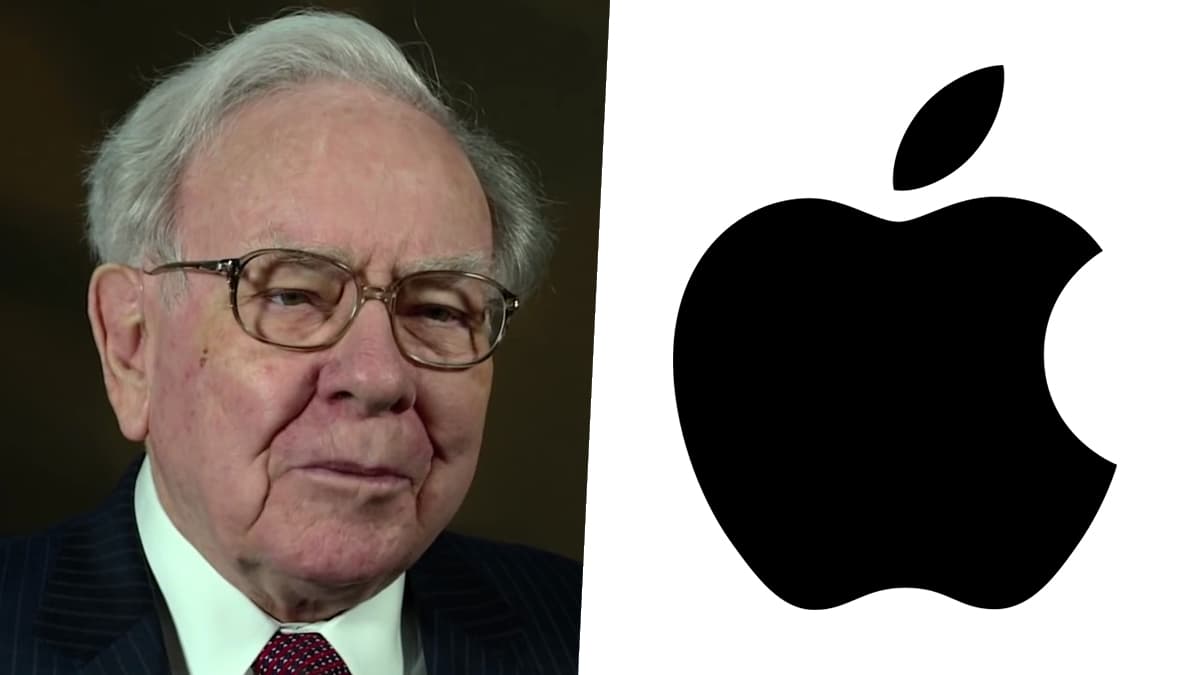

Significant Stock Gains On Euronext Amsterdam 8 After Trumps Tariff Action

May 24, 2025

Significant Stock Gains On Euronext Amsterdam 8 After Trumps Tariff Action

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Analiz Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Analiz Publikatsii V Gazete Trud

May 24, 2025 -

Frankfurt Aktien Dax Faellt Analyse Zum Optionsablauf Am 21 Maerz 2025

May 24, 2025

Frankfurt Aktien Dax Faellt Analyse Zum Optionsablauf Am 21 Maerz 2025

May 24, 2025

Latest Posts

-

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025 -

Babalikta En Zorlu Erkek Burclari Gercekler Ve Beklentiler

May 24, 2025

Babalikta En Zorlu Erkek Burclari Gercekler Ve Beklentiler

May 24, 2025 -

En Cok Yakan Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025

En Cok Yakan Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025 -

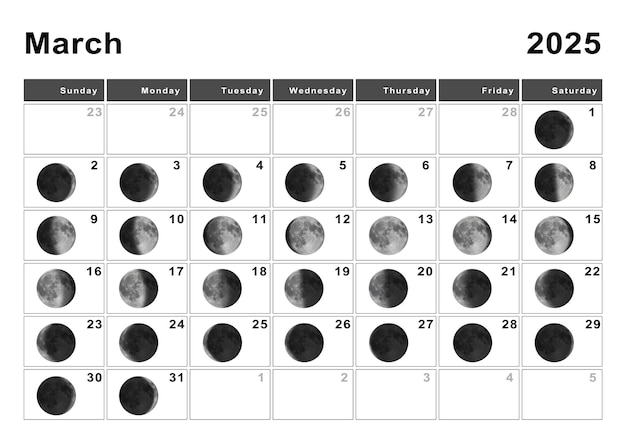

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025 -

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Consulta Tu Signo

May 24, 2025

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Consulta Tu Signo

May 24, 2025