The Financial Risks Of Public Sector Pension Liabilities

Table of Contents

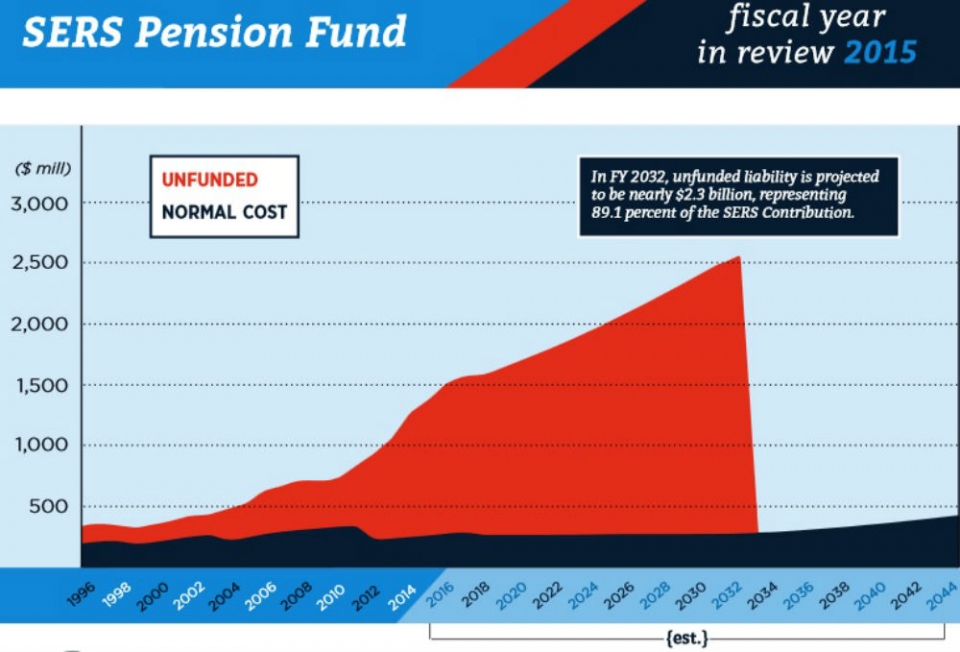

Underfunded Pension Plans: A Looming Crisis

Underfunded pension plans, a common characteristic of many public sector systems, represent a critical financial risk. This occurs when the assets held in a pension fund are insufficient to cover the projected future benefit payments to retirees. The implications of this underfunding are far-reaching and potentially devastating.

- Increased Taxpayer Burden: The shortfall necessitates increased taxation to cover the gap, potentially diverting funds from other essential public services like education and healthcare. This can lead to increased public discontent and political instability.

- Benefit Cuts for Retirees: To address underfunding, governments may be forced to reduce promised benefits to current and future retirees, leading to hardship and social unrest. This can also damage public trust in government institutions.

- Credit Rating Downgrades: The financial strain of substantial unfunded pension liabilities can result in credit rating downgrades for municipalities and national governments, making it more expensive to borrow money and hindering economic development.

Several countries are grappling with severely underfunded public sector pension plans. For instance, some municipalities in the US face billions of dollars in unfunded pension obligations. Similarly, several European nations are wrestling with the long-term financial implications of their pension systems.

Factors contributing to underfunding include:

- Increased Life Expectancy: People are living longer, requiring pension payments for an extended period, increasing the overall liability.

- Lower-than-Expected Investment Returns: Poor investment performance can significantly impact the fund's ability to meet its obligations.

- Unrealistic Benefit Promises: Overly generous pension promises made in the past, without adequate funding mechanisms, contribute significantly to the problem.

- Poor Actuarial Assumptions: Inaccurate predictions about future factors, such as inflation and longevity, can lead to significant underestimation of future liabilities.

Demographic Shifts and Their Impact

The aging population presents a major challenge to the sustainability of public sector pension liabilities. As populations age and the ratio of working-age individuals to retirees declines, the burden on the working population to support retirees increases dramatically.

Data projections from the UN and other organizations consistently point to a rapidly aging global population. This demographic shift will place immense pressure on existing public pension systems, potentially leading to a crisis. The implications are severe:

- Increased Strain on Social Security Systems: Existing social security systems will struggle to meet the demands of a larger and longer-living retiree population.

- Potential for Intergenerational Inequity: Younger generations may bear a disproportionate burden of supporting older generations, creating social and political tension.

- Reduced Government Spending in Other Vital Areas: The need to allocate more resources to pensions may reduce funding for crucial areas like infrastructure, healthcare, and education.

Investment Risk and Market Volatility

The value of assets held in public sector pension funds is susceptible to market fluctuations. Investment strategies play a crucial role in mitigating risk, but even the most diversified portfolios can be affected by unexpected market downturns.

Different investment strategies carry varying levels of risk. High-risk investments, while offering the potential for higher returns, also expose pension funds to greater losses during market downturns. Conversely, low-risk investments may not generate sufficient returns to keep pace with liabilities.

Diversification and prudent investment management are vital for mitigating risks associated with public sector pension liabilities. However, several factors still pose a threat:

- Equity Market Crashes: Major stock market declines can significantly erode the value of pension fund assets.

- Bond Market Fluctuations: Changes in interest rates and creditworthiness can impact the value of bond holdings.

- Inflationary Pressures: Unexpected inflation can erode the purchasing power of pension assets and future payments.

- Geopolitical Instability: Global events can create uncertainty and volatility in financial markets, affecting investment returns.

Managing the Risks: Strategies for Mitigation

Addressing the challenges posed by public sector pension liabilities requires a multi-pronged approach. Several strategies can help mitigate the risks:

- Pension Reforms: Adjusting benefit formulas and increasing contribution rates are crucial steps in enhancing the long-term financial health of pension plans.

- Improved Investment Strategies: Employing sophisticated risk management techniques and diversified investment portfolios can help protect against market volatility.

- Transparency and Accountability: Increased transparency in pension fund management and enhanced accountability mechanisms can build public trust and improve efficiency.

- Increased Public Awareness: Educating the public about the challenges and risks associated with public sector pensions can foster support for necessary reforms.

Conclusion

The financial risks associated with public sector pension liabilities are substantial and far-reaching. Underfunded plans, demographic shifts, and investment risks combine to create a complex and potentially destabilizing situation for governments and taxpayers alike. The urgent need for proactive measures, such as pension reforms and improved investment strategies, cannot be overstated. Failure to address these challenges could lead to significant financial strain, reduced public services, and social unrest. Understanding the financial risks of public sector pension liabilities is crucial for securing a stable economic future. Learn more about the pension plans in your area and become an informed advocate for responsible management and reform.

Featured Posts

-

Us Attorney Generals Transgender Athlete Ban Minnesotas Response

Apr 29, 2025

Us Attorney Generals Transgender Athlete Ban Minnesotas Response

Apr 29, 2025 -

Porsches New Macan Ev Electric Drive Experiences Unveiled

Apr 29, 2025

Porsches New Macan Ev Electric Drive Experiences Unveiled

Apr 29, 2025 -

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025

Immigration Enforcement Raid On Underground Nightclub Results In Numerous Detainees

Apr 29, 2025 -

Is The One Plus 13 R Worth It A Head To Head With The Pixel 9a

Apr 29, 2025

Is The One Plus 13 R Worth It A Head To Head With The Pixel 9a

Apr 29, 2025 -

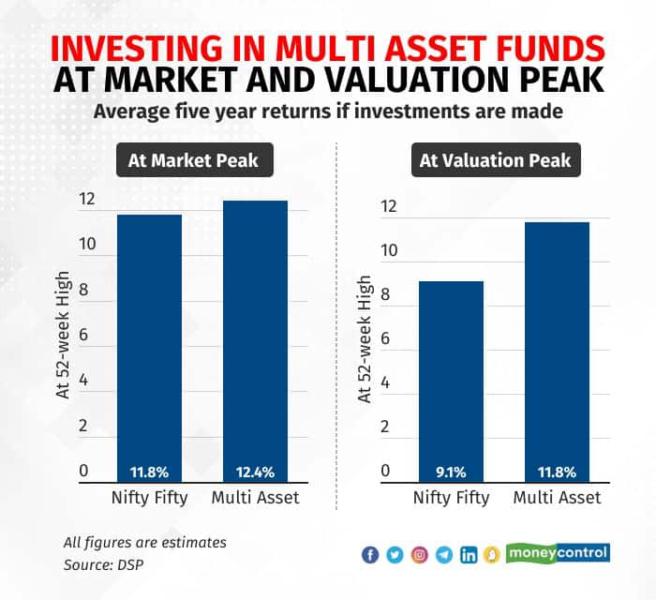

India Fund Manager Dsp Sounds Warning Bell On Equities Boosts Cash Holdings

Apr 29, 2025

India Fund Manager Dsp Sounds Warning Bell On Equities Boosts Cash Holdings

Apr 29, 2025

Latest Posts

-

Watch Ru Pauls Drag Race Season 17 Episode 9 Online Free

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 9 Online Free

Apr 30, 2025 -

Nba Icons Godfather Status To Ru Pauls Drag Race Star Confirmed

Apr 30, 2025

Nba Icons Godfather Status To Ru Pauls Drag Race Star Confirmed

Apr 30, 2025 -

Watch Ru Pauls Drag Race Live 1000th Show Global Livestream From Vegas

Apr 30, 2025

Watch Ru Pauls Drag Race Live 1000th Show Global Livestream From Vegas

Apr 30, 2025 -

Ru Pauls Drag Race Live Las Vegas 1000th Show Global Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live Las Vegas 1000th Show Global Broadcast

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Preview Of The Wicked Challenge

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Preview Of The Wicked Challenge

Apr 30, 2025