India Fund Manager DSP Sounds Warning Bell On Equities, Boosts Cash Holdings

Table of Contents

Reasons Behind DSP's Increased Cash Holdings

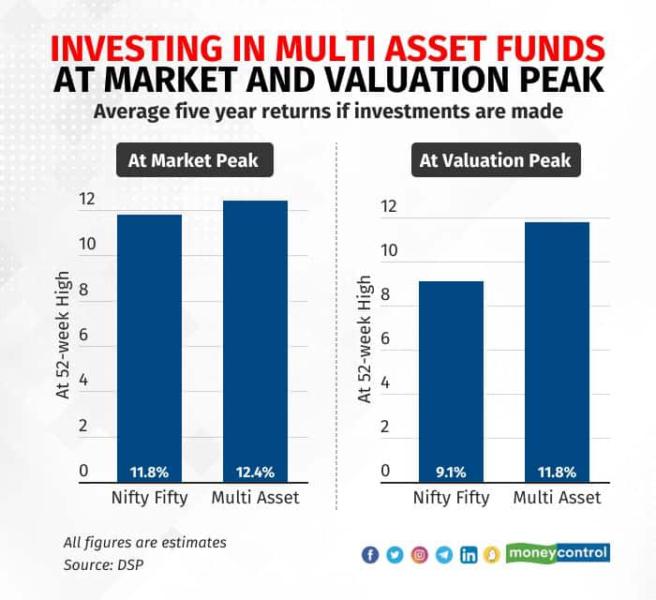

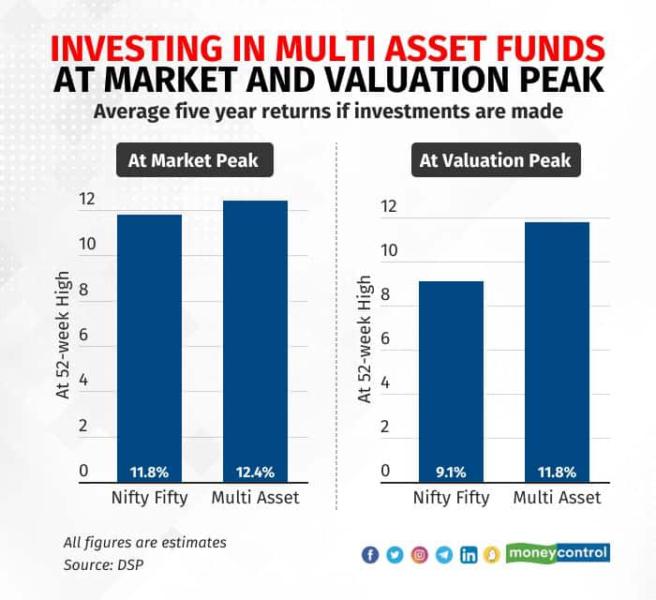

DSP's decision to boost its cash reserves reflects a growing concern regarding several key factors impacting the Indian equity market.

Concerns Regarding Valuation

DSP's apprehension likely stems from perceived overvaluation in certain sectors of the Indian equity market.

- Overvaluation in specific sectors: Certain sectors may be experiencing inflated valuations, creating a potential for a market correction.

- Potential for market correction: High valuations often precede market corrections, leading to potential capital losses for investors heavily invested in equities.

- High PE ratios compared to historical averages: Price-to-earnings (PE) ratios in some sectors may be significantly higher than historical averages, suggesting a potential risk.

- Global economic uncertainties impacting Indian markets: Global factors like inflation and recessionary fears can significantly impact the performance of the Indian equity market.

Macroeconomic Factors

Several macroeconomic headwinds are contributing to DSP's cautious approach.

- Inflationary pressures: Persistent inflationary pressures erode purchasing power and can lead to central bank interventions that impact market performance.

- Rising interest rates: Increased interest rates typically dampen economic growth and can lead to lower equity valuations.

- Geopolitical risks: Global geopolitical instability and conflicts can create uncertainty and volatility in the market.

- Potential slowdown in global growth: A slowdown in global growth can negatively impact export-oriented Indian companies.

- Impact of rupee fluctuation: Fluctuations in the Indian Rupee's exchange rate against major currencies add another layer of risk for investors.

Uncertainty in the Regulatory Landscape

Regulatory changes and uncertainties also play a role in shaping investment decisions.

- Upcoming policy changes: Anticipation of new government policies can create uncertainty and affect investor sentiment.

- Regulatory scrutiny: Increased regulatory scrutiny on certain sectors can impact their performance.

- Potential tax implications for investors: Changes in tax regulations can significantly affect investment returns.

Impact of DSP's Decision on the Market

DSP's decision to increase its cash holdings is not an isolated event and is likely to have a wider impact.

Sentiment Shift

This move could trigger a sentiment shift among other fund managers and investors.

- Potential for a ripple effect among other fund managers: Other fund managers might follow suit, leading to further reduction in equity exposure.

- Impact on investor confidence: The move could erode investor confidence, potentially leading to further market corrections.

- Potential for short-term market volatility: Increased uncertainty can create short-term volatility in the market.

Opportunities for Cautious Investors

While the situation presents challenges, it also offers opportunities for investors with a cautious approach.

- Advantages of holding cash in a volatile market: Cash provides stability and liquidity during periods of market uncertainty.

- Potential for future entry points at lower valuations: Market corrections can create opportunities to buy assets at lower valuations.

- Benefits of diversification: Diversification across asset classes reduces overall portfolio risk.

Alternative Investment Strategies

Given the current market climate, investors might consider alternative investment strategies.

Debt Market Opportunities

The debt market offers a relatively safer alternative to equities.

- Higher yields in fixed-income instruments: Debt instruments often provide higher yields compared to cash deposits, offering better returns.

- Lower risk compared to equities: Debt investments typically carry lower risk compared to equities, offering greater stability.

- Diversification benefits: Including debt instruments in a portfolio enhances diversification.

Other Asset Classes

Diversification beyond equities and debt is crucial for risk management.

- Real estate: Real estate can provide long-term capital appreciation and rental income.

- Gold: Gold acts as a safe haven asset during times of economic uncertainty.

- International diversification: Investing in international markets reduces reliance on a single economy.

Conclusion: Navigating the Indian Equity Market with Caution

DSP Mutual Fund's decision to increase its cash holdings and reduce equity exposure reflects legitimate concerns about valuations, macroeconomic factors, and regulatory uncertainties in the Indian equity market. This move, signifying "India Fund Manager DSP Sounds Warning Bell on Equities, Boosts Cash Holdings," serves as a significant indicator for investors to exercise caution. The potential impact on investor sentiment and market behavior underscores the importance of a well-diversified portfolio and a thorough understanding of current market conditions. Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor to develop a strategy aligned with your risk tolerance and financial goals. Further research into Indian market analysis, portfolio diversification strategies, and risk management in investment is strongly recommended.

Featured Posts

-

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025

From Hollywood To The Pitch Ryan Reynolds And Wrexhams Success

Apr 29, 2025 -

The Legacy Of Murder An Ohio Doctors Parole Hearing And A Sons Journey

Apr 29, 2025

The Legacy Of Murder An Ohio Doctors Parole Hearing And A Sons Journey

Apr 29, 2025 -

Minnesota Faces Attorney Generals Demand Compliance With Trumps Transgender Sports Ban

Apr 29, 2025

Minnesota Faces Attorney Generals Demand Compliance With Trumps Transgender Sports Ban

Apr 29, 2025 -

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025 -

University Shooting In North Carolina Leaves Seven Victims

Apr 29, 2025

University Shooting In North Carolina Leaves Seven Victims

Apr 29, 2025

Latest Posts

-

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

Apr 29, 2025 -

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025

Months Long Lingering Of Toxic Chemicals From Ohio Train Derailment In Buildings

Apr 29, 2025 -

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025

Data Breach Costs T Mobile 16 Million Details Of The Security Lapses

Apr 29, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025

16 Million Fine For T Mobile A Three Year Data Breach Timeline

Apr 29, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 29, 2025