The Fed's Cautious Stance: Examining Reasons For Delayed Rate Cuts

Table of Contents

Persistent Inflation as a Primary Obstacle

The primary obstacle preventing immediate Federal Reserve rate cuts is persistent inflation. Despite efforts to cool the economy, inflationary pressures remain stubbornly high. This makes the Fed hesitant to stimulate the economy further, fearing a resurgence of inflation.

Sticky Inflationary Pressures

Core inflation, which excludes volatile food and energy prices, remains significantly above the Fed's target rate of 2%. This persistence signals a deeper-seated inflationary problem that requires more than just a temporary reduction in interest rates to solve.

- Rising housing costs: Rent and home prices continue to climb, representing a significant portion of consumer spending.

- Wage growth: While a positive sign for workers, robust wage growth can fuel inflationary pressures if not balanced by productivity increases.

- Supply chain disruptions: lingering supply chain issues contribute to higher prices for goods and services.

These persistent inflationary pressures directly influence the Fed's decision-making. Cutting rates too soon risks reigniting inflation, undoing the progress made in curbing price increases and potentially leading to a more challenging and prolonged fight against inflation later.

The Risk of Premature Rate Cuts

The potential downsides of prematurely cutting rates are considerable. Acting too hastily could reignite inflation, potentially leading to a more aggressive tightening cycle later on – a scenario the Fed is keen to avoid.

- Higher inflation: Stimulating the economy through rate cuts while inflation remains high could push prices even higher.

- Economic instability: Unpredictable shifts in monetary policy can create instability in the markets, impacting investor confidence and potentially harming economic growth.

- Erosion of credibility: Erratic rate decisions can undermine the Fed's credibility and make it harder to manage expectations in the future.

The Fed needs to carefully navigate a delicate balance: stimulating enough growth to avoid a recession without fueling inflation further. This balancing act explains much of their cautious approach and the subsequent delay in rate cuts.

Uncertainty in the Economic Outlook

Adding to the complexity, the Fed faces significant uncertainty in the economic outlook. Contradictory data makes it difficult to accurately assess the state of the economy and the effectiveness of potential policy adjustments.

Mixed Economic Signals

The current economic landscape offers a mixed bag of indicators. While employment remains relatively strong, consumer spending is showing signs of softening, and GDP growth has been slower than predicted.

- Strong labor market: Low unemployment rates suggest strong economic activity.

- Weakening consumer spending: Decreasing consumer confidence and reduced retail sales signal potential future economic weakness.

- Slowing GDP growth: Recent GDP figures suggest a slowdown in overall economic growth.

This conflicting data makes it exceedingly challenging for the Fed to predict how rate cuts would affect the economy. A premature easing of monetary policy in the face of such uncertainty could be counterproductive.

Geopolitical Risks and Global Economic Slowdown

External factors add further layers of complexity. The ongoing war in Ukraine, persistent supply chain disruptions, and a potential global economic slowdown are creating significant uncertainties.

- War in Ukraine: The conflict continues to disrupt global energy markets and supply chains, contributing to inflation.

- Global supply chain disruptions: Ongoing bottlenecks in global supply chains continue to limit the availability of goods and impact prices.

- Global economic slowdown: Slowing growth in other major economies can impact the US economy through reduced exports and decreased demand.

These geopolitical risks and the global economic slowdown further influence the Fed's risk assessment and contribute to their reluctance to cut interest rates prematurely.

The Importance of Maintaining Credibility and Market Stability

Beyond economic factors, the Fed is acutely aware of the importance of managing market expectations and maintaining credibility to foster stability. Sudden or unexpected rate changes can cause significant market volatility.

Managing Market Expectations

The Fed's actions profoundly influence market expectations. Unpredictable rate changes can lead to abrupt market shifts, causing investor uncertainty and potentially triggering destabilizing events.

- Market shocks: Unexpected rate cuts could cause sudden market volatility, potentially harming investor confidence.

- Investor uncertainty: Inconsistent monetary policy signals can lead to uncertainty and hesitation in investment decisions.

- Increased risk premium: Volatility increases the risk premium, making borrowing more expensive and potentially hindering investment.

Therefore, the Fed prioritizes clear communication and transparent decision-making to guide market expectations and mitigate potential disruptions.

Long-Term Inflation Expectations

The Fed's actions also shape long-term inflation expectations. Anchoring these expectations at the desired level is crucial for sustained economic health and price stability.

- Communication and transparency: Clear communication about the Fed's goals and strategy can help anchor long-term inflation expectations.

- Credibility: The Fed's actions must align with its stated goals to maintain credibility and influence market expectations effectively.

- Economic stability: Well-anchored inflation expectations contribute to greater economic stability and predictability.

Controlling long-term inflation expectations is paramount for the Fed. Premature rate cuts risk destabilizing these expectations and potentially fueling future inflation.

Conclusion

The Fed's cautious stance on delayed rate cuts stems from a complex interplay of factors. Persistent inflation, uncertainty regarding the economic outlook, and the crucial need to maintain market stability and credibility all contribute to their current approach. The delicate balance between controlling inflation and stimulating economic growth requires careful consideration of numerous intertwined variables.

Key Takeaways: The complexities highlighted underscore the challenges involved in navigating the current economic climate and the importance of the Fed's measured approach. Monetary policy decisions are far from simple, requiring careful analysis of a wide range of economic indicators and potential risks.

Call to Action: Understanding the Fed's cautious stance on delayed rate cuts requires ongoing monitoring of economic data and central bank communications. To deepen your understanding, explore resources like the Federal Reserve's website and reputable financial news outlets. Staying informed about the factors contributing to delayed rate cuts is crucial for navigating the current economic environment and making informed financial decisions.

Featured Posts

-

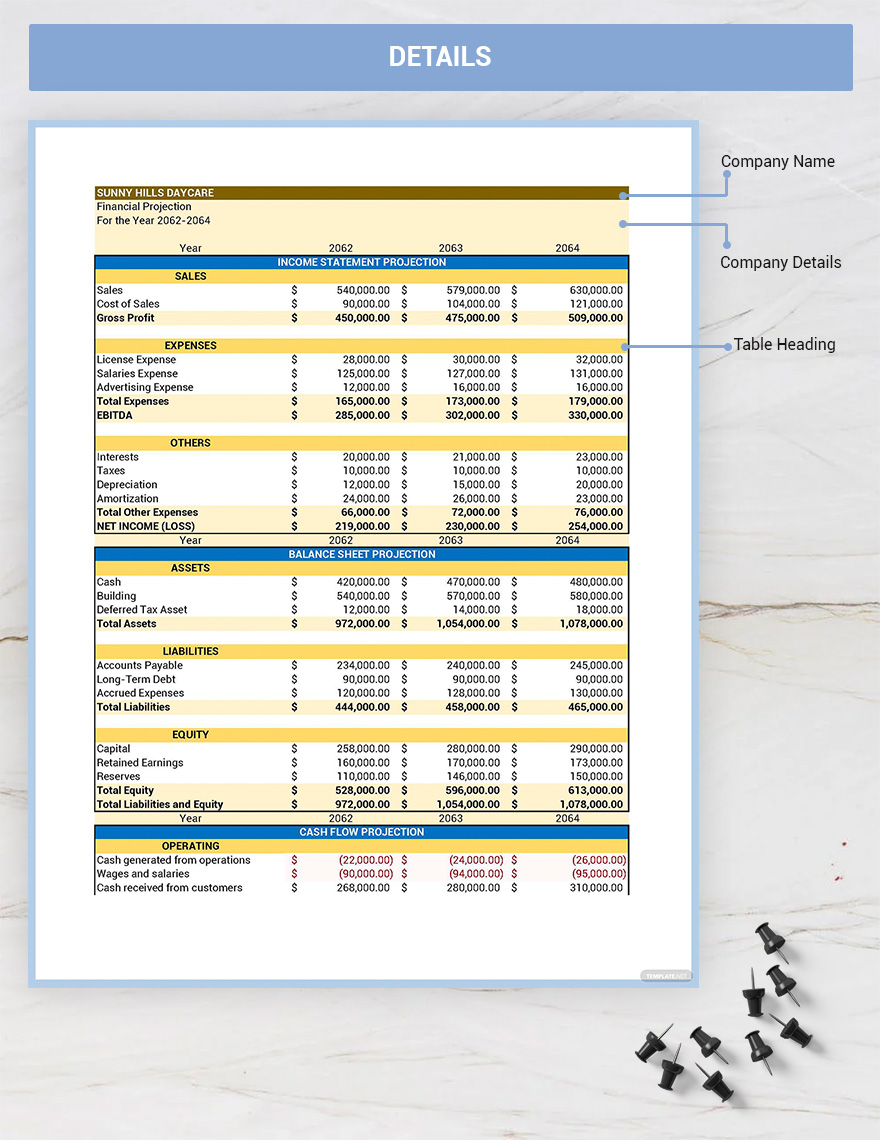

3 000 On Babysitting 3 600 On Daycare A Financial Nightmare For One Father

May 09, 2025

3 000 On Babysitting 3 600 On Daycare A Financial Nightmare For One Father

May 09, 2025 -

Psx Portal Offline Market Volatility And Geopolitical Risks

May 09, 2025

Psx Portal Offline Market Volatility And Geopolitical Risks

May 09, 2025 -

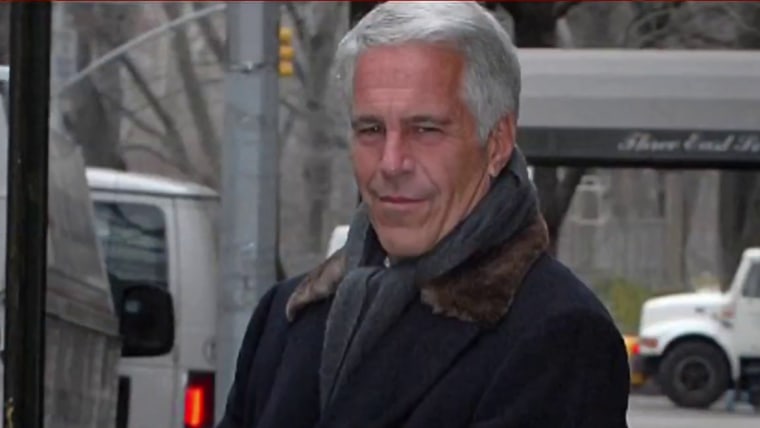

Ag Pam Bondis Decision Should The Jeffrey Epstein Files Be Released A Voters Guide

May 09, 2025

Ag Pam Bondis Decision Should The Jeffrey Epstein Files Be Released A Voters Guide

May 09, 2025 -

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025 -

Expected Announcement Trump And Britain Finalize Major Trade Deal

May 09, 2025

Expected Announcement Trump And Britain Finalize Major Trade Deal

May 09, 2025