PSX Portal Offline: Market Volatility And Geopolitical Risks

Table of Contents

The recent temporary unavailability of the PSX portal served as a stark reminder of the vulnerabilities facing Pakistan's stock market. The phrase "PSX Portal Offline" instantly triggers concern among investors, highlighting the crucial role of a stable and accessible online platform for the functioning of the Pakistan Stock Exchange (PSX). This disruption underscores the broader issue of market volatility and the impact of geopolitical risks on the Pakistani economy. This article will delve into the factors contributing to PSX portal offline instances, exploring the technical issues, market volatility, and geopolitical risks that influence the PSX's performance and investor confidence. We will examine how these factors interrelate and discuss potential strategies for mitigation.

2. Main Points:

2.1. Technical Issues Contributing to PSX Portal Offline Periods:

2.1.1 System Failures and Maintenance: Unexpected system failures and even scheduled maintenance can lead to the dreaded "PSX portal offline" status. Server outages, software glitches, and database errors are all potential culprits.

- Example 1: In [Month, Year], a reported server malfunction caused a [duration] disruption to PSX trading activities.

- Example 2: Scheduled maintenance in [Month, Year] resulted in a [duration] period of limited accessibility to the PSX portal.

A robust IT infrastructure is paramount. Redundancy in systems, regular backups, and disaster recovery plans are crucial to minimizing downtime and ensuring business continuity. Furthermore, robust cybersecurity measures are essential to prevent malicious attacks that could compromise the PSX portal's availability and security. Investing in advanced threat detection and prevention systems is vital for maintaining the integrity of the platform.

2.1.2 Network Connectivity Problems: Pakistan's internet infrastructure, while improving, still faces challenges. Power outages, bandwidth limitations, and issues with internet service providers (ISPs) can all contribute to PSX portal inaccessibility.

- Frequent power cuts in certain regions can disrupt trading activities, impacting investor access to real-time data and trading opportunities.

- Limited bandwidth, particularly during peak trading hours, can lead to slow loading times and even complete outages for some users.

- Reliability issues with ISPs can further exacerbate the problem, leaving investors unable to connect to the PSX portal.

Addressing these issues requires a multi-pronged approach, including investments in improved network infrastructure, backup power systems, and enhanced ISP reliability. Improved network resilience is critical for mitigating future instances of "PSX portal offline" due to connectivity issues.

2.2. Market Volatility and its Impact on the PSX:

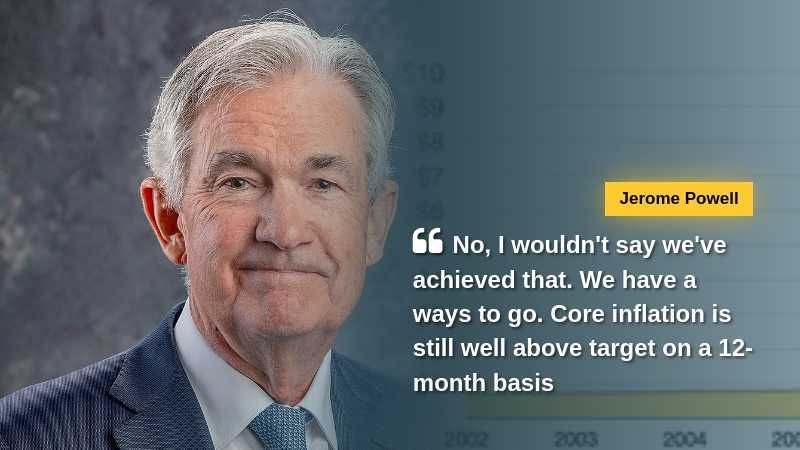

2.2.1 Global Economic Factors: The PSX is not immune to global economic shocks. International events, such as inflation, interest rate hikes by major central banks, and global recessionary fears, significantly influence investor sentiment and market performance.

- Rising inflation in developed economies can lead to capital flight from emerging markets like Pakistan, impacting the PSX.

- Increased interest rates globally can make borrowing more expensive, reducing investment in Pakistan's stock market.

- Global market downturns can trigger a "contagion effect," leading to declines in the PSX even if Pakistan's economy is relatively stable.

Understanding these global correlations is crucial for investors navigating the PSX. Staying informed about international economic trends and their potential impact on the Pakistani economy is vital for risk management.

2.2.2 Domestic Economic Factors: Internal economic indicators play a significant role in PSX volatility. Inflation, currency fluctuations, political stability, and government policies all affect investor confidence.

- High inflation erodes purchasing power and reduces investor confidence.

- A weakening Pakistani Rupee makes foreign investments less attractive.

- Political instability and uncertainty create a risk-averse environment, impacting investment decisions.

- Transparent and predictable economic policies are essential for attracting both domestic and foreign investment.

Strong macroeconomic fundamentals are essential for a stable and thriving PSX. Sound fiscal and monetary policies are vital for mitigating market volatility caused by internal economic factors.

2.3. Geopolitical Risks and their Influence on the PSX:

2.3.1 Regional Instability: Geopolitical tensions in the region directly impact investor sentiment towards the PSX. Regional conflicts and security concerns can lead to capital flight and reduced foreign investment.

- Escalating tensions with neighboring countries can create uncertainty, discouraging both domestic and international investors.

- Terrorist attacks or security threats can negatively impact investor confidence and lead to market declines.

- Geopolitical uncertainty often results in reduced trading volumes as investors adopt a "wait-and-see" approach.

Effective risk management strategies are necessary for navigating these challenging geopolitical environments. A clear understanding of regional risks and their potential impact on the PSX is crucial for investors.

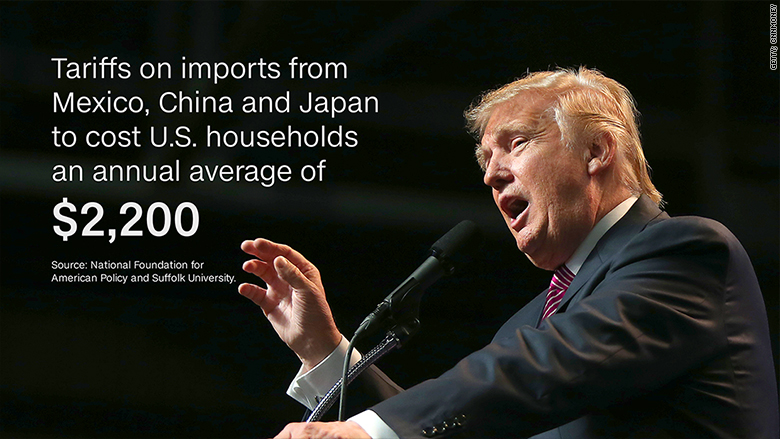

2.3.2 International Relations: Pakistan's relationships with other countries significantly influence its stock market. International sanctions, trade disputes, and changes in global alliances can all impact the PSX.

- Imposition of sanctions can severely restrict access to international capital markets, negatively affecting the PSX.

- Trade disputes with major trading partners can disrupt economic activity and investor confidence.

- Positive international relations, on the other hand, can attract foreign investment and boost market performance.

Maintaining stable and constructive international relations is vital for the long-term health and stability of the PSX. A positive international environment fosters economic growth and investor confidence.

3. Conclusion: Navigating the Challenges of PSX Portal Offline and Market Volatility

The PSX faces a complex interplay of challenges: technical vulnerabilities leading to "PSX portal offline" situations, economic volatility stemming from both global and domestic factors, and the ever-present influence of geopolitical risks. Addressing these challenges requires a multi-faceted approach encompassing improvements to IT infrastructure, robust cybersecurity measures, sound macroeconomic policies, and proactive management of geopolitical risks. Investors need to remain informed about market developments, understand these interconnected factors, and diversify their investment portfolios to mitigate risks. Consulting with qualified financial professionals for personalized investment advice is crucial. By acknowledging and addressing the potential for "PSX portal offline" issues, "PSX market volatility," and "Pakistan Stock Exchange instability," investors can develop robust risk management strategies to navigate the complexities of Pakistan's stock market and potentially capitalize on long-term growth opportunities.

Featured Posts

-

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh On Decision

May 09, 2025

U S Federal Reserve Maintains Rates Inflation Unemployment Weigh On Decision

May 09, 2025 -

Large Scale Anti Trump Protest Rocks Anchorage For Second Time This Month

May 09, 2025

Large Scale Anti Trump Protest Rocks Anchorage For Second Time This Month

May 09, 2025 -

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025

Nyt Strands Hints And Answers Wednesday March 12 Game 374

May 09, 2025 -

Oilers Vs Kings Prediction Game 1 Playoffs Picks And Odds

May 09, 2025

Oilers Vs Kings Prediction Game 1 Playoffs Picks And Odds

May 09, 2025 -

Rio Ferdinands Revised Champions League Final Prediction Arsenal Or Psg

May 09, 2025

Rio Ferdinands Revised Champions League Final Prediction Arsenal Or Psg

May 09, 2025

Latest Posts

-

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025 -

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025

Us Tariffs French Minister Pushes For Stronger Eu Countermeasures

May 09, 2025 -

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025

Further Eu Action Needed On Us Tariffs French Ministers Statement

May 09, 2025 -

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Robust Eu Action Against Us Tariffs

May 09, 2025 -

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025

French Minister Advocates For Collaborative Nuclear Defense In Europe

May 09, 2025