The Fed's Cautious Approach: Why Powell's Delaying Interest Rate Cuts Despite Trump's Urging

Table of Contents

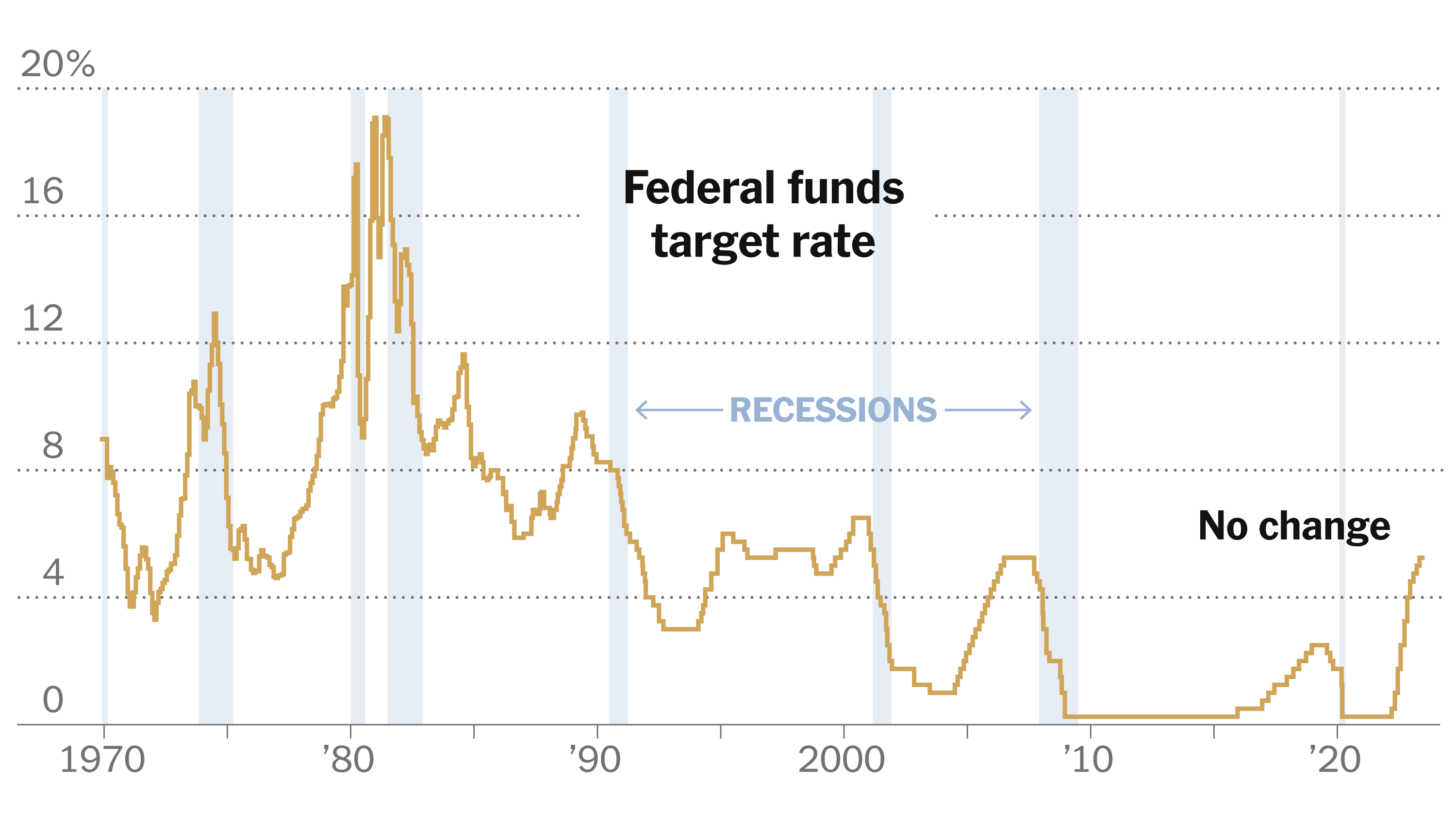

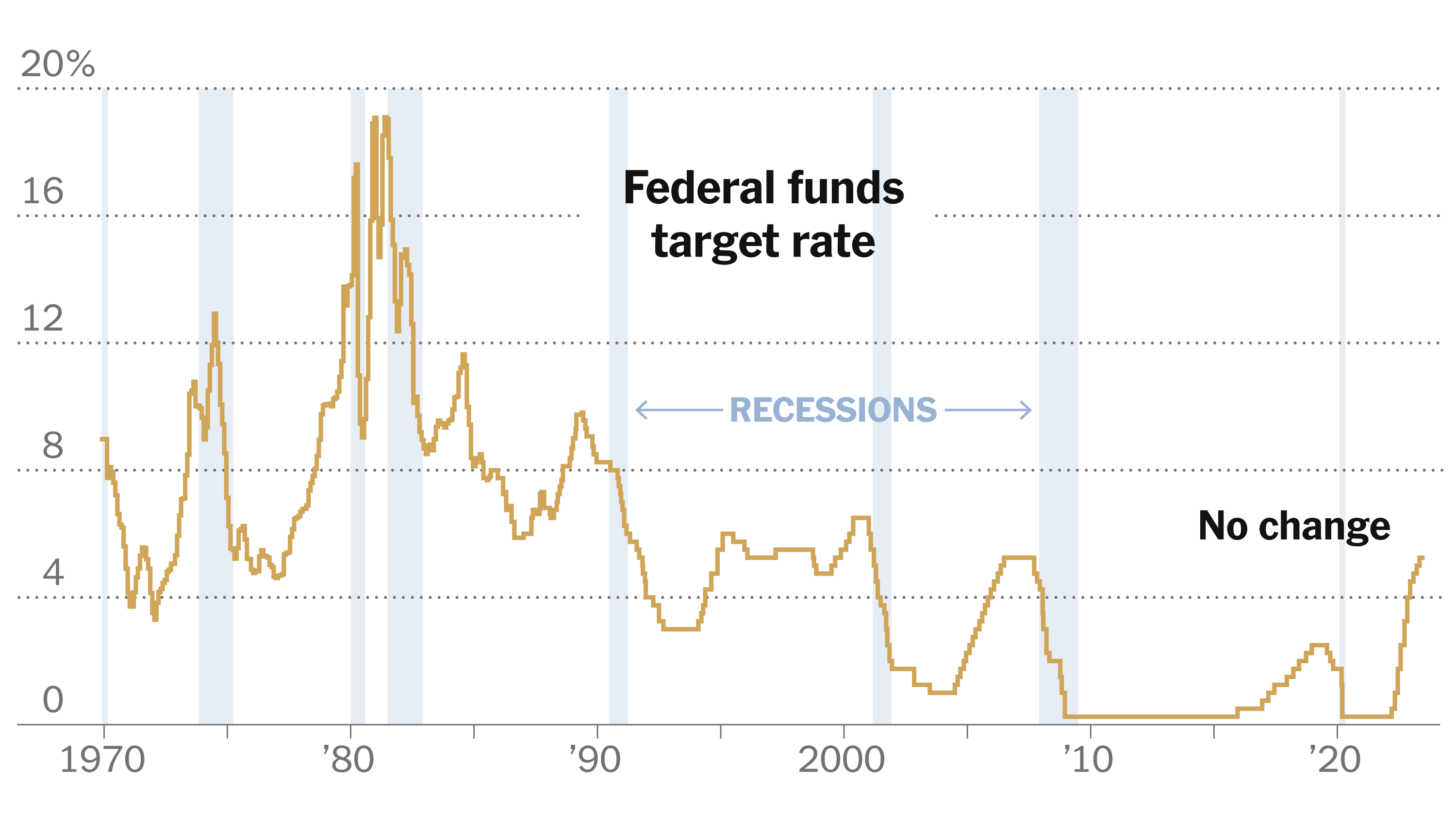

Inflation Concerns: A Key Factor in the Fed's Decision

The Fed's primary mandate is to maintain price stability and full employment. While the current inflation rate hovers near the Fed's 2% target, there are concerns about underlying inflationary pressures. Premature interest rate cuts, even in response to President Trump's urging, risk reigniting inflation. Lowering interest rates too aggressively could inject excessive liquidity into the economy, potentially leading to:

- Increased consumer prices: More money chasing the same goods and services will push prices upward, eroding purchasing power.

- Impact on purchasing power: Rising inflation diminishes the value of consumers' savings and reduces their real income.

- Potential for wage-price spiral: If inflation rises significantly, workers may demand higher wages to keep up, leading to a self-perpetuating cycle of rising prices and wages. This inflationary pressure necessitates a careful approach to monetary policy.

The Fed meticulously monitors various inflationary indicators, including the Consumer Price Index (CPI) and Producer Price Index (PPI), to gauge the true extent of inflationary pressure and maintain price stability. Any decision regarding interest rate cuts must consider the potential consequences for price stability and the long-term health of the US economy.

Assessing the Strength of the US Economy: Beyond Surface-Level Indicators

Evaluating the health of the US economy is far more nuanced than simply looking at GDP growth figures. The Fed considers a wide array of economic indicators to paint a comprehensive picture. While GDP growth provides a snapshot of overall economic output, the Fed also scrutinizes:

- Unemployment rate: While unemployment is currently low, the Fed also analyzes the quality of jobs created and the participation rate to get a full picture of the labor market.

- Consumer confidence: Consumer spending is a significant driver of economic growth, so consumer sentiment is a crucial indicator.

- Investment levels: Business investment plays a vital role in future economic expansion. A decline in investment could signal weakening growth prospects.

Analyzing these economic indicators reveals a more intricate story than headline figures alone. For example, while job growth figures may appear strong, a closer look might reveal a disproportionate number of low-paying jobs, impacting overall economic health and potentially undermining the effectiveness of a rate cut. The Fed's approach prioritizes a thorough, data-driven assessment of the economic outlook.

Geopolitical Uncertainty and Global Economic Slowdown: External Pressures on the Fed

The US economy is deeply intertwined with the global financial system. Geopolitical events, such as trade wars and Brexit, introduce significant uncertainty and can impact the Fed's monetary policy decisions. These external pressures necessitate a cautious approach:

- Impact of trade tensions on supply chains: Trade disputes disrupt global supply chains, potentially leading to higher prices and reduced economic activity.

- The influence of global uncertainty on investment decisions: Businesses are hesitant to invest in uncertain times, leading to slower economic growth.

- The role of the US dollar as a reserve currency: The strength of the dollar affects global trade and capital flows, adding another layer of complexity to the Fed's considerations.

The global economic slowdown, exacerbated by trade wars and other geopolitical risks, requires the Fed to carefully consider the potential spillover effects on the US economy before implementing interest rate cuts. A premature cut could weaken the dollar and exacerbate global instability.

The Importance of Maintaining Credibility and Independence

The Fed's independence from political pressure is paramount to its effectiveness in managing the US economy. Bowing to political pressure, especially when making decisions around interest rate cuts, would severely undermine its credibility and long-term effectiveness. The potential consequences include:

- Long-term damage to the Fed's reputation: The Fed’s credibility is built on its ability to make objective, data-driven decisions, free from political influence.

- Risk of undermining its credibility in managing the economy: Political interference could lead to erratic monetary policy, eroding confidence in the Fed's ability to manage the economy.

- Potential for erratic monetary policy: A politically influenced Fed could engage in unpredictable monetary policy, leading to instability and uncertainty in the financial markets.

Maintaining central bank independence is crucial for sound monetary policy and the long-term health of the US economy. The Fed's commitment to its mandate, rather than reacting to political pressures around interest rate cuts, underpins its effectiveness and ensures its continued credibility.

Conclusion: Navigating the Cautious Path of Interest Rate Policy

The Fed's cautious approach to interest rate cuts stems from a careful consideration of inflation concerns, a comprehensive assessment of the US economy's health, awareness of geopolitical uncertainty, and a commitment to maintaining its independence. Balancing the need for economic growth with the risk of fueling inflation is a delicate act, requiring a nuanced understanding of multiple economic factors. Understanding the Fed's cautious approach to interest rate cuts is critical for investors and policymakers alike. Stay informed about the latest economic data and Fed announcements to make informed decisions about your investments and financial planning.

Featured Posts

-

Ldc Future Forum Minister Tavios Attendance Announced Via Apo Group Press Release

May 07, 2025

Ldc Future Forum Minister Tavios Attendance Announced Via Apo Group Press Release

May 07, 2025 -

Fan Question For Donovan Mitchell On Talking Heads With Ashley Holder

May 07, 2025

Fan Question For Donovan Mitchell On Talking Heads With Ashley Holder

May 07, 2025 -

All Star Game 2024 Steph Currys Victory Overshadows Format Debate

May 07, 2025

All Star Game 2024 Steph Currys Victory Overshadows Format Debate

May 07, 2025 -

Anthony Edwards Alleged Texts To Ayesha Howard Spark Controversy

May 07, 2025

Anthony Edwards Alleged Texts To Ayesha Howard Spark Controversy

May 07, 2025 -

Analysis The Carney Trump Encounter At The White House

May 07, 2025

Analysis The Carney Trump Encounter At The White House

May 07, 2025

Latest Posts

-

Epic Crypto Stories From Humble Beginnings To Billion Dollar Empires

May 08, 2025

Epic Crypto Stories From Humble Beginnings To Billion Dollar Empires

May 08, 2025 -

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025

Top Crypto Narratives Inspiring Tales Of Success And Failure

May 08, 2025 -

The Greatest Crypto Stories Of All Time

May 08, 2025

The Greatest Crypto Stories Of All Time

May 08, 2025 -

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025

New Superman Sneak Peek Kryptos Unexpected Attack

May 08, 2025 -

These Are The Best Crypto Stories Ever Told

May 08, 2025

These Are The Best Crypto Stories Ever Told

May 08, 2025