Canada's Conservatives: Tax Cuts And Deficit Reduction Plan

Table of Contents

Core Principles of the Conservative Tax Plan

The core tenets of the Conservative tax plan revolve around lower taxes for both individuals and corporations, fostering a business-friendly environment designed to boost economic activity. While specific details may evolve, the overarching goal is to create a more competitive tax system that attracts investment and encourages job creation.

-

Individual Tax Bracket Reductions: The plan typically proposes reductions in personal income tax rates across multiple brackets. This aims to leave more money in the hands of Canadians, stimulating consumer spending and economic growth. The predicted impact varies depending on the specific bracket changes, with lower-income earners potentially seeing smaller percentage reductions than higher-income earners. Precise figures are subject to change and should be verified with official party statements.

-

Corporate Tax Rate Cuts: Lowering the corporate tax rate is a central component, intended to incentivize businesses to invest, expand, and hire more employees. The justification is that a more competitive tax environment attracts foreign investment and boosts domestic business activity, ultimately increasing tax revenue in the long run. The proposed reduction aims to make Canada more attractive compared to other countries with lower business tax rates.

-

Targeted Tax Relief: Depending on the specific platform, the plan may include targeted tax credits or deductions for families, particularly those with children, and for specific sectors of the economy, such as manufacturing or clean energy. These measures aim to address specific economic challenges and support strategic industries. For example, a tax credit for childcare expenses could stimulate economic participation among parents.

Deficit Reduction Strategies

The Conservative Party's approach to deficit reduction typically involves a combination of spending cuts and increased revenue generation through economic growth spurred by the proposed tax cuts. The plan acknowledges the need for fiscal responsibility while avoiding drastic austerity measures that could harm the economy.

-

Targeted Spending Cuts: Specific areas targeted for spending cuts often include government programs deemed inefficient or overlapping, as well as streamlining administrative costs. The party emphasizes identifying areas for savings without significantly impacting essential services. Precise figures on projected savings are often subject to ongoing review and debate.

-

Revenue Generation through Growth: The core argument is that lower taxes will stimulate economic growth, leading to higher overall tax revenues. This is based on the "supply-side economics" principle, suggesting that reducing tax burdens incentivizes work, investment, and business expansion, leading to increased economic activity and, ultimately, higher government revenues.

-

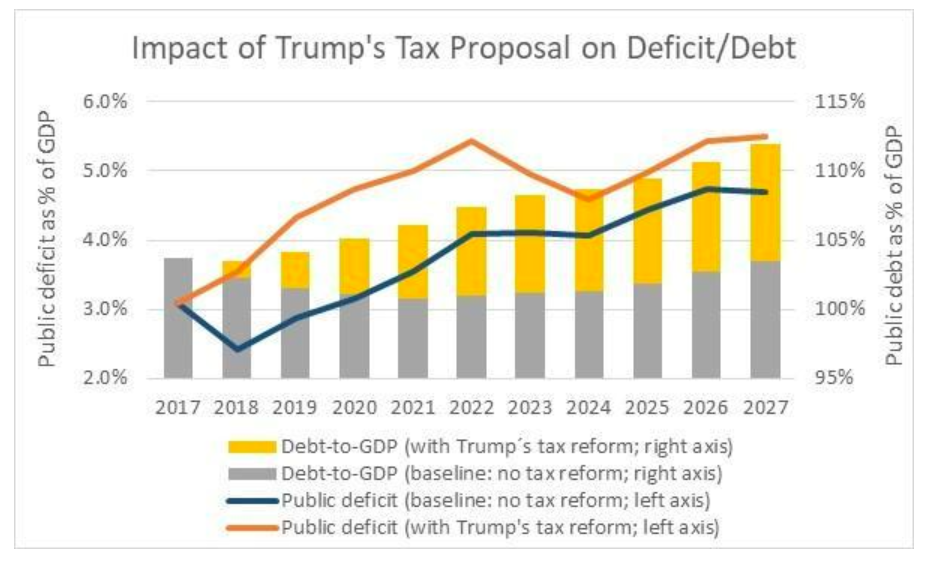

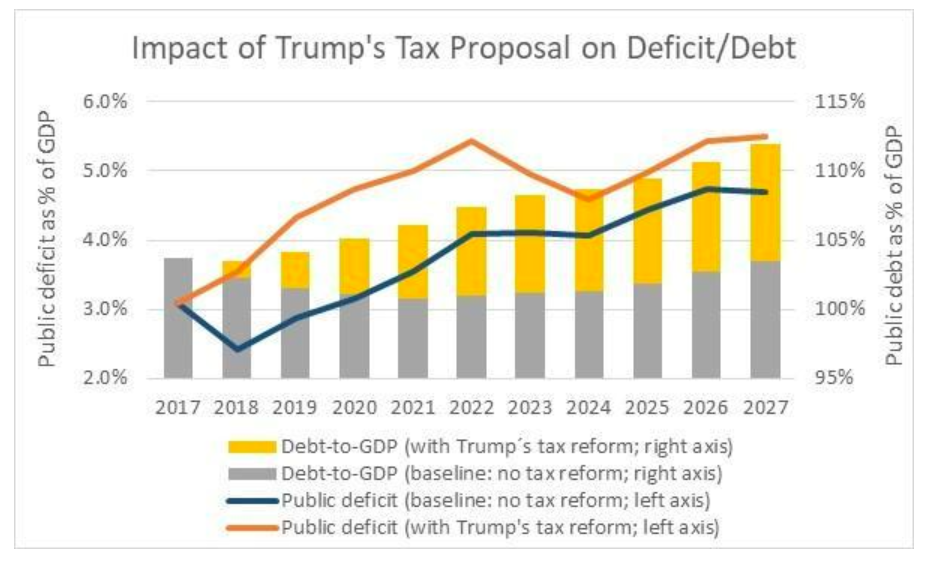

Feasibility and Drawbacks: The feasibility of this strategy depends on several factors, including the responsiveness of the economy to tax cuts and the accuracy of economic projections. Potential drawbacks include the possibility that revenue increases may not fully offset the tax cuts, potentially leading to a slower pace of deficit reduction than projected.

Economic Impact and Projections

The projected economic impact of the Conservative tax plan is a subject of ongoing debate and analysis. The party typically presents projections showing increased GDP growth, job creation, and improved economic indicators as a result of the plan.

-

Independent Analyses: Independent economic analyses often offer varying perspectives on the projected impact, with some agreeing with the party's optimistic forecasts and others expressing concerns about potential risks and challenges. It’s crucial to consult a variety of sources for a well-rounded understanding.

-

Potential Risks and Challenges: Potential challenges include the possibility of increased income inequality, the risk of inflation if consumer spending rises too rapidly, and the potential for the deficit reduction targets to be harder to achieve than initially predicted.

-

Comparison with Alternative Strategies: The plan's effectiveness is often compared to alternative economic approaches, such as those that prioritize government spending on social programs or infrastructure development. The debate centers on the optimal balance between tax cuts, government spending, and deficit reduction.

-

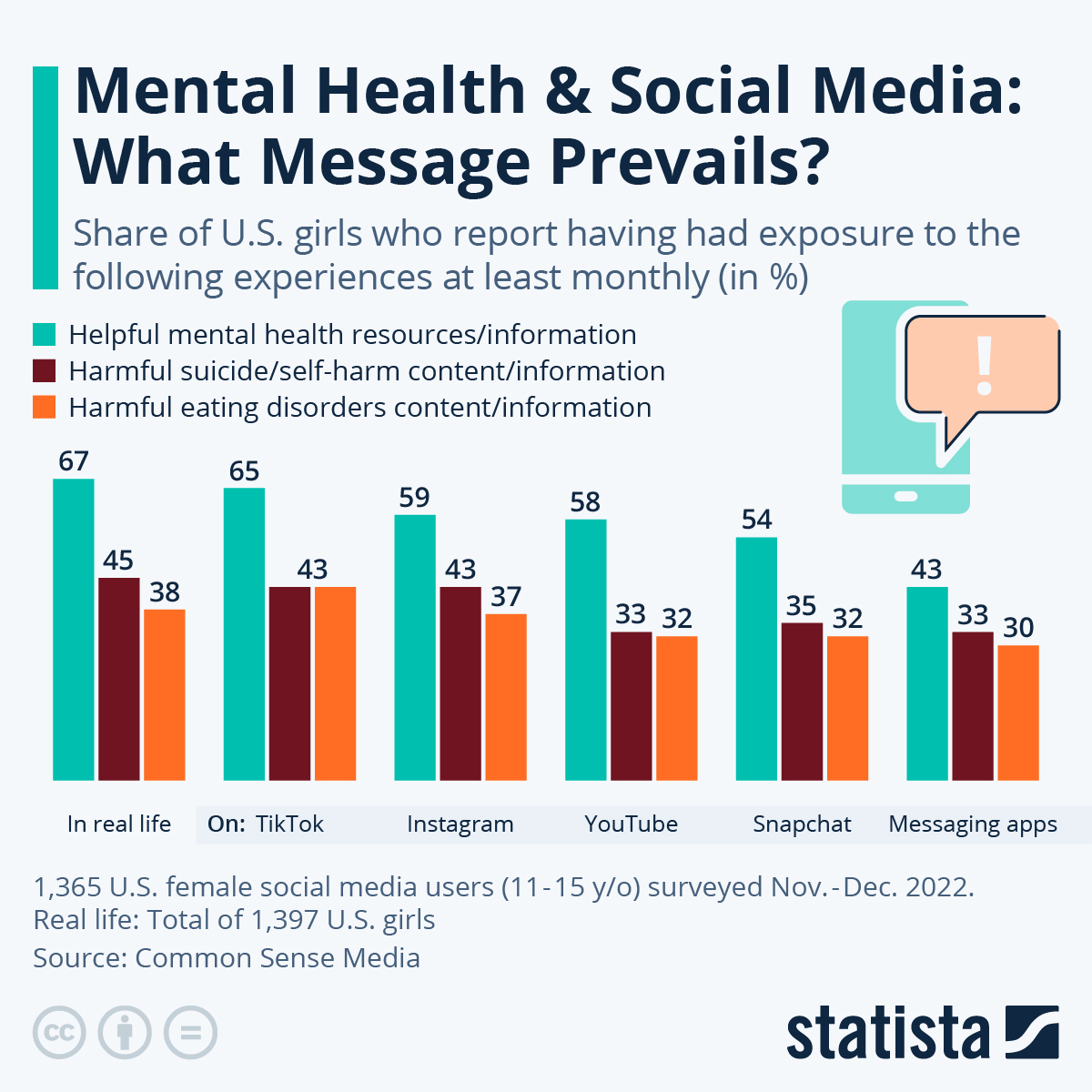

Impact on Different Demographic Groups: The effects of the plan are likely to vary across different income groups. While higher-income earners may benefit disproportionately from tax cuts, the plan may also indirectly benefit lower-income groups through increased employment opportunities resulting from economic growth.

Addressing Potential Criticisms

The Conservative tax plan faces criticisms focusing on its potential to exacerbate income inequality and the sustainability of its deficit reduction targets.

-

Rebuttal of Criticisms: Proponents often argue that the overall economic benefits of increased growth will outweigh concerns about income inequality, pointing to increased job creation and investment as benefits for all segments of society. They may also highlight measures included to mitigate potential negative impacts on vulnerable populations.

-

Addressing Sectoral Concerns: Concerns are often raised regarding the impact on specific sectors or vulnerable populations. The party usually addresses these concerns by emphasizing measures designed to support those sectors or groups, or by highlighting the long-term positive effects of overall economic growth.

-

Long-Term Benefits: Supporters emphasize the long-term benefits of the plan, including sustained economic growth, job creation, and improved living standards for Canadians.

Conclusion

Canada's Conservative tax plan proposes significant tax cuts for individuals and corporations, paired with strategies for deficit reduction primarily focused on spending cuts and increased economic activity. While projections suggest positive economic outcomes like increased GDP and job creation, critics raise concerns about income inequality and the feasibility of deficit reduction targets. The plan's ultimate success hinges on several factors, including the accuracy of economic projections and the effectiveness of the proposed spending cuts and growth initiatives.

Understand the full implications of Canada’s Conservative tax plan – visit [link to relevant website] to learn more about Conservative tax policy and the Canadian Conservative economic plan.

Featured Posts

-

The Zuckerberg Trump Dynamic Impact On Social Media And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Impact On Social Media And Beyond

Apr 24, 2025 -

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 24, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

Apr 24, 2025 -

Hong Kong Stock Market Rally Chinese Stocks On The Rise

Apr 24, 2025

Hong Kong Stock Market Rally Chinese Stocks On The Rise

Apr 24, 2025 -

Oblivion Remastered Official Release Date And Details

Apr 24, 2025

Oblivion Remastered Official Release Date And Details

Apr 24, 2025