The Effect Of Trump's Tariffs On Norway's Sovereign Wealth Fund: Nicolai Tangen's Approach

Table of Contents

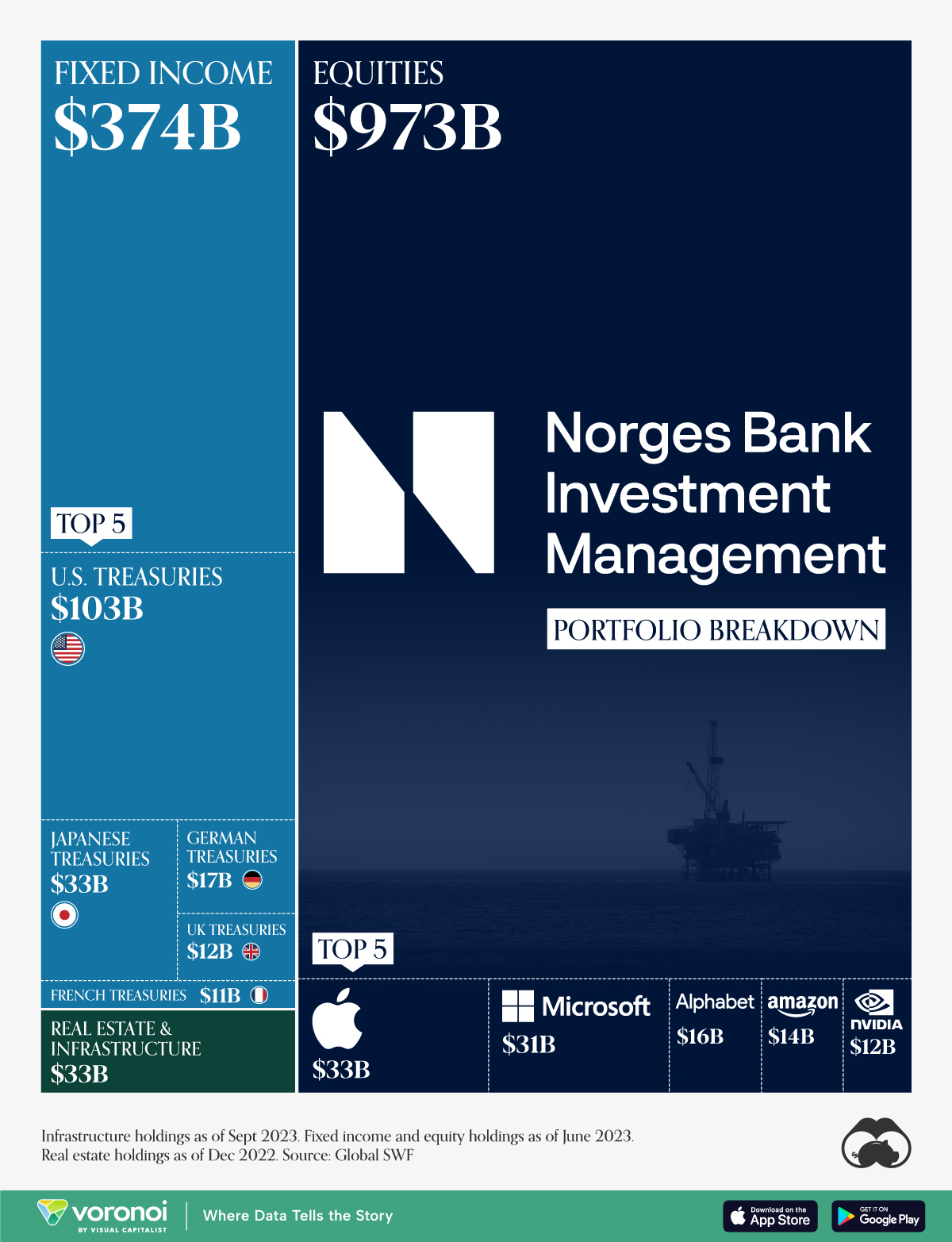

Understanding Norway's Sovereign Wealth Fund (SWF) and its Vulnerability to Global Trade

Norway's Government Pension Fund Global (GPFG), also known as the Oil Fund, is the world's largest sovereign wealth fund, managing assets exceeding one trillion US dollars. Its mandate is to invest broadly, aiming for long-term returns to secure Norway's future prosperity. However, this global investment strategy inherently exposes the GPFG to the fluctuations of the international market, making it vulnerable to events like the Trump-era trade wars. Global trade directly impacts the fund's performance because a significant portion of its portfolio is invested in companies and industries heavily reliant on international commerce.

- Exposure to US markets and industries affected by tariffs: The GPFG holds substantial investments in US-based companies across various sectors. Trump's tariffs, particularly those targeting goods from China, impacted numerous industries within the fund's portfolio, creating uncertainty and potential for decreased returns.

- Dependence on global economic growth: The GPFG's success is intrinsically linked to global economic growth. Trade wars, by their nature, disrupt global supply chains and hinder economic expansion, creating headwinds for the fund's investments.

- Risk diversification strategies employed by the fund: To mitigate these risks, the GPFG employs a diversified investment strategy across various asset classes and geographies. However, even a well-diversified portfolio cannot entirely eliminate the impact of large-scale global economic shocks like trade wars.

The Direct Impact of Trump's Tariffs on GPFG Investments

Trump's tariffs directly affected several sectors within the GPFG portfolio. For example, tariffs on steel and aluminum impacted companies in the manufacturing sector, while tariffs on energy-related goods affected energy companies. The fund's exposure to these sectors resulted in noticeable financial implications.

- Impact on specific sectors (e.g., energy, manufacturing): The energy sector, a significant component of the GPFG's portfolio, experienced fluctuations due to tariff-related uncertainties in global energy markets. Similarly, manufacturing companies faced challenges due to increased input costs and reduced demand caused by trade tensions.

- Analysis of stock price fluctuations due to tariff uncertainty: The uncertainty surrounding the tariffs and the retaliatory measures from other countries led to increased volatility in global stock markets, directly impacting the GPFG's returns. Stock prices of companies exposed to trade wars often experienced significant fluctuations.

- Mention of any direct divestments due to tariff-related concerns: While the GPFG doesn't publicly announce divestments based solely on tariffs, it's reasonable to assume that the fund considered the long-term effects of trade disputes when making investment decisions. Their investment strategy prioritizes long-term value, necessitating careful consideration of such significant geopolitical events.

Nicolai Tangen's Response and Adaptability

Nicolai Tangen, appointed CEO of the GPFG in 2020, inherited the challenges presented by the lingering effects of Trump's tariffs. His approach emphasized a long-term perspective and proactive risk management.

- Shift in investment allocation (if any): While specific details on portfolio shifts directly attributable to Trump's tariffs aren't publicly available, it's likely that the fund adjusted its investment strategy to mitigate potential risks. This might involve a subtle shift towards sectors less susceptible to trade disputes or an increase in hedging strategies.

- Increased focus on specific sectors less vulnerable to trade wars: The GPFG's investment strategy likely incorporated a heightened focus on sectors with more resilient global demand, less reliant on international trade, and potentially less vulnerable to future trade disputes.

- Enhanced risk management strategies: The experience of the Trump-era tariffs undoubtedly contributed to the refinement of the GPFG's risk management framework, incorporating lessons learned about the impact of protectionist trade policies on global investment.

- Public statements or interviews by Tangen addressing the issue: While Tangen might not have directly attributed specific portfolio adjustments to Trump's tariffs, his public statements likely reflected a cautious approach to global economic uncertainty and a commitment to adapting the fund's strategy to changing circumstances.

Long-Term Implications and Lessons Learned

The Trump tariffs left a lasting impact on the GPFG's long-term investment strategy, emphasizing the crucial role of proactive risk management in a globalized economy.

- Changes in the GPFG's risk assessment methodologies: The experience likely led to a review and refinement of the GPFG's risk assessment methodologies, with a greater emphasis on geopolitical risks and the potential impact of protectionist trade policies.

- Revised investment guidelines for future global uncertainties: The fund likely incorporated lessons learned into its investment guidelines, improving its ability to respond to future global uncertainties, including trade disputes and economic shocks.

- Impact on future investment decisions and diversification strategies: The experience reinforced the importance of diversification and a long-term investment horizon, shaping future investment decisions and further enhancing the fund's risk management approach.

Conclusion

This article analyzed the effects of Trump's tariffs on Norway's sovereign wealth fund, highlighting the challenges faced and the strategic responses implemented under Nicolai Tangen's leadership. The analysis demonstrates the vulnerability of even the largest SWFs to global trade uncertainties and the importance of adaptable investment strategies. Understanding the impact of global trade policies on major investment vehicles like Norway's sovereign wealth fund is crucial for investors and policymakers alike. Continue learning about the effects of Trump's tariffs and other global trade developments on Norway's Sovereign Wealth Fund and its future investment strategies.

Featured Posts

-

La Fire Aftermath Investigation Into Landlord Price Gouging Practices

May 04, 2025

La Fire Aftermath Investigation Into Landlord Price Gouging Practices

May 04, 2025 -

Daur Ulang Cangkang Telur Petunjuk Praktis Mendapatkan Nutrisi Tambahan

May 04, 2025

Daur Ulang Cangkang Telur Petunjuk Praktis Mendapatkan Nutrisi Tambahan

May 04, 2025 -

Rare 45 000 Novel Found Bookstores Hidden Treasure

May 04, 2025

Rare 45 000 Novel Found Bookstores Hidden Treasure

May 04, 2025 -

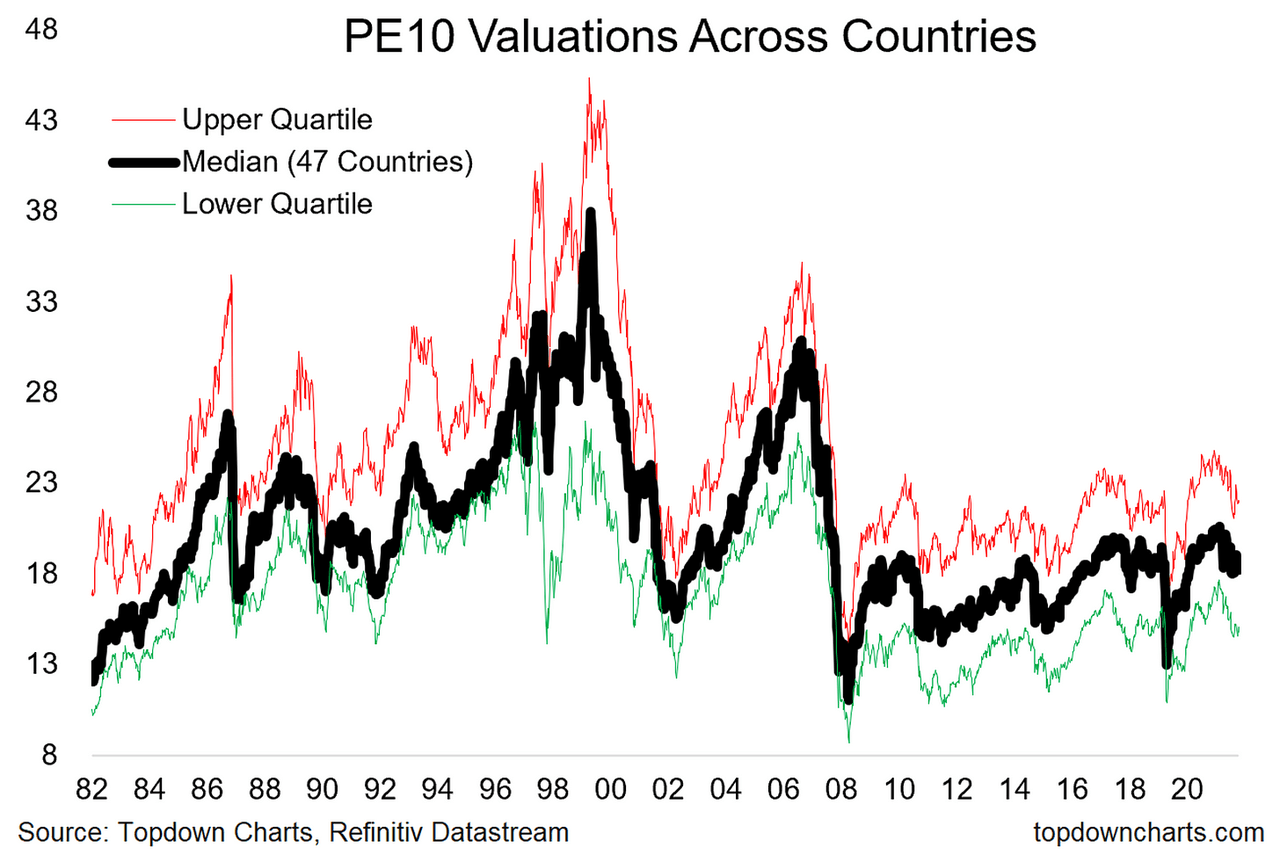

Bof As Take Why Elevated Stock Market Valuations Shouldnt Worry Investors

May 04, 2025

Bof As Take Why Elevated Stock Market Valuations Shouldnt Worry Investors

May 04, 2025 -

Reform Uks Farage Sides With Snp For Scottish Parliament Election

May 04, 2025

Reform Uks Farage Sides With Snp For Scottish Parliament Election

May 04, 2025

Latest Posts

-

Lizzo And Myke Wright A Look At Their Relationship His Career And Net Worth

May 04, 2025

Lizzo And Myke Wright A Look At Their Relationship His Career And Net Worth

May 04, 2025 -

Who Is Lizzo Dating Now Myke Wright Job Net Worth And Relationship Details

May 04, 2025

Who Is Lizzo Dating Now Myke Wright Job Net Worth And Relationship Details

May 04, 2025 -

Lizzos Boyfriend Myke Wrights Net Worth And Career

May 04, 2025

Lizzos Boyfriend Myke Wrights Net Worth And Career

May 04, 2025 -

New Lizzo Single Ignites The Charts

May 04, 2025

New Lizzo Single Ignites The Charts

May 04, 2025 -

Los Angeles Concert Lizzos Confidence And Curves

May 04, 2025

Los Angeles Concert Lizzos Confidence And Curves

May 04, 2025