BofA's Take: Why Elevated Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Underlying Factors

BofA's analysis of current elevated stock market valuations points to several key underlying factors. Their research considers a multitude of economic indicators, and it suggests that current valuations aren't necessarily unsustainable or indicative of an imminent market crash.

-

Sustained Low Interest Rates: BofA highlights the impact of persistently low interest rates on stock valuations. Lower borrowing costs incentivize companies to invest and expand, leading to increased corporate earnings. This, in turn, can support higher price-to-earnings (P/E) ratios, a common metric used to assess stock market valuations. For example, BofA's recent report (cite specific report if available) emphasizes how historically low rates have fueled growth in certain sectors.

-

Robust Corporate Earnings: Strong corporate earnings reports across various sectors are another significant factor cited by BofA. Many companies have demonstrated resilience and even significant growth despite economic uncertainties. This positive earnings trend supports higher stock prices and contributes to the perception of elevated valuations. BofA analysts often point to specific industry performance to back up this assertion (cite specific examples if available).

-

Long-Term Economic Growth Projections: BofA's outlook on long-term economic growth plays a crucial role in their assessment. Their projections often consider factors beyond short-term market fluctuations, encompassing long-term technological advancements, demographic shifts, and global economic trends. These projections help to contextualize current valuations, suggesting that they may be justified given the anticipated long-term growth trajectory. (Reference a specific BofA report and its projections if possible).

-

Inflation's Influence: While inflation can erode purchasing power, BofA’s analysis often considers the interplay between inflation, interest rates, and corporate earnings. Moderate inflation, coupled with strong earnings growth, might not necessarily signal an overvalued market, according to their assessments. The key is the balance between these factors and how they affect future earning potential.

The Importance of Long-Term Perspective in Stock Market Investment

The key to navigating elevated stock market valuations lies in adopting a long-term investment perspective. Short-term market volatility is a normal occurrence, and focusing solely on short-term fluctuations can lead to poor investment decisions.

-

Long-Term Horizon: Investors should focus on their long-term financial goals rather than reacting to daily market movements. A long-term investment strategy allows you to weather short-term market corrections and benefit from the long-term growth potential of the market.

-

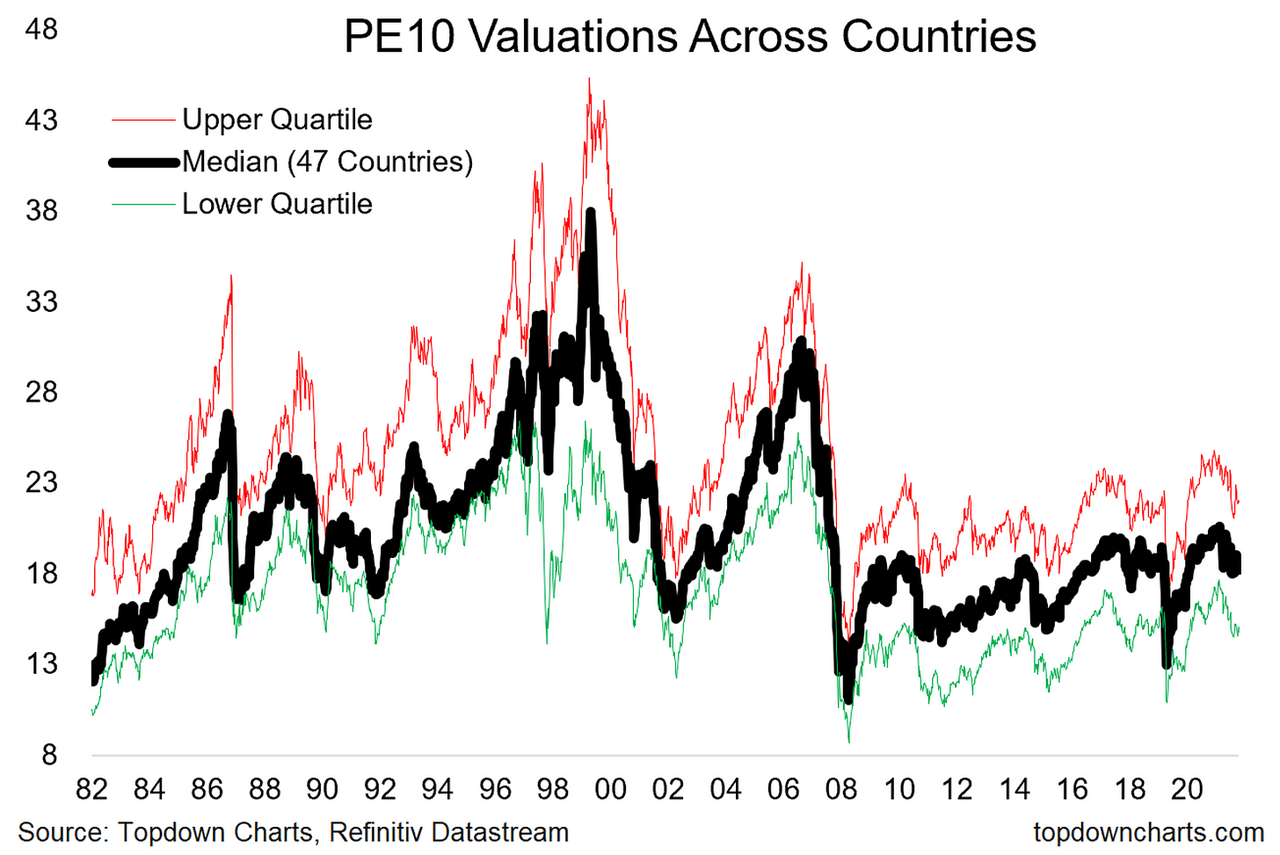

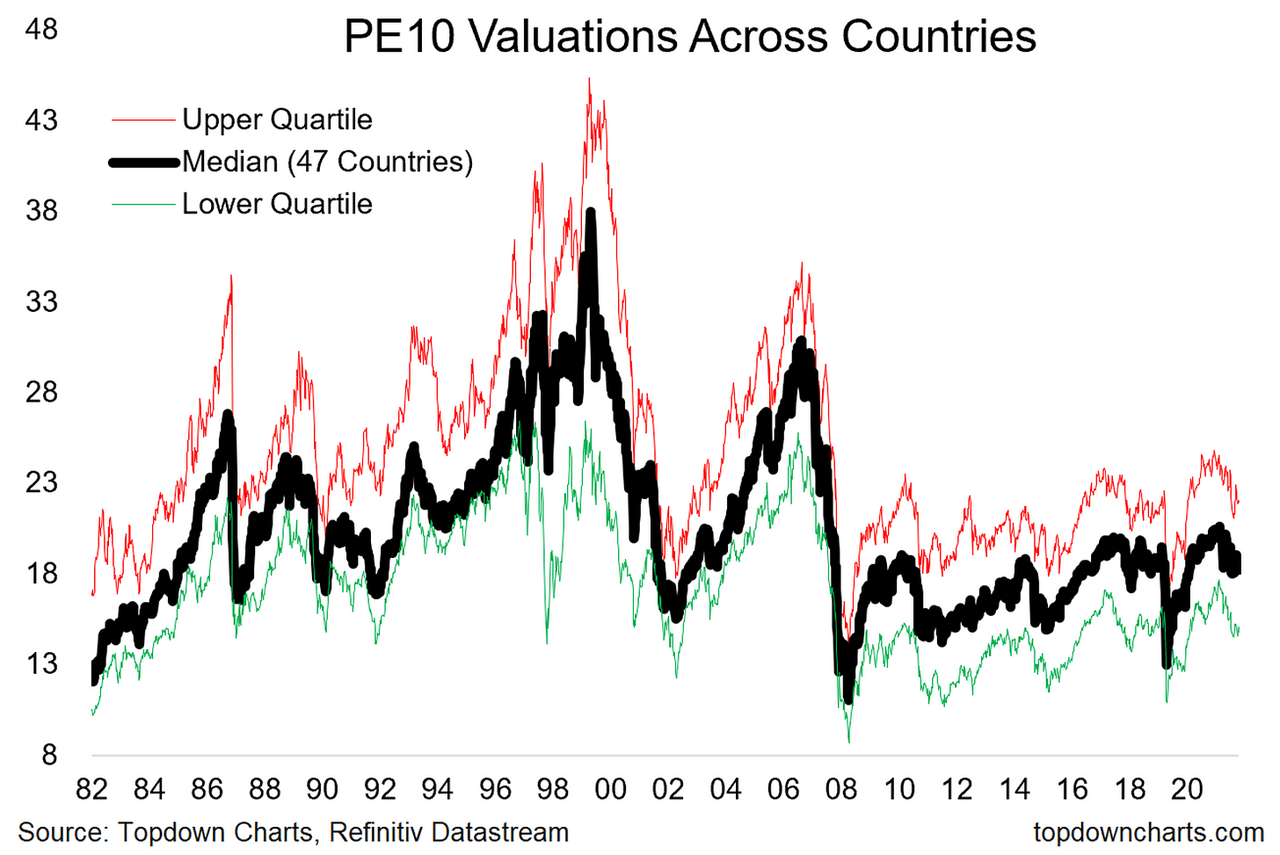

Historical Context: Examining historical market valuations provides valuable context. There have been numerous instances throughout history where valuations reached similar or even higher levels, only to be followed by periods of sustained market growth. (Include a chart demonstrating historical P/E ratios if possible).

-

Managing Risk Tolerance: A long-term perspective enables better risk management. By understanding your risk tolerance and aligning your investment strategy accordingly, you can navigate periods of market uncertainty more effectively. This might involve adjusting your asset allocation or diversifying your portfolio.

-

Patience is Key: Investing in the stock market is a marathon, not a sprint. Patience and discipline are essential for long-term success. Avoid impulsive decisions based on short-term market fluctuations.

Strategies for Navigating Elevated Stock Market Valuations

Even with BofA's reassuring perspective, adopting sound investment strategies is crucial. Here are some approaches to navigate the current market environment:

-

Portfolio Diversification: Diversifying your portfolio across various asset classes (stocks, bonds, real estate, etc.) helps reduce overall risk. Don't put all your eggs in one basket.

-

Fundamental Analysis: Focus on selecting stocks based on fundamental analysis, considering factors like earnings growth, revenue streams, and management quality. Don't solely rely on valuation metrics.

-

Active vs. Passive Investing: Consider the benefits of both active and passive investment strategies. Active management allows for more personalized stock selection, while passive strategies (like index funds) offer diversification and lower fees. Choose the approach best suited to your skills and resources.

-

Asset Allocation: Carefully consider your asset allocation strategy based on your risk tolerance and time horizon. Adjust your portfolio as your circumstances change. Consult with a financial advisor to tailor your asset allocation to your specific needs.

Conclusion

BofA's analysis suggests that elevated stock market valuations, while notable, shouldn't necessarily cause undue investor concern. Their reasoning focuses on robust corporate earnings, low interest rates, and long-term economic growth projections. However, adopting a long-term investment perspective, diversifying your portfolio, and employing sound risk management strategies are crucial. Don't let elevated stock market valuations deter you from pursuing your long-term investment goals. Consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial objectives. Learn more about BofA's market outlook and develop a robust approach to navigating the current stock market environment. Understand the nuances of elevated stock market valuations and make informed investment decisions.

Featured Posts

-

U S Electric Motor Development A Strategy For Global Supply Chain Independence

May 04, 2025

U S Electric Motor Development A Strategy For Global Supply Chain Independence

May 04, 2025 -

Another Simple Favor Blake Lively And Anna Kendricks Red Carpet Duo

May 04, 2025

Another Simple Favor Blake Lively And Anna Kendricks Red Carpet Duo

May 04, 2025 -

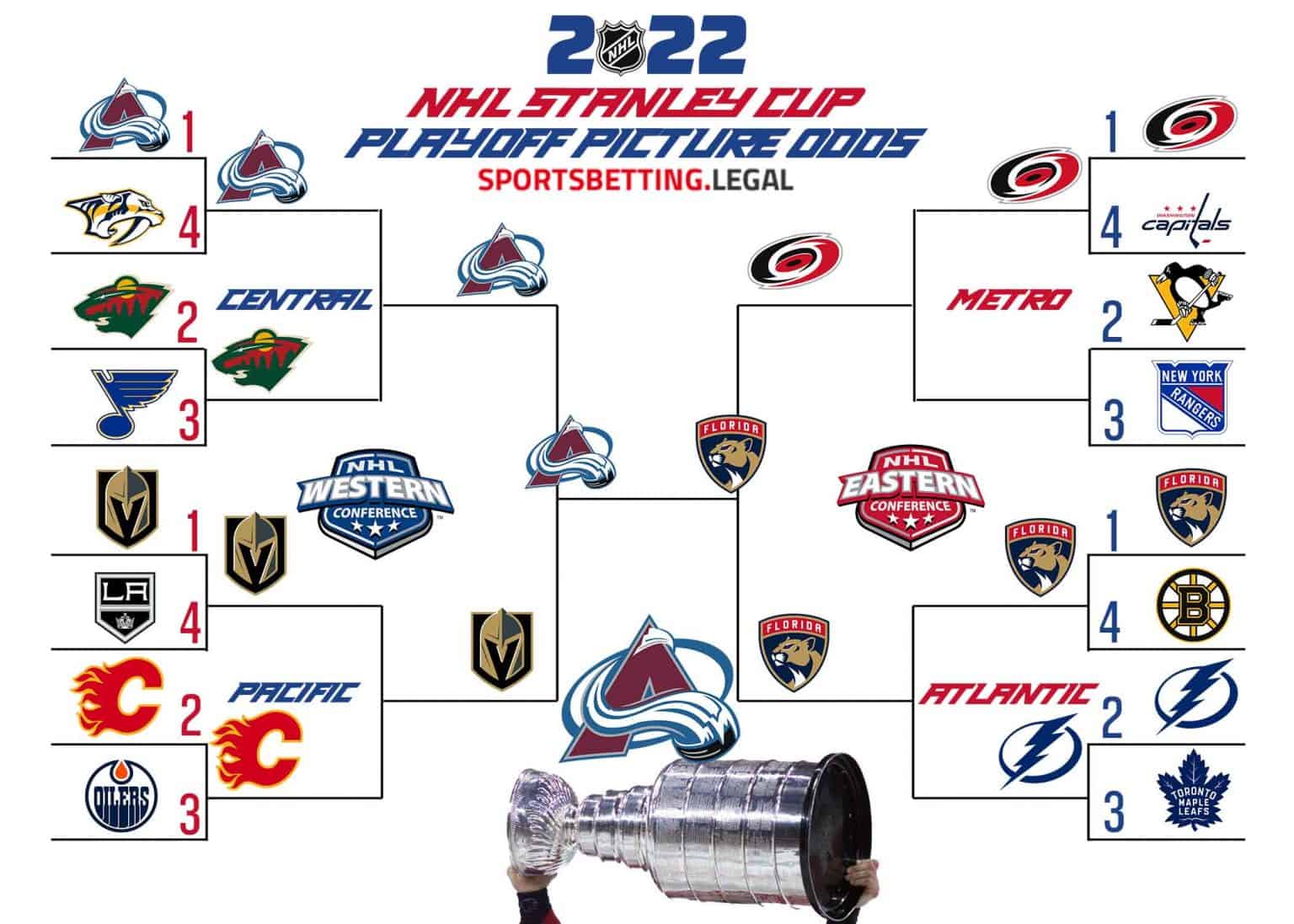

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025 -

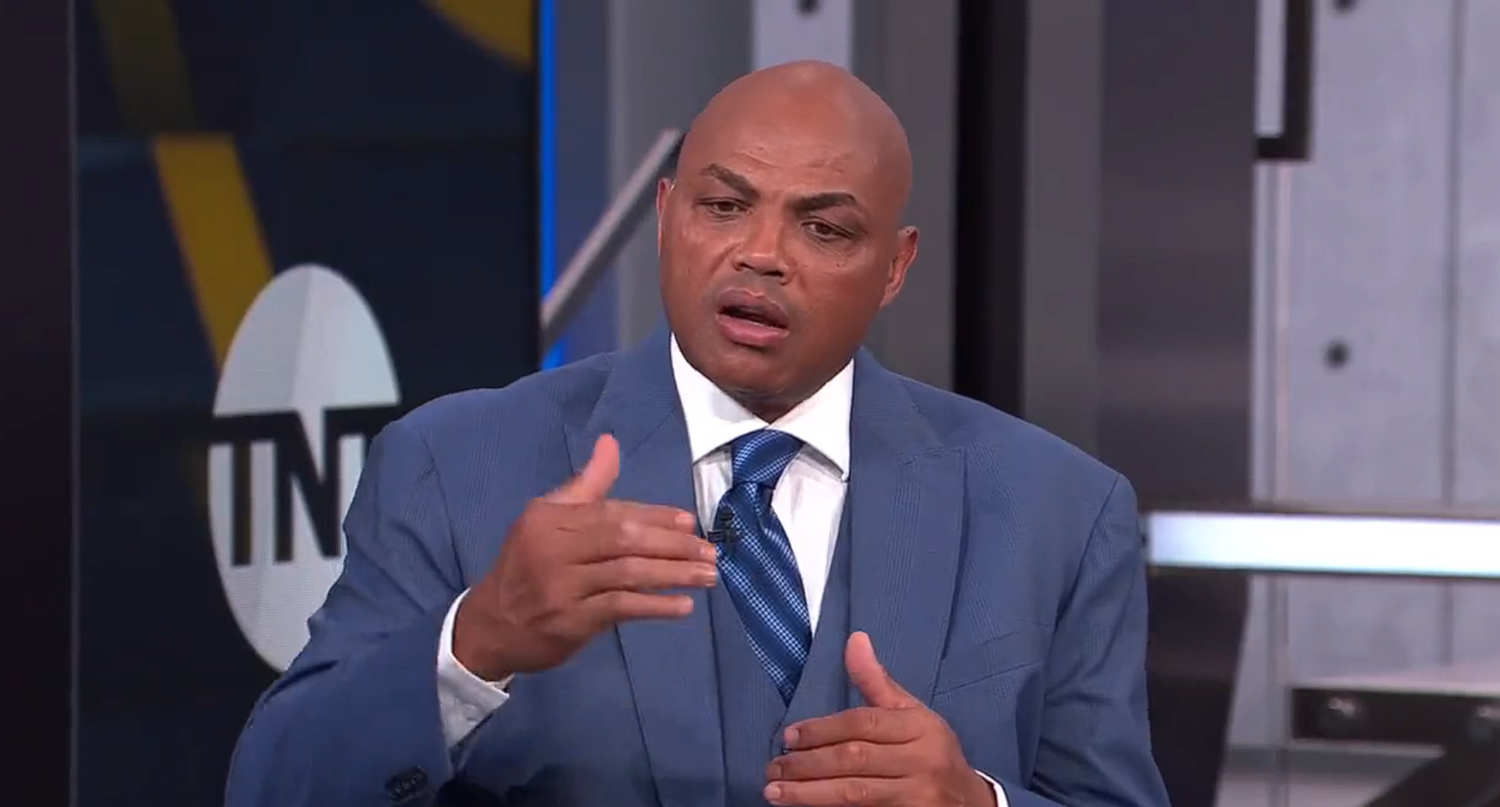

Charles Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025

Charles Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025 -

Sheung Wans Honjo Review Of A Fun And Modern Japanese Restaurant

May 04, 2025

Sheung Wans Honjo Review Of A Fun And Modern Japanese Restaurant

May 04, 2025

Latest Posts

-

Blake Lively And Anna Kendricks Feud A Complete Explanation

May 04, 2025

Blake Lively And Anna Kendricks Feud A Complete Explanation

May 04, 2025 -

Is There A Feud A Body Language Expert Analyzes Blake Lively And Anna Kendricks Interactions

May 04, 2025

Is There A Feud A Body Language Expert Analyzes Blake Lively And Anna Kendricks Interactions

May 04, 2025 -

Lizzos Weight Loss A Health And Fitness Update

May 04, 2025

Lizzos Weight Loss A Health And Fitness Update

May 04, 2025 -

Body Language Reveals The Truth Decoding Blake Lively And Anna Kendricks Tense Encounters

May 04, 2025

Body Language Reveals The Truth Decoding Blake Lively And Anna Kendricks Tense Encounters

May 04, 2025 -

Social Media Dance Lizzos Weight Loss Victory

May 04, 2025

Social Media Dance Lizzos Weight Loss Victory

May 04, 2025