The Easiest Path To Profitable Dividends

Table of Contents

Understanding Dividend Investing Basics

Before diving into strategies, it’s crucial to grasp the fundamentals of dividend investing.

What are Dividends?

Dividends are payments made by companies to their shareholders, typically from a portion of the company's profits. They represent a share of the company's success, rewarding investors for their participation.

- Dividend Yield: This is the annual dividend per share, divided by the stock's current market price. It represents the percentage return on your investment based on dividends alone. A higher yield might seem attractive, but it's crucial to examine the underlying company's health.

- Dividend Payout Ratio: This is the percentage of a company's earnings paid out as dividends. A healthy payout ratio is usually between 30% and 70%, indicating the company retains enough earnings for growth and reinvestment. A ratio too high can be unsustainable.

- Tax Implications: Dividend income is typically taxed as ordinary income, but qualified dividends may receive a lower tax rate. Consult a tax professional for personalized advice.

- Dividend Reinvestment Plans (DRIPs): DRIPs allow you to automatically reinvest your dividends to purchase more shares, accelerating the growth of your portfolio through compounding. This is a powerful tool for building wealth over the long term.

Identifying Strong Dividend-Paying Companies

Not all companies are created equal when it comes to dividends. You need to identify financially sound companies with a history of rewarding shareholders.

- Financial Health: Look for companies with low debt levels, consistent earnings growth, and strong free cash flow. These are signs of financial stability and a greater ability to sustain dividend payments.

- Dividend Aristocrats: Companies with a long history of consistently increasing their dividend payments, often for 25 years or more, are known as Dividend Aristocrats. These are generally considered reliable dividend payers.

- Sector Diversification: Diversifying your portfolio across various sectors (technology, healthcare, consumer goods, etc.) helps mitigate risk. If one sector underperforms, the others may offset those losses.

Selecting the Right Dividend Stocks for Your Portfolio

Now that you understand the basics, let's explore how to choose the right dividend stocks.

Screening for Profitable Dividend Stocks

Use online stock screeners to filter for companies meeting your criteria. These tools allow you to customize your search based on factors like:

- Dividend Yield: Target a yield that aligns with your risk tolerance and financial goals.

- Payout Ratio: Look for companies with sustainable payout ratios.

- Earnings Growth: Consistent earnings growth indicates a company's ability to increase its dividend payments over time.

Beyond screeners, perform fundamental analysis: review the company's financial statements, understand its business model, and assess its competitive landscape.

Diversification and Risk Management

Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Multiple Companies: Invest in a variety of dividend-paying companies to reduce the impact of any single stock's underperformance.

- Multiple Sectors: Spread your investments across different sectors to further reduce risk. If one sector experiences a downturn, the others may compensate.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps mitigate the risk of investing a lump sum at a market peak.

Building Your Profitable Dividend Portfolio

This section outlines the strategy for building and maintaining your portfolio.

Creating a Long-Term Investment Strategy

Dividend investing is a long-term game.

- Buy-and-Hold: Adopt a buy-and-hold strategy, focusing on long-term growth rather than short-term market fluctuations.

- Compounding Returns: Reinvest your dividends to purchase more shares, allowing your earnings to generate more earnings over time. This is the power of compounding.

- Regular Reinvestment: Make dividend reinvestment a core part of your strategy to maximize long-term growth.

Monitoring and Adjusting Your Portfolio

Regularly review your portfolio's performance and make adjustments as needed.

- Performance Review: Monitor your dividend income, portfolio growth, and the performance of individual holdings.

- Adjusting Holdings: Based on market conditions, company performance, and changes in your financial goals, adjust your holdings accordingly. Sell underperforming stocks and reinvest in better opportunities.

- Professional Advice: Consider seeking advice from a qualified financial advisor for personalized guidance.

Beyond the Basics: Advanced Strategies for Profitable Dividends

For more experienced investors, consider these advanced strategies.

Dividend Growth Investing

Focus on companies with a proven track record of increasing their dividends annually. This strategy offers the potential for higher long-term returns.

Covered Call Writing (Optional)

Covered call writing involves selling call options on stocks you already own. This can generate additional income, but it also carries increased risk. Only consider this strategy if you have a strong understanding of options trading and are comfortable with the associated risks. Always consult with a financial professional before implementing this strategy.

Your Path to Profitable Dividends Awaits

Building a portfolio that generates profitable dividends is achievable with a well-planned approach. By understanding dividend investing basics, selecting strong companies, diversifying your portfolio, and employing a long-term strategy, you can create a reliable stream of passive income. Start your journey today by researching strong dividend-paying companies using a stock screener or conducting thorough fundamental analysis. Take the first step towards securing your financial future—start building your profitable dividend portfolio now!

Featured Posts

-

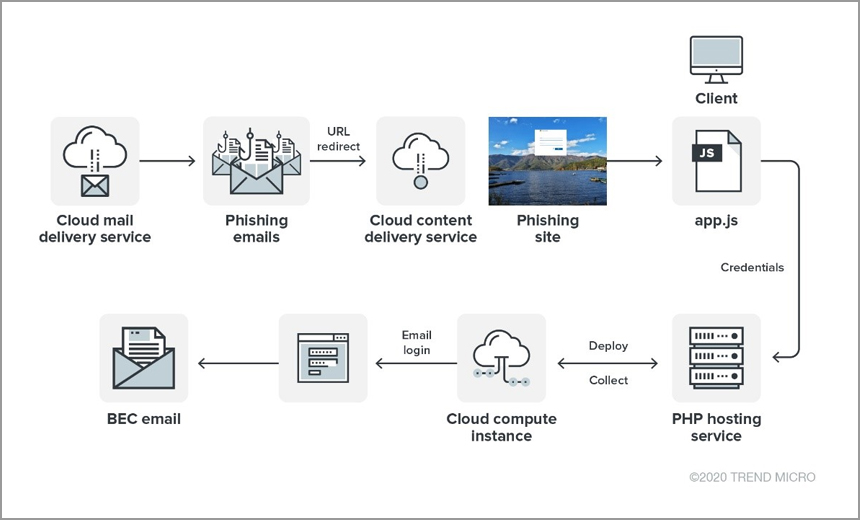

Executive Office365 Accounts Targeted In Multi Million Dollar Cybercrime Ring

May 11, 2025

Executive Office365 Accounts Targeted In Multi Million Dollar Cybercrime Ring

May 11, 2025 -

Henry Goldings Excitement For The Crazy Rich Asians Tv Series A Look Inside

May 11, 2025

Henry Goldings Excitement For The Crazy Rich Asians Tv Series A Look Inside

May 11, 2025 -

Crazy Rich Asians Tv Adaptation In The Works At Max

May 11, 2025

Crazy Rich Asians Tv Adaptation In The Works At Max

May 11, 2025 -

Philippe Candeloro Et Chantal Ladesou Vente Des Vins De Nuits Saint Georges En Images

May 11, 2025

Philippe Candeloro Et Chantal Ladesou Vente Des Vins De Nuits Saint Georges En Images

May 11, 2025 -

Jurickson Profars 80 Game Ped Suspension Details And Impact

May 11, 2025

Jurickson Profars 80 Game Ped Suspension Details And Impact

May 11, 2025