The Bank Of Canada And The Trade Wars: Assessing The April Interest Rate Debate

Table of Contents

The Global Economic Landscape and Trade Tensions

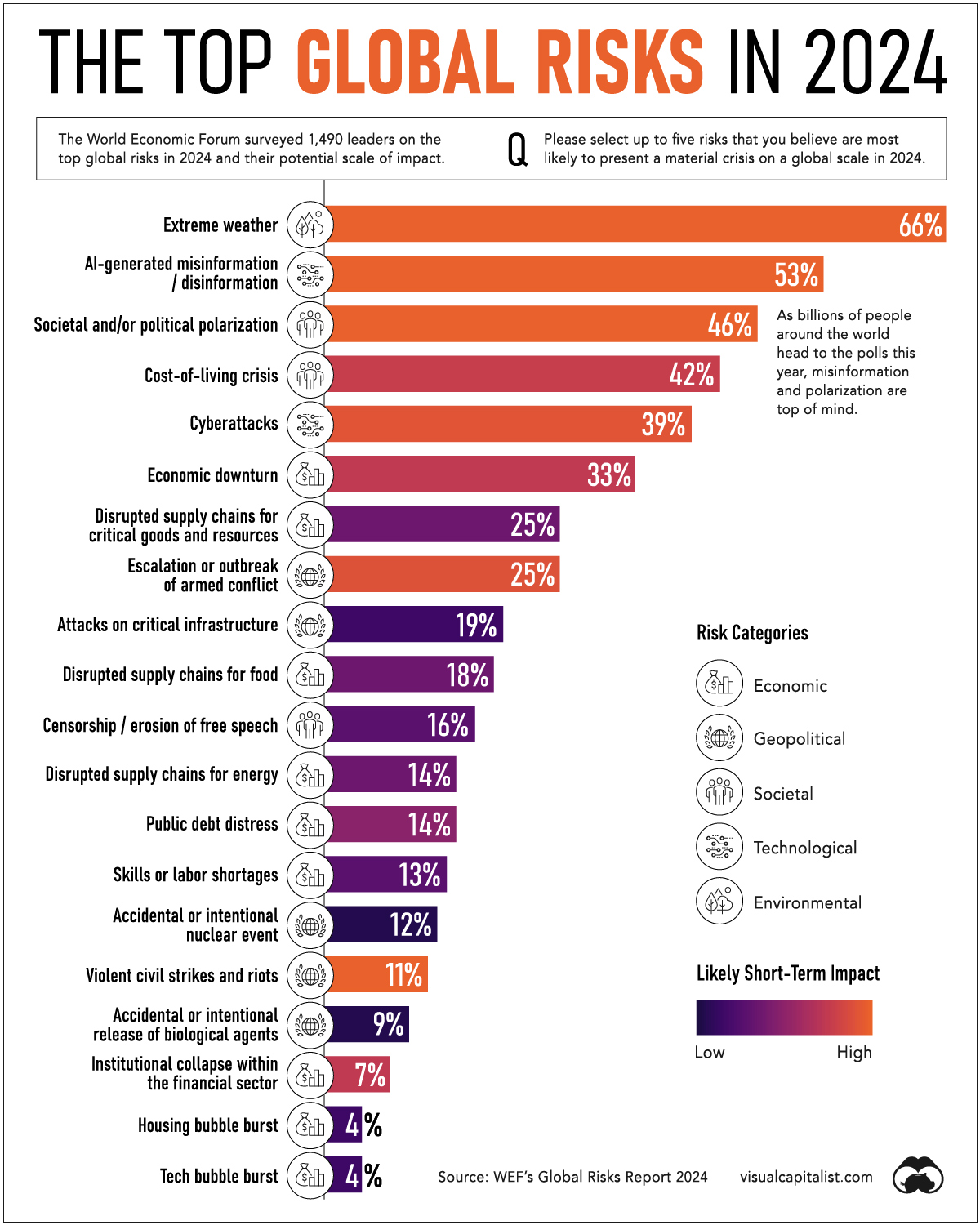

April [Year] saw a global economic climate marked by significant uncertainty, largely fueled by ongoing trade disputes, most notably the US-China trade war. These trade wars significantly impacted global trade flows and investor confidence. The imposition of tariffs disrupted established supply chains, increased costs for businesses, and dampened global demand. This complex global backdrop significantly influenced the Bank of Canada's considerations for its April interest rate decision.

- Impact of tariffs on Canadian exports: Canadian businesses faced increased challenges exporting goods to key markets due to retaliatory tariffs imposed by trading partners involved in the trade disputes. This negatively affected Canadian export growth and overall economic activity.

- Uncertainty in global supply chains: The disruption of global supply chains resulted in increased production costs and delivery delays for Canadian businesses, hindering their competitiveness and impacting economic growth.

- Weakening of global demand: The trade war uncertainty led to a weakening of global demand, affecting Canadian businesses relying on exports and creating a less favorable environment for investment and growth.

- Inflationary pressures: While initially subdued, there were increasing concerns about inflationary pressures stemming from tariff-induced cost increases and supply chain disruptions.

Domestic Economic Indicators and Bank of Canada’s Mandate

The Bank of Canada’s mandate is to promote the economic and financial well-being of Canadians. This involves maintaining price stability and full employment. To achieve this, they carefully consider a range of key domestic economic indicators. In April [Year], several factors were at play, requiring careful analysis.

- Analysis of Canadian GDP growth in the preceding months: GDP growth in the months leading up to April [Year] likely showed [insert actual data or analysis of growth rate, e.g., a modest increase, a slowdown, etc.]. This provided crucial information about the health of the Canadian economy.

- Assessment of inflation rates and their proximity to the Bank of Canada's target: The inflation rate in Canada in the months leading up to April [Year] was [insert actual data or analysis, e.g., near the target range, slightly above or below, etc.]. This is a crucial factor informing the Bank of Canada's monetary policy decisions.

- Examination of the unemployment rate and its implications: The unemployment rate in the period leading up to April [Year] was [insert actual data or analysis, e.g., relatively low, stable, rising, etc.]. Changes in the unemployment rate are a critical indicator of the health of the labor market and overall economic performance.

- Evaluation of consumer and business confidence levels: Consumer and business confidence surveys provided insights into the overall sentiment within the Canadian economy. These indicators, influenced by trade war uncertainty, provided crucial context for the Bank of Canada's assessment.

Analyzing the April Interest Rate Decision

In April [Year], the Bank of Canada [insert actual decision: e.g., maintained, raised, or lowered] its key interest rate to [insert actual interest rate]. This decision reflected the Bank's assessment of the complex interplay between global trade tensions and domestic economic conditions.

- Rationale behind the decision: The Bank of Canada likely justified its decision based on [insert actual reasons, e.g., a need to maintain stability in the face of uncertainty, a desire to stimulate economic growth despite trade headwinds, or a need to control inflation].

- Potential impact on various sectors of the Canadian economy: The April interest rate decision had varied impacts across different sectors. For example, [explain specific impacts, e.g., lower borrowing costs may benefit homebuyers, while higher rates could hurt businesses with debt].

- Comparison to previous rate decisions: This decision can be compared to earlier decisions to understand any shifts in monetary policy due to changing circumstances. [Insert a comparative analysis].

- Dissenting opinions within the Bank of Canada's governing council: It's important to note whether there were any dissenting opinions within the Bank of Canada's governing council concerning the April interest rate decision. [Mention any dissenting views if available].

Market Reactions and Future Outlook

The Bank of Canada's April interest rate decision triggered various market reactions.

- Changes in the Canadian dollar exchange rate: The Canadian dollar’s value against other major currencies likely [insert actual change in the exchange rate, e.g., strengthened, weakened, or remained relatively stable] following the announcement.

- Reactions of the stock market: The Canadian stock market's response [insert details of market reaction, e.g., showed a positive or negative reaction, remained largely unchanged].

- Impact on borrowing costs for businesses and consumers: The interest rate decision impacted borrowing costs for businesses and consumers, affecting investment decisions and consumer spending.

The Bank of Canada's forward guidance indicated its [insert actual forecast for future interest rates, e.g., intention to maintain rates, or plans to adjust them depending on future economic indicators]. The bank's contingency plans for further escalation of trade tensions remained a key factor in its future monetary policy projections.

The Bank of Canada, Trade Wars, and the April Interest Rate Decision – Key Takeaways and Next Steps

In conclusion, the Bank of Canada's April [Year] interest rate decision was a response to a complex economic environment shaped by global trade wars and their impact on the Canadian economy. The Bank's decision reflected a careful balancing act between maintaining price stability and stimulating growth amidst considerable uncertainty. Analyzing the interplay between global trade tensions and domestic economic indicators is crucial for understanding the rationale behind the Bank of Canada's monetary policy decisions.

To stay informed about the ongoing impact of trade wars on the Canadian economy and the Bank of Canada's interest rate policy, it is crucial to monitor future Bank of Canada announcements and related economic data. You can find valuable resources and detailed analysis on the Bank of Canada's official website. Understanding the Bank of Canada interest rate policy and its evolution in response to global economic shifts is essential for anyone interested in analyzing future interest rate decisions and the overall health of the Canadian economy.

Featured Posts

-

Broadcoms Proposed V Mware Price Increase A 1050 Jump Says At And T

May 02, 2025

Broadcoms Proposed V Mware Price Increase A 1050 Jump Says At And T

May 02, 2025 -

Fortnite Chapter 6 Season 3 Are The Servers Down

May 02, 2025

Fortnite Chapter 6 Season 3 Are The Servers Down

May 02, 2025 -

The China Factor Assessing Risks And Opportunities For International Auto Brands

May 02, 2025

The China Factor Assessing Risks And Opportunities For International Auto Brands

May 02, 2025 -

Play Station Showcase Addressing The Ps 5 Fans Two Year Wait

May 02, 2025

Play Station Showcase Addressing The Ps 5 Fans Two Year Wait

May 02, 2025 -

Mbahthat Sewdyt Adhrbyjanyt Ltezyz Alteawn Fy Mjal Altjart

May 02, 2025

Mbahthat Sewdyt Adhrbyjanyt Ltezyz Alteawn Fy Mjal Altjart

May 02, 2025

Latest Posts

-

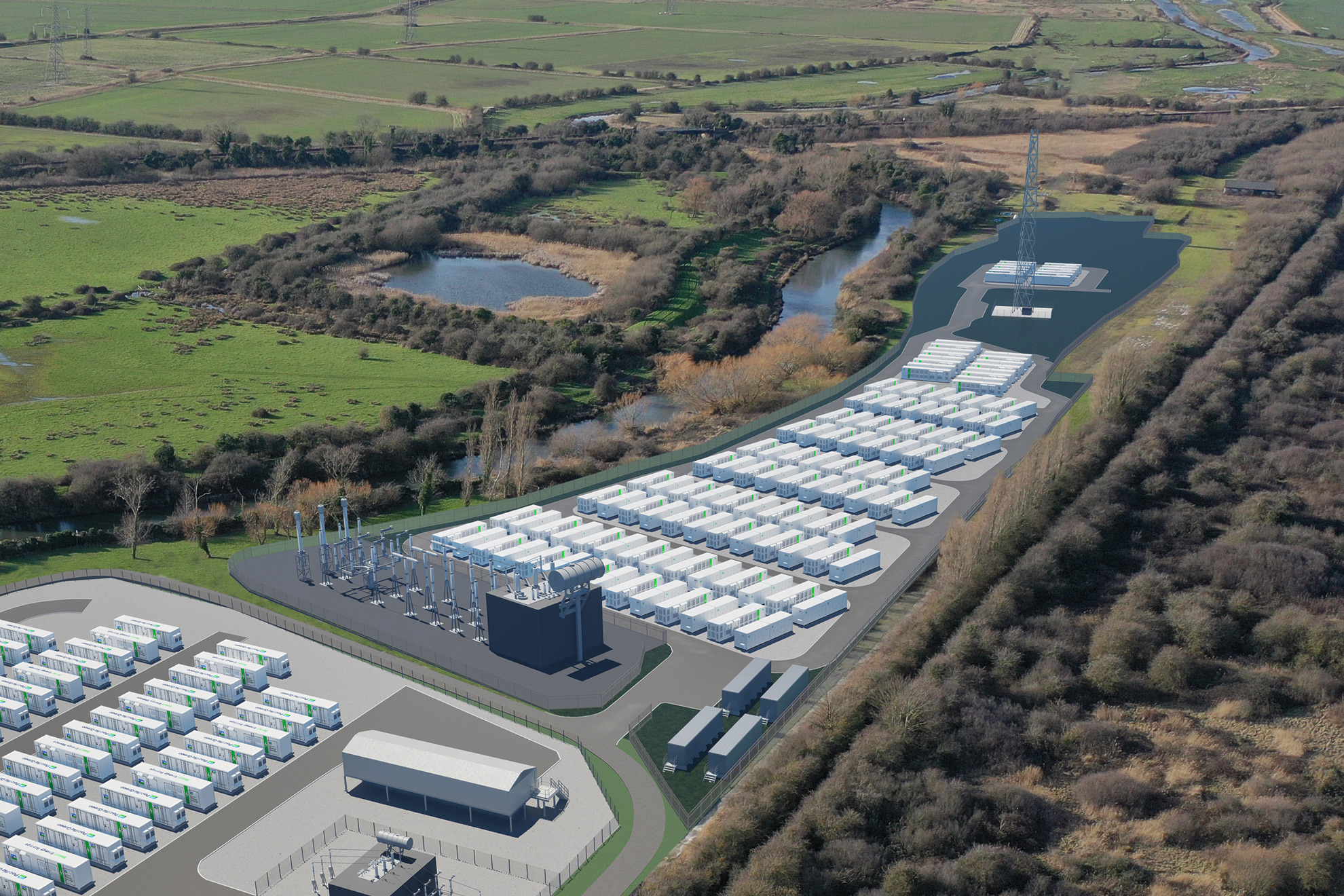

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Securing Funding For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025

270 M Wh Battery Energy Storage System Bess Financing In Belgium

May 03, 2025 -

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025

Belgium Bess Financing Navigating The Complex Merchant Market

May 03, 2025 -

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025

Financing A 270 M Wh Bess In Belgiums Complex Merchant Market

May 03, 2025 -

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025

Navigating Turbulence Airlines Struggle With Oil Supply Shock Impacts

May 03, 2025