Belgium BESS Financing: Navigating The Complex Merchant Market

Table of Contents

Understanding the Belgian BESS Financing Landscape

Types of BESS Financing Available in Belgium:

Securing capital for your BESS project in Belgium involves exploring several financing avenues. Each has its own set of benefits and drawbacks:

-

Project Finance: This approach involves securing financing specifically for the BESS project itself, often using the project's future cash flows as collateral. Benefits include potentially lower interest rates and longer repayment periods. Drawbacks can include a more complex and time-consuming application process.

-

Debt Financing: This is a common route, involving loans from banks, private equity firms, or other financial institutions. Advantages include a relatively straightforward process for established projects. Disadvantages can include higher interest rates and stricter lending criteria compared to project finance.

-

Equity Financing: This involves selling a share of ownership in your project in exchange for capital. Venture capital firms and crowdfunding platforms are potential sources. Advantages include reduced debt burden. Disadvantages are potential dilution of ownership and loss of control.

-

Public Grants and Subsidies: The Belgian government offers various grants and subsidies to promote renewable energy and energy storage. These programs often have specific eligibility criteria and application processes. Examples include regional initiatives and EU-funded programs that support BESS deployment. It's crucial to research current programs and their eligibility requirements.

- Example: The Flemish Region's [insert specific program name and link if available] offers subsidies for BESS projects integrated with renewable energy sources.

-

Other options: Leasing models and power purchase agreements (PPAs) also provide alternative routes for financing.

Key Players in the Belgian BESS Financing Market:

Several key players are active in the Belgian BESS financing market. These include:

- Major Banks: [List major Belgian banks involved in renewable energy financing and link to their websites]

- Investment Firms: [List major Belgian and international investment firms focusing on energy storage and provide links]

- Government Agencies: [List relevant Belgian government agencies involved in energy policy and financing, and provide links]

These entities often have specific investment criteria, focusing on factors such as project viability, risk assessment, and the experienced management team. Understanding their investment mandates is crucial for tailoring your financing proposal effectively.

Regulatory Framework and Incentives for BESS in Belgium:

The regulatory landscape and available incentives significantly influence BESS financing in Belgium. Understanding these elements is crucial:

- Regulations: [Mention relevant Belgian regulations impacting BESS deployment, such as grid connection rules and safety standards. Include links to official sources.]

- Incentives: Belgium offers various incentives to promote BESS adoption, including:

- Tax incentives: [Detail any tax breaks or deductions available for BESS investments.]

- Feed-in tariffs: [Explain how feed-in tariffs can influence BESS project economics.]

- Other support mechanisms: [Mention any other government programs or initiatives supporting BESS projects.]

Navigating the Complexities of the Merchant Market

The merchant market for BESS financing presents unique challenges. Careful planning and execution are vital.

Due Diligence and Risk Assessment:

Before seeking financing, thorough due diligence is paramount:

- Technical Due Diligence: Assess the technology's suitability, reliability, and efficiency.

- Financial Due Diligence: Analyze the project's financial projections, cash flow, and risk profile.

- Regulatory Due Diligence: Ensure compliance with all relevant regulations and permits.

- Environmental Due Diligence: Address environmental impacts and obtain necessary permits.

- Experienced Advisors: Engaging experienced financial advisors and legal counsel is crucial for navigating the complexities of the merchant market.

Structuring a Compelling Investment Proposal:

A strong investment proposal is essential for attracting investors:

- Financial Projections: Provide detailed financial forecasts, including revenue projections, operating expenses, and ROI.

- Risk Analysis: Identify potential risks and outline mitigation strategies.

- Technical Specifications: Include detailed technical specifications of the BESS system.

- Team Expertise: Highlight the experience and expertise of the project team.

- Clear ROI: Demonstrate a clear and attractive return on investment for potential investors.

Negotiating Favorable Financing Terms:

Negotiating financing terms requires strategic planning:

- Interest Rates: Secure competitive interest rates.

- Loan Terms: Negotiate favorable repayment schedules and terms.

- Security Packages: Minimize the required collateral.

- Contract Terms: Ensure that contract terms protect your interests.

Success Factors for Securing Belgium BESS Financing

Several key factors contribute to successful BESS financing in Belgium:

Building a Strong Project Team:

A skilled team is crucial for project success:

- Technical Expertise: Ensure you have experienced engineers and technicians.

- Financial Management: A strong financial management team is essential.

- Legal and Regulatory Advisors: Experienced legal and regulatory advisors provide invaluable support.

Demonstrating Project Viability:

Investors require clear evidence of project viability:

- Robust Business Plan: Develop a comprehensive business plan.

- Financial Model: Create a detailed and realistic financial model.

- Risk Mitigation: Clearly articulate risk mitigation strategies.

- Value Proposition: Present a compelling value proposition to investors.

Networking and Relationship Building:

Networking is key to securing financing:

- Industry Connections: Build strong relationships within the Belgian energy sector.

- Investor Relationships: Develop relationships with key players in the financing market.

- Industry Events: Attend relevant industry events and conferences.

Conclusion:

Successfully navigating the Belgium BESS financing market requires a deep understanding of the available options, the regulatory landscape, and the intricacies of the merchant market. This article has provided an overview of these key aspects. Are you ready to explore the possibilities of Belgium BESS financing and secure funding for your energy storage project? Contact us today to discuss your specific needs and learn how we can help you navigate this complex market and unlock the potential of BESS in Belgium. Don't delay – secure your future with strategic Belgium BESS financing.

Featured Posts

-

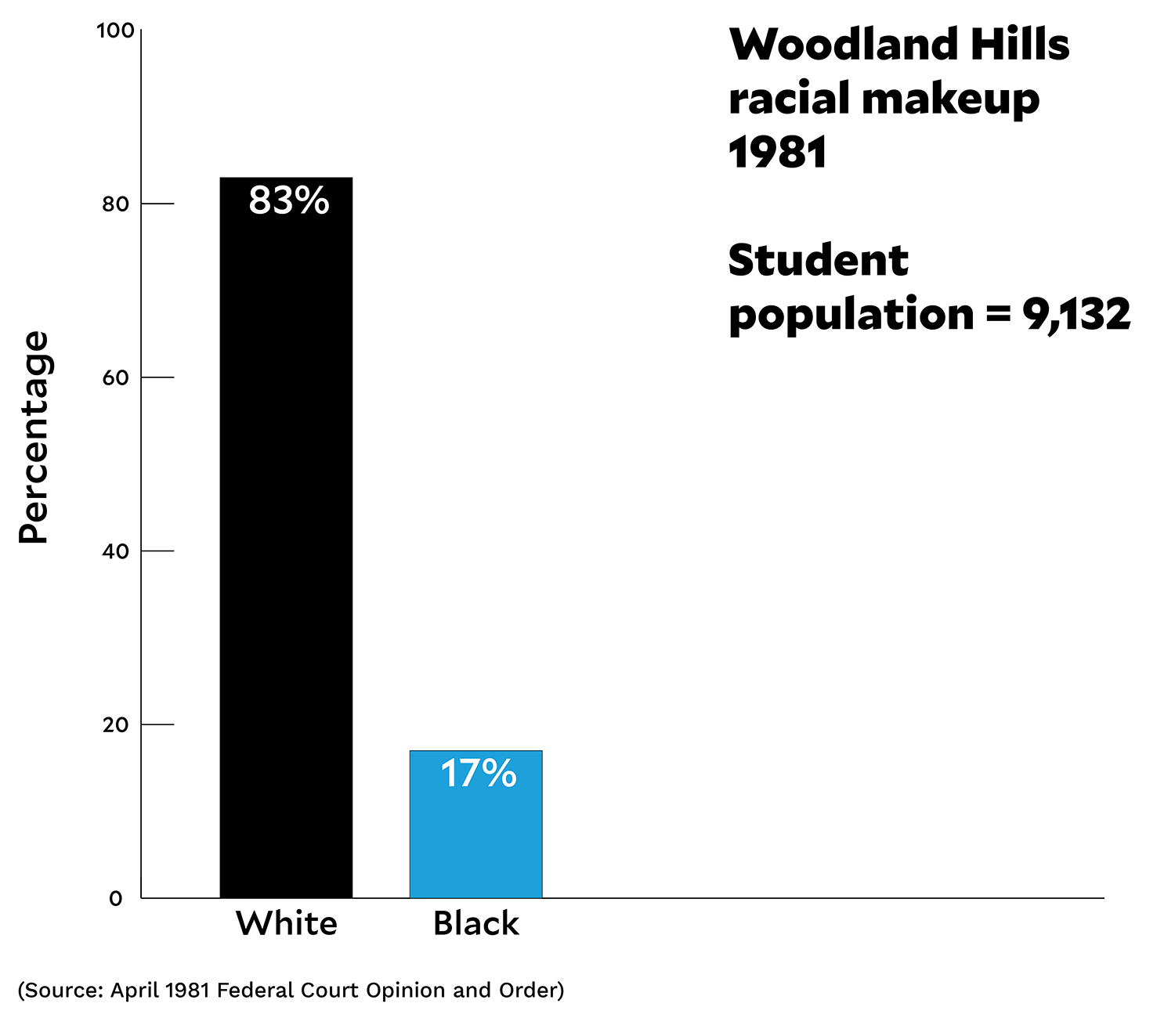

School Desegregation Order Terminated Expected Impact On Educational Equity

May 03, 2025

School Desegregation Order Terminated Expected Impact On Educational Equity

May 03, 2025 -

A Place In The Sun Tips For Buying Property Abroad

May 03, 2025

A Place In The Sun Tips For Buying Property Abroad

May 03, 2025 -

Green Trains Exploring The Potential Of Wind Powered Rail

May 03, 2025

Green Trains Exploring The Potential Of Wind Powered Rail

May 03, 2025 -

Canadian Products At Loblaw Ceo Casts Doubt On The Sustainability Of The Buy Canadian Movement

May 03, 2025

Canadian Products At Loblaw Ceo Casts Doubt On The Sustainability Of The Buy Canadian Movement

May 03, 2025 -

Understanding This Country People Places And Perspectives

May 03, 2025

Understanding This Country People Places And Perspectives

May 03, 2025