The 10-Year Mortgage: Is It Right For Canadian Homebuyers?

Table of Contents

Understanding the Mechanics of a 10-Year Mortgage in Canada

A 10-year mortgage in Canada differs significantly from the more common 5-year term. The most obvious difference lies in the length of the commitment. You're locked into your interest rate and payment schedule for a full decade. This longer term often comes with a longer amortization period (the total time it takes to repay the loan), potentially reducing your monthly payments. However, this also means you'll pay more interest over the life of the loan compared to a shorter-term mortgage.

How it Differs from Shorter-Term Mortgages:

The key distinction lies in the balance between risk and reward. Shorter-term mortgages, like 5-year fixed-rate mortgages, offer greater flexibility. You can renegotiate your interest rate every five years, taking advantage of potentially lower rates. Conversely, a 10-year fixed-rate mortgage provides stability and predictability, but at the cost of less flexibility.

- Longer-term stability of payments: Predictable budgeting for ten years.

- Potential for lower interest rates: While not guaranteed, a 10-year mortgage might offer a slightly lower interest rate than a shorter term due to the reduced risk for the lender. This depends heavily on the prevailing market conditions for Canadian mortgage rates.

- Higher penalties for breaking the mortgage early: Prepayment penalties on a 10-year mortgage are usually significantly higher than those on a 5-year mortgage.

- Impact on overall mortgage interest paid: You'll likely pay more total interest over the life of a 10-year mortgage compared to a shorter-term mortgage, even if the initial interest rate is lower.

Advantages of a 10-Year Mortgage for Canadian Homebuyers

The primary allure of a 10-year mortgage lies in its inherent stability. In the volatile world of Canadian mortgage rates, a fixed rate for a decade offers significant peace of mind.

Financial Stability and Predictability:

One of the most significant advantages is the predictability it offers. Your monthly payments remain consistent for ten years, simplifying budgeting and financial planning. This predictability is invaluable in navigating the uncertainties of life.

- Budget predictability and financial planning ease: Easy to incorporate into long-term financial plans.

- Reduced stress from fluctuating interest rates: Shielding yourself from interest rate hikes for a decade.

- Potential for significant long-term savings: If interest rates rise significantly during the 10-year period, you’ll benefit from having locked in a lower rate.

Disadvantages and Potential Risks of a 10-Year Mortgage

While offering stability, a 10-year mortgage also presents significant drawbacks that require careful consideration.

Lock-in Period and Penalty Costs:

The most considerable risk is the substantial penalty for breaking the mortgage early. Life is unpredictable; job loss, unexpected medical expenses, or a desire to move could necessitate breaking the mortgage before the ten years are up. These penalties can be substantial, potentially wiping out any perceived savings from a lower interest rate.

- High penalties for breaking the mortgage early: These can be very costly.

- Risk of being locked into a high interest rate: If interest rates fall significantly during the 10-year period, you will be locked into a higher rate.

- Potential for changing financial circumstances: Your financial situation may change dramatically over a decade.

Long-Term Financial Commitment:

A 10-year mortgage represents a significant long-term commitment. This lack of flexibility can hinder other financial goals.

- Limited flexibility in refinancing or making significant changes: Difficult to adapt to changing circumstances.

- Impact on future home renovations or other investments: Might restrict your ability to pursue other financial opportunities.

Is a 10-Year Mortgage Right for YOU? Factors to Consider

Deciding whether a 10-year mortgage is suitable requires a thorough assessment of your individual circumstances.

Your Financial Situation and Risk Tolerance:

Your current financial stability, future income projections, and risk tolerance are paramount. Honest self-assessment is crucial.

- Current income and debt levels: Can you comfortably afford the payments for ten years?

- Future income projections and career stability: What are your prospects for future income growth?

- Personal risk tolerance and comfort level with long-term commitments: Are you comfortable with the limited flexibility?

The Current Mortgage Rate Environment in Canada:

Before committing to a 10-year mortgage, compare current 10-year rates with shorter-term options (like a 5-year fixed-rate mortgage).

- Comparing 10-year rates with 5-year and other term options: Explore all available options.

- Understanding the factors influencing Canadian mortgage rates: Stay informed about market trends.

- Seeking advice from a mortgage broker: A professional can provide valuable guidance.

Conclusion

A 10-year mortgage offers significant advantages in terms of financial stability and predictable payments, particularly in an uncertain Canadian mortgage rate environment. However, the high prepayment penalties and lack of flexibility represent substantial risks. Careful consideration of your personal financial situation, risk tolerance, and a comparison of current rates with shorter-term options are essential. Consult with a financial advisor or mortgage broker to determine if a 10-year mortgage aligns with your Canadian home buying journey. Make an informed decision about whether a 10-year mortgage, or a shorter-term alternative, is the right choice for you.

Featured Posts

-

Double Strike Cripples Hollywood Writers And Actors Demand Fair Compensation

May 04, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Compensation

May 04, 2025 -

T

May 04, 2025

T

May 04, 2025 -

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025 -

Blake Lively And Anna Kendrick A Body Language Expert Decodes Their Awkward Interactions

May 04, 2025

Blake Lively And Anna Kendrick A Body Language Expert Decodes Their Awkward Interactions

May 04, 2025 -

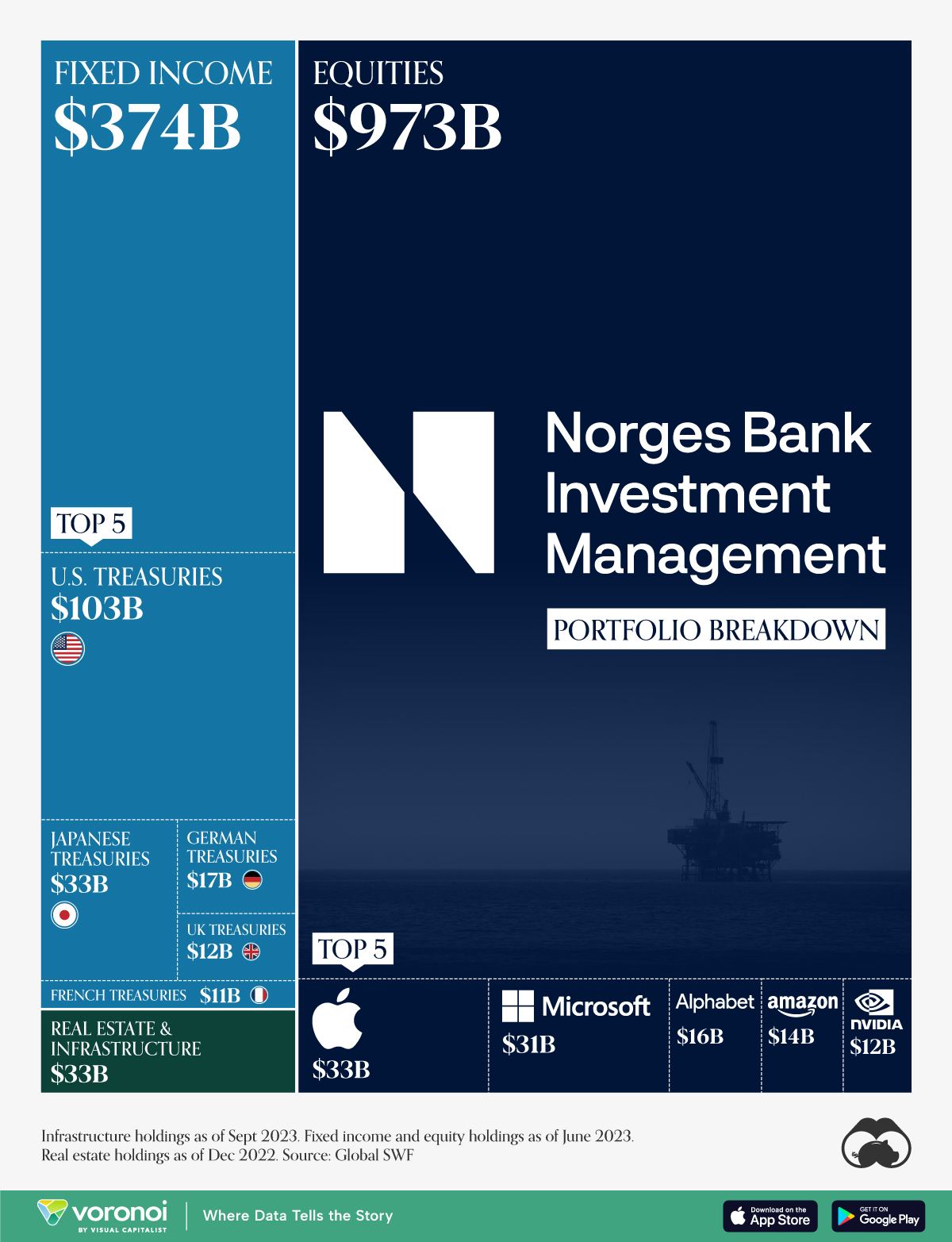

The Effect Of Trumps Tariffs On Norways Sovereign Wealth Fund Nicolai Tangens Approach

May 04, 2025

The Effect Of Trumps Tariffs On Norways Sovereign Wealth Fund Nicolai Tangens Approach

May 04, 2025

Latest Posts

-

Analyzing The Opening Odds Volkanovski Vs Lopes At Ufc 314

May 04, 2025

Analyzing The Opening Odds Volkanovski Vs Lopes At Ufc 314

May 04, 2025 -

Greg Olsens Third Emmy Nomination Beating Out Tom Brady

May 04, 2025

Greg Olsens Third Emmy Nomination Beating Out Tom Brady

May 04, 2025 -

Chris Fallica Condemns Trumps Appeasement Of Putin

May 04, 2025

Chris Fallica Condemns Trumps Appeasement Of Putin

May 04, 2025 -

Live Stream Chicago Cubs Vs La Dodgers Mlb Tokyo Series

May 04, 2025

Live Stream Chicago Cubs Vs La Dodgers Mlb Tokyo Series

May 04, 2025 -

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds Breakdown

May 04, 2025

Volkanovski Vs Lopes Ufc 314 Main Event Betting Odds Breakdown

May 04, 2025